重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

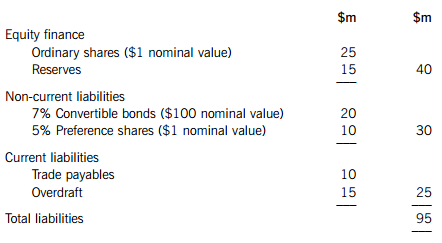

The statement of financial position of BKB Co provides the following information:

BKB Co has an equity beta of 1·2 and the ex-dividend market value of the company’s equity is $125 million. The ex-interest market value of the convertible bonds is $21 million and the ex-dividend market value of the preference shares is $6·25 million.

The convertible bonds of BKB Co have a conversion ratio of 19 ordinary shares per bond. The conversion date and redemption date are both on the same date in five years’ time. The current ordinary share price of BKB Co is expected to increase by 4% per year for the foreseeable future.

The overdraft has a variable interest rate which is currently 6% per year and BKB Co expects this to increase in the near future. The overdraft has not changed in size over the last financial year, although one year ago the overdraft interest rate was 4% per year. The company’s bank will not allow the overdraft to increase from its current level.

The equity risk premium is 5% per year and the risk-free rate of return is 4% per year. BKB Co pays profit tax at an annual rate of 30% per year.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of BKB Co, explaining clearly any assumptions you make. (12 marks)

(b) Discuss why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (4 marks)

(c) Comment on the interest rate risk faced by BKB Co and discuss briefly how this risk can be managed. (5 marks)

(d) Discuss the attractions to a company of convertible debt compared to a bank loan of a similar maturity as a source of finance. (4 marks)

更多“The statement of financial position of BKB Co provides the following information:BKB Co ha”相关的问题

更多“The statement of financial position of BKB Co provides the following information:BKB Co ha”相关的问题

第1题

KXP Co is an e-business which trades solely over the internet. In the last year the company had sales of $15 million. All sales were on 30 days’ credit to commercial customers.

Extracts from the company’s most recent statement of financial position relating to working capital are as follows:

In order to encourage customers to pay on time, KXP Co proposes introducing an early settlement discount of 1% for payment within 30 days, while increasing its normal credit period to 45 days. It is expected that, on average, 50% of customers will take the discount and pay within 30 days, 30% of customers will pay after 45 days, and 20% of customers will not change their current paying behaviour.

KXP Co currently orders 15,000 units per month of Product Z, demand for which is constant. There is only one supplier of Product Z and the cost of Product Z purchases over the last year was $540,000. The supplier has offered a 2% discount for orders of Product Z of 30,000 units or more. Each order costs KXP Co $150 to place and the holding cost is 24 cents per unit per year.

KXP Co has an overdraft facility charging interest of 6% per year.

Required:

(a) Calculate the net benefit or cost of the proposed changes in trade receivables policy and comment on your findings. (6 marks)

(b) Calculate whether the bulk purchase discount offered by the supplier is financially acceptable and comment on the assumptions made by your calculation. (6 marks)

(c) Identify and discuss the factors to be considered in determining the optimum level of cash to be held by a company. (5 marks)

(d) Discuss the factors to be considered in formulating a trade receivables management policy. (8 marks)

第2题

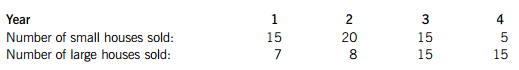

BQK Co, a house-building company, plans to build 100 houses on a development site over the next four years. The purchase cost of the development site is $4,000,000, payable at the start of the first year of construction. Two types of house will be built, with annual sales of each house expected to be as follows:

Houses are built in the year of sale. Each customer finances the purchase of a home by taking out a long-term personal loan from their bank. Financial information relating to each type of house is as follows:

Selling prices and variable cost of construction are in current price terms, before allowing for selling price inflation of 3% per year and variable cost of construction inflation of 4·5% per year.

Fixed infrastructure costs of $1,500,000 per year in current price terms would be incurred. These would not relate to any specific house, but would be for the provision of new roads, gardens, drainage and utilities. Infrastructure cost inflation is expected to be 2% per year.

