重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Budgeted production and sales volumes for X, Y and Z for the next year are 20,000 units, 16,000 units and 22,000 units respectively.

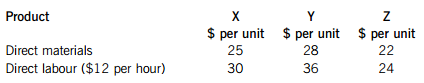

The budgeted direct costs of the three products are shown below:

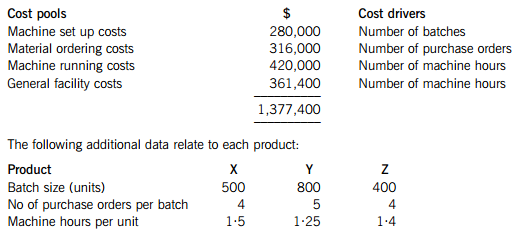

In the next year, Duff Co also expects to incur indirect production costs of $1,377,400, which are analysed as follows:

Duff Co wants to boost sales revenue in order to increase profits but its capacity to do this is limited because of its use of cost plus pricing and the application of the standard mark-up. The finance director has suggested using activity based costing (ABC) instead of full absorption costing, since this will alter the cost of the products and may therefore enable a different price to be charged.

Required:

(a) Calculate the budgeted full production cost per unit of each product using Duff Co’s current method of absorption costing. All workings should be to two decimal places. (3 marks)

(b) Calculate the budgeted full production cost per unit of each product using activity based costing. All workings should be to two decimal places. (11 marks)

(c) Discuss the impact on the selling prices and the sales volumes OF EACH PRODUCT which a change to activity based costing would be expected to bring about. (6 marks)

更多“Duff Co manufactures three products, X, Y and Z. Demand for products X and Y is relatively”相关的问题

更多“Duff Co manufactures three products, X, Y and Z. Demand for products X and Y is relatively”相关的问题

第1题

. The company has two divisions: the assembly division, and the retail division.

The company’s policy is to transfer the machines from the assembly division to the retail division at full cost plus 10%. This has resulted in internal transfer prices, when S and R are being transferred to the retail division, of $220·17 and $241·69 respectively. The retail division currently sells S to the general public for $320 per machine and R for $260 per machine. Assume it incurs no other costs except for the transfer price.

The retail division’s manager is convinced that, if he could obtain R at a lower cost and therefore reduce the external selling price from $260 to $230 per unit, he could significantly increase sales of R, which would be beneficial to both divisions. He has questioned the fact that the overhead costs are allocated to the products on the basis of labour hours; he thinks it should be done using machine hours or even activity based costing.

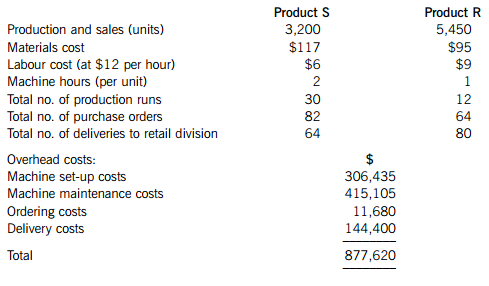

You have obtained the following information for the last month from the assembly division:

Required:

(a) Using traditional absorption costing, calculate new transfer prices for S and R if machine hours are used as a basis for absorption rather than labour hours. Note: round all workings to 2 decimal places. (3 marks)

(b) Using activity based costing to allocate the overheads, recalculate the transfer prices for S and R. Note: round all workings to 2 decimal places. (8 marks)

(c) (i) Calculate last month’s profit for each division, showing it both for each product and in total, if activity based costing is used. (3 marks)

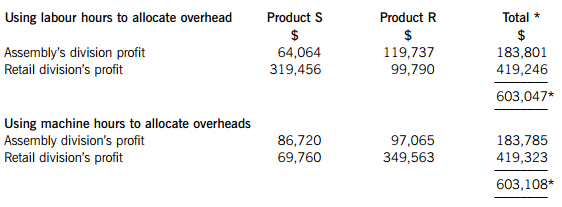

(ii) You have calculated the profits that both divisions made last month using traditional absorption costing and found them to be as follows:

* Note: small differences arise in figures because of rounding.

