重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

(a) IAS 37 Provisions, contingent liabilities and contingent assets prescribes the accounting and disclosure for those items named in its title.

Required:

Define provisions and contingent liabilities and briefly explain how IAS 37 improves consistency in financial reporting.

(b) The following items have arisen during the preparation of Borough’s draft financial statements for the year ended 30 September 2011:

(i) On 1 October 2010, Borough commenced the extraction of crude oil from a new well on the seabed. The cost of a 10-year licence to extract the oil was $50 million. At the end of the extraction, although not legally bound to do so, Borough intends to make good the damage the extraction has caused to the seabed environment. This intention has been communicated to parties external to Borough. The cost of this will be in two parts: a fixed amount of $20 million and a variable amount of 2 cents per barrel extracted. Both of these amounts are based on their present values as at 1 October 2010 (discounted at 8%) of the estimated costs in 10 years’ time. In the year to 30 September 2011 Borough extracted 150 million barrels of oil.

(ii) Borough owns the whole of the equity share capital of its subsidiary Hamlet. Hamlet’s statement of financial position includes a loan of $25 million that is repayable in five years’ time. $15 million of this loan is secured on Hamlet’s property and the remaining $10 million is guaranteed by Borough in the event of a default by Hamlet. The economy in which Hamlet operates is currently experiencing a deep recession, the effects of which are that the current value of its property is estimated at $12 million and there are concerns over whether Hamlet can survive the recession and therefore repay the loan.

Required:

Describe, and quantify where possible, how items (i) and (ii) above should be treated in Borough’s statement of financial position for the year ended 30 September 2011.

In the case of item (ii) only, distinguish between Borough’s entity and consolidated financial statements and refer to any disclosure notes. Your answer should only refer to the treatment of the loan and should not consider any impairment of Hamlet’s property or Borough’s investment in Hamlet.

Note: the treatment in the income statement is NOT required for any of the items.

The following mark allocation is provided as guidance for this requirement:

(i) 5 marks

(ii) 4 marks

更多“(a) IAS 37 Provisions, contingent liabilities and contingent assets prescribes the account”相关的问题

更多“(a) IAS 37 Provisions, contingent liabilities and contingent assets prescribes the account”相关的问题

第1题

(a) The following information relates to the draft financial statements of Mocha.

Summarised statements of financial position as at 30 September:

Summarised income statements for the years ended 30 September:

The following additional information is available:

(i) Property, plant and equipment:

The property disposed of was sold for $8·1 million.

(ii) Investments/investment income:

During the year an investment that had a carrying amount of $3 million was sold for $3·4 million. No investments were purchased during the year.

Investment income consists of:

(iii) On 1 April 2011 there was a bonus issue of shares that was funded from the share premium and some of the revaluation reserve. This was followed on 30 April 2011 by an issue of shares for cash at par.

(iv) The movement in the product warranty provision has been included in cost of sales.

Required:

Prepare a statement of cash flows for Mocha for the year ended 30 September 2011, in accordance with IAS 7 Statement of cash flows, using the indirect method. (19 marks)

(b) Shareholders can often be confused when trying to evaluate the information provided to them by a company’s financial statements, particularly when comparing accruals-based information in the income statement and the statement of financial position with that in the statement of cash flows.

Required: In the two areas stated below, illustrate, by reference to the information in the question and your answer to (a), how information in a statement of cash flows may give a different perspective of events than that given by accruals-based financial statements:

(i) operating performance; and

(ii) investment in property, plant and equipment.

The following mark allocation is provided as guidance for this requirement:

(i) 3 marks

(ii) 3 marks

第2题

The following trial balance relates to Keystone at 30 September 2011:

The following notes are relevant:

(i) Revenue includes goods sold and despatched in September 2011 on a 30-day right of return basis. Their selling price was $2·4 million and they were sold at a gross profit margin of 25%. Keystone is uncertain as to whether any of these goods will be returned within the 30-day period.

(ii) Non-current assets:

During the year Keystone manufactured an item of plant for its own use. The direct materials and labour were $3 million and $4 million respectively. Production overheads are 75% of direct labour cost and Keystone determines the final selling price for goods by adding a mark-up on total cost of 40%. These manufacturing costs are included in the relevant expense items in the trial balance. The plant was completed and put into immediate use on 1 April 2011.

All plant and equipment is depreciated at 20% per annum using the reducing balance method with time apportionment in the year of acquisition.