BQK Co pays profit tax one year in arrears at an annual rate of 30%. The company can claim capital allowances on the purchase cost of the development site on a straight-line basis over the four years of construction.

BQK Co has a real after-tax cost of capital of 9% per year and a nominal after-tax cost of capital of 12% per year. New investments are required by the company to have a before-tax return on capital employed (accounting rate of return) on an average investment basis of 20% per year.

Required:

(a) Calculate the net present value of the proposed investment and comment on its financial acceptability. Work to the nearest $1,000. (13 marks)

(b) Calculate the before-tax return on capital employed (accounting rate of return) of the proposed investment on an average investment basis and discuss briefly its financial acceptability. (5 marks)

(c) Discuss the effect of a substantial rise in interest rates on the financing cost of BQK Co and its customers, and on the capital investment appraisal decision-making process of BQK Co. (7 marks)

第3题

inance. It plans to make a rights issue and to use the funds raised to pay off some of its debt. The rights issue will be at a 20% discount to its current ex-dividend share price of $7·50 per share and Bar Co plans to raise $90 million. Bar Co believes that paying off some of its debt will not affect its price/earnings ratio, which is expected to remain constant.

Income statement information

The 8% bonds are currently trading at $112·50 per $100 bond and bondholders have agreed that they will allow Bar Co to buy back the bonds at this market value. Bar Co pays tax at a rate of 30% per year.

Required:

(a) Calculate the theoretical ex rights price per share of Bar Co following the rights issue. (3 marks)

(b) Calculate and discuss whether using the cash raised by the rights issue to buy back bonds is likely to be financially acceptable to the shareholders of Bar Co, commenting in your answer on the belief that the current price/earnings ratio will remain constant. (7 marks)

(c) Calculate and discuss the effect of using the cash raised by the rights issue to buy back bonds on the financial risk of Bar Co, as measured by its interest coverage ratio and its book value debt to equity ratio. (4 marks)

(d) Compare and contrast the financial objectives of a stock exchange listed company such as Bar Co and the financial objectives of a not-for-profit organisation such as a large charity. (11 marks)

第4题

llows.

Financial analysts have forecast that the dividends of Close Co will grow in the future at a rate of 4% per year. This is slightly less than the forecast growth rate of the profit after tax (earnings) of the company, which is 5% per year. The finance director of Close Co thinks that, considering the risk associated with expected earnings growth, an earnings yield of 11% per year can be used for valuation purposes.

Close Co has a cost of equity of 10% per year and a before-tax cost of debt of 7% per year. The 8% bonds will be redeemed at nominal value in six years’ time. Close Co pays tax at an annual rate of 30% per year and the ex-dividend share price of the company is $8·50 per share.

Required:

(a) Calculate the value of Close Co using the following methods:

(i) net asset value method;

(ii) dividend growth model;

(iii) earnings yield method. (5 marks)

(b) Discuss the weaknesses of the dividend growth model as a way of valuing a company and its shares. (5 marks)

(c) Calculate the weighted average after-tax cost of capital of Close Co using market values where appropriate. (8 marks)

(d) Discuss the circumstances under which the weighted average cost of capital (WACC) can be used as a discount rate in investment appraisal. Briefly indicate alternative approaches that could be adopted when using the WACC is not appropriate. (7 marks)

第5题

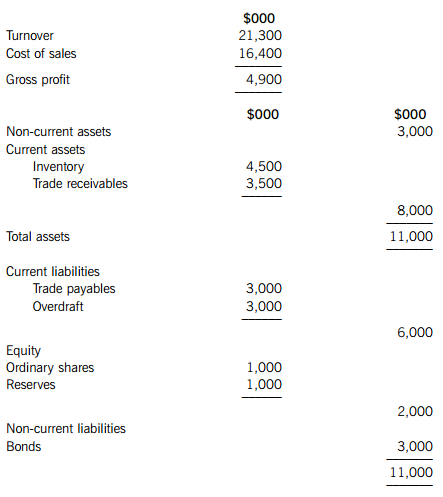

Extracts from the recent financial statements of Bold Co are given below.