Required:

Given these two sets of figures and your calculations in (c) (i), discuss whether activity based costing should be implemented. Consider the decision from the view of each of the divisional managers. (6 marks)

第2题

nts. The business is mature and fairly stable year on year. It has 30 employees and is privately owned by its founder. Designit prepares an annual fixed budget. The company’s accounts department consists of one part-qualified accountant who has a heavy workload. He prepares the budget using spreadsheets. The company has a November year end.

Designit pays each of its three sales managers an annual salary of $150,000, plus an individual bonus based on sales targets set at the beginning of the year. There are always two levels of bonus that can be earned, based on a lower and an upper level of fee income. For the year ended 30 November 2012, for example, each of the sales managers was given a lower target of securing $1·5m of fee income each, to be rewarded by an individual bonus equating to 20% of salary. If any of the managers secured a further $1·5m of fee income, their bonus would increase by 5% to the upper target of 25%. None of the managers achieved the upper target but all of them achieved the lower one.

This is the same every year and Designit finds that often the managers secure work from several major clients early in the year and reach the $1·5m target well before the year has ended. They then make little effort to secure extra fees for the company, knowing that it would be almost impossible to hit the second target. This, together with a few other problems that have arisen, has made the company consider whether its current budgeting process could be improved and whether the bonus scheme should also be changed.

Designit is now considering replacing the fixed budget with a monthly rolling budget, which Designit believes will make the budgeting process more relevant and timely and encourage managers to focus on the future rather than the past. It would also prevent the problem of targets being met too early on in the year by the sales managers because the targets would be set for monthly performance rather than annual performance. For example, a manager could be given a target of securing $200,000 fee income in the first month for a reward of 2% of salary. Then, depending on what is happening both within the business and in the economy as a whole, at the end of the first month, a different target fee income could be set for the second month.

Required:

(a) Explain what a monthly rolling budget is and how it would operate at Designit. (4 marks)

(b) Discuss the problems that may be encountered if Designit decides to introduce monthly rolling budgets together with a new bonus scheme, such as the one outlined above. (6 marks)

(c) Discuss the problems with the current bonus scheme and, assuming that the company decides against introducing rolling budgets, describe and justify an alternative, more effective bonus scheme that could be introduced. (6 marks)

(d) Discuss the risk of using the company accountant’s own spreadsheets for budgeting. (4 marks)

第3题

o measure the performance of the business. The company’s management have been increasingly concerned about the lack of sales growth over the last year and, in an attempt to resolve this, made the following changes right at the start of quarter 2:

Advertising: Web Co placed an advert on the webpage of a well-known online fashion magazine at a cost of $200,000. This had a direct link from the magazine’s website to Web Co’s online store.

Search engine: Web Co also engaged the services of a website consultant to ensure that, when certain key words are input by potential customers onto key search engines, such as Google and Yahoo, Web Co’s website is listed on the first page of results. This makes it more likely that a customer will visit a company’s website. The consultant’s fee was $20,000.

Website availability: During quarter 1, there were a few problems with Web Co’s website, meaning that it was not available to customers some of the time. Web Co was concerned that this was losing them sales and the IT department therefore made some changes to the website in an attempt to correct the problem.

The following incentives were also offered to customers:

Incentive 1: A free ‘Fast Track’ delivery service, guaranteeing delivery within two working days, for all continuing customers who subscribe to Web Co’s online subscription newsletter. Subscribers are thought by Web Co to become customers who place further orders.

Incentive 2: A $10 discount to all customers spending $100 or more at any one time.

The results for the last two quarters are shown below, quarter 2 being the most recent one. The results for quarter 1 reflect the period before the changes and incentives detailed above took place and are similar to the results of other quarters in the preceding year.

Required:

Assess the performance of the business in Quarter 2 in relation to the changes and incentives that the company introduced at the beginning of this quarter. State clearly where any further information might be necessary, concluding as to whether the changes and incentives have been effective.

第4题

iler. All chocolates are made in batches of 16, to fit the standard boxes supplied by the retailer. The standard cost of labour for each batch is $6·00 and the standard labour time for each batch is half an hour. In November, Truffle Co had budgeted production of 24,000 batches; actual production was only 20,500 batches. 12,000 labour hours were used to complete the work and there was no idle time. All workers were paid for their actual hours worked. The actual total labour cost for November was $136,800. The production manager at Truffle Co has no input into the budgeting process.

