重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

5 Assume today’s date is 1 May 2005.

On 1 April 1999, Alan set up his own company, Alantech Ltd to design and produce technology components in mobile

phones. He personally owns 100% of the share capital. Accounts are drawn up to 31 December each year.

The company was successful, and the profits made allowed Alantech to buy 7.5% of the ordinary shares in another

technology company, Mobile Ltd, on 1 July 2001. The price paid for the shares was £75,000. At this time, the

remaining ordinary shares in Mobile were held by Boron Ltd (7.5%), Carbon plc (40%) and Diamond Ltd (45%).

Technology companies faced difficult trading during this time, and although Alantech Ltd continued to make profits,

other companies suffered. This allowed Alantech Ltd to buy 100% of the shares of Boron Ltd (together with its 100%

subsidiary, Bubble Ltd) at a low price as both companies were performing poorly. The acquisition took place on 1

July 2004, and was funded by the sale of a building used in Alantech Ltd’s trade. The building had cost £150,000

on 1 September 1999, and was sold for £250,000 on 1 May 2004.

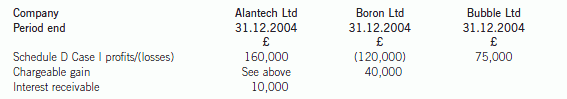

Trading results for the companies are as follows:

Additional information:

– Boron Ltd’s chargeable gain took place prior to its acquisition by Alantech Ltd.

– Bubble Ltd has brought forward Schedule D Case I losses of £25,000 as at 1 January 2004.

– It is anticipated that Boron Ltd will make a small Schedule D Case I loss in 2005.

– Mobile Ltd is profit making.

Alan believes that to improve the Boron Ltd business, the company needs to invest in new high-tech fixed machinery

within the next year. The projected cost of the fixed machinery is £200,000. In order to raise funds, Alantech Ltd and

Boron Ltd will have to sell the shares in Mobile Ltd. From an examination of Boron Ltd’s accounting records, Alan

understands that Boron Ltd’s holding of shares in Mobile Ltd was bought on 1 November 2000 for £55,000.

Alan has identified a possible sale of the group’s entire shareholdings (15%) in Mobile Ltd for £300,000 to Carbon

plc, as this will give Carbon plc a controlling shareholding in Mobile Ltd. He plans to sell the shares at the beginning

of June 2005. Alan has heard that there is a form. of tax relief available to companies selling shares and would like

advice on whether or not it applies to his situation.

In addition, Alan has struggled to deal with the VAT returns for each company in the group, in particular the intragroup

transactions, and wonders if there is any way in which the VAT accounting for the group can be simplified.

Required:

(a) Calculate the chargeable gain arising on Alantech Ltd’s disposal of the building in May 2004. State clearly

any reliefs available, and the conditions to be satisfied to obtain such reliefs. (6 marks)

更多“5 Assume today’s date is 1 May 2005.On 1 April 1999, Alan set up his own company, Alantech”相关的问题

更多“5 Assume today’s date is 1 May 2005.On 1 April 1999, Alan set up his own company, Alantech”相关的问题

第1题

1 Today’s date is 8 June 2005.

David and Debbie were an elderly couple who had worked hard and over a number of years they built up a successful

family company, Dee Limited. Their success allowed them to accumulate a series of investments. David died in May

2005. Debbie is 66 and still in good health.

The couple had two children, Andrew and Allison. Andrew, aged 37, is single but is shortly to be married. He is the

managing director of the family trading company, Dee Limited, which was set up 30 years ago by David and Debbie.

Both Andrew and Allison are shareholders in the company, although Allison does not work for the company. She is

32, and lives abroad with her husband and two children (aged 2 and 4) in a villa gifted to her by Debbie in June

2003. The villa was worth £180,000 at that time, but the current value has fallen to £110,000 as a result of

exchange rate movements.

Dee Limited is currently worth £1,260,000 in total, and the value is unlikely to change in the foreseeable future. The

shareholdings in the company at the date of David’s death (May 2005) were held as follows:

Required:

(a) Calculate the inheritance tax (IHT) that will be payable as a result of David’s death. Your answer should

include calculations of the tax arising on any lifetime transfers and give reasons for any reliefs given.

(12 marks)

第2题

5 Gloria Seaford is UK resident and ordinarily resident but is not domiciled in the UK.

Gloria has owned and run a shop selling books, cards and small gifts as a sole trader since June 1992. She

purchased her current premises, which were built in 1990, in July 2005 for £267,000. Gloria is registered for value

added tax. Gloria will be 66 on 4 January 2007 and, with this in mind, on 1 November 2006 she started looking

for a buyer for the business so that she could retire.

Gloria has received an offer of £335,000 for the shop premises from Ned Skillet who intends to convert the building

into a restaurant. It can be assumed that the sale will take place on 28 February 2007 and that Gloria will cease to

trade on that day.

Gloria estimates that on 28 February 2007 she will be able to sell the shelving and other shop fittings to local

businesses for £1,400 (no item will be sold for more than cost). She has agreed to sell all stock on hand on

28 February 2007 to a competitor at cost plus 5%. This is expected to result in sales revenue of £8,300. The only

other business asset is a van that is currently used 85% for business purposes. The van is expected to be worth

£4,700 on 28 February 2007 and Gloria will keep it for her private use.

Gloria’s tax adjusted trading profit for the year ended 31 October 2006 was £39,245. The forecast tax adjusted

trading profit for the period ending 28 February 2007, before taking account of the final sale of the business assets

on that date and before deduction of capital allowances, is £11,500. Gloria has overlap profits brought forward of

£15,720.

The tax written down value on the capital allowance general pool at 31 October 2006 was £4,050. Gloria purchased

equipment for £820 in November 2006. The tax written down value of the van at 31 October 2006 was £4,130.

In 2006/07 Gloria will have a taxable retirement pension of £4,300 and bank interest of £13,500 credited to her

bank account.

On 1 November 2004 Gloria inherited the following assets from her aunt.

第3题

to make direct to

the Revenue in respect of the years of assessment 2005/06 and 2006/07, clearly identifying for each

payment listed, the amount, the nature of the liability/liabilities, and the due date. (5 marks)

第4题

uires advice in respect of a loan to the partnership, the calculation of her share of profits and the tax treatment of her redundancy payment.

Bex:

– Is resident and domiciled in the UK.

– Received an annual salary of £120,000 from her former employer, Cape Ltd.

– Was made redundant by Cape Ltd on 30 September 2015.

– Joined Amy, a sole trader, to form. a partnership on 1 January 2016.

– Has no other source of income.

