重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Section A暂缺

Section B – ALL THREE questions are compulsory and MUST be attempted

On 1 October 2015, Zanda Co acquired 60% of Medda Co’s equity shares by means of a share exchange of one new share in Zanda Co for every two acquired shares in Medda Co. In addition, Zanda Co will pay a further $0·54 per acquired share on 30 September 2016.

Zanda Co has not recorded any of the purchase consideration and its cost of capital is 8% per annum.

The market value of Zanda Co’s shares at 1 October 2015 was $3·00 each.

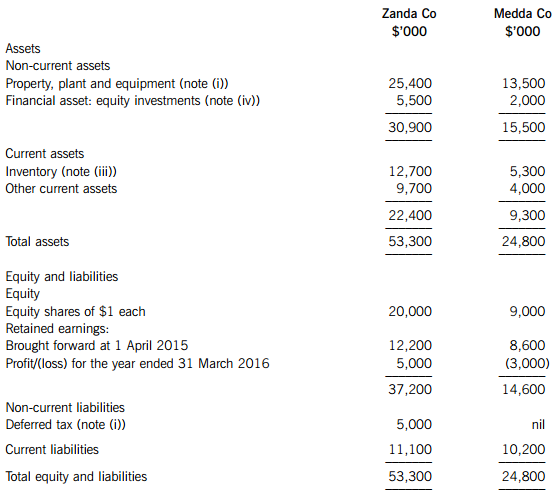

The summarised statements of financial position of the two companies as at 31 March 2016 are:

The following information is relevant:

(i) At the date of acquisition, Zanda Co conducted a fair value exercise on Medda Co’s net assets which were equal to their carrying amounts (including Medda Co’s financial asset equity investments) with the exception of an item of plant which had a fair value of $2·5 million below its carrying amount. The plant had a remaining useful life of 30 months at 1 October 2015.

The directors of Zanda Co are of the opinion that an unrecorded deferred tax asset of $1·2 million at 1 October 2015, relating to Medda Co’s losses, can be relieved in the near future as a result of the acquisition. At 31 March 2016, the directors’ opinion has not changed, nor has the value of the deferred tax asset.

(ii) Zanda Co’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, a share price for Medda Co of $1·50 each is representative of the fair value of the shares held by the noncontrolling interest.

(iii) At 31 March 2016, Medda Co held goods in inventory which had been supplied by Zanda Co at a mark-up on cost of 35%. These goods had cost Medda Co $2·43 million.

(iv) The financial asset equity investments of Zanda Co and Medda Co are carried at their fair values at 1 April 2015. At 31 March 2016, these had fair values of $6·1 million and $1·8 million respectively, with the change in Medda Co’s investments all occurring since the acquisition on 1 October 2015.

(v) There is no impairment to goodwill at 31 March 2016.

Required:

Prepare the following extracts from the consolidated statement of financial position of Zanda Co as at 31 March 2016:

(i) Goodwill;

(ii) Retained earnings;

(iii) Non-controlling interest.

The following mark allocation is provided as guidance for this question:

(i) 6 marks

(ii) 7 marks

(iii) 2 marks

更多“Section A暂缺Section B – ALL THREE questions are compulsory and MUST be attempted On 1 Oct”相关的问题

更多“Section A暂缺Section B – ALL THREE questions are compulsory and MUST be attempted On 1 Oct”相关的问题

第1题

mmediate share exchange of two shares in Palistar for five shares in Stretcher. The fair value of Palistar and Stretcher’s shares on 1 January 2015 were $4·00 and $3·00 respectively. In addition to the share exchange, Palistar will make a cash payment of $1·32 per acquired share, deferred until 1 January 2016. Palistar has not recorded any of the consideration for Stretcher in its financial statements. Palistar’s cost of capital is 10% per annum.

