重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

an immediate payment of $4 per share on 1 October 2010; and

a further amount deferred until 1 October 2011 of $5·4 million.

The immediate payment has been recorded in Paladin’s financial statements, but the deferred payment has not been recorded. Paladin’s cost of capital is 8% per annum.

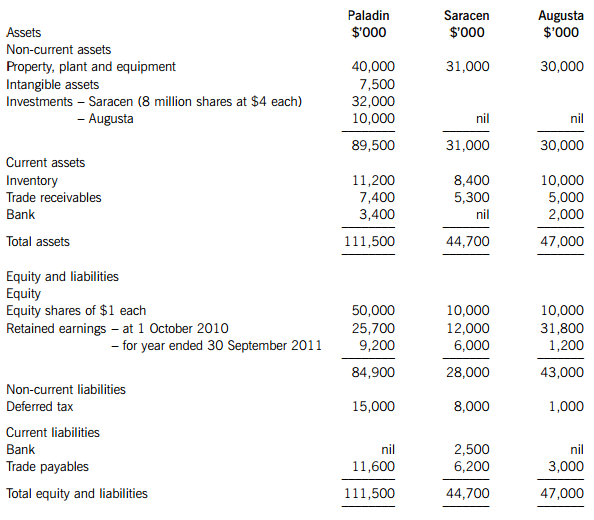

On 1 February 2011, Paladin also acquired 25% of the equity shares of Augusta paying $10 million in cash. The summarised statements of financial position of the three companies at 30 September 2011 are:

The following information is relevant:

(i) Paladin’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose the directors of Paladin considered a share price for Saracen of $3·50 per share to be appropriate.

(ii) At the date of acquisition, the fair values of Saracen’s property, plant and equipment was equal to its carrying amount with the exception of Saracen’s plant which had a fair value of $4 million above its carrying amount. At that date the plant had a remaining life of four years. Saracen uses straight-line depreciation for plant assuming a nil residual value. Also at the date of acquisition, Paladin valued Saracen’s customer relationships as a customer base intangible asset at fair value of $3 million. Saracen has not accounted for this asset. Trading relationships with Saracen’s customers last on average for six years.

(iii) At 30 September 2011, Saracen’s inventory included goods bought from Paladin (at cost to Saracen) of $2·6 million. Paladin had marked up these goods by 30% on cost. Paladin’s agreed current account balance owed by Saracen at 30 September 2011 was $1·3 million.

(iv) Impairment tests were carried out on 30 September 2011 which concluded that consolidated goodwill was not impaired, but, due to disappointing earnings, the value of the investment in Augusta was impaired by $2·5 million.

(v) Assume all profits accrue evenly through the year.

Required:

Prepare the consolidated statement of financial position for Paladin as at 30 September 2011.

更多“On 1 October 2010, Paladin secured a majority equity shareholding in Saracen on the follow”相关的问题

更多“On 1 October 2010, Paladin secured a majority equity shareholding in Saracen on the follow”相关的问题

第1题

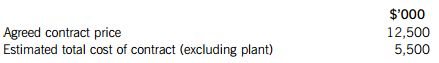

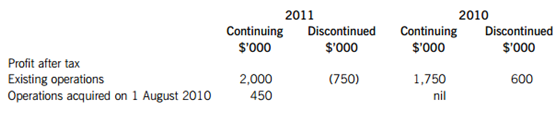

months and therefore be completed on 31 December 2011. Details of the contract are:

Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of $8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge.

The correctly reported income statement results for the contract for the year ended 31 March 2010 were:

The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price.

Required:

Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

第2题

ion of financial statements (Framework) and as part of the qualitative characteristics of financial statements under the heading of ‘relevance’ he notes that the predictive value of information is considered important. He is aware that financial statements are prepared historically (i.e. after transactions have occurred) and offers the view that the predictive value of financial statements would be enhanced if forward-looking information (e.g. forecasts) were published rather than backward-looking historical statements.