Amy and Bex partnership:

– Will prepare its first set of accounts for the 16-month period to 30 April 2017.

– Is expected to make a tax-adjusted profit of £255,000 (before deducting interest and capital allowances) for the period ending 30 April 2017.

– The tax written down value on its main pool at 1 January 2016 is £nil.

– Except for the computer referred to below, no further assets will be purchased by either Amy or Bex for use in the partnership in the period ending 30 April 2017.

Profit sharing arrangements:

– The partnership’s profit sharing agreement is as follows:

Bex – loans:

– In addition to her capital contribution, Bex will make a £20,000 loan to the partnership on 1 August 2016. The partnership will use this money wholly for business purposes.

– This loan will be financed by a £25,000 personal loan from Bex’s bank, taken out on the same date.

– The remaining £5,000 of the bank loan will be used to purchase a computer for use in the partnership. Bex will have 20% private use of this computer.

– Both the loan from Bex to the partnership and the personal bank loan to Bex will carry interest at the rate of 5% per annum.

Bex – redundancy package from Cape Ltd:

– The package comprised a £22,000 statutory redundancy payment and an additional ex-gratia payment of £48,000.

– Bex also received three months’ salary in lieu of notice, as specified in her contract of employment.

Required:

(a) (i) Explain, with the aid of calculations, the tax deductions which will be available in respect of the loan interest payable on both the loan from Bex to the partnership and the personal bank loan to Bex. (7 marks)

(ii) In respect of the period ending 30 April 2017, show the allocation between the partners of the taxable trading profit of the partnership. (4 marks)

(iii) Calculate Bex’s taxable trading income in respect of her share of the partnership profits for all relevant tax years. Note: Your answer to (a)(iii) should clearly state the tax years and basis periods involved. (3 marks)

(b) Explain the income tax implications for Bex of the receipt of the redundancy package from Cape Ltd and calculate her total income tax liability for the tax year 2015/16. (6 marks)

第5题

ria. Maria wants advice on the tax consequences of selling some of her shares back to Granada Ltd. Granada Ltd wants advice on the corporation tax and value added tax (VAT) implications of the recent acquisition of an unincorporated business.

Maria:

– Is resident and domiciled in the UK.

– Is a higher rate taxpayer and will remain so in the future.

– Has already realised chargeable gains of £15,000 in the tax year 2015/16.

Shares in Granada Ltd:

– Maria subscribed for 10,000 £1 ordinary shares in Granada Ltd at par in June 2006.

– Maria is one of four equal shareholders and directors of Granada Ltd.

– Maria intends to sell either 2,700 or 3,200 shares back to the company on 31 March 2016 at their current market value of £12·80 per share.

– All of the conditions for capital treatment are satisfied, except for, potentially, the condition relating to the reduction in the level of shareholding.

Granada Ltd:

– Is a UK resident trading company which manufactures knitwear.

– Prepares accounts to 31 December each year.

– Is registered for VAT.

– Acquired the trade and assets of an unincorporated business, Starling Partners, on 1 January 2016.

Starling Partners:

– Had been trading as a partnership for many years as a wholesaler of handbags within the UK.

– Starling Partners’ main assets comprise a freehold commercial building and its ‘Starling’ brand, which were valued on acquisition by Granada Ltd at £105,000 and £40,000 respectively.

– Is registered for VAT.

– The transfer of its trade and assets to Granada Ltd qualified as a transfer of a going concern (TOGC) for VAT purposes.

– The business is forecast to make a trading loss of £130,000 in the year ended 31 December 2016.

Granada Ltd – results and proposed expansion:

– The knitwear business is expected to continue making a taxable trading profit of around £100,000 each year.

– Granada Ltd has no non-trading income but realised a chargeable gain of £10,000 on 1 March 2016.

– Granada Ltd is considering expanding the wholesale handbag trade acquired from Starling Partners into the export market from 1 January 2017.

– Granada Ltd anticipates that this expansion will result in the wholesale handbag trade returning a profit of £15,000 in the year ended 31 December 2017.

Required:

(a) (i) Explain, with the aid of calculations, why the capital treatment WILL NOT apply if Maria sells 2,700 of her shares back to Granada Ltd, but WILL apply if, alternatively, she sells back 3,200 shares. (4 marks)

(ii) Calculate Maria’s after-tax proceeds per share if she sells:

(1) 2,700 shares back to Granada Ltd; and alternatively

(2) 3,200 shares back to Granada Ltd. (4 marks)

(b) (i) Describe the corporation tax treatment of the acquisition of the ‘Starling’ brand by Granada Ltd, if no charge for amortisation was required in its statement of profit or loss. (3 marks)

(ii) Discuss how Granada Ltd could obtain relief for the trading loss expected to be incurred by the trade acquired from Starling Partners, if it does not wish to carry any of the loss back. (5 marks)

(c) Explain the value added tax (VAT) implications for Granada Ltd in respect of the acquisition of the business of Starling Partners, and the additional information needed in relation to the building to fully clarify the VAT position. (4 marks)

第6题

Section B – TWO questions ONLY to be attempted

Your client, Eric, requires advice on the capital gains tax implications arising from the receipt of insurance proceeds and the disposal of some shares, and the inheritance tax reliefs available in respect of assets in his estate at death. His son Zak requires advice regarding the application of the personal service company (IR35) legislation.

Eric:

– Is UK resident and domiciled.

– Is a higher rate taxpayer.

– Is in ill health and is expected to die within the next few months.

Capital transactions in the tax year 2014/15:

– Eric made no disposals for capital gains tax purposes in the tax year 2014/15 other than those detailed below.

– Eric received insurance proceeds of £10,000 following damage to a valuable painting.

– Eric sold half of his shareholding in Malaga plc for £11·50 per share.

Damaged painting:

– Eric purchased the painting for £46,000 in July 2012.

– The painting was damaged in October 2014 such that immediately afterwards its value fell to £38,000.

– The insurance proceeds of £10,000 were received by Eric on 1 December 2014.

– Eric has not had the painting repaired.

Malaga plc shares:

– Malaga plc is a quoted trading company with 200,000 issued shares.

– 80% of Malaga plc’s chargeable assets have always been chargeable business assets.

– Eric was given 12,000 shares in Malaga plc by his sister on 1 April 2010, when they were valued at £126,000.

– Eric’s sister had purchased the shares for £96,000 on 1 March 2009.

– Gift relief was claimed in respect of the gift of the shares to Eric on 1 April 2010.

– Eric paid the inheritance tax arising in respect of this gift following his sister’s death on 1 September 2011.

– Eric has never worked for Malaga plc.

– Eric sold 6,000 shares in Malaga plc on 1 March 2015.