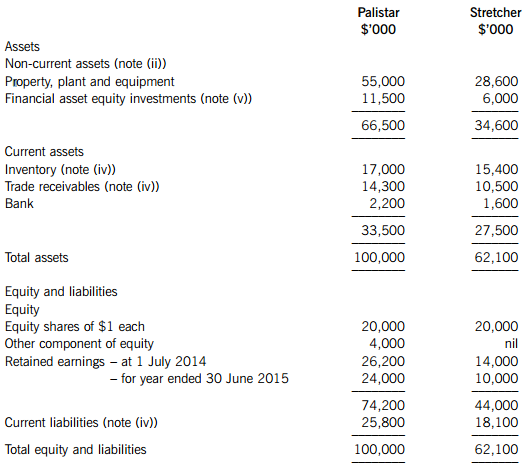

The summarised statements of financial position of the two companies as at 30 June 2015 are:

The following information is relevant:

(i) Stretcher’s business is seasonal and 60% of its annual profit is made in the period 1 January to 30 June each year.

(ii) At the date of acquisition, the fair value of Stretcher’s net assets was equal to their carrying amounts with the following exceptions:

An item of plant had a fair value of $2 million below its carrying value. At the date of acquisition it had a remaining life of two years.

The fair value of Stretcher’s investments was $7 million (see also note (v)).

Stretcher owned the rights to a popular mobile (cell) phone game. At the date of acquisition, a specialist valuer estimated that the rights were worth $12 million and had an estimated remaining life of five years.

(iii) Following an impairment review, consolidated goodwill is to be written down by $3 million as at 30 June 2015.

(iv) Palistar sells goods to Stretcher at cost plus 30%. Stretcher had $1·8 million of goods in its inventory at 30 June 2015 which had been supplied by Palistar. In addition, on 28 June 2015, Palistar processed the sale of $800,000 of goods to Stretcher, which Stretcher did not account for until their receipt on 2 July 2015. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Stretcher before the year end. At 30 June 2015, Palistar had a trade receivable balance of $2·4 million due from Stretcher which differed to the equivalent balance in Stretcher’s books due to the sale made on 28 June 2015.

(v) At 30 June 2015, the fair values of the financial asset equity investments of Palistar and Stretcher were $13·2 million and $7·9 million respectively.

(vi) Palistar’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Stretcher’s share price at that date is representative of the fair value of the shares held by the non-controlling interest.

Required:

Prepare the consolidated statement of financial position for Palistar as at 30 June 2015. (25 marks)

(b) For many years, Dilemma has owned 35% of the voting shares and held a seat on the board of Myno which has given Dilemma significant influence over Myno. The other shares (65%) in Myno were held by many other shareholders who all owned less than 10% of the share capital. On this basis, Dilemma considered Myno to be an associate and has used equity accounting to account for its investment.

In March 2015, Agresso made an offer to buy all of the shares of Myno. The offer was supported by the majority of Myno’s directors. Dilemma did not accept the offer and held on to its shares in Myno.

On 1 April 2015, Agresso announced that it had acquired the other 65% of the share capital of Myno and immediately convened a board meeting at which three of the previous directors of Myno were replaced, including the seat held by Dilemma.

Required:

Explain how the investment in Myno should be treated in the consolidated statement of profit or loss of Dilemma for the year ended 30 June 2015 and the consolidated statement of financial position at 30 June 2015. (5 marks)

第2题

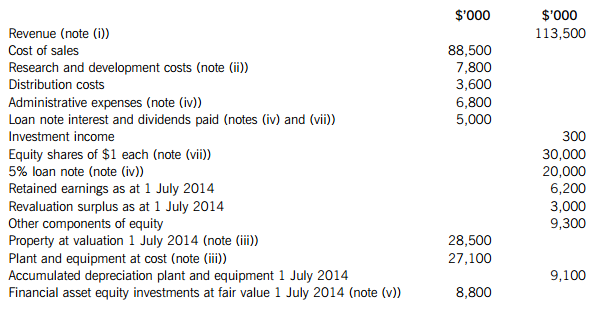

ses. The following financial statements for two potential target companies are shown below. They operate in the same industry sector and Xpand believes their shareholders would be receptive to a takeover. An indicative price for 100% acquisition of the companies is $12 million each.

