重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

更多“The sales tax account could influence statement of profit or loss.”相关的问题

更多“The sales tax account could influence statement of profit or loss.”相关的问题

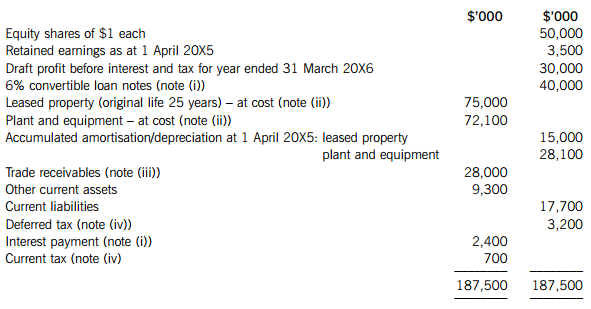

第1题

The following notes are relevant:

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

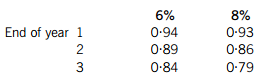

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

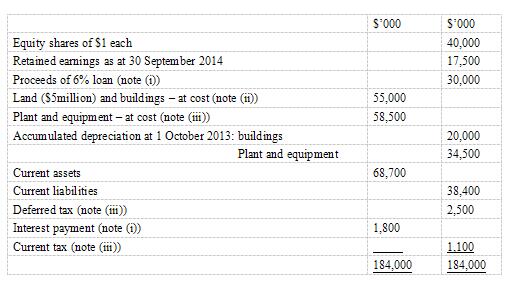

第2题

After preparing a draft statement of profit or loss for the year ended 30 September 2014 and adding the year’s profit (before any adjustments required by notes (i) to (iii) below) to retained earnings, Kandy as at 30 September 2014 is:

The following notes are relevant:

(i)The loan note was issued on 1 October 2013 and incurred issue costs of $1 million which were charged to profit or loss. Interest of $1·8 million ($30 million at 6%) was paid on 30 September 2014. The loan is redeemable on 30 September 2018 at a substantial premium which gives an effective interest rate of 9% per annum. No other repayments are due until 30 September 2018.

(i)The loan note was issued on 1 October 2013 and incurred issue costs of $1 million which were charged to profit or loss. Interest of $1·8 million ($30 million at 6%) was paid on 30 September 2014. The loan is redeemable on 30 September 2018 at a substantial premium which gives an effective interest rate of 9% per annum. No other repayments are due until 30 September 2018.

(ii)Non-current assets: The price of property has increased significantly in recent years and on 1 October 2013, the directors decided to revalue the land and buildings. The directors accepted the report of an independent surveyor who valued the land at $8 million and the buildings at $39 million on that date. The remaining life of the buildings at 1 October 2013 was 15 years. Kandy does not make an annual transfer to retained profits to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability. The income tax rate of Kandy is 20%.

Plant and equipment is depreciated at 121?2% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2014.

(iii)A provision of $2·4 million is required for current income tax on the profit of the year to 30 September 2014. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), Kandy has further taxable temporary differences of $10 million as at 30 September 2014.

Required:

(a) Prepare a schedule of adjustments required to the retained earnings of Kandy as at 30 September 2014 as a result of the information in notes (i) to (iii) above.

(b) Prepare the statement of financial position of Kandy as at 30 September 2014.

第3题

A、A revaluation gain on an investment property

B、Profit on sale of an investment

C、Receipt of a government grant

D、Gain on revaluation of a factory building

第4题

此题为判断题(对,错)。

第5题

此题为判断题(对,错)。

第6题

此题为判断题(对,错)。

第7题

A.defect

B.handicap

C.deficit

D.flaw

第8题

第9题

Tourmalet Co sold an item of plant for $50 million on 1 April 20X4.The plant had a carrying amount of $40 million at the date of sale,which was charged to cost of sales. On the same date, Tourmalet Co entered into an agreement to lease back the plant for the next five years (being the estimated remaining life of the plant) at a cost of $14 million per annum payable annually in arrears. An arrangement of this type is normally deemed to have a financing cost of 10% per annum. Tourmalet Co retained the rights to direct the use of and retain substantially all the remaining benefits from the plant. Using the drop down box, select what amount will be shown as income from this transaction in the statement of profit or loss for the year ended 30 September 20X4?

A、Nil

B、$10 million

C、$40 million

D、$50 million

第10题

A、The interest charge in the statement of profit or loss account will be $75,000

B、The interest charge in the statement of profit or loss account will be $37,500

C、The statement of financial position will contain a liability for outstanding interest of $75,000

D、The interest charge in the statement of profit or loss account will be $112,500

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!