Assets owned by Eric and a previous lifetime gift:

– Eric owns farmland in the UK, which has been leased to a tenant farmer for the last ten years.

– The farmland has a market value of £420,000 and an agricultural value of £340,000.

– Eric’s other assets, excluding the remaining Malaga plc shares, are valued at £408,000.

– Eric has made only one previous lifetime gift, of £60,000 cash to his son Zak on 1 July 2009.

Zak:

– Is the sole shareholder, director and employee of Yoyo Ltd, a company which provides consultancy services.

– In the year ended 31 March 2016, Yoyo Ltd’s gross fee income from relevant engagements performed by Zak will be £110,000.

– In the tax year 2015/16, Zak will draw a salary of £24,000 and dividends of £50,000 from Yoyo Ltd.

– Neither Yoyo Ltd nor Zak has any other source of income.

Required:

(a) Calculate Eric’s total after-tax proceeds in respect of the two capital gains tax disposals in the tax year 2014/15. (6 marks)

(b) (i) On the assumption that Eric dies on 31 March 2016, advise on the availability and effect (if any), of agricultural property relief, business property relief and quick succession relief in respect of the farmland and the retained shares in Malaga plc.

Note: You are not required to prepare calculations for this part of the question. (6 marks)

(ii) Explain, with the aid of calculations, the impact on the inheritance tax liability arising on Eric’s death if Eric does not die until 1 August 2016. (3 marks)

(c) Calculate Zak’s taxable income for the tax year 2015/16 if the personal service company (IR35) legislation were to apply to the fee income received by Yoyo Ltd. (5 marks)

第7题

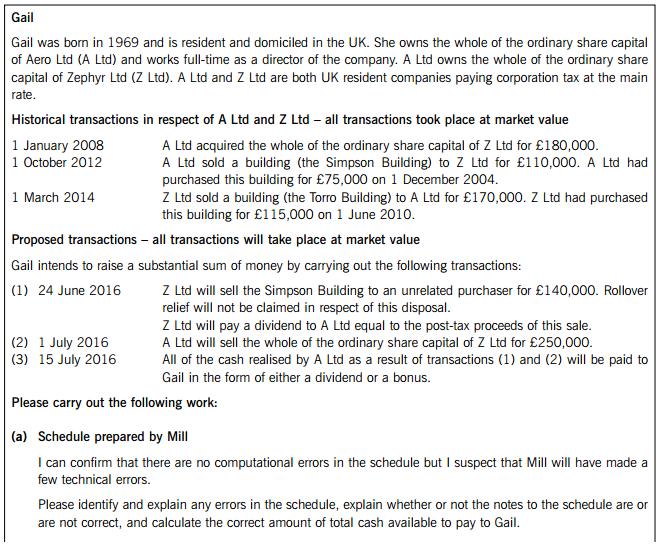

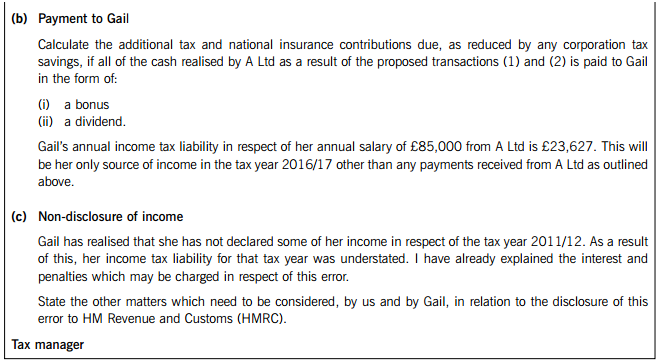

l of Aero Ltd. An email from your manager setting out the matters discussed in the meeting and a schedule prepared by Mill, a junior member of your firm’s tax department, are set out below.

Email from your manager – dated 9 June 2016

Schedule prepared by Mill

Required:

Carry out the work requested in the email from your manager. The following marks are available:

(a) Schedule prepared by Mill. (11 marks)

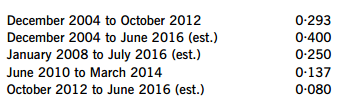

Note: The following movements in the Retail Prices Index should be used, where necessary.

(b) Payment to Gail. (9 marks)

(c) Non-disclosure of income. (5 marks)

第8题

Section A – BOTH questions are compulsory and MUST be attempted

Your manager has received schedules of information from Ray and Shanira in connection with their personal tax affairs. These schedules and an extract from an email from your manager are set out below.

