重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

(a) The objective of IAS 36 Impairment of assets is to prescribe the procedures that an entity applies to ensure that its assets are not impaired.

Required:

Explain what is meant by an impairment review. Your answer should include reference to assets that may form. a cash generating unit.

Note: you are NOT required to describe the indicators of an impairment or how impairment losses are allocated against assets. (4 marks)

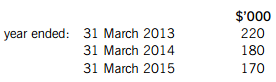

(b) (i) Telepath acquired an item of plant at a cost of $800,000 on 1 April 2010 that is used to produce and package pharmaceutical pills. The plant had an estimated residual value of $50,000 and an estimated life of five years, neither of which has changed. Telepath uses straight-line depreciation. On 31 March 2012, Telepath was informed by a major customer (who buys products produced by the plant) that it would no longer be placing orders with Telepath. Even before this information was known, Telepath had been having difficulty finding work for this plant. It now estimates that net cash inflows earned from the plant for the next three years will be:

On 31 March 2015, the plant is still expected to be sold for its estimated realisable value.

Telepath has confirmed that there is no market in which to sell the plant at 31 March 2012.

Telepath’s cost of capital is 10% and the following values should be used:

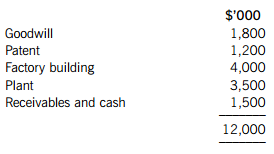

(ii) Telepath owned a 100% subsidiary, Tilda, that is treated as a cash generating unit. On 31 March 2012, there was an industrial accident (a gas explosion) that caused damage to some of Tilda’s plant. The assets of Tilda immediately before the accident were:

As a result of the accident, the recoverable amount of Tilda is $6·7 million

The explosion destroyed (to the point of no further use) an item of plant that had a carrying amount of $500,000.

Tilda has an open offer from a competitor of $1 million for its patent. The receivables and cash are already stated at their fair values less costs to sell (net realisable values).

Required:

Calculate the carrying amounts of the assets in (i) and (ii) above at 31 March 2012 after applying any impairment losses.

Calculations should be to the nearest $1,000.

The following mark allocation is provided as guidance for this requirement:

(i) 4 marks

(ii) 7 marks

更多“(a) The objective of IAS 36 Impairment of assets is to prescribe the procedures that an en”相关的问题

更多“(a) The objective of IAS 36 Impairment of assets is to prescribe the procedures that an en”相关的问题

第1题

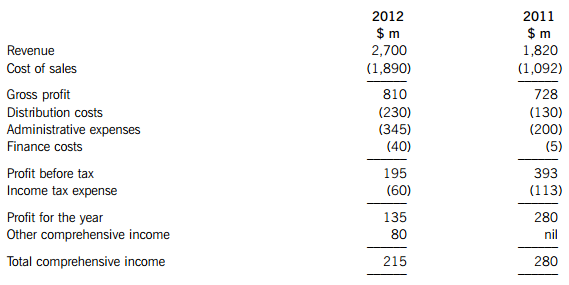

ended 31 March 2012 and the comparative figures are shown below.

Statements of comprehensive income for the year ended 31 March:

Statements of financial position as at 31 March:

The following information is relevant:

Depreciation/amortisation charges for the year ended 31 March 2012 were:

There were no sales of non-current assets during the year, although property has been revalued.

Required:

Prepare the statement of cash flows for the year ended 31 March 2012 for Tangier in accordance with the indirect method in accordance with IAS 7 Statement of cash flows. (11 marks)

(b) The following additional information has been obtained in relation to the operations of Tangier for the year ended 31 March 2012:

(i) On 1 June 2011, Tangier won a tender for a new contract to supply Jetside with aircraft engines that Tangier manufactures under a recently-acquired licence. The bidding process was very competitive and Tangier had to increase its manufacturing capacity to fulfil the contract.

(ii) Tangier also decided to invest in Raremetal by acquiring 8% of its equity shares in order to secure supplies of specialised materials used in the manufacture of the engines. No dividends were received from Raremetal nor had the value of its shares changed since acquisition.

(iii) Tangier revalued its property during the year to facilitate the issue of the 10% loan notes.

On seeing the results for the first time, one of the company’s non-executive directors is disappointed by the current year’s performance.