Required:

By the use of specific examples, provide an explanation to your assistant of how IFRS presentation and disclosure requirements can assist the predictive role of historically prepared financial statements. (6 marks)

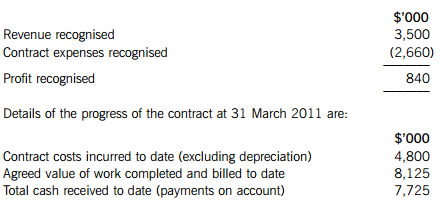

(b) The following summarised information is available in relation to Rebound, a publicly listed company:

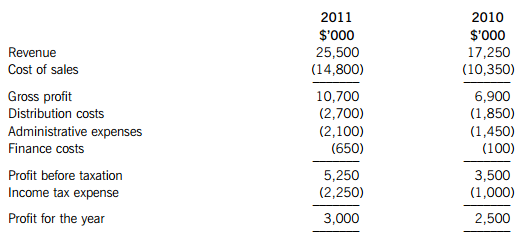

Income statement extracts years ended 31 March:

Analysts expect profits from the market sector in which Rebound’s existing operations are based to increase by 6% in the year to 31 March 2012 and by 8% in the sector of its newly acquired operations.

On 1 April 2009 Rebound had:

$3 million of 25 cents equity shares in issue.

$5 million 8% convertible loan stock 2016; the terms of conversion are 40 equity shares in exchange for each

$100 of loan stock. Assume an income tax rate of 30%.

On 1 October 2010 the directors of Rebound were granted options to buy 2 million shares in the company for $1 each. The average market price of Rebound’s shares for the year ending 31 March 2011 was $2·50 each.

Required:

(i) Calculate Rebound’s estimated profit after tax for the year ending 31 March 2012 assuming the analysts’ expectations prove correct; (3 marks)

(ii) Calculate the diluted earnings per share (EPS) on the continuing operations of Rebound for the year ended 31 March 2011 and the comparatives for 2010. (6 marks)

第3题

Bengal is a public company. Its most recent financial statements are shown below:

Income statements for the year ended 31 March

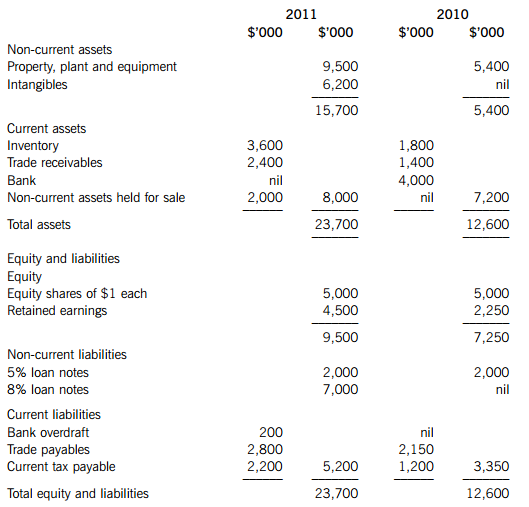

Statements of financial position as at 31 March

Notes

(i) There were no disposals of non-current assets during the period; however Bengal does have some non-current assets classified as ‘held for sale’ at 31 March 2011.

(ii) Depreciation of property, plant and equipment for the year ended 31 March 2011 was $640,000.

A disappointed shareholder has observed that although revenue during the year has increased by 48% (8,250/17,250 x 100), profit for the year has only increased by 20% (500/2,500 x 100). 6

Required:

(a) Prepare a statement of cash flows for Bengal for the year ended 31 March 2011, in accordance with IAS 7 Statement of cash flows, using the indirect method. (9 marks)

(b) Using the information in the question and your answer to (a) above, comment on the performance (including addressing the shareholder’s observation) and financial position of Bengal for the year ended 31 March 2011.

Note: up to 5 marks are available for the calculation of appropriate ratios. (16 marks)

第4题

The following trial balance relates to Highwood at 31 March 2011:

The following notes are relevant:

(i) An equity dividend of 5 cents per share was paid in November 2010 and charged to retained earnings.

(ii) The 8% $30 million convertible loan note was issued on 1 April 2010 at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2013 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each $100 of loan note. Highwood’s finance director has calculated that to issue an equivalent loan note without the conversion rights it would have to pay an interest rate of 10% per annum to attract investors.

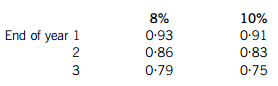

The present value of $1 receivable at the end of each year, based on discount rates of 8% and 10% are:

(iii) Non-current assets:

On 1 April 2010 Highwood decided for the first time to value its freehold property at its current value. A qualified property valuer reported that the market value of the freehold property on this date was $80 million, of which $30 million related to the land. At this date the remaining estimated life of the property was 20 years. Highwood does not make a transfer to retained earnings in respect of excess depreciation on the revaluation of its assets.

Plant is depreciated at 20% per annum on the reducing balance method.

All depreciation of non-current assets is charged to cost of sales.