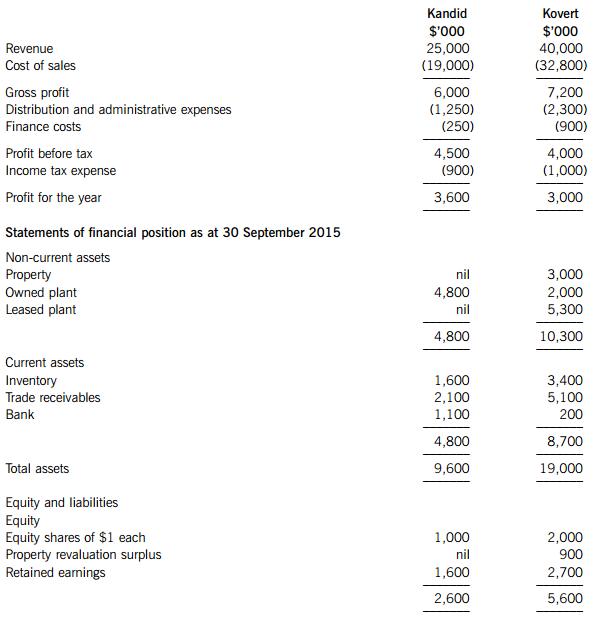

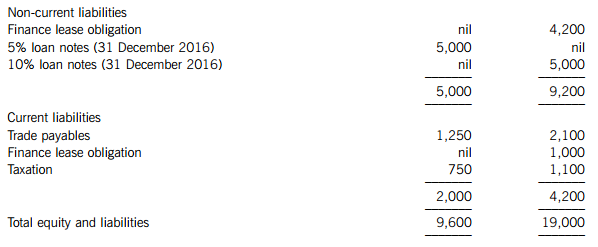

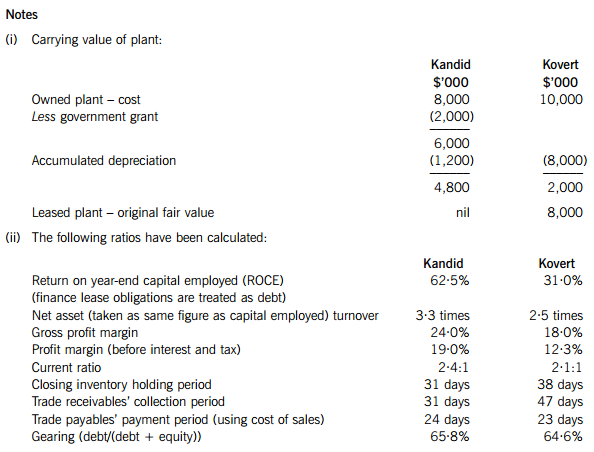

Statements of profit or loss for the year ended 30 September 2015

Required:

(a) Using the above information, assess the relative performance and financial position of Kandid and Kovert for the year ended 30 September 2015 in order to assist the directors of Xpand to make an acquisition decision. (11 marks)

(b) Describe what further information may be useful to Xpand when making an acquisition decision. (4 marks)

第3题

Section A暂缺

Section B – ALL THREE questions are compulsory and MUST be attempted

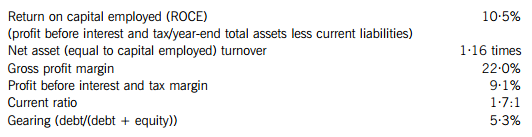

The following trial balance extracts (i.e. it is not a complete trial balance) relate to Moston as at 30 June 2015:

The following notes are relevant:

(i) Revenue includes a $3 million sale made on 1 January 2015 of maturing goods which are not biological assets. The carrying amount of these goods at the date of sale was $2 million. Moston is still in possession of the goods (but they have not been included in the inventory count) and has an unexercised option to repurchase them at any time in the next three years. In three years’ time the goods are expected to be worth $5 million. The repurchase price will be the original selling price plus interest at 10% per annum from the date of sale to the date of repurchase.

(ii) Moston commenced a research and development project on 1 January 2015. It spent $1 million per month on research until 31 March 2015, at which date the project passed into the development stage. From this date it spent $1·6 million per month until the year end (30 June 2015), at which date development was completed. However, it was not until 1 May 2015 that the directors of Moston were confident that the new product would be a commercial success.

Expensed research and development costs should be charged to cost of sales.

(iii) Non-current assets:

Moston’s property is carried at fair value which at 30 June 2015 was $29 million. The remaining life of the property at the beginning of the year (1 July 2014) was 15 years. Moston does not make an annual transfer to retained earnings in respect of the revaluation surplus. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 June 2015. All depreciation is charged to cost of sales.