Required:

Explain how the new contract and its related costs may have affected Tangier’s operating performance, identifying any further information that may be useful to your answer.

Your answer may be supported by appropriate ratios (up to 4 marks available), but ratios and analysis of working capital are not required. (14 marks)

第2题

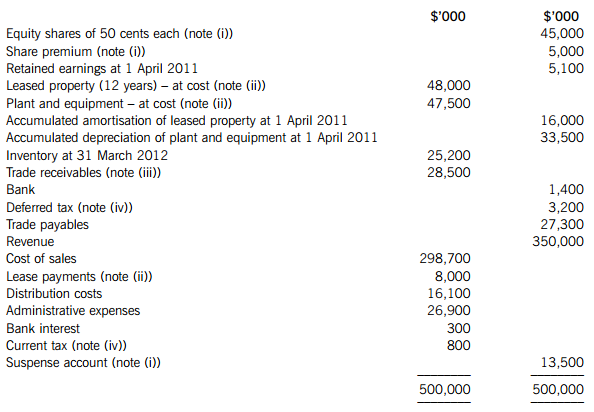

The following trial balance relates to Fresco at 31 March 2012:

The following notes are relevant:

(i) The suspense account represents the corresponding credit for cash received for a fully subscribed rights issue of equity shares made on 1 January 2012. The terms of the share issue were one new share for every five held at a price of 75 cents each. The price of the company’s equity shares immediately before the issue was $1·20 each.

(ii) Non-current assets:

To reflect a marked increase in property prices, Fresco decided to revalue its leased property on 1 April 2011. The Directors accepted the report of an independent surveyor who valued the leased property at $36 million on that date. Fresco has not yet recorded the revaluation. The remaining life of the leased property is eight years at the date of the revaluation. Fresco makes an annual transfer to retained profits to reflect the realisation of the revaluation reserve. In Fresco’s tax jurisdiction the revaluation does not give rise to a deferred tax liability.

On 1 April 2011, Fresco acquired an item of plant under a finance lease agreement that had an implicit finance cost of 10% per annum. The lease payments in the trial balance represent an initial deposit of $2 million paid on 1 April 2011 and the first annual rental of $6 million paid on 31 March 2012. The lease agreement requires further annual payments of $6 million on 31 March each year for the next four years. Had the plant not been leased it would have cost $25 million to purchase for cash.

Plant and equipment (other than the leased plant) is depreciated at 20% per annum using the reducing balance method.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2012. Depreciation and amortisation are charged to cost of sales.

(iii) In March 2012, Fresco’s internal audit department discovered a fraud committed by the company’s credit controller who did not return from a foreign business trip. The outcome of the fraud is that $4 million of the company’s trade receivables have been stolen by the credit controller and are not recoverable. Of this amount, $1 million relates to the year ended 31 March 2011 and the remainder to the current year. Fresco is not insured against this fraud.

(iv) Fresco’s income tax calculation for the year ended 31 March 2012 shows a tax refund of $2·4 million. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2011. At 31 March 2012, Fresco had taxable temporary differences of $12 million (requiring a deferred tax liability). The income tax rate of Fresco is 25%.

Required:

(a) (i) Prepare the statement of comprehensive income for Fresco for the year ended 31 March 2012.

(ii) Prepare the statement of changes in equity for Fresco for the year ended 31 March 2012.

(iii) Prepare the statement of financial position of Fresco as at 31 March 2012.

The following mark allocation is provided as guidance for this requirement:

(i) 9 marks

(ii) 5 marks

(iii) 8 marks (22 marks)

(b) Calculate the basic earnings per share for Fresco for the year ended 31 March 2012. (3 marks)

Notes to the financial statements are not required.

第3题

hare exchange and a cash payment of 88 cents per acquired share, deferred until 1 April 2012. Pyramid has recorded the share exchange, but not the cash consideration. Pyramid’s cost of capital is 10% per annum.

The summarised statements of financial position of the two companies as at 31 March 2012 are:

The following information is relevant:

(i) At the date of acquisition, Pyramid conducted a fair value exercise on Square’s net assets which were equal to their carrying amounts with the following exceptions:

– An item of plant had a fair value of $3 million above its carrying amount. At the date of acquisition it had a remaining life of five years. Ignore deferred tax relating to this fair value.