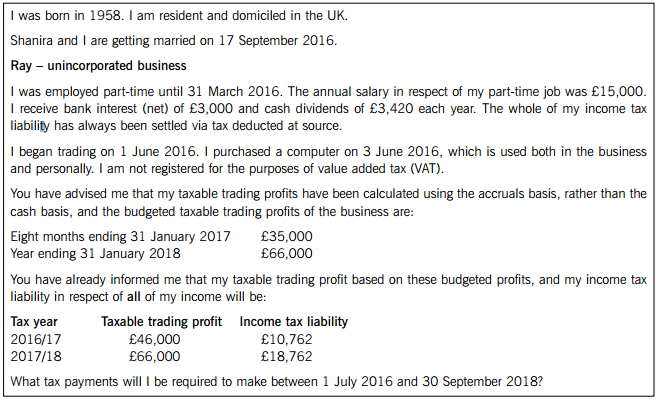

Schedule of information from Ray – dated 8 June 2016

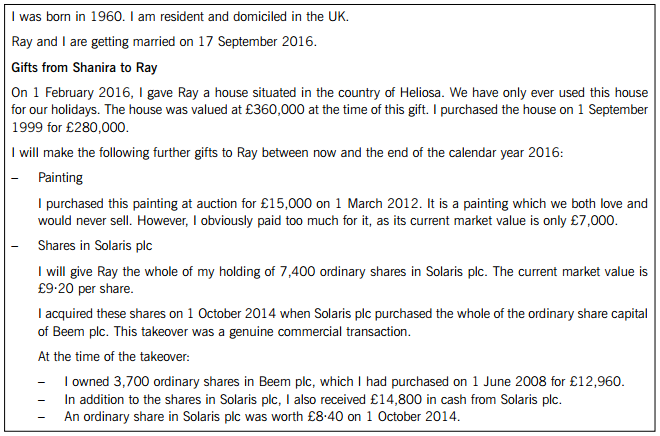

Schedule of information from Shanira – dated 8 June 2016

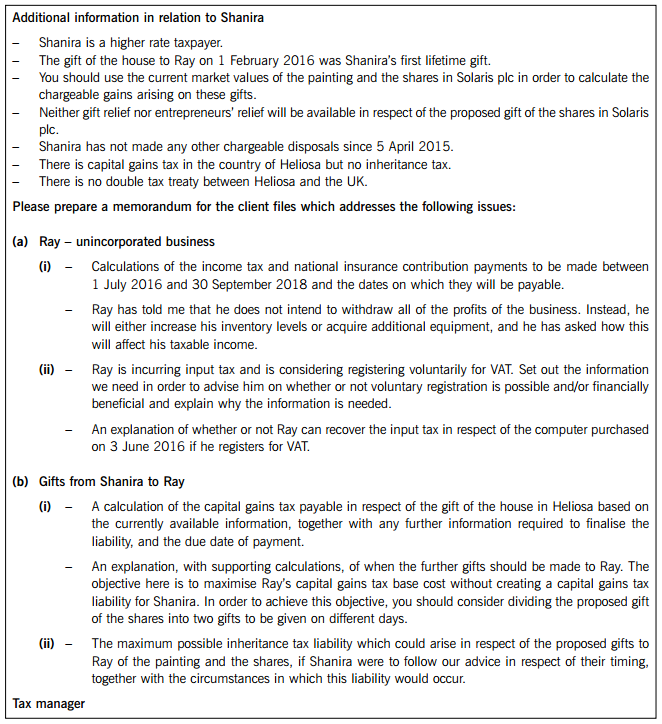

Extract from an email from your manager – dated 9 June 2016

Required:

Prepare the memorandum as requested in the email from your manager. The following marks are available:

(a) Ray – unincorporated business.

(i) Income tax and national insurance contribution payments, and the level of his taxable income. (11 marks)

(ii) Value added tax (VAT). (5 marks)

(b) Gifts from Shanira to Ray.

(i) Capital gains tax. (10 marks)

(ii) Inheritance tax. (5 marks)

Professional marks will be awarded for the approach taken to problem solving, the clarity of the explanations and calculations, the effectiveness with which the information is communicated and the overall presentation. (4 marks)

第9题

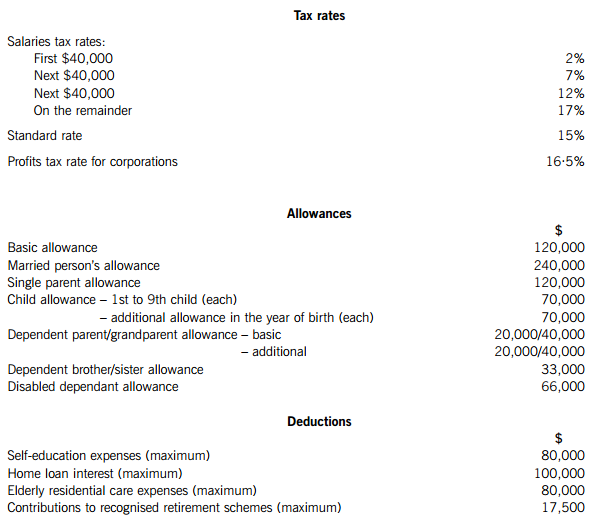

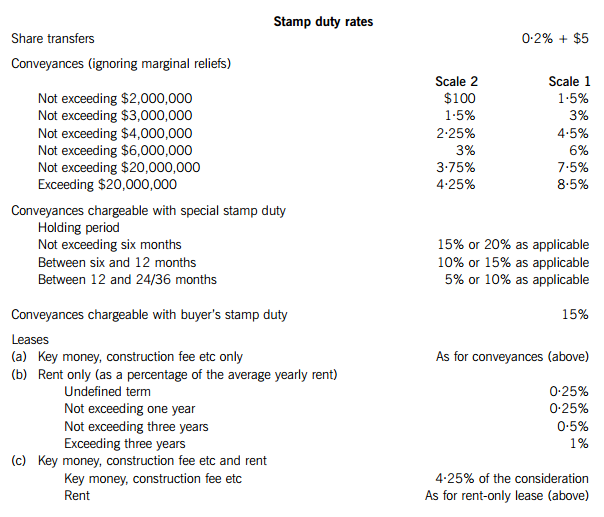

SUPPLEMENTARY INSTRUCTIONS

1. You should assume that the tax rates and allowances shown below will continue to apply for the foreseeable future.

2. Calculations and workings should be rounded down to the nearest HK$.

3. Apportionments need only be made to the nearest month, unless the law and prevailing practice require otherwise.

4. All workings should be shown.

5. Ignore provisional tax and statutory tax reductions, unless specified otherwise.

TAX RATES AND ALLOWANCES

The following 2014/15 tax rates and allowances are to be used in answering the questions.

Section A – BOTH questions are compulsory and MUST be attempted

1.

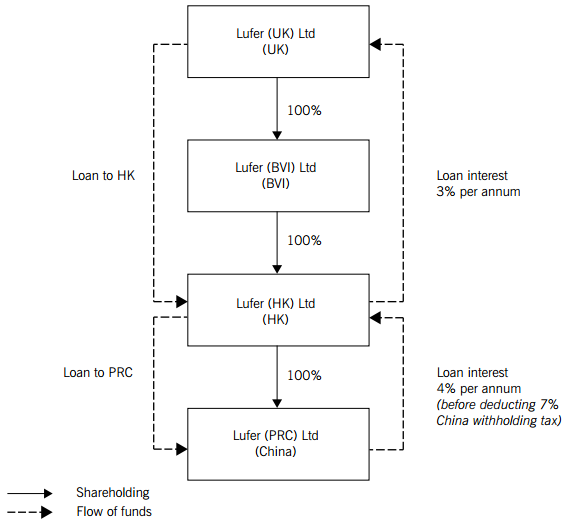

Lufer (HK) Ltd (Lufer-HK) carries on a business in Hong Kong as a wholesaler of smart phone accessories. Lufer-HK’s major customers are leading retailers in Hong Kong. Lufer-HK procures its products from Lufer (PRC) Ltd (Lufer-China) which is a wholly-owned foreign enterprise established in Mainland China as a subsidiary of Lufer-HK. Lufer-China operates as a manufacturer and is the sole supplier of products to Lufer-HK. Other than Lufer-HK, Lufer-China also supplies related products to other China customers under different specifications.

Lufer-HK is held by Lufer (UK) Ltd through a company incorporated in the British Virgin Islands (BVI), Lufer (BVI) Ltd. The group structure is as follows:

Lufer-HK has signed an import processing contract with Lufer-China, under which the following have been arranged:

(1) Lufer-HK agrees to provide support to Lufer-China for the manufacture of the required products, in terms of product design, technical know-how, training and quality control. Special machinery together with moulds will also be provided for use by Lufer-China for manufacturing the products solely for sale by Lufer-HK. If Lufer-HK is required to send technical staff to support Lufer-China, a service fee will be charged to Lufer-China on a cost-plus-10% basis. However, no charge will be made to Lufer-China for the use of the machinery and moulds.