A factor has offered to manage the trade receivables of Bold Co in a servicing and factor-financing agreement. The factor expects to reduce the average trade receivables period of Bold Co from its current level to 35 days; to reduce bad debts from 0·9% of turnover to 0·6% of turnover; and to save Bold Co $40,000 per year in administration costs. The factor would also make an advance to Bold Co of 80% of the revised book value of trade receivables. The interest rate on the advance would be 2% higher than the 7% that Bold Co currently pays on its overdraft. The factor would charge a fee of 0·75% of turnover on a with-recourse basis, or a fee of 1·25% of turnover on a non-recourse basis. Assume that there are 365 working days in each year and that all sales and supplies are on credit.

Required:

(a) Explain the meaning of the term ‘cash operating cycle’ and discuss the relationship between the cash operating cycle and the level of investment in working capital. Your answer should include a discussion of relevant working capital policy and the nature of business operations. (7 marks)

(b) Calculate the cash operating cycle of Bold Co. (Ignore the factor’s offer in this part of the question). (4 marks)

(c) Calculate the value of the factor’s offer:

(i) on a with-recourse basis;

(ii) on a non-recourse basis. (7 marks)

(d) Comment on the financial acceptability of the factor’s offer and discuss the possible benefits to Bold Co of factoring its trade receivables. (7 marks)

第6题

0,000 and the machine has an expected life of five years. Additional investment in working capital of $90,000 will be required at the start of the first year of operation. At the end of five years, the machine will be sold for scrap, with the scrap value expected to be 5% of the initial purchase cost of the machine. The machine will not be replaced.

Production and sales from the new machine are expected to be 100,000 units per year. Each unit can be sold for $16 per unit and will incur variable costs of $11 per unit. Incremental fixed costs arising from the operation of the machine will be $160,000 per year.

Warden Co has an after-tax cost of capital of 11% which it uses as a discount rate in investment appraisal. The company pays profit tax one year in arrears at an annual rate of 30% per year. Capital allowances and inflation should be ignored.

Required:

(a) Calculate the net present value of investing in the new machine and advise whether the investment is financially acceptable. (7 marks)

(b) Calculate the internal rate of return of investing in the new machine and advise whether the investment is financially acceptable. (4 marks)

(c) (i) Explain briefly the meaning of the term ‘sensitivity analysis’ in the context of investment appraisal; (1 mark) (ii) Calculate the sensitivity of the investment in the new machine to a change in selling price and to a change in discount rate, and comment on your findings. (6 marks)

(d) Discuss the nature and causes of the problem of capital rationing in the context of investment appraisal, and explain how this problem can be overcome in reaching the optimal investment decision for a company. (7 marks)

第7题

(a) ZPS Co, whose home currency is the dollar, took out a fixed-interest peso bank loan several years ago when peso interest rates were relatively cheap compared to dollar interest rates. Economic difficulties have now increased peso interest rates while dollar interest rates have remained relatively stable. ZPS Co must pay interest of 5,000,000 pesos in six months’ time. The following information is available.

Required:

(i) Explain briefly the relationships between;

(1) exchange rates and interest rates;

(2) exchange rates and inflation rates. (5 marks)

(ii) Calculate whether a forward market hedge or a money market hedge should be used to hedge the interest payment of 5 million pesos in six months’ time. Assume that ZPS Co would need to borrow any cash it uses in hedging exchange rate risk. (6 marks)

(b) ZPS Co places monthly orders with a supplier for 10,000 components that are used in its manufacturing processes. Annual demand is 120,000 components. The current terms are payment in full within 90 days, which ZPS Co meets, and the cost per component is $7·50. The cost of ordering is $200 per order, while the cost of holding components in inventory is $1·00 per component per year.

The supplier has offered either a discount of 0·5% for payment in full within 30 days, or a discount of 3·6% on orders of 30,000 or more components. If the bulk purchase discount is taken, the cost of holding components in inventory would increase to $2·20 per component per year due to the need for a larger storage facility.

Assume that there are 365 days in the year and that ZPS Co can borrow short-term at 4·5% per year.

