重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

与其他模式相比,()合同更接近于固定总价合同。

A.CM

B.EPC

C.Partnering

D.Project Controlling

更多“与其他模式相比,()合同更接近于固定总价合同。A.CMB.EPCC.PartneringD.Project Controlling”相关的问题

更多“与其他模式相比,()合同更接近于固定总价合同。A.CMB.EPCC.PartneringD.Project Controlling”相关的问题

第1题

(c) Calculate the expected corporation tax liability of Dovedale Ltd for the year ending 31 March 2007 on the

assumption that all available reliefs are claimed by Dovedale Ltd but that Hira Ltd will not claim any capital

allowances in that year. (4 marks)

第2题

(d) Explain whether or not Dovedale Ltd, Hira Ltd and Atapo Inc can register as a group for the purposes of value

added tax. (3 marks)

第3题

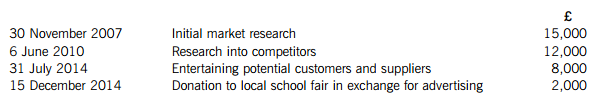

What is the amount of Lili Ltd’s deductible pre-trading expenditure in respect of the year ended 31 December 2015?

A.£10,000

B.£14,000

C.£27,000

D.£29,000

第4题

5 (a) Carver Ltd was incorporated and began trading in August 2002. It is a close company with no associated

companies. It has always prepared accounts to 31 December and will continue to do so in the future.

It has been decided that Carver Ltd will sell its business as a going concern to Blade Ltd, an unconnected

company, on 31 July 2007. Its premises and goodwill will be sold for £2,135,000 and £290,000 respectively

and its machinery and equipment for £187,000. The premises, which do not constitute an industrial building,

were acquired on 1 August 2002 for £1,808,000 and the goodwill has been generated internally by the

company. The machinery and equipment cost £294,000; no one item will be sold for more than its original cost.

The tax adjusted trading profit of Carver Ltd in 2007, before taking account of both capital allowances and the

sale of the business assets, is expected to be £81,000. The balance on the plant and machinery pool for the

purposes of capital allowances as at 31 December 2006 was £231,500. Machinery costing £38,000 was

purchased on 1 March 2007. Carver Ltd is classified as a small company for the purposes of capital allowances.

On 1 August 2007, the proceeds from the sale of the business will be invested in either an office building or a

portfolio of UK quoted company shares, as follows:

Office building

The office building would be acquired for £3,100,000; the vendor is not registered for value added tax (VAT).

Carver Ltd would borrow the additional funds required from a UK bank. The building is let to a number of

commercial tenants who are not connected with Carver Ltd and will pay rent, in total, of £54,000 per calendar

quarter, in advance, commencing on 1 August 2007. The company’s expenditure for the period from 1 August

2007 to 31 December 2007 is expected to be:

£

Loan interest payable to UK bank 16,000

Building maintenance costs 7,500

Share portfolio

Shares would be purchased for the amount of the proceeds from the sale of the business with no need for further

loan finance. It is estimated that the share portfolio would generate dividends of £36,000 and capital gains, after

indexation allowance, of £10,000 in the period from 1 August 2007 to 31 December 2007.

All figures are stated exclusive of value added tax (VAT).

Required:

(i) Taking account of the proposed sale of the business on 31 July 2007, state with reasons the date(s) on

which Carver Ltd must submit its corporation tax return(s) for the year ending 31 December 2007.

(2 marks)

第5题

What is the amount of consumption tax (CT) payable by Cig Ltd in January 2014?

A.RMB42,000

B.RMB42,900

C.RMB60,000

D.RMB77,100

第6题

(c) At 1 June 2006, Router held a 25% shareholding in a film distribution company, Wireless, a public limited

company. On 1 January 2007, Router sold a 15% holding in Wireless thus reducing its investment to a 10%

holding. Router no longer exercises significant influence over Wireless. Before the sale of the shares the net asset

value of Wireless on 1 January 2007 was $200 million and goodwill relating to the acquisition of Wireless was

$5 million. Router received $40 million for its sale of the 15% holding in Wireless. At 1 January 2007, the fair

value of the remaining investment in Wireless was $23 million and at 31 May 2007 the fair value was

$26 million. (6 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

第7题

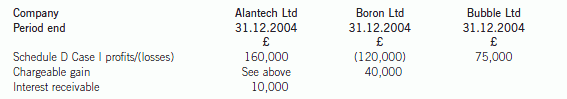

5 Assume today’s date is 1 May 2005.

On 1 April 1999, Alan set up his own company, Alantech Ltd to design and produce technology components in mobile

phones. He personally owns 100% of the share capital. Accounts are drawn up to 31 December each year.

The company was successful, and the profits made allowed Alantech to buy 7.5% of the ordinary shares in another

technology company, Mobile Ltd, on 1 July 2001. The price paid for the shares was £75,000. At this time, the

remaining ordinary shares in Mobile were held by Boron Ltd (7.5%), Carbon plc (40%) and Diamond Ltd (45%).

Technology companies faced difficult trading during this time, and although Alantech Ltd continued to make profits,

other companies suffered. This allowed Alantech Ltd to buy 100% of the shares of Boron Ltd (together with its 100%

subsidiary, Bubble Ltd) at a low price as both companies were performing poorly. The acquisition took place on 1

July 2004, and was funded by the sale of a building used in Alantech Ltd’s trade. The building had cost £150,000

on 1 September 1999, and was sold for £250,000 on 1 May 2004.

Trading results for the companies are as follows:

Additional information:

– Boron Ltd’s chargeable gain took place prior to its acquisition by Alantech Ltd.

– Bubble Ltd has brought forward Schedule D Case I losses of £25,000 as at 1 January 2004.

– It is anticipated that Boron Ltd will make a small Schedule D Case I loss in 2005.

– Mobile Ltd is profit making.

Alan believes that to improve the Boron Ltd business, the company needs to invest in new high-tech fixed machinery

within the next year. The projected cost of the fixed machinery is £200,000. In order to raise funds, Alantech Ltd and

Boron Ltd will have to sell the shares in Mobile Ltd. From an examination of Boron Ltd’s accounting records, Alan

understands that Boron Ltd’s holding of shares in Mobile Ltd was bought on 1 November 2000 for £55,000.

Alan has identified a possible sale of the group’s entire shareholdings (15%) in Mobile Ltd for £300,000 to Carbon

plc, as this will give Carbon plc a controlling shareholding in Mobile Ltd. He plans to sell the shares at the beginning

of June 2005. Alan has heard that there is a form. of tax relief available to companies selling shares and would like

advice on whether or not it applies to his situation.

In addition, Alan has struggled to deal with the VAT returns for each company in the group, in particular the intragroup

transactions, and wonders if there is any way in which the VAT accounting for the group can be simplified.

Required:

(a) Calculate the chargeable gain arising on Alantech Ltd’s disposal of the building in May 2004. State clearly

any reliefs available, and the conditions to be satisfied to obtain such reliefs. (6 marks)

第8题

Alpha Trading Ltd (Alpha) is a value added tax (VAT) general taxpayer. On 1 January 2014, Alpha lent RMB200,000 to Beta Ltd at an interest rate of 10% per annum.

What is the type and amount of turnover tax which Alpha Trading Ltd will pay on the interest income received for the year 2014?

A.Business tax of RMB1,053

B.Business tax of RMB1,000

C.Value added tax of RMB3,400

D.Value added tax of RMB1,200

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!