(2) Lufer-China agrees to be responsible for the provision of workers and a factory including utilities and facilities for the manufacture of the required products. In order to finance the renovation of the factory, Lufer-China received a loan from Lufer-HK at an interest rate of 4% per annum.

(3) Lufer-China will acquire raw materials from Lufer-HK at cost, and sell the finished products to Lufer-HK based on the selling price of similar products in the China market.

In the accounts of Lufer-HK, an interest cost of 3% per annum is recorded as payable to Lufer-UK in respect of a borrowing obtained to finance the loan to Lufer-China. The interest income receivable from Lufer-China at 4% per annum is also recorded as income by Lufer-HK. On the remittance of the interest from China to Hong Kong, China withholding tax at the rate of 7% is deducted by Lufer-China and recorded as an expense in the accounts of Lufer-HK.

Required:

As the tax consultant engaged by Lufer-HK, prepare a report for the company’s directors, addressing each of the following issues from a Hong Kong tax perspective.

(a) Profits earned from the sale of smart phone accessories:

(i) Whether the profits earned from the sale of smart phone accessories by Lufer (HK) Ltd to retailers in Hong Kong should be subject to, or exempt from, profits tax. Include an explanation of the general principles for determining the source of manufacturing profits and trading profits in Hong Kong, based on the Departmental Interpretation and Practice Note No. 21 entitled ‘Locality of Profits’ and other relevant court cases. (14 marks)

(ii) Whether Lufer (HK) Ltd is entitled to any deduction (including depreciation allowance) in respect of the cost of the special machinery and moulds provided to Lufer (PRC) Ltd for use in China. (8 marks)

(b) Funding of the loan made to Lufer (PRC) Ltd:

(i) The profits tax treatment of the 1% margin earned by Lufer (HK) Ltd on the borrowing obtained from Lufer (UK) Ltd at 3% per annum, and the loan extended to Lufer (PRC) Ltd at 4% per annum. Include an explanation of the taxability of the interest income received from Lufer (PRC) Ltd, and the deductibility of the interest expense to Lufer (UK) Ltd and comment on whether the loan arrangement is tax effective. (7 marks)

(ii) Whether the China withholding tax on the interest income earned from Lufer (PRC) Ltd is tax deductible to Lufer (HK) Ltd for Hong Kong profits tax purposes. (2 marks)

Note: You are NOT required to discuss the Arrangement between the Mainland of China and HKSAR for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the report and the effectiveness with which its advice is communicated. (4 marks)

2.

John and Mary are married to each other and are permanent residents of Hong Kong. Each of them currently has full-time employment working for organisations in Hong Kong. Last year, Mary’s father passed away, leaving her a boutique business. Also, Mary is pregnant and expecting twin babies in two months’ time. John and Mary recently met with a local tax consultant to discuss their future Hong Kong tax positions. A summary of the major points discussed during the meeting is as follows:

(1) Based on the information from her late father’s lawyer, the boutique business is currently held through a company incorporated in the British Virgin Islands (BVI). The BVI company is cash-rich without any debt or liability, and does not own any asset other than the boutique business. The boutique is operated at a leased retail shop located in Hong Kong. Mary has been given a choice by the lawyer either to take over the shares in the BVI company or to own the boutique business directly. It is Mary’s intention to continue to run the boutique by herself.

(2) Mary has been invited by her brother to participate in an established partnership business following the recent retirement of one of the partners. Mary expects that in addition to her share of profits, she will draw a monthly salary from the partnership. If this is not tax effective, the partnership may engage John as an employee and pay the salary to him instead. On the other hand, Mary’s sister has recently graduated and is interested in being engaged as an employee of the partnership.

(3) John has recently signed a new employment contract with an organisation based in Mainland China (China Co). This new employment will commence in three weeks’ time. Under the new employment contract, John will be responsible for looking after both China Co’s Shenzhen factory and its Hong Kong operations, and thus is expected to travel extensively between China and Hong Kong. The tentative schedule shows that John will stay in Hong Kong for about eight months each year and spend the remaining four months in China. John negotiated his new employment terms during visits to China Co’s premises in China, and he also signed the contract there. The major items in the remuneration package include:

(i) A monthly salary of $100,000 (the take-home amount payable to John is $90,000 after withholding 10% for China’s individual income tax).

(ii) A lump sum incentive of $80,000 to encourage John to resign from his current employment.

(iii) A housing allowance of $30,000 to compensate for John’s mortgage loan repayment for his residence in Hong Kong.

(iv) Reimbursement of any additional China tax liability arising from his employment after adjusting for the 10% amount withheld from the monthly salary.

(v) A holiday package (flight tickets plus hotel) for John’s family up to a maximum of $60,000 per annum.

(4) The couple’s existing apartment is too small to accommodate themselves and the two babies, and the couple are planning to move into the residence currently owned and occupied by John’s parents. John’s parents will then move into the couple’s existing apartment. The couple jointly owns their current apartment and will continue to pay their mortgage loan instalments after the swap. The residence owned by John’s parents is free from any mortgage. John intends to pay a nominal rental to his parents each month for the use of their residence.

(5) The couple are financially independent. Each spouse files their individual tax return each year and pays their salaries tax according to the assessment issued in their own name. Their tax positions in the previous years have been simple and straightforward with their respective employment income as the only item in their tax calculations. After the birth of the twins, each spouse intends to claim one child allowance for Hong Kong tax purposes.

Required:

(a) Discuss the implications for Mary’s Hong Kong tax position in respect of the potential income earned (or losses incurred) by the boutique business in the event that Mary takes over the shares in the BVI company as compared to the alternative that Mary takes over the boutique business directly. You should also address the potential differences in the implications, if any, depending on whether or not Mary elects for personal assessment. (5 marks)

(b) Explain how a partnership is assessed for Hong Kong tax purposes, and the Hong Kong tax implications for Mary in respect of the partnership profit or loss shared by her and the salary drawn from the partnership. You should also discuss whether it will make any difference to the tax treatment of the partnership and/or the partners if the salary is received by John or Mary’s sister rather than by Mary. (4 marks)

(c) Explain whether John is assessable to Hong Kong salaries tax in respect of the income from his new employment, and if so, state on what basis and explain the Hong Kong tax treatment of the major remuneration items specified in the question. Note: You are NOT required to discuss the Arrangement between the Mainland of China and HKSAR for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. (9 marks)

(d) Analyse the major impact on the couple’s Hong Kong tax position arising from the proposed swap of residences between themselves and John’s parents. State any assumptions which you deem necessary. (3 marks)

(e) Comment on the proposed action intended to be taken by the couple with regard to their claiming the child allowance in respect of the twins, and advise on the amount of allowance for which they will be eligible. (4 marks)

Section B – TWO questions ONLY to be attempted

3.