The directors decided to revalue the leased property in line with recent increases in market values. On 1 October 2010 an independent surveyor valued the leased property at $48 million, which the directors have accepted. The leased property was being amortised over an original life of 20 years which has not changed. Keystone does not make a transfer to retained earnings in respect of excess amortisation. The revaluation gain will create a deferred tax liability (see note (vi)).

All depreciation and amortisation is charged to cost of sales. No depreciation or amortisation has yet been charged on any non-current asset for the year ended 30 September 2011.

(iii) On 15 August 2011, Keystone’s share price stood at $2·40 per share. On this date Keystone paid a dividend (included in administrative expenses) that was calculated to give a dividend yield of 4%.

(iv) The inventory on Keystone’s premises at 30 September 2011 was counted and valued at cost of $54·8 million.

(v) The equity investments had a fair value of $17·4 million on 30 September 2011. There were no purchases or disposals of any of these investments during the year. Keystone has not made the election in accordance with IFRS 9 Financial Instruments. Keystone adopts this standard when accounting for its financial assets.

(vi) A provision for income tax for the year ended 30 September 2011 of $24·3 million is required. At 30 September 2011, the tax base of Keystone’s net assets was $15 million less than their carrying amounts. This excludes the effects of the revaluation of the leased property. The income tax rate of Keystone is 30%.

Required:

(a) Prepare the statement of comprehensive income for Keystone for the year ended 30 September 2011.

(b) Prepare the statement of financial position for Keystone as at 30 September 2011.

Notes to the financial statements are not required.

A statement of changes in equity is not required.

The following mark allocation is provided as guidance for this question:

(a) 15 marks

(b) 10 marks

第3题

ing terms:

an immediate payment of $4 per share on 1 October 2010; and

a further amount deferred until 1 October 2011 of $5·4 million.

The immediate payment has been recorded in Paladin’s financial statements, but the deferred payment has not been recorded. Paladin’s cost of capital is 8% per annum.

On 1 February 2011, Paladin also acquired 25% of the equity shares of Augusta paying $10 million in cash. The summarised statements of financial position of the three companies at 30 September 2011 are:

The following information is relevant:

(i) Paladin’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose the directors of Paladin considered a share price for Saracen of $3·50 per share to be appropriate.

(ii) At the date of acquisition, the fair values of Saracen’s property, plant and equipment was equal to its carrying amount with the exception of Saracen’s plant which had a fair value of $4 million above its carrying amount. At that date the plant had a remaining life of four years. Saracen uses straight-line depreciation for plant assuming a nil residual value. Also at the date of acquisition, Paladin valued Saracen’s customer relationships as a customer base intangible asset at fair value of $3 million. Saracen has not accounted for this asset. Trading relationships with Saracen’s customers last on average for six years.

(iii) At 30 September 2011, Saracen’s inventory included goods bought from Paladin (at cost to Saracen) of $2·6 million. Paladin had marked up these goods by 30% on cost. Paladin’s agreed current account balance owed by Saracen at 30 September 2011 was $1·3 million.

(iv) Impairment tests were carried out on 30 September 2011 which concluded that consolidated goodwill was not impaired, but, due to disappointing earnings, the value of the investment in Augusta was impaired by $2·5 million.

(v) Assume all profits accrue evenly through the year.

Required:

Prepare the consolidated statement of financial position for Paladin as at 30 September 2011.

第4题

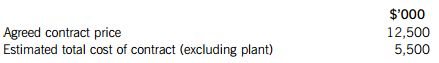

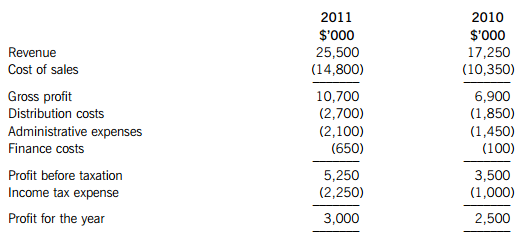

months and therefore be completed on 31 December 2011. Details of the contract are:

Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of $8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge.

The correctly reported income statement results for the contract for the year ended 31 March 2010 were:

The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price.

Required:

Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

第5题

ion of financial statements (Framework) and as part of the qualitative characteristics of financial statements under the heading of ‘relevance’ he notes that the predictive value of information is considered important. He is aware that financial statements are prepared historically (i.e. after transactions have occurred) and offers the view that the predictive value of financial statements would be enhanced if forward-looking information (e.g. forecasts) were published rather than backward-looking historical statements.

