重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Alpha Trading Ltd (Alpha) is a value added tax (VAT) general taxpayer. On 1 January 2014, Alpha lent RMB200,000 to Beta Ltd at an interest rate of 10% per annum.

What is the type and amount of turnover tax which Alpha Trading Ltd will pay on the interest income received for the year 2014?

A.Business tax of RMB1,053

B.Business tax of RMB1,000

C.Value added tax of RMB3,400

D.Value added tax of RMB1,200

更多“Alpha Trading Ltd (Alpha) is a value added tax (VAT) general taxpayer. On 1 January 2014,”相关的问题

更多“Alpha Trading Ltd (Alpha) is a value added tax (VAT) general taxpayer. On 1 January 2014,”相关的问题

第1题

What is the type and amount of turnover tax which Alpha Trading Ltd will pay on the interest income received for the year 2014?

A.Business tax of RMB1,053

B.Business tax of RMB1,000

C.Value added tax of RMB3,400

D.Value added tax of RMB1,200

第3题

(ii) The use of the trading loss of Tethys Ltd for the year ending 31 December 2008; (6 marks)

第4题

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

第5题

(b) (i) Compute the corporation tax liability of Speak Write Ltd for its first trading period on the assumption

that the IR 35 legislation applies to all of its income. (2 marks)

第6题

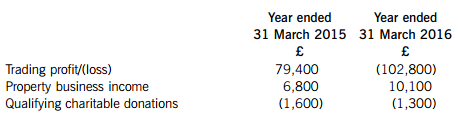

Oblong Ltd has had the following results:

If Oblong Ltd makes a claim to relieve its trading loss of £102,800 for the year ended 31 March 2016 against total profits for the year ended 31 March 2015, how much of this loss will remain unrelieved?

A.£6,500

B.£16,600

C.£9,400

D.£23,400

第7题

capital of Hira Ltd from Belgrove Ltd. Belgrove Ltd currently owns 100% of the share capital of Hira Ltd and has no

other subsidiaries. All three companies have their head offices in the UK and are UK resident.

Hira Ltd had trading losses brought forward, as at 1 April 2006, of £18,600 and no income or gains against which

to offset losses in the year ended 31 March 2006. In the year ending 31 March 2007 the company expects to make

further tax adjusted trading losses of £55,000 before deduction of capital allowances, and to have no other income

or gains. The tax written down value of Hira Ltd’s plant and machinery as at 31 March 2006 was £96,000 and

there will be no fixed asset additions or disposals in the year ending 31 March 2007. In the year ending 31 March

2008 a small tax adjusted trading loss is anticipated. Hira Ltd will surrender the maximum possible trading losses

to Belgrove Ltd and Dovedale Ltd.

The tax adjusted trading profit of Dovedale Ltd for the year ending 31 March 2007 is expected to be £875,000 and

to continue at this level in the future. The profits chargeable to corporation tax of Belgrove Ltd are expected to be

£38,000 for the year ending 31 March 2007 and to increase in the future.

On 1 February 2007 Dovedale Ltd will sell a small office building to Hira Ltd for its market value of £234,000.

Dovedale Ltd purchased the building in March 2005 for £210,000. In October 2004 Dovedale Ltd sold a factory

for £277,450 making a capital gain of £84,217. A claim was made to roll over the gain on the sale of the factory

against the acquisition cost of the office building.

On 1 April 2007 Dovedale Ltd intends to acquire the whole of the ordinary share capital of Atapo Inc, an unquoted

company resident in the country of Morovia. Atapo Inc sells components to Dovedale Ltd as well as to other

companies in Morovia and around the world.

It is estimated that Atapo Inc will make a profit before tax of £160,000 in the year ending 31 March 2008 and will

pay a dividend to Dovedale Ltd of £105,000. It can be assumed that Atapo Inc’s taxable profits are equal to its profit

before tax. The rate of corporation tax in Morovia is 9%. There is a withholding tax of 3% on dividends paid to

non-Morovian resident shareholders. There is no double tax agreement between the UK and Morovia.

Required:

(a) Advise Belgrove Ltd of any capital gains that may arise as a result of the sale of the shares in Hira Ltd. You

are not required to calculate any capital gains in this part of the question. (4 marks)

第8题

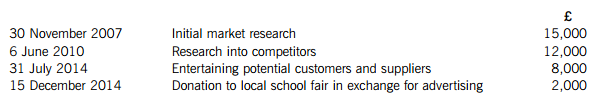

What is the amount of Lili Ltd’s deductible pre-trading expenditure in respect of the year ended 31 December 2015?

A.£10,000

B.£14,000

C.£27,000

D.£29,000

第9题

Although the company did manage to make a small profi t in its fi rst year of trading, it was never a great success and in its second year of trading it made a loss of £10,000.

At that time Fran said he thought the company should cease trading and be wound up. Gram and Hen, however,were insistent that the company would be profi table in the long-term so they agreed to carry on the business, with Fran taking less of a part in the day-to-day management of the business, although retaining his position as a company director.

In the course of the next three years Gram and Hen falsifi ed Ire Ltd’s accounts to disguise the fact that the company had continued to suffer losses, until it became obvious that they could no longer hide the company’s debts and that it would have to go into insolvent liquidation, with debts of £100,000.

Required:

Advise Fran, Gram and Hen as to any potential liability they might face as regards:

(a) fraudulent trading, under both criminal and civil law; (5 marks)

(b) wrongful trading under s.214 of the Insolvency Act 1986. (5 marks)

第10题

A、$240,000

B、$180,000

C、$300,000

D、$90,000

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!