(iv) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2010. The required provision for income tax for the year ended 31 March 2011 is $19·4 million. The difference between the carrying amounts of the net assets of Highwood (including the revaluation of the property in note (iii) above) and their (lower) tax base at 31 March 2011 is $27 million. Highwood’s rate of income tax is 25%.

(v) The inventory of Highwood was not counted until 4 April 2011 due to operational reasons. At this date its value at cost was $36 million and this figure has been used in the cost of sales calculation above. Between the year end of 31 March 2011 and 4 April 2011, Highwood received a delivery of goods at a cost of $2·7 million and made sales of $7·8 million at a mark-up on cost of 30%. Neither the goods delivered nor the sales made in this period were included in Highwood’s purchases (as part of cost of sales) or revenue in the above trial balance.

(vi) On 31 March 2011 Highwood factored (sold) trade receivables with a book value of $10 million to Easyfinance. Highwood received an immediate payment of $8·7 million and will pay Easyfinance 2% per month on any uncollected balances. Any of the factored receivables outstanding after six months will be refunded to Easyfinance. Highwood has derecognised the receivables and charged $1·3 million to administrative expenses. If Highwood had not factored these receivables it would have made an allowance of $600,000 against them.

Required:

(i) Prepare the statement of comprehensive income for Highwood for the year ended 31 March 2011;

(ii) Prepare the statement of changes in equity for Highwood for the year ended 31 March 2011;

(iii) Prepare the statement of financial position of Highwood as at 31 March 2011.

Note: your answers and workings should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(i) 11 marks

(ii) 4 marks

(iii) 10 marks

第5题

was through a share exchange of two shares in Prodigal for every three shares in Sentinel. The stock market price of Prodigal’s shares at 1 October 2010 was $4 per share.

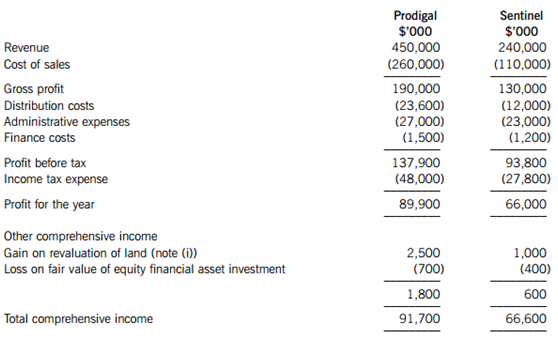

The summarised statements of comprehensive income for the two companies for the year ended 31 March 2011 are:

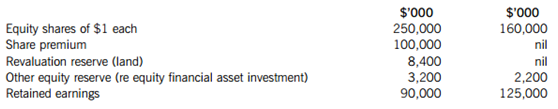

The following information for the equity of the companies at 1 April 2010 (i.e. before the share exchange took place) is available:

The following information is relevant:

(i) Prodigal’s policy is to revalue the group’s land to market value at the end of each accounting period. Prior to its acquisition Sentinel’s land had been valued at historical cost. During the post acquisition period Sentinel’s land had increased in value over its value at the date of acquisition by $1 million. Sentinel has recognised the revaluation within its own financial statements.

(ii) Immediately after the acquisition of Sentinel on 1 October 2010, Prodigal transferred an item of plant with a carrying amount of $4 million to Sentinel at an agreed value of $5 million. At this date the plant had a remaining life of two and half years. Prodigal had included the profit on this transfer as a reduction in its depreciation costs. All depreciation is charged to cost of sales.

(iii) After the acquisition Sentinel sold goods to Prodigal for $40 million. These goods had cost Sentinel $30 million. $12 million of the goods sold remained in Prodigal’s closing inventory.

(iv) Prodigal’s policy is to value the non-controlling interest of Sentinel at the date of acquisition at its fair value which the directors determined to be $100 million.

(v) The goodwill of Sentinel has not suffered any impairment.

(vi) All items in the above statements of comprehensive income are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Prepare the consolidated statement of comprehensive income of Prodigal for the year ended 31 March 2011;

(ii) Prepare the equity section (including the non-controlling interest) of the consolidated statement of financial position of Prodigal as at 31 March 2011.

Note: you are NOT required to calculate consolidated goodwill or produce the statement of changes in equity.

The following mark allocation is provided as guidance for this requirement:

(i) 14 marks

(ii) 7 marks (21 marks)

(b) IFRS 3 Business combinations permits a non-controlling interest at the date of acquisition to be valued by one of two methods:

(i) at its proportionate share of the subsidiary’s identifiable net assets; or

(ii) at its fair value (usually determined by the directors of the parent company).

