重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Which of the following statements is true?

A.The target cost will decrease and the cost gap will increase

B.The target cost will increase and the cost gap will decrease

C.The target cost will remain the same and the cost gap will increase

D.The target cost will remain the same and the cost gap will decrease

更多“The direct labour cost per unit has been based on an expected learning rate of 90% but now”相关的问题

更多“The direct labour cost per unit has been based on an expected learning rate of 90% but now”相关的问题

第1题

A、$6,720

B、$8,400

C、$10,080

D、$10,500

第2题

A、$252,923

B、$258,948

C、$321,052

D、$327,077

第3题

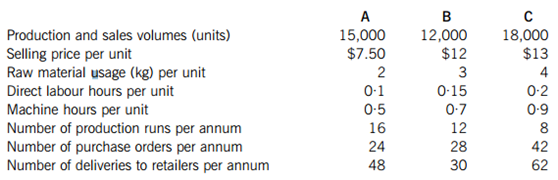

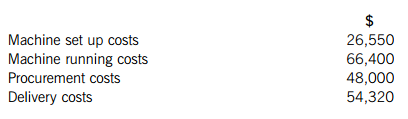

The price for raw materials remained constant throughout the year at $1·20 per kg. Similarly, the direct labour cost for the whole workforce was $14·80 per hour. The annual overhead costs were as follows:

Required:

(a) Calculate the full cost per unit for products A, B and C under traditional absorption costing, using direct labour hours as the basis for apportionment. (5 marks)

(b) Calculate the full cost per unit of each product using activity based costing. (9 marks)

(c) Using your calculation from (a) and (b) above, explain how activity based costing may help The Gadget Co improve the profitability of each product. (6 marks)

第4题

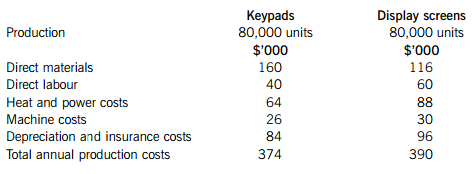

It currently produces and sells 80,000 units per annum, with production of them being restricted by the short supply of labour. Each control panel includes two main components – one key pad and one display screen. At present, Robber Co manufactures both of these components in-house. However, the company is currently considering outsourcing the production of keypads and/or display screens. A newly established company based in Burgistan is keen to secure a place in the market, and has offered to supply the keypads for the equivalent of $4·10 per unit and the display screens for the equivalent of $4·30 per unit. This price has been guaranteed for two years.

The current total annual costs of producing the keypads and the display screens are:

Notes:

1. Materials costs for keypads are expected to increase by 5% in six months’ time; materials costs for display screens are only expected to increase by 2%, but with immediate effect.

2. Direct labour costs are purely variable and not expected to change over the next year.

3. Heat and power costs include an apportionment of the general factory overhead for heat and power as well as the costs of heat and power directly used for the production of keypads and display screens. The general apportionment included is calculated using 50% of the direct labour cost for each component and would be incurred irrespective of whether the components are manufactured in-house or not.

4. Machine costs are semi-variable; the variable element relates to set up costs, which are based upon the number of batches made. The keypads’ machine has fixed costs of $4,000 per annum and the display screens’ machine has fixed costs of $6,000 per annum. Whilst both components are currently made in batches of 500, this would need to change, with immediate effect, to batches of 400.

5. 60% of depreciation and insurance costs relate to an apportionment of the general factory depreciation and insurance costs; the remaining 40% is specific to the manufacture of keypads and display screens.

Required:

(a) Advise Robber Co whether it should continue to manufacture the keypads and display screens in-house or whether it should outsource their manufacture to the supplier in Burgistan, assuming it continues to adopt a policy to limit manufacture and sales to 80,000 control panels in the coming year. (8 marks)

(b) Robber Co takes 0·5 labour hours to produce a keypad and 0·75 labour hours to produce a display screen. Labour hours are restricted to 100,000 hours and labour is paid at $1 per hour. Robber Co wishes to increase its supply to 100,000 control panels (i.e. 100,000 each of keypads and display screens). Advise Robber Co as to how many units of keypads and display panels they should either manufacture and/or outsource in order to minimise their costs. (7 marks)

(c) Discuss the non-financial factors that Robber Co should consider when making a decision about outsourcing the manufacture of keypads and display screens. (5 marks)

第5题

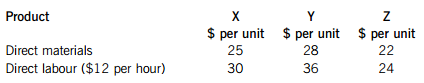

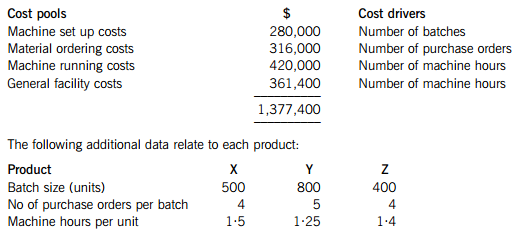

Budgeted production and sales volumes for X, Y and Z for the next year are 20,000 units, 16,000 units and 22,000 units respectively.

The budgeted direct costs of the three products are shown below:

In the next year, Duff Co also expects to incur indirect production costs of $1,377,400, which are analysed as follows:

Duff Co wants to boost sales revenue in order to increase profits but its capacity to do this is limited because of its use of cost plus pricing and the application of the standard mark-up. The finance director has suggested using activity based costing (ABC) instead of full absorption costing, since this will alter the cost of the products and may therefore enable a different price to be charged.

Required:

(a) Calculate the budgeted full production cost per unit of each product using Duff Co’s current method of absorption costing. All workings should be to two decimal places. (3 marks)

(b) Calculate the budgeted full production cost per unit of each product using activity based costing. All workings should be to two decimal places. (11 marks)

(c) Discuss the impact on the selling prices and the sales volumes OF EACH PRODUCT which a change to activity based costing would be expected to bring about. (6 marks)

第7题

A.$4,250 favourable

B.$4,250 adverse

C.$5,250 favourable

D.$5,250 adverse

第8题

A、part of prime cost

B、factory overhead

C、direct labour costs

D、administrative overheads

第9题

A、$170

B、$195

C、$200

D、$240

第10题

A、40% of direct material cost

B、200% of direct labour cost

C、$10 per direct labour hour

D、$0.60 per machine hour

第11题

A、$4,250 favourable

B、$4,250 adverse

C、$5,250 favourable

D、$5,250 adverse

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!