– Square had an unrecorded deferred tax liability of $1 million, which was unchanged as at 31 March 2012.

Pyramid’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose a share price for Square of $3·50 each is representative of the fair value of the shares held by the non-controlling interest.

(ii) Immediately after the acquisition, Square issued $4 million of 11% loan notes, $2·5 million of which were bought by Pyramid. All interest due on the loan notes as at 31 March 2012 has been paid and received.

(iii) Pyramid sells goods to Square at cost plus 50%. Below is a summary of the recorded activities for the year ended 31 March 2012 and balances as at 31 March 2012:

On 26 March 2012, Pyramid sold and despatched goods to Square, which Square did not record until they were received on 2 April 2012. Square’s inventory was counted on 31 March 2012 and does not include any goods purchased from Pyramid.

On 27 March 2012, Square remitted to Pyramid a cash payment which was not received by Pyramid until 4 April 2012. This payment accounted for the remaining difference on the current accounts.

(iv) Pyramid bought 1·5 million shares in Cube on 1 October 2011; this represents a holding of 30% of Cube’s equity. At 31 March 2012, Cube’s retained profits had increased by $2 million over their value at 1 October 2011. Pyramid uses equity accounting in its consolidated financial statements for its investment in Cube.

(v) The other equity investments of Pyramid are carried at their fair values on 1 April 2011. At 31 March 2012, these had increased to $2·8 million.

(vi) There were no impairment losses within the group during the year ended 31 March 2012.

Required:

Prepare the consolidated statement of financial position for Pyramid as at 31 March 2012.

第4题

interest (coupon) rate of 5% per annum. They are redeemable on 30 September 2013 at par for cash or can be exchanged for equity shares in Bertrand on the basis of 20 shares for each $100 of loan. A similar loan note, without the conversion option, would have required Bertrand to pay an interest rate of 8%.

When preparing the draft financial statements for the year ended 30 September 2011, the directors are proposing to show the loan note within equity in the statement of financial position, as they believe all the loan note holders will choose the equity option when the loan note is due for redemption. They further intend to charge a finance cost of $500,000 ($10 million x 5%) in the income statement for each year up to the date of redemption.

The present value of $1 receivable at the end of each year, based on discount rates of 5% and 8%, can be taken as:

Required:

(a) (i) Explain why the nominal interest rate on the convertible loan notes is 5%, but for non-convertible loan notes it would be 8%. (2 marks)

(ii) Briefly comment on the impact of the directors’ proposed treatment of the loan notes on the financial statements and the acceptability of this treatment. (3 marks)

(b) Prepare extracts to show how the loan notes and the finance charge should be treated by Bertrand in its financial statements for the year ended 30 September 2011. (5 marks)

第5题

ing and disclosure for those items named in its title.

Required:

Define provisions and contingent liabilities and briefly explain how IAS 37 improves consistency in financial reporting.

(b) The following items have arisen during the preparation of Borough’s draft financial statements for the year ended 30 September 2011:

(i) On 1 October 2010, Borough commenced the extraction of crude oil from a new well on the seabed. The cost of a 10-year licence to extract the oil was $50 million. At the end of the extraction, although not legally bound to do so, Borough intends to make good the damage the extraction has caused to the seabed environment. This intention has been communicated to parties external to Borough. The cost of this will be in two parts: a fixed amount of $20 million and a variable amount of 2 cents per barrel extracted. Both of these amounts are based on their present values as at 1 October 2010 (discounted at 8%) of the estimated costs in 10 years’ time. In the year to 30 September 2011 Borough extracted 150 million barrels of oil.

(ii) Borough owns the whole of the equity share capital of its subsidiary Hamlet. Hamlet’s statement of financial position includes a loan of $25 million that is repayable in five years’ time. $15 million of this loan is secured on Hamlet’s property and the remaining $10 million is guaranteed by Borough in the event of a default by Hamlet. The economy in which Hamlet operates is currently experiencing a deep recession, the effects of which are that the current value of its property is estimated at $12 million and there are concerns over whether Hamlet can survive the recession and therefore repay the loan.

Required:

Describe, and quantify where possible, how items (i) and (ii) above should be treated in Borough’s statement of financial position for the year ended 30 September 2011.