Required:

Explain the difference that the accounting treatment of these alternative methods could have on the consolidated financial statements, including where consolidated goodwill may be impaired. (4 marks)

第6题

ions in the production of chemicals. The company has grown rapidly over the past eight years and this is due partly to the warranties that the company gives to its customers. It guarantees its products for five years and if problems arise in this period it undertakes to fix them, or provide a replacement product.

You are the manager responsible for the audit of Greenfields and you are performing the final review stage of the audit and have come across the following two issues.

Receivable balance owing from Yellowmix Co

Greenfields has a material receivable balance owing from its customer, Yellowmix Co. During the year-end audit, your team reviewed the ageing of this balance and found that no payments had been received from Yellowmix for over six months, and Greenfields would not allow this balance to be circularised. Instead management has assured your team that they will provide a written representation confirming that the balance is recoverable.

Warranty provision

The warranty provision included within the statement of financial position is material. The audit team has performed testing over the calculations and assumptions which are consistent with prior years. The team has requested a written representation from management confirming the basis and amount of the provision are reasonable. Management has yet to confirm acceptance of this representation.

Required:

(a) Describe the audit procedures required in respect of accounting estimates. (5 marks)

(b) For each of the two issues above:

(i) Discuss the appropriateness of written representations as a form. of audit evidence; and (4 marks)

(ii) Describe additional procedures the auditor should now perform. in order to reach a conclusion on the balance to be included in the financial statements. (6 marks)

Note: The total marks will be split equally between each issue.

(c) The directors of Greenfields have decided not to provide the audit firm with the written representation for the warranty provision as they feel that it is unnecessary.

Required:

Explain the steps the auditor of Greenfields Co should now take and the impact on the audit report in relation to the refusal to provide the written representation. (5 marks)

第7题

(a) Explain the purpose of a value for money audit. (4 marks)

(b) Bluesberry hospital is located in a country where healthcare is free, as the taxpayers fund the hospitals which are owned by the government. Two years ago management reviewed all aspects of hospital operations and instigated a number of measures aimed at improving overall ‘value for money’ for the local community. Management have asked that you, an audit manager in the hospital’s internal audit department, perform. a review over the measures which have been implemented.

Bluesberry has one centralised buying department and all purchase requisition forms for medical supplies must be forwarded here. Upon receipt the buying team will research the lowest price from suppliers and a purchase order is raised. This is then passed to the purchasing director, who authorises all orders. The small buying team receive in excess of 200 forms a day.

The human resources department has had difficulties with recruiting suitably trained staff. Overtime rates have been increased to incentivise permanent staff to fill staffing gaps, this has been popular, and reliance on expensive temporary staff has been reduced. Monitoring of staff hours had been difficult but the hospital has implemented time card clocking in and out procedures and these hours are used for overtime payments as well.

The hospital has invested heavily in new surgical equipment, which although very expensive, has meant that more operations could be performed and patient recovery rates are faster. However, currently there is a shortage of appropriately trained medical staff. A capital expenditure committee has been established, made up of senior managers, and they plan and authorise any significant capital expenditure items.

Required:

(i) Identify and explain FOUR STRENGTHS within Bluesberry’s operating environment; and (6 marks)

(ii) For each strength identified, describe how Bluesberry might make further improvements to provide the best value for money. (4 marks)

(c) Describe TWO substantive procedures the external auditor of Bluesberry should adopt to verify EACH of the following assertions in relation to an entity’s property, plant and equipment;

(i) Valuation;

(ii) Completeness; and

(iii) Rights and obligations.

Note: Assume that the hospital adopts International Financial Reporting Standards. (6 marks)

第8题

is on which the audit is to be carried out. This involves establishing whether the preconditions for an audit are present and confirming that there is a common understanding between the auditor and management of the terms of the engagement.

Required:

Describe the process the auditor should undertake to assess whether the PRECONDITIONS for an audit are present. (3 marks)

(b) List FOUR examples of matters the auditor may consider when obtaining an understanding of the entity. (2 marks)

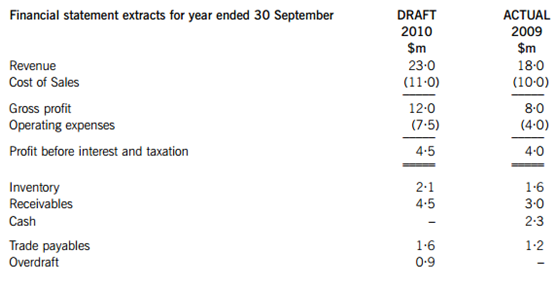

(c) You are the audit senior of White & Co and are planning the audit of Redsmith Co for the year ended 30 September 2010. The company produces printers and has been a client of your firm for two years; your audit manager has already had a planning meeting with the finance director. He has provided you with the following notes of his meeting and financial statement extracts.