At the end of October, the managing director decided to hold a meeting and offer staff the choice of either accepting a 5% pay cut or facing a certain number of redundancies. All staff subsequently agreed to accept the 5% pay cut with immediate effect.

At the same time, the retailer requested that the truffles be made slightly softer. This change was implemented immediately and made the chocolates more difficult to shape. When recipe changes such as these are made, it takes time before the workers become used to working with the new ingredient mix, making the process 20% slower for at least the first month of the new operation.

The standard costing system is only updated once a year in June and no changes are ever made to the system outside of this.

Required:

(a) Calculate the total labour rate and total labour efficiency variances for November, based on the standard cost provided above. (4 marks)

(b) Analyse the total labour rate and total labour efficiency variances into component parts for planning and operational variances in as much detail as the information allows. (8 marks)

(c) Assess the performance of the production manager for the month of November. (8 marks)

第5题

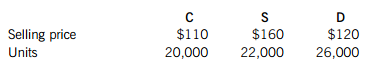

irons (S) and dryers (D.) The budgeted sales prices and volumes for the next year are as follows:

Each product is made using a different mix of the same materials and labour. Product S also uses new revolutionary technology for which the company obtained a ten-year patent two years ago. The budgeted sales volumes for all the products have been calculated by adding 10% to last year’s sales.

The standard cost card for each product is shown below.

Both skilled and unskilled labour costs are variable.

The general fixed overheads are expected to be $640,000 for the next year.

Required:

(a) Calculate the weighted average contribution to sales ratio for Hair Co.

Note: round all workings to 2 decimal places. (6 marks)

(b) Calculate the total break-even sales revenue for the next year for Hair Co.

Note: round all workings to 2 decimal places. (2 marks)

(c) Using the graph paper provided, draw a multi-product profit-volume (PV) chart showing clearly the profit/loss lines assuming:

(i) you are able to sell the products in order of the ones with the highest ranking contribution to sales ratios first; and

(ii) you sell the products in a constant mix.

Note: only one graph is required. (9 marks)

(d) Briefly comment on your findings in (c). (3 marks)

第6题

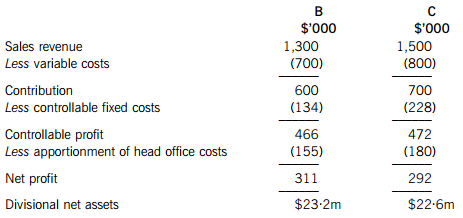

f a large, manufacturing company. Whilst both divisions operate in almost identical markets, each division operates separately as an investment centre. Each month, operating statements must be prepared by each division and these are used as a basis for performance measurement for the divisions.

Last month, senior management decided to recharge head office costs to the divisions. Consequently, each division is now going to be required to deduct a share of head office costs in its operating statement before arriving at ‘net profit’, which is then used to calculate return on investment (ROI). Prior to this, ROI has been calculated using controllable profit only. The company’s target ROI, however, remains unchanged at 20% per annum. For each of the last three months, Divisions B and C have maintained ROIs of 22% per annum and 23% per annum respectively, resulting in healthy bonuses being awarded to staff. The company has a cost of capital of 10%.

The budgeted operating statement for the month of July is shown below:

Required

(a) Calculate the expected annualised Return on Investment (ROI) using the new method as preferred by senior management, based on the above budgeted operating statements, for each of the divisions. (2 marks)

(b) The divisional managing directors are unhappy about the results produced by your calculations in (a) and have heard that a performance measure called ‘residual income’ may provide more information. Calculate the annualised residual income (RI) for each of the divisions, based on the net profit figures for the month of July. (3 marks)

(c) Discuss the expected performance of each of the two divisions, using both ROI and RI, and making any additional calculations deemed necessary. Conclude as to whether, in your opinion, the two divisions have performed well. (6 marks)

(d) Division B has now been offered an immediate opportunity to invest in new machinery at a cost of $2·12 million. The machinery is expected to have a useful economic life of four years, after which it could be sold for $200,000. Division B’s policy is to depreciate all of its machinery on a straight-line basis over the life of the asset. The machinery would be expected to expand Division B’s production capacity, resulting in an 8·5% increase in contribution per month.