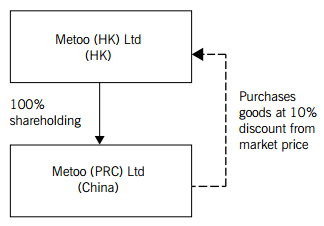

Metoo (HK) Ltd (Metoo-HK) carries on business in Hong Kong as a trader. Metoo-HK purchases its products from its wholly-owned subsidiary in Mainland China, Metoo (PRC) Ltd (Metoo-China), as follows:

Metoo-HK provides management support to Metoo-China and is responsible for promoting the products in Asian markets including Hong Kong. In recognition of Metoo-HK’s contribution, Metoo-China grants a 10% discount from the market selling price in respect of the products it sells to Metoo-HK. Metoo-HK files its profits tax returns in Hong Kong reporting all of its profits as assessable in Hong Kong.

During the year ended 31 December 2013, Metoo-China was investigated by the China tax bureau, as a result of which a transfer pricing adjustment was made to adjust the sales made from Metoo-China to Metoo-HK based on the market selling price. The sales income reported in the 2013 accounts of Metoo-China was $900,000. This amount was adjusted to $1,000,000 by the China tax bureau by removing the discount element, which it considered was not at arm’s length. Metoo-China was required to pay additional China corporate income tax of $25,000 as a consequence of this adjustment.

The management of Metoo-HK considers that the price adjustment in China is not fair to Metoo-HK and wants to know whether it is possible to revise its Hong Kong profits tax assessment for the year of assessment 2013/14.

Required:

(a) Based on the facts as stated and making reference to the Arrangement between the Mainland of China and HKSAR for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income (the DTA), explain the relationship between Metoo (HK) Ltd and Metoo (PRC) Ltd, and analyse the impact on the whole Metoo group arising from the pricing adjustment made by the China tax bureau to Metoo (PRC) Ltd. (4 marks)

(b) Explain the relevant Hong Kong tax law governing the circumstances in which a taxpayer is given the right to revise its tax assessment, and give an opinion as to whether Metoo (HK) Ltd can make a successful revision claim. (4 marks)

(c) (i) Making reference to the Departmental Interpretation and Practice Note No. 45 ‘Relief from double taxation due to transfer pricing or profit reallocation adjustments’ and the DTA, explain the different types of double taxation in the context of the DTA, and identify the type of double taxation to which the pricing adjustment made by the China tax bureau belongs. (7 marks)

(ii) Advise whether, and if so how, in terms of the DTA, Metoo (HK) Ltd may be able to apply for its Hong Kong profits tax assessment for 2013/14 to be revised. (5 marks)

Happy Club (the Club) operates as a recreational club in Hong Kong. The Club owns a clubhouse which provides basic catering and spa services to its members. All members are voting members, and all club facilities are restricted to members’ use only.

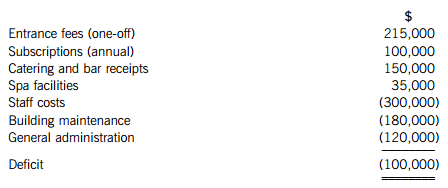

During the year ended 31 March 2015, the Club had the following receipts and payments:

In view of the unfavourable financial position of the Club, the Club’s management has made the following proposals:

(1) The catering services will be opened to non-members during lunch and dinner hours.

(2) The Club will acquire the car park adjacent to the clubhouse and lease it out for rental purposes. The acquisition will be financed by a loan from the Club’s founders. It is intended that the car park will be used by both Club members and the public.

Required:

(a) Explain the current Hong Kong tax position of Happy Club based on the information given for the year ended 31 March 2015. Note: Calculations are not required. (3 marks)

(b) Discuss the implications for and potential changes to Happy Club’s Hong Kong tax position if both of the proposals are implemented. Note: Calculations are not required. (10 marks)

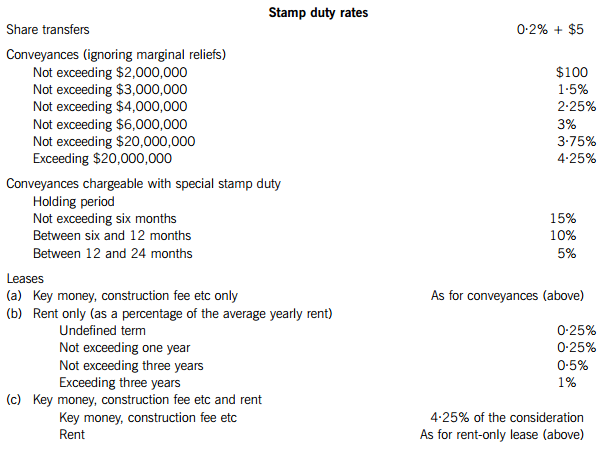

(c) Explain the stamp duty implication, if any, to Happy Club arising from proposal 2. (7 marks)

5.

(a) Joyce Ltd owns a commercial property (shop) in a major shopping mall. The market rent of the shop is $200,000 per month. On 1 January 2014, Joyce Ltd agreed to lease the shop to Fun Ltd for three years. The lease provides that Fun Ltd will pay to Joyce Ltd $100,000 per month plus 2% of Fun Ltd’s gross turnover each month from the business conducted in the shop. In addition, Fun Ltd agreed to pay Joyce Ltd a lump sum of $2,400,000 at the commencement of the lease in consideration for Joyce Ltd agreeing to accept a lower rent. The lump sum is not refundable.

In preparing its financial statements for the year ended 31 December 2014, Joyce Ltd apportioned the upfront payment of $2,400,000 over the term of the lease, and brought only $800,000 into its statement of profit or loss. However, the Inland Revenue Department (IRD) assessed Joyce Ltd on the full upfront payment of $2,400,000 in the year of assessment 2014/15. Joyce Ltd disputes the decision of the IRD.