Redsmith’s management were disappointed with the 2009 results and so in 2010 undertook a number of strategies to improve the trading results. This included the introduction of a generous sales-related bonus scheme for their salesmen and a high profile advertising campaign. In addition, as market conditions are difficult for their customers, they have extended the credit period given to them.

The finance director of Redsmith has reviewed the inventory valuation policy and has included additional overheads incurred this year as he considers them to be production related. He is happy with the 2010 results and feels that they are a good reflection of the improved trading levels.

Required:

Using the information above:

(i) Calculate FIVE ratios, for BOTH years, which would assist the audit senior in planning the audit; and (5 marks)

(ii) From a review of the above information and the ratios calculated, explain the audit risks that arise and describe the appropriate response to these risks. (10 marks)

第9题

(a) Explain the concept of TRUE and FAIR presentation. (4 marks)

(b) Explain the status of International Standards on Auditing. (2 marks)

(c) ISA 230 Audit Documentation deals with the auditor’s responsibility to prepare audit documentation for an audit of financial statements.

Required:

State FOUR benefits of documenting audit work. (4 marks)

第10题

ntrol to those Charged with Governance and Management, to communicate deficiencies in internal controls. In particular SIGNIFICANT deficiencies in internal controls must be communicated in writing to those charged with governance.

Required:

Explain examples of matters the auditor should consider in determining whether a deficiency in internal controls is significant. (5 marks)

Greystone Co is a retailer of ladies clothing and accessories. It operates in many countries around the world and has expanded steadily from its base in Europe. Its main market is aimed at 15 to 35 year olds and its prices are mid to low range. The company’s year end was 30 September 2010.

In the past the company has bulk ordered its clothing and accessories twice a year. However, if their goods failed to meet the key fashion trends then this resulted in significant inventory write downs. As a result of this the company has recently introduced a just in time ordering system. The fashion buyers make an assessment nine months in advance as to what the key trends are likely to be, these goods are sourced from their suppliers but only limited numbers are initially ordered.

Greystone Co has an internal audit department but at present their only role is to perform. regular inventory counts at the stores.

Ordering process

Each country has a purchasing manager who decides on the initial inventory levels for each store, this is not done in conjunction with store or sales managers. These quantities are communicated to the central buying department at the head office in Europe. An ordering clerk amalgamates all country orders by specified regions of countries, such as Central Europe and North America, and passes them to the purchasing director to review and authorise.

As the goods are sold, it is the store manager’s responsibility to re-order the goods through the purchasing manager; they are prompted weekly to review inventory levels as although the goods are just in time, it can still take up to four weeks for goods to be received in store.

It is not possible to order goods from other branches of stores as all ordering must be undertaken through the purchasing manager. If a customer requests an item of clothing, which is unavailable in a particular store, then the customer is provided with other branch telephone numbers or recommended to try the company website.

Goods received and Invoicing

To speed up the ordering to receipt of goods cycle, the goods are delivered directly from the suppliers to the individual stores. On receipt of goods the quantities received are checked by a sales assistant against the supplier’s delivery note, and then the assistant produces a goods received note (GRN). This is done at quiet times of the day so as to maximise sales. The checked GRNs are sent to head office for matching with purchase invoices.

As purchase invoices are received they are manually matched to GRNs from the stores, this can be a very time consuming process as some suppliers may have delivered to over 500 stores. Once the invoice has been agreed then it is sent to the purchasing director for authorisation. It is at this stage that the invoice is entered onto the purchase ledger.

Required:

(b) As the external auditors of Greystone Co, write a report to management in respect of the purchasing system which:

(i) Identifies and explains FOUR deficiencies in that system;

(ii) Explains the possible implication of each deficiency;

(iii) Provides a recommendation to address each deficiency.

A covering letter is required.

Note: Up to two marks will be awarded within this requirement for presentation. (14 marks)

(c) Describe substantive procedures the auditor should perform. on the year-end trade payables of Greystone Co. (5 marks)

(d) Describe additional assignments that the internal audit department of Greystone Co could be asked to perform. by those charged with governance. (6 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!