重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

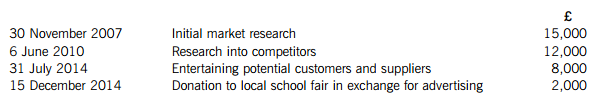

What is the amount of Lili Ltd’s deductible pre-trading expenditure in respect of the year ended 31 December 2015?

A.£10,000

B.£14,000

C.£27,000

D.£29,000

更多“Lili Ltd commenced trading on 1 January 2015. The company incurred the following expenditu”相关的问题

更多“Lili Ltd commenced trading on 1 January 2015. The company incurred the following expenditu”相关的问题

第1题

On 1 July 2014, Sameer made a cash gift of £2,500 to his sister.

On 1 May 2015, he made a cash gift of £2,000 to a friend.

On 1 June 2015, he made a cash gift of £50,000 to a trust. Sameer has not made any other lifetime gifts.

In respect of Sameer’s cash gift of £50,000 to the trust, what is the lifetime transfer of value for inheritance tax purposes after taking account of all available exemptions?

A.£48,500

B.£44,000

C.£46,000

D.£46,500

第2题

rprise income tax (EIT) rate is 25%. The company’s accountant has prepared the following statement of profit or loss for the year end 31 December 2014.

Notes:

(1) Customers who settle their bills within 30 days receive an early payment discount of 2%. Discounts totalling RMB55,000 were deducted directly from sales.

(2) Staff welfare is calculated and provided for in the accounts at 14% of the wages and salaries paid of RMB8,240,000. The actual amount of staff welfare expenses incurred was RMB1,026,350.

(3) Entertainment expenses incurred in the year 2014 were as charged in the profit or loss account, i.e. RMB967,000. Entertainment expenses incurred in 2013 in excess of the deduction threshold were RMB68,000.

(4) The bad debt related to a debtor who went bankrupt in 2013. The accountant has submitted a report to the tax bureau in relation to this bad debt.

(5) The specific provision for doubtful debts relates to an amount which was difficult to recover. The accountant has submitted a report to the tax bureau in relation to this specific provision.

(6) These research and development costs qualified for an additional deduction.

(7) The compensation was due to the late delivery of software to the customers.

(8) Sware Ltd was penalised by the State Administration for Industry and Commerce because of misstatements on its website.

(9) Project Pibeta relates to the piloting of software encouraged by the government. The project was started in 2013 and is expected to be completed in 2016. The project is subsidised by the government (see (18) below).

(10) A fire destroyed a warehouse with a net book value of RMB2,500,000. Sware Ltd received insurance compensation of RMB2,284,000. The accountant has submitted a report to the tax bureau in relation to this loss.

(11) Sware Ltd declared an interim dividend of RMB5,000,000 in 2014. Individual income tax was withheld from this interim dividend before distribution to the company’s shareholders.

(12) A donation receipt was obtained for the donation to China Red-Cross.

(13) A donation receipt was obtained for the donation to the school.

(14) Sware Ltd acquired a new subsidiary in 2014 and wrote off the goodwill incurred on this acquisition.

(15) Sware Ltd lent some of its surplus funds to its Shanghai subsidiary at an interest rate of 36% per annum. The market interest rate was 8% per annum.

(16) Sware Ltd has invested some of its surplus funds in the capital market. The profit on the sale of government bonds included interest of RMB15,000.

(17) The A-shares were acquired in 2012.

(18) The government granted Sware Ltd a specific financial subsidy to cover all of the expenditure on Project Pibeta.

Required:

(a) Calculate the enterprise income tax (EIT) payable by Sware Ltd for the year 2014.

Note: You should start your computation with the net loss figure of RMB3,385,150 and list all of the items referred to in notes (1) to (18) identifying any items which do not require adjustment by the use of zero (0). (11 marks)

(b) Identify and briefly describe ANY TWO enterprise income tax (EIT) preferential policies which Sware Ltd could consider applying, in addition to the qualified research and development additional deduction. (4 marks)

第3题

:

Option A: Joining Delta Ltd as a manager with a monthly salary of RMB40,000 and an annual bonus of RMB100,000 payable in December each year.