Required:

By the use of specific examples, provide an explanation to your assistant of how IFRS presentation and disclosure requirements can assist the predictive role of historically prepared financial statements. (6 marks)

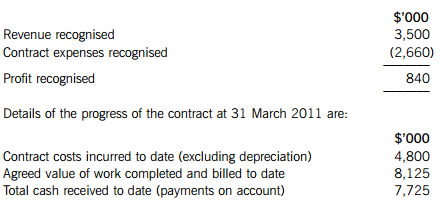

(b) The following summarised information is available in relation to Rebound, a publicly listed company:

Income statement extracts years ended 31 March:

Analysts expect profits from the market sector in which Rebound’s existing operations are based to increase by 6% in the year to 31 March 2012 and by 8% in the sector of its newly acquired operations.

On 1 April 2009 Rebound had:

$3 million of 25 cents equity shares in issue.

$5 million 8% convertible loan stock 2016; the terms of conversion are 40 equity shares in exchange for each

$100 of loan stock. Assume an income tax rate of 30%.

On 1 October 2010 the directors of Rebound were granted options to buy 2 million shares in the company for $1 each. The average market price of Rebound’s shares for the year ending 31 March 2011 was $2·50 each.

Required:

(i) Calculate Rebound’s estimated profit after tax for the year ending 31 March 2012 assuming the analysts’ expectations prove correct; (3 marks)

(ii) Calculate the diluted earnings per share (EPS) on the continuing operations of Rebound for the year ended 31 March 2011 and the comparatives for 2010. (6 marks)

第6题

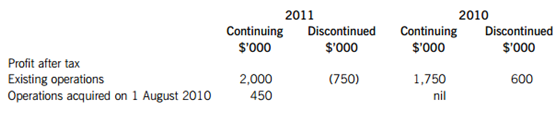

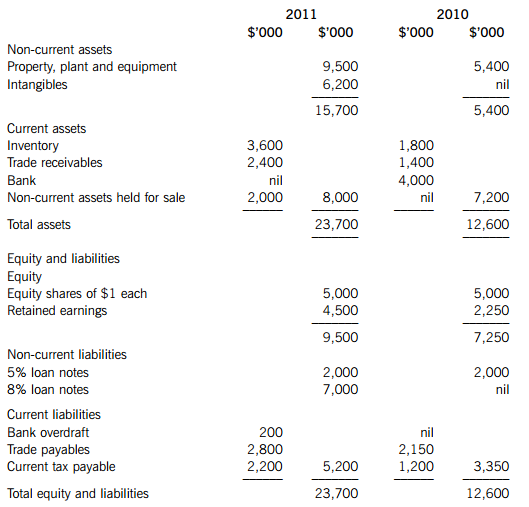

Bengal is a public company. Its most recent financial statements are shown below:

Income statements for the year ended 31 March

Statements of financial position as at 31 March

Notes

(i) There were no disposals of non-current assets during the period; however Bengal does have some non-current assets classified as ‘held for sale’ at 31 March 2011.

(ii) Depreciation of property, plant and equipment for the year ended 31 March 2011 was $640,000.

A disappointed shareholder has observed that although revenue during the year has increased by 48% (8,250/17,250 x 100), profit for the year has only increased by 20% (500/2,500 x 100). 6

Required:

(a) Prepare a statement of cash flows for Bengal for the year ended 31 March 2011, in accordance with IAS 7 Statement of cash flows, using the indirect method. (9 marks)

(b) Using the information in the question and your answer to (a) above, comment on the performance (including addressing the shareholder’s observation) and financial position of Bengal for the year ended 31 March 2011.

Note: up to 5 marks are available for the calculation of appropriate ratios. (16 marks)

第7题

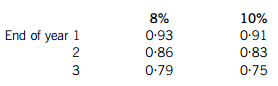

The following trial balance relates to Highwood at 31 March 2011:

The following notes are relevant:

(i) An equity dividend of 5 cents per share was paid in November 2010 and charged to retained earnings.

(ii) The 8% $30 million convertible loan note was issued on 1 April 2010 at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2013 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each $100 of loan note. Highwood’s finance director has calculated that to issue an equivalent loan note without the conversion rights it would have to pay an interest rate of 10% per annum to attract investors.