(iv) The 5% loan note was issued on 1 July 2014 at its nominal value of $20 million incurring direct issue costs of $500,000 which have been charged to administrative expenses. The loan note will be redeemed after three years at a premium which gives the loan note an effective finance cost of 8% per annum. Annual interest was paid on 30 June 2015.

(v) At 30 June 2015, the financial asset equity investments had a fair value of $9·6 million. There were no acquisitions or disposals of these investments during the year.

(vi) A provision for current tax for the year ended 30 June 2015 of $1·2 million is required, together with an increase to the deferred tax provision to be charged to profit or loss of $800,000.

(vii) Moston paid a dividend of 20 cents per share on 30 March 2015, which was followed the day after by an issue of 10 million equity shares at their full market value of $1·70. The share premium on the issue was recorded in other components of equity.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Moston for the year ended 30 June 2015. (11 marks)

(b) Prepare the statement of changes in equity for Moston for the year ended 30 June 2015. (4 marks)

Note: The statement of financial position and notes to the financial statements are NOT required.

第4题

ments for the year ended 31 March 2014:

(i) From 1 April 2013, the directors have decided to reclassify research and amortised development costs as administrative expenses rather than its previous classification as cost of sales. They believe that the previous treatment unfairly distorted the company’s gross profit margin.

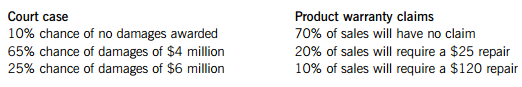

(ii) Skeptic has two potential liabilities to assess. The first is an outstanding court case concerning a customer claiming damages for losses due to faulty components supplied by Skeptic. The second is the provision required for product warranty claims against 200,000 units of retail goods supplied with a one-year warranty.

The estimated outcomes of the two liabilities are:

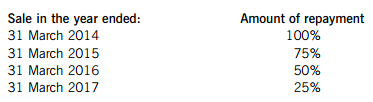

(iii) On 1 April 2013, Skeptic received a government grant of $8 million towards the purchase of new plant with a gross cost of $64 million. The plant has an estimated life of 10 years and is depreciated on a straight-line basis. One of the terms of the grant is that the sale of the plant before 31 March 2017 would trigger a repayment on a sliding scale as follows:

Accordingly, the directors propose to credit to the statement of profit or loss $2 million ($8 million x 25%) being the amount of the grant they believe has been earned in the year to 31 March 2014. Skeptic accounts for government grants as a separate item of deferred credit in its statement of financial position. Skeptic has no intention of selling the plant before the end of its economic life.

Required:

Advise, and quantify where possible, how the above items (i) to (iii) should be treated in Skeptic’s financial statements for the year ended 31 March 2014.

The following mark allocation is provided as guidance for this question:

(i) 3 marks

(ii) 4 marks

(iii) 3 marks

第5题

ng treatment of some of the company’s items of property, plant and equipment which have increased in value. His main concern is that the statement of financial position does not show the true value of assets which have increased in value and that this ‘undervaluation’ is compounded by having to charge depreciation on these assets, which also reduces reported profit. He argues that this does not make economic sense.

Required:

Respond to the director’s concerns by summarising the principal requirements of IAS 16 Property, Plant and Equipment in relation to the revaluation of property, plant and equipment, including its subsequent treatment.

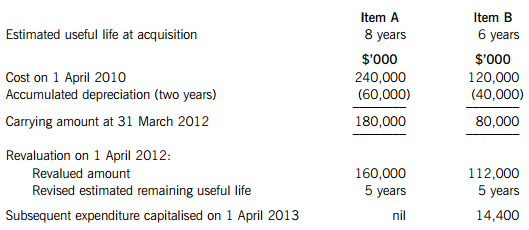

(b) The following details relate to two items of property, plant and equipment (A and B) owned by Delta which are depreciated on a straight-line basis with no estimated residual value:

At 31 March 2014 item A was still in use, but item B was sold (on that date) for $70 million.

Note: Delta makes an annual transfer from its revaluation surplus to retained earnings in respect of excess depreciation.