Required:

(i) Explain the profits tax and stamp duty implications of the lease arrangements for Joyce Ltd. (9 marks)

(ii) State, giving reasons, whether and if so, how your answer to part (a) above would differ if the lease also provided that under no circumstances would the rent payable each month exceed $200,000. (2 marks)

(b) Assuming that Joyce Ltd’s tax dispute with the IRD proceeds to litigation, list the advantages of having the case heard before the Board of Review, rather than in the Court of First Instance. (4 marks)

(c) Instead of leasing the property to Fun Ltd for three years, Joyce Ltd decided to grant a licence to Fun Ltd to occupy the premises for ten years. In consideration, Fun Ltd paid Joyce Ltd a lump sum of $20 million. This receipt was recorded in Joyce Ltd’s statement of profit or loss as arising from the ‘disposal of a fixed asset’.

Required:

Discuss the tax treatment of the $20 million received by Joyce Ltd from Fun Ltd. (5 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第10题

SUPPLEMENTARY INSTRUCTIONS

1. You should assume that the tax rates and allowances shown below will continue to apply for the foreseeable future.

2. Calculations and workings should be rounded down to the nearest HK$.

3. Apportionments need only be made to the nearest month, unless the law and prevailing practice require otherwise.

4. All workings should be shown.

5. Ignore provisional tax and statutory tax reductions, unless specified otherwise.

TAX RATES AND ALLOWANCES

The following 2013/14 tax rates and allowances are to be used in answering the questions.

Section A – BOTH questions are compulsory and MUST be attempted

1.

Tee-fashion Ltd (T-fashion) is a company incorporated and carrying on business in England, engaged in the manufacture and sale of top-brand fashion. In a recent business strategy meeting, the directors of T-fashion have expressed an interest in developing the Mainland China (PRC) market, and have engaged a business consultant to draft a proposal for review.

The following is the proposed structure of the investment and other details:

(a) T-fashion will incorporate a wholly-owned subsidiary in Hong Kong, HK-Co Ltd (HK-Co), as the investment holding vehicle for the operating company in the PRC, PRC-Co Ltd (PRC-Co).

(b) HK-Co will also be the regional support service centre which will hire staff to provide accounting and other support services to the group including PRC-Co.

(c) HK-Co will receive subsidy income from T-fashion to finance its operations. The subsidy will be determined on the basis of 110% of the total annual operating cost before interest and royalty. The 10% premium is intended to be remuneration for HK-Co’s services in Hong Kong.

(d) HK-Co will borrow an interest-bearing loan from T-fashion to partly fund its own operation in Hong Kong, and to partly enable HK-Co to extend another loan to PRC-Co to finance the operations within the PRC. Both loans are interest bearing, allowing HK-Co to earn a small interest spread from PRC-Co. The two loan agreements are separate and independent.

(e) HK-Co will pay a royalty of $50,000 to Media-fashion Ltd (Media-fashion), which is another wholly-owned subsidiary of T-fashion in England. Media-fashion produces and owns a series of fashion show videos/films in support of the latest fashion trends promoted by T-fashion. Pursuant to the licence agreement signed with Media-fashion, HK-Co will pay a royalty in return for the right to use and exhibit some of these videos/films in the PRC.

The following structure chart demonstrates the basic mechanism:

The directors of T-fashion have approached a tax consultancy firm in Hong Kong to obtain tax advice on the major Hong Kong tax implications arising from the proposed structure.

Required:

As the tax manager of the consultancy firm approached by the directors of Tee-fashion Ltd (T-fashion), prepare a report for the directors, addressing each of the following issues from a Hong Kong tax perspective:

(a) Subsidy income received by HK-Co Ltd (HK-Co) from T-fashion:

(i) Discuss the Hong Kong tax implications of the subsidy income received by HK-Co from T-fashion. (3 marks)

(ii) Based on the prevailing transfer pricing principles and practice, discuss the issues surrounding the determination of the amount of the intra-group service fee, and comment on the cost-plus basis used to determine the subsidy income as remuneration for HK-Co’s services. (5 marks)

(b) Loan from HK-Co to PRC-Co Ltd (PRC-Co); and loan from T-fashion to HK-Co:

(i) Discuss the Hong Kong tax implications of the loan interest income received by HK-Co from PRC-Co of $66,000. (3 marks)

(ii) Discuss the Hong Kong tax implications of the loan interest payment made by HK-Co to T-fashion of $60,000. Based on your analysis, briefly comment on whether you consider that the proposed funding arrangements are tax effective. (3 marks)

(c) Royalty income received by Media-fashion Ltd (Media-fashion): Assuming that Media-fashion is not carrying on a business in Hong Kong, discuss whether the royalty income of $50,000 received from HK-Co will be subject to Hong Kong profits tax and if so, why. (5 marks)

(d) Based on the projected management accounts of HK-Co for its first year of operation:

Explain the Hong Kong tax treatment of the following items, including the relevant tax principles underlying their tax treatment:

(i) Depreciation of the computer system of $30,000; (3 marks)

(ii) Incorporation fee of $50,000; (2 marks)

(iii) Mandatory provident fund (MPF) contribution of $30,000. (3 marks)

(iv) Give an estimated calculation of HK Co’s Hong Kong profits tax liability, if any, stating any assumptions which you have made. (4 marks)

Note: You should ignore overseas tax and any double-taxation arrangements throughout this question.

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the report and the effectiveness with which its advice is communicated. (4 marks)

2.

You should assume that today’s date is 1 January 2014.

Mr Lee is a Hong Kong permanent resident earning salary income under a Hong Kong employment. In planning for his marriage in March 2014, Mr Lee is in the course of negotiating with a potential seller in respect of a property which he intends to acquire as the home for himself and his wife.

The property will be the first property Mr Lee has acquired in Hong Kong. The offered price is $21 million including a car parking space which is worth around $1·5 million. The seller is a company incorporated in Hong Kong which wholly owns the property (including the car parking space), and Mr Lee is only interested in acquiring the property and the car parking space, not the company. It has been proposed to Mr Lee that he could enter into two separate conveyances, one for the property and the other one for the car parking space, as this would minimise his total stamp duty costs.

In order to finance the acquisition, Mr Lee is considering the following proposals:

(1) Obtaining a mortgage loan from a local bank of up to 50% of the property value. The approximate annual interest cost of this loan is $400,000. Mr Lee has not yet determined whether the property and the bank loan would be held solely in his name or jointly with his wife.

(2) Selling shares in Mr Lee’s employer company. Mr Lee currently holds 100,000 shares in his employer company and an option to acquire another 200,000 shares. The 100,000 shares were awarded to him directly by his employer in 2010/11 as part of his performance bonus. These shares were registered in the name of Mr Lee at the time when the shares were awarded to him. The option for 200,000 shares was granted to him in 2012/13. By exercising the option, Mr Lee will have a total of 300,000 shares on hand. By selling them all on the market, he will be able to realise an amount which can finance up to 30% of the property value.