In the case of item (ii) only, distinguish between Borough’s entity and consolidated financial statements and refer to any disclosure notes. Your answer should only refer to the treatment of the loan and should not consider any impairment of Hamlet’s property or Borough’s investment in Hamlet.

Note: the treatment in the income statement is NOT required for any of the items.

The following mark allocation is provided as guidance for this requirement:

(i) 5 marks

(ii) 4 marks

第6题

(a) The following information relates to the draft financial statements of Mocha.

Summarised statements of financial position as at 30 September:

Summarised income statements for the years ended 30 September:

The following additional information is available:

(i) Property, plant and equipment:

The property disposed of was sold for $8·1 million.

(ii) Investments/investment income:

During the year an investment that had a carrying amount of $3 million was sold for $3·4 million. No investments were purchased during the year.

Investment income consists of:

(iii) On 1 April 2011 there was a bonus issue of shares that was funded from the share premium and some of the revaluation reserve. This was followed on 30 April 2011 by an issue of shares for cash at par.

(iv) The movement in the product warranty provision has been included in cost of sales.

Required:

Prepare a statement of cash flows for Mocha for the year ended 30 September 2011, in accordance with IAS 7 Statement of cash flows, using the indirect method. (19 marks)

(b) Shareholders can often be confused when trying to evaluate the information provided to them by a company’s financial statements, particularly when comparing accruals-based information in the income statement and the statement of financial position with that in the statement of cash flows.

Required: In the two areas stated below, illustrate, by reference to the information in the question and your answer to (a), how information in a statement of cash flows may give a different perspective of events than that given by accruals-based financial statements:

(i) operating performance; and

(ii) investment in property, plant and equipment.

The following mark allocation is provided as guidance for this requirement:

(i) 3 marks

(ii) 3 marks

第7题

The following trial balance relates to Keystone at 30 September 2011:

The following notes are relevant:

(i) Revenue includes goods sold and despatched in September 2011 on a 30-day right of return basis. Their selling price was $2·4 million and they were sold at a gross profit margin of 25%. Keystone is uncertain as to whether any of these goods will be returned within the 30-day period.

(ii) Non-current assets:

During the year Keystone manufactured an item of plant for its own use. The direct materials and labour were $3 million and $4 million respectively. Production overheads are 75% of direct labour cost and Keystone determines the final selling price for goods by adding a mark-up on total cost of 40%. These manufacturing costs are included in the relevant expense items in the trial balance. The plant was completed and put into immediate use on 1 April 2011.

All plant and equipment is depreciated at 20% per annum using the reducing balance method with time apportionment in the year of acquisition.

The directors decided to revalue the leased property in line with recent increases in market values. On 1 October 2010 an independent surveyor valued the leased property at $48 million, which the directors have accepted. The leased property was being amortised over an original life of 20 years which has not changed. Keystone does not make a transfer to retained earnings in respect of excess amortisation. The revaluation gain will create a deferred tax liability (see note (vi)).

All depreciation and amortisation is charged to cost of sales. No depreciation or amortisation has yet been charged on any non-current asset for the year ended 30 September 2011.

(iii) On 15 August 2011, Keystone’s share price stood at $2·40 per share. On this date Keystone paid a dividend (included in administrative expenses) that was calculated to give a dividend yield of 4%.

(iv) The inventory on Keystone’s premises at 30 September 2011 was counted and valued at cost of $54·8 million.

(v) The equity investments had a fair value of $17·4 million on 30 September 2011. There were no purchases or disposals of any of these investments during the year. Keystone has not made the election in accordance with IFRS 9 Financial Instruments. Keystone adopts this standard when accounting for its financial assets.

(vi) A provision for income tax for the year ended 30 September 2011 of $24·3 million is required. At 30 September 2011, the tax base of Keystone’s net assets was $15 million less than their carrying amounts. This excludes the effects of the revaluation of the leased property. The income tax rate of Keystone is 30%.

Required:

(a) Prepare the statement of comprehensive income for Keystone for the year ended 30 September 2011.

(b) Prepare the statement of financial position for Keystone as at 30 September 2011.

Notes to the financial statements are not required.

A statement of changes in equity is not required.