Required:

Prepare extracts from:

(i) Delta’s statements of profit or loss for the years ended 31 March 2013 and 2014 in respect of charges (expenses) related to property, plant and equipment;

(ii) Delta’s statements of financial position as at 31 March 2013 and 2014 for the carrying amount of property, plant and equipment and the revaluation surplus.

The following mark allocation is provided as guidance for this requirement:

(i) 5 marks

(ii) 5 marks (10 marks)

第6题

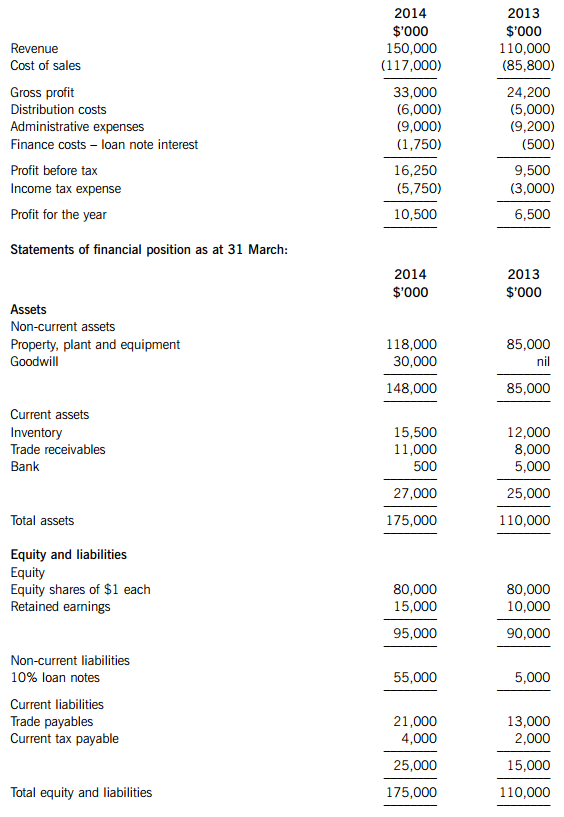

Shown below are the financial statements of Woodbank for its most recent two years:

Statements of profit or loss for the year ended 31 March:

The following information is available:

(i) On 1 January 2014, Woodbank purchased the trading assets and operations of Shaw for $50 million and, on the same date, issued additional 10% loan notes to finance the purchase. Shaw was an unincorporated entity and its results (for three months from 1 January 2014 to 31 March 2014) and net assets (including goodwill not subject to any impairment) are included in Woodbank’s financial statements for the year ended 31 March 2014 .There were no other purchases or sales of non-current assets during the year ended 31 March 2014.

(ii) Extracts of the results (for three months) of the previously separate business of Shaw, which are included in Woodbank’s statement of profit or loss for the year ended 31 March 2014, are:

(iii) The following six ratios have been correctly calculated for Woodbank for the year ended 31 March 2013:

Required:

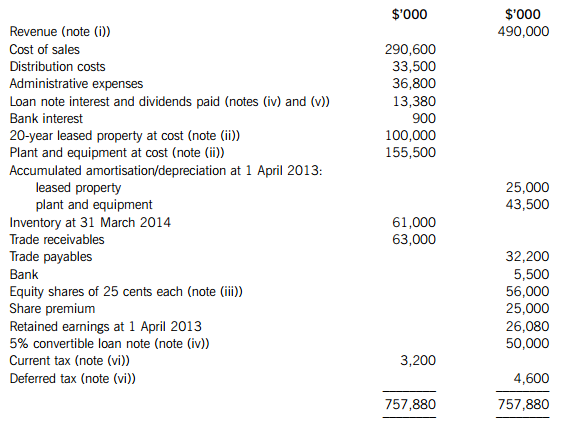

(a) Calculate for the year ended 31 March 2014:

(i) equivalent ratios (all six) to the above for Woodbank based on its reported figures; and

(ii) equivalent ratios to the first FOUR only for Woodbank excluding the effects of the purchase of Shaw.

Note: Assume the capital employed for Shaw is equal to its purchase price of $50 million. (10 marks)

(b) Assess the comparative financial performance and position of Woodbank for the year ended 31 March 2014. Your answer should refer to the effects of the purchase of Shaw. (15 marks)

第7题

The following trial balance relates to Xtol at 31 March 2014:

The following notes are relevant:

(i) Revenue includes an amount of $20 million for cash sales made through Xtol’s retail outlets during the year on behalf of Francais. Xtol, acting as agent, is entitled to a commission of 10% of the selling price of these goods. By 31 March 2014, Xtol had remitted to Francais $15 million (of the $20 million sales) and recorded this amount in cost of sales.