Recalculate Division B’s expected annualised ROI and annualised RI, based on July’s budgeted operating statement after adjusting for the investment. State whether the managing director will be making a decision that is in the best interests of the company as a whole if ROI is used as the basis of the decision. (5 marks)

(e) Explain any behavioural problems that will result if the company’s senior management insist on using solely ROI, based on net profit rather than controllable profit, to assess divisional performance and reward staff. (4 marks)

第7题

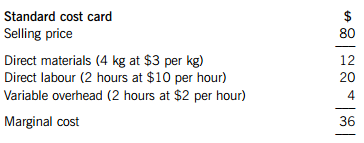

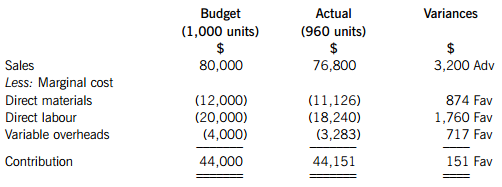

d for one unit is as follows:

A junior member of the accounts team produced the following variance statement for the month of May.

Lock Co used 3,648 kg of materials in the period and the labour force worked – and was paid for – 1,824 hours. Until now, Lock Co has had a market share of 25%. In the month of May, however, the market faced an unexpected 10% decline in the demand for locks.

Required:

(a) Prepare a statement which reconciles budgeted contribution to actual contribution in as much detail as possible. Do not calculate the sales price and the labour rate variances, since both of these have a value of nil. Clearly show all other workings. (12 marks)

(b) The production director at Lock Co believes that the way to persistently increase market share in the long term is to focus on quality, and is hoping to introduce a ‘Total Quality Management’ (TQM) approach. The finance director also shares this view and has said that ‘standard costing will no longer have a place within the organisation if TQM is introduced.’

Discuss the view that there is no longer a place for standard costing if TQM is introduced at Lock Co. (8 marks)

第8题

must be used within three months. Over the last two years, Sauce Co has experienced all kinds of problems. The financial and sales directors believe these to be a result of persistently unrealistic sales targets imposed by the managing director, who makes forecasts based on his own subjective and overly optimistic views about future sales. Whilst an incentive scheme is in place for employees, the company has not hit its targets for the last three years, so no bonuses have been paid out. The financial director has asked you to forecast the sales for the last two quarters of 2012, hoping to present these figures to the managing director in an attempt to persuade him that the basis of forecasting needs to be changed. Production volumes are also currently based on anticipated sales rather than actual orders.

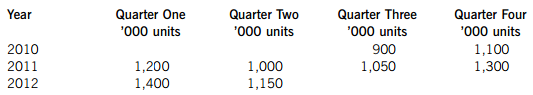

The following sales figures are available for the last two years. All of the figures represent actual sales except for quarter 2 of 2012, which is an estimate. The financial director is satisfied that this estimate can be relied upon.

The following centred moving averages have been calculated, using a base period of four quarters:

The average seasonal variations for 2010 have already been made available to you and are 0·908 for quarter 3 and 1·082 for quarter 4. The random component is negligible and can therefore be ignored.

Required:

(a) Using the information provided above, and assuming a proportional (multiplicative) model, forecast the sales of Sauce Co for the last two quarters of 2012. Calculate your seasonal adjustments to four decimal places. (10 marks)

(b) Discuss the likely impact that the budgeting style. and inaccurate sales forecasts have had on the staff and business of Sauce Co. (10 marks)

第9题

llopia. The UHS is funded centrally through revenues from taxpayers. However, the government is not involved in the day-to-day running of the UHS, which is largely managed regionally by a number of self-governing trusts, such as the Sickham UHS Trust.

The Sickham UHS Trust runs one hospital in Sickham and, like other trusts in Illopia, receives 70% of its income largely from the UHS’ ‘payments by results’ scheme, which was established two years ago. Under this scheme, the trust receives a pre-set tariff (fee income) for each service it provides. If the Trust manages to provide any of its services at a lower cost than the pre-set tariff, it is allowed to use the surplus as it wishes. Similarly, it has to bear the cost of any deficits itself. Currently, the Trust knows that a number of its services simply cannot be provided at the tariff paid and accepts that these always lead to a deficit. Similarly, other services always seem to create a surplus. This is partly because different trusts define their services and account for overheads differently. Also, it is partly due to regional differences in costs, which are not taken into account by the scheme, which operates on the basis that ‘one tariff fits all’.