The present value of $1 receivable at the end of each year, based on discount rates of 8% and 10% are:

(iii) Non-current assets:

On 1 April 2010 Highwood decided for the first time to value its freehold property at its current value. A qualified property valuer reported that the market value of the freehold property on this date was $80 million, of which $30 million related to the land. At this date the remaining estimated life of the property was 20 years. Highwood does not make a transfer to retained earnings in respect of excess depreciation on the revaluation of its assets.

Plant is depreciated at 20% per annum on the reducing balance method.

All depreciation of non-current assets is charged to cost of sales.

(iv) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2010. The required provision for income tax for the year ended 31 March 2011 is $19·4 million. The difference between the carrying amounts of the net assets of Highwood (including the revaluation of the property in note (iii) above) and their (lower) tax base at 31 March 2011 is $27 million. Highwood’s rate of income tax is 25%.

(v) The inventory of Highwood was not counted until 4 April 2011 due to operational reasons. At this date its value at cost was $36 million and this figure has been used in the cost of sales calculation above. Between the year end of 31 March 2011 and 4 April 2011, Highwood received a delivery of goods at a cost of $2·7 million and made sales of $7·8 million at a mark-up on cost of 30%. Neither the goods delivered nor the sales made in this period were included in Highwood’s purchases (as part of cost of sales) or revenue in the above trial balance.

(vi) On 31 March 2011 Highwood factored (sold) trade receivables with a book value of $10 million to Easyfinance. Highwood received an immediate payment of $8·7 million and will pay Easyfinance 2% per month on any uncollected balances. Any of the factored receivables outstanding after six months will be refunded to Easyfinance. Highwood has derecognised the receivables and charged $1·3 million to administrative expenses. If Highwood had not factored these receivables it would have made an allowance of $600,000 against them.

Required:

(i) Prepare the statement of comprehensive income for Highwood for the year ended 31 March 2011;

(ii) Prepare the statement of changes in equity for Highwood for the year ended 31 March 2011;

(iii) Prepare the statement of financial position of Highwood as at 31 March 2011.

Note: your answers and workings should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(i) 11 marks

(ii) 4 marks

(iii) 10 marks

第8题

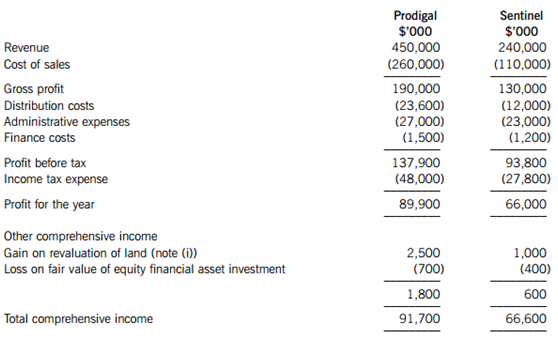

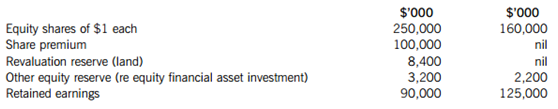

was through a share exchange of two shares in Prodigal for every three shares in Sentinel. The stock market price of Prodigal’s shares at 1 October 2010 was $4 per share.

The summarised statements of comprehensive income for the two companies for the year ended 31 March 2011 are:

The following information for the equity of the companies at 1 April 2010 (i.e. before the share exchange took place) is available:

The following information is relevant:

(i) Prodigal’s policy is to revalue the group’s land to market value at the end of each accounting period. Prior to its acquisition Sentinel’s land had been valued at historical cost. During the post acquisition period Sentinel’s land had increased in value over its value at the date of acquisition by $1 million. Sentinel has recognised the revaluation within its own financial statements.

(ii) Immediately after the acquisition of Sentinel on 1 October 2010, Prodigal transferred an item of plant with a carrying amount of $4 million to Sentinel at an agreed value of $5 million. At this date the plant had a remaining life of two and half years. Prodigal had included the profit on this transfer as a reduction in its depreciation costs. All depreciation is charged to cost of sales.

(iii) After the acquisition Sentinel sold goods to Prodigal for $40 million. These goods had cost Sentinel $30 million. $12 million of the goods sold remained in Prodigal’s closing inventory.

(iv) Prodigal’s policy is to value the non-controlling interest of Sentinel at the date of acquisition at its fair value which the directors determined to be $100 million.