(ii) Plant and equipment is depreciated at 12?% per annum on the reducing balance basis. All amortisation/depreciation of non-current assets is charged to cost of sales.

(iii) On 1 August 2013, Xtol made a fully subscribed rights issue of equity share capital based on two new shares at 60 cents each for every five shares held. The market price of Xtol’s shares before the issue was $1·02 each. The issue has been fully recorded in the trial balance figures.

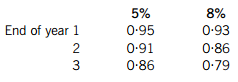

(iv) On 1 April 2013, Xtol issued a 5% $50 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2016.

The interest on an equivalent loan note without the conversion rights would be 8% per annum. The present values of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(v) An equity dividend of 4 cents per share was paid on 30 May 2013 and, after the rights issue, a further dividend of 2 cents per share was paid on 30 November 2013.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2013. A provision of $28 million is required for current tax for the year ended 31 March 2014 and at this date the deferred tax liability was assessed at $8·3 million.

Required:

(a) Prepare the statement of profit or loss for Xtol for the year ended 31 March 2014.

(b) Prepare the statement of changes in equity for Xtol for the year ended 31 March 2014.

(c) Prepare the statement of financial position for Xtol as at 31 March 2014.

(d) Calculate the basic earnings per share (EPS) for Xtol for the year ended 31 March 2014.

Note: Answers and workings (for parts (a) to (c)) should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 8 marks

(b) 6 marks

(c) 8 marks

(d) 3 marks

第8题

he acquisition was achieved through a share exchange of one share in Penketh for every three shares in Sphere. At that date the stock market prices of Penketh’s and Sphere’s shares were $4 and $2·50 per share respectively. Additionally, Penketh will pay $1·54 cash on 30 September 2014 for each share acquired. Penketh’s finance cost is 10% per annum.

The retained earnings of Sphere brought forward at 1 April 2013 were $120 million.

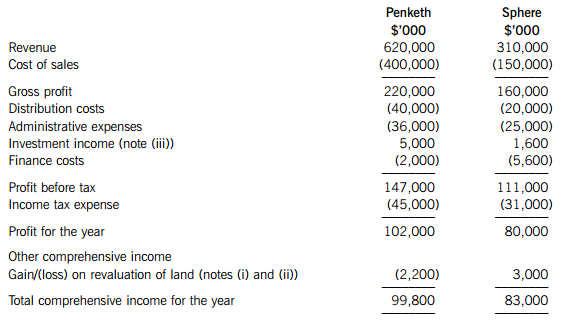

The summarised statements of profit or loss and other comprehensive income for the companies for the year ended 31 March 2014 are:

The following information is relevant:

(i) A fair value exercise conducted on 1 October 2013 concluded that the carrying amounts of Sphere’s net assets were equal to their fair values with the following exceptions:

– the fair value of Sphere’s land was $2 million in excess of its carrying amount

– an item of plant had a fair value of $6 million in excess of its carrying amount. The plant had a remaining life of two years at the date of acquisition. Plant depreciation is charged to cost of sales.

– Penketh placed a value of $5 million on Sphere’s good trading relationships with its customers. Penketh expected, on average, a customer relationship to last for a further five years. Amortisation of intangible assets is charged to administrative expenses.

(ii) Penketh’s group policy is to revalue land to market value at the end of each accounting period. Prior to its acquisition, Sphere’s land had been valued at historical cost, but it has adopted the group policy since its acquisition. In addition to the fair value increase in Sphere’s land of $2 million (see note (i)), it had increased by a further $1 million since the acquisition.

(iii) On 1 October 2013, Penketh also acquired 30% of Ventor’s equity shares. Ventor’s profit after tax for the year ended 31 March 2014 was $10 million and during March 2014 Ventor paid a dividend of $6 million. Penketh uses equity accounting in its consolidated financial statements for its investment in Ventor.

Sphere did not pay any dividends in the year ended 31 March 2014.