The remaining 30% of the Trust’s income comes from transplant and heart operations. Since these are not covered by the scheme, the payment the Trust receives is based on the actual costs it incurs in providing the operations. However, the Trust is not allowed to exceed the total budget provided for these operations in any one year.

Over recent years, the Trust’s board of directors has become increasingly dissatisfied with the financial performance of the Trust and has blamed it on poor costing systems, leading to an inability to control costs. As a result, the finance director and his second in command – the financial controller – have now been replaced. The board of directors has taken this decision after complaining that ‘the Trust simply cannot sustain the big deficit between income and spending’. The new financial controller comes from a manufacturing background and is a great advocate of target costing, believing that the introduction of a target costing system at the Sickham UHS Trust is the answer to all of its problems. The new financial director is unconvinced, believing target costing to be only really suitable in manufacturing companies.

Required:

(a) Explain the main steps involved in developing a target price and target cost for a product in a typical manufacturing company. (6 marks)

(b) Explain four key characteristics that distinguish services from manufacturing. (4 marks)

(c) Describe how the Sickham UHS Trust is likely, in the current circumstances, to try to derive: (i) a target cost for the services that it provides under the ‘payment by results’ scheme; and (2 marks) (ii) a target cost for transplants and heart operations. (2 marks)

(d) Discuss THREE of the particular difficulties that the Sickham UHS Trust may find in using target costing in its service provision. (6 marks)

第10题

product comes with a one year warranty offering free repairs if any faults arise in this period.

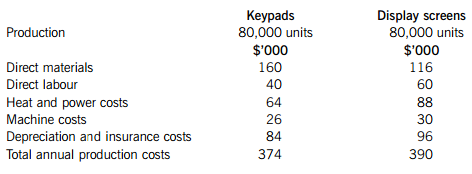

It currently produces and sells 80,000 units per annum, with production of them being restricted by the short supply of labour. Each control panel includes two main components – one key pad and one display screen. At present, Robber Co manufactures both of these components in-house. However, the company is currently considering outsourcing the production of keypads and/or display screens. A newly established company based in Burgistan is keen to secure a place in the market, and has offered to supply the keypads for the equivalent of $4·10 per unit and the display screens for the equivalent of $4·30 per unit. This price has been guaranteed for two years.

The current total annual costs of producing the keypads and the display screens are:

Notes:

1. Materials costs for keypads are expected to increase by 5% in six months’ time; materials costs for display screens are only expected to increase by 2%, but with immediate effect.

2. Direct labour costs are purely variable and not expected to change over the next year.

3. Heat and power costs include an apportionment of the general factory overhead for heat and power as well as the costs of heat and power directly used for the production of keypads and display screens. The general apportionment included is calculated using 50% of the direct labour cost for each component and would be incurred irrespective of whether the components are manufactured in-house or not.

4. Machine costs are semi-variable; the variable element relates to set up costs, which are based upon the number of batches made. The keypads’ machine has fixed costs of $4,000 per annum and the display screens’ machine has fixed costs of $6,000 per annum. Whilst both components are currently made in batches of 500, this would need to change, with immediate effect, to batches of 400.

5. 60% of depreciation and insurance costs relate to an apportionment of the general factory depreciation and insurance costs; the remaining 40% is specific to the manufacture of keypads and display screens.

Required:

(a) Advise Robber Co whether it should continue to manufacture the keypads and display screens in-house or whether it should outsource their manufacture to the supplier in Burgistan, assuming it continues to adopt a policy to limit manufacture and sales to 80,000 control panels in the coming year. (8 marks)

(b) Robber Co takes 0·5 labour hours to produce a keypad and 0·75 labour hours to produce a display screen. Labour hours are restricted to 100,000 hours and labour is paid at $1 per hour. Robber Co wishes to increase its supply to 100,000 control panels (i.e. 100,000 each of keypads and display screens). Advise Robber Co as to how many units of keypads and display panels they should either manufacture and/or outsource in order to minimise their costs. (7 marks)

(c) Discuss the non-financial factors that Robber Co should consider when making a decision about outsourcing the manufacture of keypads and display screens. (5 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!