重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.5 6 7 8 9 10 11 12 13 14 15

B.5 7 9 11 13 15

C.5 7 9

D.5 6 7

更多“seq(5,15,by=2)输出结果是?”相关的问题

更多“seq(5,15,by=2)输出结果是?”相关的问题

第1题

Much exciting【C4】______is going on in an effort to find【C5】______to these questions. Foremost is the【C6】______of Jean Piaget, the Swiss psychologist who pioneered the【C7】______and whose theories have had an unparalleled【C8】______on education, especially in Europe. He has【C9】______(in French)over twenty - five books and 150 articles【C10】______are a gold【C11】______of ideas about the development of a child's【C12】______. About half the books and a【C13】______of the articles have been translated into English,【C14】______his style. of writing and the【C15】______technical vocabulary make him a very【C16】______author to read in any language.

Following Piaget's lead, there has been a【C17】______of research in a number of countries,【C18】______the United States. Reports of these【C19】______, too, are often so hedged about with a thicket of professional jargon that they are【C20】______to the nonspecialist.

【C1】

A.part

B.along

C.place

D.position

第2题

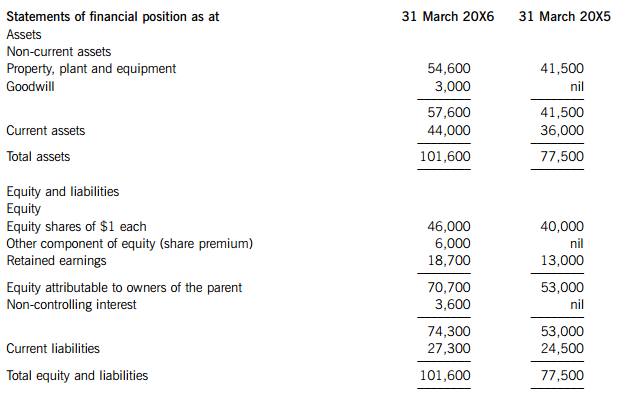

The summarised financial statements of Gregory Co as a single entity at 31 March 20X5 and as a group at 31 March 20X6 are:

Other information:

(i) Each month since the acquisition, Gregory Co’s sales to Tamsin Co were consistently $2m. Gregory Co had chosen to only make a gross profit margin of 10% on these sales as Tamsin Co is part of the group.

(ii) The values of property, plant and equipment held by both companies have been rising for several years.

(iii) On reviewing the above financial statements, Gregory Co’s chief executive officer (CEO) made the following observations:

(1) I see the profit for the year has increased by $1m which is up 20% on last year, but I thought it would be more as Tamsin Co was supposed to be a very profitable company.

(2) I have calculated the earnings per share (EPS) for 20X6 at 13 cents (6,000/46,000 x 100) and for 20X5 at 12·5 cents (5,000/40,000 x 100) and, although the profit has increased 20%, our EPS has barely changed.

(3) I am worried that the low price at which we are selling goods to Tamsin Co is undermining our group’s overall profitability.

(4) I note that our share price is now $2·30, how does this compare with our share price immediately before we bought Tamsin Co?

Required: (a) Reply to the four observations of the CEO. (8 marks)

(b) Using the above financial statements, calculate the following ratios for Gregory Co for the years ended 31 March 20X6 and 20X5 and comment on the comparative performance:

(i) Return on capital employed (ROCE)

(ii) Net asset turnover

(iii) Gross profit margin

(iv) Operating profit margin

Note: Four marks are available for the ratio calculations. (12 marks)

Note: Your answers to (a) and (b) should reflect the impact of the consolidation of Tamsin Co during the year ended 31 March 20X6.

第3题

Section B – ALL THREE questions are compulsory and MUST be attempted

On 1 October 2015, Zanda Co acquired 60% of Medda Co’s equity shares by means of a share exchange of one new share in Zanda Co for every two acquired shares in Medda Co. In addition, Zanda Co will pay a further $0·54 per acquired share on 30 September 2016.

Zanda Co has not recorded any of the purchase consideration and its cost of capital is 8% per annum.

The market value of Zanda Co’s shares at 1 October 2015 was $3·00 each.