Required:

(i) Discuss the factors that influence the formulation of working capital policy; (7 marks)

(ii) Calculate if ZPS Co will benefit financially by accepting the offer of:

(1) the early settlement discount;

(2) the bulk purchase discount. (7 marks)

第8题

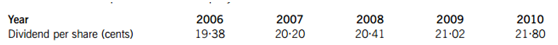

Assume that it is now 31 March 2011 and that the ordinary share price of YNM Co is $4·17 per share. YNM Co has been experiencing trading difficulties due to a continuing depressed level of economic activity:

Income statement information for recent years ending 31 March

Note: the statement of financial position takes no account of any dividend to be paid. The ordinary share capital of YNM Co has not changed during the period under consideration and the 8% bonds were issued in 1998.

Dividend and share price information

Financial objective of

YNM Co YNM Co has a declared objective of maximising shareholder wealth.

(1) To pay the same total cash dividend as in 2010

(2) To pay no dividend at all for the year ending 31 March 2011

Financing decision

YNM Co is also considering raising $50 million of new debt finance to support existing business operations.

Required:

(a) Analyse and discuss the recent financial performance and the current financial position of YNM Co, commenting on:

(i) achievement of the objective of maximising shareholder wealth;

(ii) the two dividend choices;

(iii) the proposal to raise $50 million of new debt finance. (13 marks)

(b) Discuss the following sources of finance that could be suitable for YNM Co, in its current position, to meet its need for $50m to support existing business operations:

(i) equity finance;

(ii) sale and leaseback. (6 marks)

(c) Explain the nature of a scrip (share) dividend and discuss the advantages and disadvantages to a company of using scrip dividends to reward shareholders. (6 marks)

第9题

e if the weighted average cost of capital of the company is decreased. The company, which is listed on a stock exchange, has 100 million shares in issue and the current ex div ordinary share price is $2·50 per share. AQR Co also has in issue bonds with a book value of $60 million and their current ex interest market price is $104 per $100 bond. The current after-tax cost of debt of AQR Co is 7% and the tax rate is 30%.

The recent dividends per share of the company are as follows.

The finance director proposes to decrease the weighted average cost of capital of AQR Co, and hence increase its market value, by issuing $40 million of bonds at their par value of $100 per bond. These bonds would pay annual interest of 8% before tax and would be redeemed at a 5% premium to par after 10 years.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of AQR Co in the following circumstances:

(i) before the new issue of bonds takes place;

(ii) after the new issue of bonds takes place. Comment on your findings. (12 marks)

(b) Identify and discuss briefly the factors that influence the market value of traded bonds. (5 marks)

(c) Discuss the director’s view that issuing traded bonds will decrease the weighted average cost of capital of AQR Co and thereby increase the market value of the company. (8 marks)

第10题

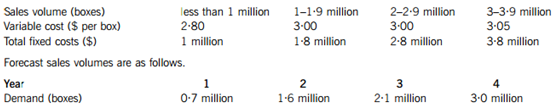

is expected to have continuing popularity for many years. The Finance Director has proposed that investment in the new product should be evaluated over a four-year time-horizon, even though sales would continue after the fourth year, on the grounds that cash flows after four years are too uncertain to be included in the evaluation. The variable and fixed costs (both in current price terms) will depend on sales volume, as follows.

The production equipment for the new confectionery line would cost $2 million and an additional initial investment of $750,000 would be needed for working capital. Capital allowances (tax-allowable depreciation) on a 25% reducing balance basis could be claimed on the cost of equipment. Profit tax of 30% per year will be payable one year in arrears. A balancing allowance would be claimed in the fourth year of operation.

The average general level of inflation is expected to be 3% per year and selling price, variable costs, fixed costs and working capital would all experience inflation of this level. BRT Co uses a nominal after-tax cost of capital of 12% to appraise new investment projects.

Required:

(a) Assuming that production only lasts for four years, calculate the net present value of investing in the new product using a nominal terms approach and advise on its financial acceptability (work to the nearest $1,000). (13 marks)

(b) Comment briefly on the proposal to use a four-year time horizon, and calculate and discuss a value that could be placed on after-tax cash flows arising after the fourth year of operation, using a perpetuity approach. Assume, for this part of the question only, that before-tax cash flows and profit tax are constant from year five onwards, and that capital allowances and working capital can be ignored. (5 marks)

(c) Discuss THREE ways of incorporating risk into the investment appraisal process. (7 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!