(v) The goodwill of Sentinel has not suffered any impairment.

(vi) All items in the above statements of comprehensive income are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Prepare the consolidated statement of comprehensive income of Prodigal for the year ended 31 March 2011;

(ii) Prepare the equity section (including the non-controlling interest) of the consolidated statement of financial position of Prodigal as at 31 March 2011.

Note: you are NOT required to calculate consolidated goodwill or produce the statement of changes in equity.

The following mark allocation is provided as guidance for this requirement:

(i) 14 marks

(ii) 7 marks (21 marks)

(b) IFRS 3 Business combinations permits a non-controlling interest at the date of acquisition to be valued by one of two methods:

(i) at its proportionate share of the subsidiary’s identifiable net assets; or

(ii) at its fair value (usually determined by the directors of the parent company).

Required:

Explain the difference that the accounting treatment of these alternative methods could have on the consolidated financial statements, including where consolidated goodwill may be impaired. (4 marks)

第9题

ions in the production of chemicals. The company has grown rapidly over the past eight years and this is due partly to the warranties that the company gives to its customers. It guarantees its products for five years and if problems arise in this period it undertakes to fix them, or provide a replacement product.

You are the manager responsible for the audit of Greenfields and you are performing the final review stage of the audit and have come across the following two issues.

Receivable balance owing from Yellowmix Co

Greenfields has a material receivable balance owing from its customer, Yellowmix Co. During the year-end audit, your team reviewed the ageing of this balance and found that no payments had been received from Yellowmix for over six months, and Greenfields would not allow this balance to be circularised. Instead management has assured your team that they will provide a written representation confirming that the balance is recoverable.

Warranty provision

The warranty provision included within the statement of financial position is material. The audit team has performed testing over the calculations and assumptions which are consistent with prior years. The team has requested a written representation from management confirming the basis and amount of the provision are reasonable. Management has yet to confirm acceptance of this representation.

Required:

(a) Describe the audit procedures required in respect of accounting estimates. (5 marks)

(b) For each of the two issues above:

(i) Discuss the appropriateness of written representations as a form. of audit evidence; and (4 marks)

(ii) Describe additional procedures the auditor should now perform. in order to reach a conclusion on the balance to be included in the financial statements. (6 marks)

Note: The total marks will be split equally between each issue.

(c) The directors of Greenfields have decided not to provide the audit firm with the written representation for the warranty provision as they feel that it is unnecessary.

Required:

Explain the steps the auditor of Greenfields Co should now take and the impact on the audit report in relation to the refusal to provide the written representation. (5 marks)

第10题

(a) Explain the purpose of a value for money audit. (4 marks)

(b) Bluesberry hospital is located in a country where healthcare is free, as the taxpayers fund the hospitals which are owned by the government. Two years ago management reviewed all aspects of hospital operations and instigated a number of measures aimed at improving overall ‘value for money’ for the local community. Management have asked that you, an audit manager in the hospital’s internal audit department, perform. a review over the measures which have been implemented.

Bluesberry has one centralised buying department and all purchase requisition forms for medical supplies must be forwarded here. Upon receipt the buying team will research the lowest price from suppliers and a purchase order is raised. This is then passed to the purchasing director, who authorises all orders. The small buying team receive in excess of 200 forms a day.

The human resources department has had difficulties with recruiting suitably trained staff. Overtime rates have been increased to incentivise permanent staff to fill staffing gaps, this has been popular, and reliance on expensive temporary staff has been reduced. Monitoring of staff hours had been difficult but the hospital has implemented time card clocking in and out procedures and these hours are used for overtime payments as well.

The hospital has invested heavily in new surgical equipment, which although very expensive, has meant that more operations could be performed and patient recovery rates are faster. However, currently there is a shortage of appropriately trained medical staff. A capital expenditure committee has been established, made up of senior managers, and they plan and authorise any significant capital expenditure items.

Required:

(i) Identify and explain FOUR STRENGTHS within Bluesberry’s operating environment; and (6 marks)

(ii) For each strength identified, describe how Bluesberry might make further improvements to provide the best value for money. (4 marks)

(c) Describe TWO substantive procedures the external auditor of Bluesberry should adopt to verify EACH of the following assertions in relation to an entity’s property, plant and equipment;

(i) Valuation;

(ii) Completeness; and

(iii) Rights and obligations.

Note: Assume that the hospital adopts International Financial Reporting Standards. (6 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!