Option B: Providing services to Delta Ltd as a consultant for a consultancy fee of RMB50,000 per month.

Option C: Setting up his own sole proprietorship. He will pay himself a monthly salary of RMB20,000 from this sole proprietorship. For 2014 the net profit of the sole proprietorship after charging Mr Xu’s salary is expected to be RMB420,000.

Option D: Setting up a limited company, Xupa Ltd. He will pay himself a monthly salary of RMB20,000 from Xupa Ltd. For 2014 the net profit of the company after charging Mr Xu’s salary is expected to be RMB420,000. Xupa Ltd will pay enterprise income tax at the rate of 25% and distribute all of its profit after tax to its shareholder, Mr Xu, as a dividend.

Required:

Calculate the individual income tax (IIT) payable by Mr Xu for 2014 under each of the four options.

Note: Ignore value added tax and business tax. (10 marks)

(b) State, giving reasons, whether the following persons will be subject to individual income tax in China on their worldwide income in 2014:

(1) Ms Wang has her household in Xiamen and holds a China identity card. She has been studying in Australia since 2010 and has not returned to China for the last six years, including in 2014.

(2) Mr Beth is a US citizen, who has lived in China working for a non-government organisation since 2010. He has not travelled outside China for the last six years, including in 2014.

(3) Ms Ruth is an Australian citizen. She travelled to China and stayed in China for a total of 250 days in 2014. (5 marks)

第4题

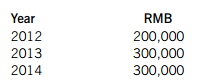

(a) Chris and Wendy graduated from high school in 2012 and set up a hair-dressing shop in the form. of a limited company, Hair Ltd. The total amounts received from the customers of Hair Ltd in each of the last three years has been as follows. The income is evenly spread over the 12 months.

In order to encourage small enterprises, the State Council has granted the following tax reliefs:

– Before 1 August 2014, an entity with a turnover of less than RMB20,000 per month was exempt from business tax (BT).

– For the period from 1 August 2014 to 31 December 2018, the exemption threshold was increased to RMB30,000 per month.

Hair Ltd files business tax on a monthly basis.

Required:

(i) Calculate the business tax payable by Hair Ltd in each of the three years, 2012, 2013 and 2014. (4 marks)

(ii) Calculate the enterprise income tax (EIT) of Hair Ltd of 2014. (2 marks)

(b) With respect to the three turnover taxes in China, namely, value added tax (VAT), business tax (BT) and consumption tax (CT):

(i) State which two of the turnover taxes are mutually exclusive. (1 mark)

(ii) Briefly explain the purpose and effect of levying consumption tax. (3 marks)

第5题

ses:

(1) A consultancy fee of RMB3,500 for services provided in China paid to Mr Xie, who is a China tax resident.

(2) A consultancy fee of RMB70,000 for services provided in China paid to Ms Ma, who is not a China tax resident.

(3) A royalty of RMB80,000 paid to Deji Ltd, which is a China tax resident enterprise.

(4) A royalty of RMB90,000 paid to Backa Ltd, which is not a China tax resident enterprise.

Required:

For each of the four payments, state whether Phi Ltd will be a withholding agent for income tax, and where Phi Ltd is the withholding agent, calculate the amount of income tax to be withheld.

Note: Ignore value added tax and business tax, and any tax incentives available under tax treaties. (7 marks)

(b) Jack has set up an e-shop selling goods via an internet platform. His total sales in 2014 were RMB400,000. He did not register with the tax authorities or pay any taxes in 2014. This was discovered by the tax bureaus in 2015.

Required:

State the possible consequences Jack may be exposed to under the Tax Collection and Administrative Law, as a result of his failure to comply with the tax registration and tax payment requirements. (3 marks)

第6题

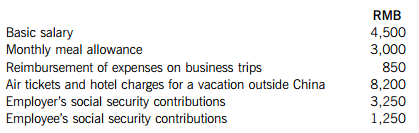

Mr Lin, a China tax resident, had the following incomes in February 2014.