(3) Borrowing from his parents up to 40% of the property value. This loan represents the idle funds which his parents have placed on bank deposit to earn interest income. To compensate for their loss of interest income, Mr Lee would promise to give his parents $10,000 per month. Currently, Mr Lee lives with his parents but they receive no regular contribution from him. After Mr Lee gets married and moves out, his parents will continue living in their own, existing property.

(4) Borrowing from his employer up to 40% of the property value under the employees’ low-interest loan scheme. The preferential loan interest rate is much lower than that offered by the bank. The approximate annual interest cost will be $150,000, payable by monthly instalments by way of deduction from Mr Lee’s monthly gross salary. Mr Lee estimates that his monthly salary will be reduced to $52,000. The estimated benefit from the saving in interest cost is around $80,000 per annum.

Required:

(a) In respect of the proposed acquisition of property, set out all of the potential Hong Kong stamp duty implications for Mr Lee, including the proposal to minimise the duty payable by splitting the conveyances. If the information provided is not sufficient, state what other information relevant to Mr Lee is required. (12 marks)

(b) With reference to proposal (1), advise on all the possible Hong Kong tax implications for Mr Lee in respect of the bank mortgage loan interest payment. (4 marks)

(c) With reference to proposal (2), advise on all the possible Hong Kong tax implications for Mr Lee arising from the proposed exercise of the share option, and the sale of all 300,000 shares. Where applicable, you should also discuss in which year(s) of assessment any benefit would be assessed. (4 marks)

(d) With reference to proposal (3), advise on all the possible Hong Kong tax implications for Mr Lee arising from the proposed course of action, including the monthly payment of $10,000 to his parents and his eligibility for dependent parent allowance both before and after his marriage. (3 marks)

(e) With reference to proposal (4), advise on all the possible Hong Kong tax implications for Mr Lee arising from the proposed course of action, including the loan interest payable to his employer, the reduced monthly salary income and the estimated saving in interest cost. (2 marks)

Section B – TWO questions ONLY to be attempted

3.

AB Co, a company resident only in Hong Kong, has several subsidiaries operating in Asia. AB Co is developing a new financial reporting system and intends to send its IT manager, Paul, to its Malaysian subsidiary for a period of four months to monitor and oversee the implementation of this new system.

Paul is a resident of Hong Kong holding a HKSAR passport. His remuneration will remain the same during his time in Malaysia and it will continue to be paid into his bank account in Hong Kong. All his travel and hotel accommodation costs in Malaysia will be reimbursed by AB Co. AB Co has also agreed to bear any additional personal income tax arising from the assignment. However, AB Co has not yet decided whether it will recharge Paul’s remuneration to the Malaysian subsidiary, though the assignment is initiated by AB Co.

Required:

(a) Advise AB Co whether it can claim a tax deduction in respect of Paul’s remuneration representing the four-month period of service rendered in Malaysia. (6 marks)

(b) Advise Paul whether his remuneration for the four-month period of service rendered in Malaysia and the travel and hotel accommodation costs reimbursed by AB Co will be chargeable to Hong Kong salaries tax. (7 marks)

(c) Based on Article 16 of the Double Tax Agreement (DTA) between Hong Kong and Malaysia (as extracted below), explain how the DTA may protect Paul’s remuneration from Malaysian personal income tax.

Hong Kong–Malaysia DTA Article 16 Dependent Personal Services, paragraph 2:

‘‘Notwithstanding the provisions of paragraph 1, remuneration derived by a resident of a Contracting Party in respect of an employment exercised in the other Contracting Party shall be taxable only in the first-mentioned Party if:

(a) the recipient is present in the other Party for a period or periods not exceeding in the aggregate 183 days in any twelve-month period commencing or ending in the taxable period concerned; and

(b) the remuneration is paid by, or on behalf of, an employer who is not a resident of the other Party; and

(c) the remuneration is not borne by a permanent establishment or a fixed base which the employer has in the other Party.’ (7 marks)

4.

Red Ltd, a furniture manufacturer carrying on business in Hong Kong, makes up accounts to 31 March each year. In May 2005, Red Ltd purchased a two-storey factory building from a property development company at a price of $3,600,000 (including land cost). Details of the costs incurred by the developer of the building are as follows:

Each floor of the building has an area of 8,000 sq ft. Red Ltd immediately used the ground floor as a factory, and the first floor as a warehouse.

Red Ltd has decided to relocate its production to Dongguan, China in September 2014. It is now considering two alternative proposals for disposing of the two-storey building:

(1) Selling the building for its market value.

(2) Demolishing the building and redeveloping the site by constructing a 20-storey factory building for letting. A bank loan will be obtained to finance the redevelopment.

Required:

(a) Discuss whether Red Ltd is entitled to a depreciation allowance in respect of each floor of the two-storey building; and calculate the allowance for all relevant years of assessment. (7 marks)

(b) Advise on the Hong Kong profits tax implications to Red Ltd of:

(i) selling the building; and (4 marks)

(ii) demolishing the building and redeveloping the site. (9 marks)

5.

You should assume that today’s date is 31 May 2014.

Derek Chan has been working as the group product director of Joyce Ltd (JL), a company resident in Hong Kong, for over ten years. As a result of a change in product line, Derek has been asked to leave his employment with JL as of 30 June 2014, and to agree not to join any competitor within the next two years.

JL has negotiated and agreed a termination package with Derek, which includes the following amounts:

(1) his last month’s salary of $70,000;

(2) accrued vacation pay of $105,000 (including some leave days brought forward from 2013); and

(3) a lump sum gratuity of $840,000.

Derek plans to move to Canada to live with his family on 15 July 2014. At Derek’s request, JL will pay the termination payment after his cessation of employment on 30 June 2014 but before he leaves Hong Kong on 15 July 2014. JL will also give Derek a letter stating that, ‘A lump sum amount of $1,015,000 is being paid to you in consideration of your agreeing to release the company from all claims you may have against the company arising from the termination of your employment.’ By doing so, Derek has been advised by a friend that he may have a good chance to avoid paying any tax on the payment because it will be treated as a tax-free capital receipt; and/or it is received after cessation of employment.

Required:

(a) Advise Derek Chan on the taxability of the termination payment under salaries tax. Where appropriate, suggest any tax planning ideas which may help minimise his salaries tax liability. (14 marks)

(b) Advise Joyce Ltd of its compliance obligations under the Inland Revenue Ordinance in respect of the termination of Derek Chan’s employment. (3 marks)

(c) Explain to Derek Chan the steps the Inland Revenue Department can take without instituting court proceedings, to recover the salaries tax payable by him for 2014/15. (3 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!