The summarised statements of financial position of the two companies as at 31 March 2016 are:

The following information is relevant:

(i) At the date of acquisition, Zanda Co conducted a fair value exercise on Medda Co’s net assets which were equal to their carrying amounts (including Medda Co’s financial asset equity investments) with the exception of an item of plant which had a fair value of $2·5 million below its carrying amount. The plant had a remaining useful life of 30 months at 1 October 2015.

The directors of Zanda Co are of the opinion that an unrecorded deferred tax asset of $1·2 million at 1 October 2015, relating to Medda Co’s losses, can be relieved in the near future as a result of the acquisition. At 31 March 2016, the directors’ opinion has not changed, nor has the value of the deferred tax asset.

(ii) Zanda Co’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, a share price for Medda Co of $1·50 each is representative of the fair value of the shares held by the noncontrolling interest.

(iii) At 31 March 2016, Medda Co held goods in inventory which had been supplied by Zanda Co at a mark-up on cost of 35%. These goods had cost Medda Co $2·43 million.

(iv) The financial asset equity investments of Zanda Co and Medda Co are carried at their fair values at 1 April 2015. At 31 March 2016, these had fair values of $6·1 million and $1·8 million respectively, with the change in Medda Co’s investments all occurring since the acquisition on 1 October 2015.

(v) There is no impairment to goodwill at 31 March 2016.

Required:

Prepare the following extracts from the consolidated statement of financial position of Zanda Co as at 31 March 2016:

(i) Goodwill;

(ii) Retained earnings;

(iii) Non-controlling interest.

The following mark allocation is provided as guidance for this question:

(i) 6 marks

(ii) 7 marks

(iii) 2 marks

第4题

【C1】

A.Obviously enough

B.Obvious

C.Strangely enough

D.Strange enough

第5题

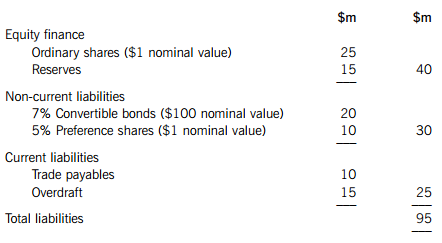

BKB Co has an equity beta of 1·2 and the ex-dividend market value of the company’s equity is $125 million. The ex-interest market value of the convertible bonds is $21 million and the ex-dividend market value of the preference shares is $6·25 million.

The convertible bonds of BKB Co have a conversion ratio of 19 ordinary shares per bond. The conversion date and redemption date are both on the same date in five years’ time. The current ordinary share price of BKB Co is expected to increase by 4% per year for the foreseeable future.

The overdraft has a variable interest rate which is currently 6% per year and BKB Co expects this to increase in the near future. The overdraft has not changed in size over the last financial year, although one year ago the overdraft interest rate was 4% per year. The company’s bank will not allow the overdraft to increase from its current level.

The equity risk premium is 5% per year and the risk-free rate of return is 4% per year. BKB Co pays profit tax at an annual rate of 30% per year.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of BKB Co, explaining clearly any assumptions you make. (12 marks)

(b) Discuss why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (4 marks)

(c) Comment on the interest rate risk faced by BKB Co and discuss briefly how this risk can be managed. (5 marks)

(d) Discuss the attractions to a company of convertible debt compared to a bank loan of a similar maturity as a source of finance. (4 marks)

第6题

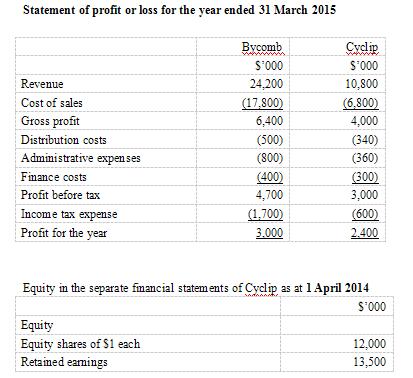

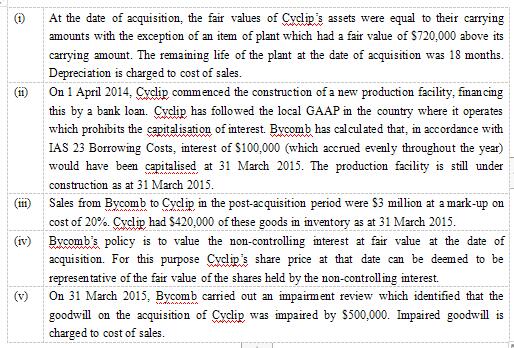

On 1 July 2014 Bycomb acquired 80% of Cyclip’s equity shares on the following terms:

–a share exchange of two shares in Bycomb for every three shares acquired in Cyclip; and

–a cash payment due on 30 June 2015 of $1·54 per share acquired (Bycomb’s cost of capital is 10% per annum).