(iv) After the acquisition Penketh sold goods to Sphere for $20 million. Sphere had one fifth of these goods still in inventory at 31 March 2014. In March 2014 Penketh sold goods to Ventor for $15 million, all of which were still in inventory at 31 March 2014. All sales to Sphere and Ventor had a mark-up on cost of 25%.

(v) Penketh’s policy is to value the non-controlling interest at the date of acquisition at its fair value. For this purpose, the share price of Sphere at that date (1 October 2013) is representative of the fair value of the shares held by the non-controlling interest.

(vi) All items in the above statements of profit or loss and other comprehensive income are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) Calculate the consolidated goodwill as at 1 October 2013.

(b) Prepare the consolidated statement of profit or loss and other comprehensive income of Penketh for the year ended 31 March 2014.

The following mark allocation is provided as guidance for this question:

(a) 6 marks

(b) 19 marks

第9题

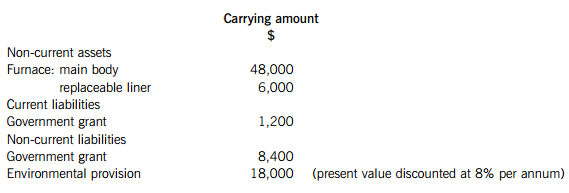

in item of plant is a furnace which was purchased on 1 October 2009. The furnace has two components: the main body (cost $60,000 including the environmental provision – see below) which has a ten-year life, and a replaceable liner (cost $10,000) with a five-year life.

The manufacturing process produces toxic chemicals which pollute the nearby environment. Legislation requires that a clean-up operation must be undertaken by Shawler on 30 September 2019 at the latest.

Shawler received a government grant of $12,000 relating to the cost of the main body of the furnace only.

The following are extracts from Shawler’s statement of financial position as at 30 September 2011 (two years after the acquisition of the furnace):

Required:

(i) Prepare equivalent extracts from Shawler’s statement of financial position as at 30 September 2012; (3 marks)

(ii) Prepare extracts from Shawler’s income statement for the year ended 30 September 2012 relating to the items in the statement of financial position. (3 marks)

(b) On 1 April 2012, the government introduced further environmental legislation which had the effect of requiring Shawler to fit anti-pollution filters to its furnace within two years. An environmental consultant has calculated that fitting the filters will reduce Shawler’s required environmental costs (and therefore its provision) by 33%. At 30 September 2012 Shawler had not yet fitted the filters.

Required:

Advise Shawler as to whether they need to provide for the cost of the filters as at 30 September 2012 and whether they should reduce the environmental provision at this date. (4 marks)

第10题

al Framework for Financial Reporting are understandability and comparability

Required:

Explain the meaning and purpose of the above characteristics in the context of financial reporting and discuss the role of consistency within the characteristic of comparability in relation to changes in accounting policy. (6 marks)

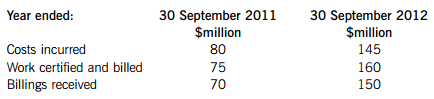

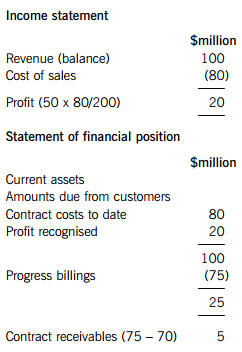

(b) Lobden is a construction contract company involved in building commercial properties. Its current policy for determining the percentage of completion of its contracts is based on the proportion of cost incurred to date compared to the total expected cost of the contract.

One of Lobden’s contracts has an agreed price of $250 million and estimated total costs of $200 million.

The cumulative progress of this contract is:

Based on the above, Lobden prepared and published its financial statements for the year ended 30 September 2011. Relevant extracts are:

Lobden has received some adverse publicity in the financial press for taking its profit too early in the contract process, leading to disappointing profits in the later stages of contracts. Most of Lobden’s competitors take profit based on the percentage of completion as determined by the work certified compared to the contract price.

Required:

(i) Assuming Lobden changes its method of determining the percentage of completion of contracts to that used by its competitors, and that this would represent a change in an accounting estimate, calculate equivalent extracts to the above for the year ended 30 September 2012; (7 marks)

(ii) Explain why the above represents a change in accounting estimate rather than a change in accounting policy. (2 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!