The following mark allocation is provided as guidance for this question:

(a) 15 marks

(b) 10 marks

第8题

ing terms:

an immediate payment of $4 per share on 1 October 2010; and

a further amount deferred until 1 October 2011 of $5·4 million.

The immediate payment has been recorded in Paladin’s financial statements, but the deferred payment has not been recorded. Paladin’s cost of capital is 8% per annum.

On 1 February 2011, Paladin also acquired 25% of the equity shares of Augusta paying $10 million in cash. The summarised statements of financial position of the three companies at 30 September 2011 are:

The following information is relevant:

(i) Paladin’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose the directors of Paladin considered a share price for Saracen of $3·50 per share to be appropriate.

(ii) At the date of acquisition, the fair values of Saracen’s property, plant and equipment was equal to its carrying amount with the exception of Saracen’s plant which had a fair value of $4 million above its carrying amount. At that date the plant had a remaining life of four years. Saracen uses straight-line depreciation for plant assuming a nil residual value. Also at the date of acquisition, Paladin valued Saracen’s customer relationships as a customer base intangible asset at fair value of $3 million. Saracen has not accounted for this asset. Trading relationships with Saracen’s customers last on average for six years.

(iii) At 30 September 2011, Saracen’s inventory included goods bought from Paladin (at cost to Saracen) of $2·6 million. Paladin had marked up these goods by 30% on cost. Paladin’s agreed current account balance owed by Saracen at 30 September 2011 was $1·3 million.

(iv) Impairment tests were carried out on 30 September 2011 which concluded that consolidated goodwill was not impaired, but, due to disappointing earnings, the value of the investment in Augusta was impaired by $2·5 million.

(v) Assume all profits accrue evenly through the year.

Required:

Prepare the consolidated statement of financial position for Paladin as at 30 September 2011.

第9题

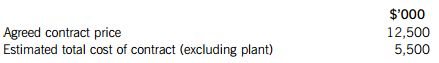

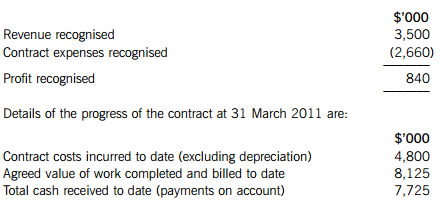

months and therefore be completed on 31 December 2011. Details of the contract are:

Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of $8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge.

The correctly reported income statement results for the contract for the year ended 31 March 2010 were:

The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price.

Required:

Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

第10题

ion of financial statements (Framework) and as part of the qualitative characteristics of financial statements under the heading of ‘relevance’ he notes that the predictive value of information is considered important. He is aware that financial statements are prepared historically (i.e. after transactions have occurred) and offers the view that the predictive value of financial statements would be enhanced if forward-looking information (e.g. forecasts) were published rather than backward-looking historical statements.

Required:

By the use of specific examples, provide an explanation to your assistant of how IFRS presentation and disclosure requirements can assist the predictive role of historically prepared financial statements. (6 marks)

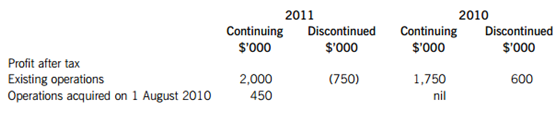

(b) The following summarised information is available in relation to Rebound, a publicly listed company:

Income statement extracts years ended 31 March:

Analysts expect profits from the market sector in which Rebound’s existing operations are based to increase by 6% in the year to 31 March 2012 and by 8% in the sector of its newly acquired operations.

On 1 April 2009 Rebound had:

$3 million of 25 cents equity shares in issue.

$5 million 8% convertible loan stock 2016; the terms of conversion are 40 equity shares in exchange for each

$100 of loan stock. Assume an income tax rate of 30%.

On 1 October 2010 the directors of Rebound were granted options to buy 2 million shares in the company for $1 each. The average market price of Rebound’s shares for the year ending 31 March 2011 was $2·50 each.

Required:

(i) Calculate Rebound’s estimated profit after tax for the year ending 31 March 2012 assuming the analysts’ expectations prove correct; (3 marks)

(ii) Calculate the diluted earnings per share (EPS) on the continuing operations of Rebound for the year ended 31 March 2011 and the comparatives for 2010. (6 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!