At the date of acquisition, shares in Bycomb and Cyclip had a stock market value of $3·00 and $2·50 each respectively.

Required:

(a)Calculate the consolidated goodwill at the date of acquisition of Cyclip.

(b)Prepare extracts from Bycomb’s consolidated statement of profit or loss for the year ended 31 March 2015, for:Kaplow

(i)revenue;

(ii)cost of sales;

(iii)finance costs;

(iv)profit or loss attributable to the non-controlling interest.

第7题

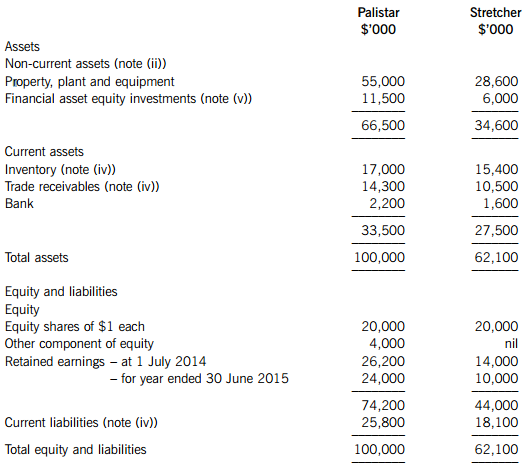

The summarised statements of financial position of the two companies as at 30 June 2015 are:

The following information is relevant:

(i) Stretcher’s business is seasonal and 60% of its annual profit is made in the period 1 January to 30 June each year.

(ii) At the date of acquisition, the fair value of Stretcher’s net assets was equal to their carrying amounts with the following exceptions:

An item of plant had a fair value of $2 million below its carrying value. At the date of acquisition it had a remaining life of two years.

The fair value of Stretcher’s investments was $7 million (see also note (v)).

Stretcher owned the rights to a popular mobile (cell) phone game. At the date of acquisition, a specialist valuer estimated that the rights were worth $12 million and had an estimated remaining life of five years.

(iii) Following an impairment review, consolidated goodwill is to be written down by $3 million as at 30 June 2015.

(iv) Palistar sells goods to Stretcher at cost plus 30%. Stretcher had $1·8 million of goods in its inventory at 30 June 2015 which had been supplied by Palistar. In addition, on 28 June 2015, Palistar processed the sale of $800,000 of goods to Stretcher, which Stretcher did not account for until their receipt on 2 July 2015. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Stretcher before the year end. At 30 June 2015, Palistar had a trade receivable balance of $2·4 million due from Stretcher which differed to the equivalent balance in Stretcher’s books due to the sale made on 28 June 2015.

(v) At 30 June 2015, the fair values of the financial asset equity investments of Palistar and Stretcher were $13·2 million and $7·9 million respectively.

(vi) Palistar’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Stretcher’s share price at that date is representative of the fair value of the shares held by the non-controlling interest.

Required:

Prepare the consolidated statement of financial position for Palistar as at 30 June 2015. (25 marks)

(b) For many years, Dilemma has owned 35% of the voting shares and held a seat on the board of Myno which has given Dilemma significant influence over Myno. The other shares (65%) in Myno were held by many other shareholders who all owned less than 10% of the share capital. On this basis, Dilemma considered Myno to be an associate and has used equity accounting to account for its investment.

In March 2015, Agresso made an offer to buy all of the shares of Myno. The offer was supported by the majority of Myno’s directors. Dilemma did not accept the offer and held on to its shares in Myno.

On 1 April 2015, Agresso announced that it had acquired the other 65% of the share capital of Myno and immediately convened a board meeting at which three of the previous directors of Myno were replaced, including the seat held by Dilemma.

Required:

Explain how the investment in Myno should be treated in the consolidated statement of profit or loss of Dilemma for the year ended 30 June 2015 and the consolidated statement of financial position at 30 June 2015. (5 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!