(1) The payroll information relating to his employment with DSR Ltd for the month of February 2014 is as summarised below:

(2) He is a part-time lecturer at the Shanghai Design Institute. He gave three lectures in February 2014 and he received a lecturing fee of RMB1,000 for each lecture.

(3) He received an insurance compensation of RMB2,000 because of a delayed flight.

(4) During the Spring Festival, his parents gave him RMB10,000 red-packet money.

(5) He won USD1,000 in a lottery when he was on vacation outside China. He paid foreign tax of USD150 on this income.

(6) He had an article published in the January 2014 edition of a journal. The authorship fee of RMB1,000 was paid to him in February 2014.

(7) He is a non-executive director of a listed company. In February 2014, he received a director’s fee of RMB60,000.

(8) He was the only shareholder of Little Ltd. He sold all of his shares in this company for RMB1,000,000 on 28 February 2014, when the net asset value of Little Ltd was RMB800,000. The purchase cost of the shares was RMB400,000.

Required:

Calculate the individual income tax (IIT) payable by Mr Lin on each of his items of income ((1) to (8)) for February 2014. State clearly if any item is tax exempt or not taxable.

Note: Ignore value added tax and business tax.

第7题

Section B – ALL SIX questions are compulsory and MUST be attempted

Please write your answers to all parts of these questions on the lined pages within the Candidate Answer Booklet.

Lambda Ltd was set up in Guangzhou 12 years ago. The company has been continually loss making in recent years, and the shareholders decided to liquidate it in December 2014. The following assets were sold before the start of the liquidation process.

Notes

(1) The factory building was acquired 12 years ago for RMB4,000,000. The replacement cost of the same factory building in 2014 was RMB5,000,000.

(2) The inventory of finished goods comprised self-produced cosmetics packs. Cosmetics packs with a cost of RMB20,000 were expired and needed to be destroyed. The remaining (unexpired) packs with a cost of RMB440,000 were sold on to another trader.

(3) The inventory of raw materials comprised chemicals.

After carrying out all of the above transactions, Lambda Ltd had input value added tax (VAT) not yet credited of RMB135,600.

Required:

(a) Calculate the amount of business tax and land appreciation tax (LAT) payable on the sale of the factory building.

Notes:

1. City maintenance and construction tax and education levy should be calculated at 12% of business tax.

2. Ignore stamp duty. (4 marks)

(b) Calculate the consumption tax payable on the sale of the cosmetics packs. Note: The consumption tax rate for cosmetics is 30%. (1 mark)

(c) State, giving reasons, if the expired cosmetic packs would be treated as a value added tax (VAT) abnormal loss. (2 marks)

(d) Calculate the output VAT on the sale of the inventories (finished goods and raw materials). (2 marks) (e) State whether Lambda Ltd can obtain a VAT refund on the liquidation of the company. (1 mark)

第8题

00,000. The consumption tax rate for yachts is 10%.

What are the amounts to be recorded in the factory’s accounts for sales and consumption tax respectively?

A.RMB400,000 and RMB40,000

B.RMB310,800 and RMB31,080

C.RMB341,880 and RMB34,188

D.RMB376,068 and RMB37,607

第9题

end of RMB500,000 to its investor, Hoo Ltd. Hoo Ltd is set up in the Cayman Islands, which does not have any tax treaty with China.

What are the amounts of enterprise income tax (EIT) and business tax respectively, which CA Ltd should withhold before remitting the dividend to Hoo Ltd?

A.RMB47,500 and RMB25,000

B.RMB50,000 and RMB25,000

C.RMB50,000 and RMB22,500

D.RMB50,000 and RMB0

第10题

Alpha lent RMB200,000 to Beta Ltd at an interest rate of 10% per annum.

What is the type and amount of turnover tax which Alpha Trading Ltd will pay on the interest income received for the year 2014?

A.Business tax of RMB1,053

B.Business tax of RMB1,000

C.Value added tax of RMB3,400

D.Value added tax of RMB1,200

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!