重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.施工总承包单位

B.分包单位

C.出租单位

D.安装单位

E.监理单位

更多“施工过程中使用承租的机械设备和施工机具及配件的,应由()共同进行验收,验收合格的方可使用。A.”相关的问题

更多“施工过程中使用承租的机械设备和施工机具及配件的,应由()共同进行验收,验收合格的方可使用。A.”相关的问题

第1题

(ii) Calculate her income tax (IT) and national insurance (NIC) payable for the year of assessment 2006/07.

(4 marks)

第2题

(b) (i) Calculate the inheritance tax (IHT) that will be payable if Debbie were to die today (8 June 2005).

Assume that no tax planning measures are taken and that there has been no change in the value of any

of the assets since David’s death. (4 marks)

第3题

(c) Assuming that Joanne registers for value added tax (VAT) with effect from 1 April 2006:

(i) Calculate her income tax (IT) and capital gains tax (CGT) payable for the year of assessment 2005/06.

You are not required to calculate any national insurance liabilities in this sub-part. (6 marks)

第4题

A、DR: wages expense $500 CR: social security tax payable $90 CR: Income tax payable $100 CR: Pension scheme payable $3 CR:Wages accrued $280

B、DR: wages expense $550 CR :social security tax $90 CR:Income tax payable $100 CR: Pension scheme payable $30 CR:Wages accrued $330

C、DR: wages expense $280 DR:social security tax $90 DR:Income tax expense $100 DR:Pension scheme $30 CR: wages accrued $500

D、DR: wages expense $330 DR: social security tax $90 DR: Income tax expense $100 DR:Pension scheme $30 CR wages accrued $550

第5题

(ii) Calculate the corporation tax (CT) payable by Tay Limited for the year ended 31 March 2006, taking

advantage of all available reliefs. (3 marks)

第6题

(ii) List the additional information required in order to calculate the employment income benefit in respect

of the provision of the furnished flat for 2007/08 and advise Benny of the potential income tax

implications of requesting a more centrally located flat in accordance with the company’s offer.

(4 marks)

第7题

A.$37,500.

B.$45,000.

C.$60,000.

第8题

For the year ended 5 April 2016, OK-Joe Ltd’s taxable total profits, before taking account of director’s remuneration, are £65,000. After allowing for employer’s class 1 national insurance contributions (NIC) of £5,141, Joe’s gross director’s remuneration is £59,859.

The figure for employer’s NIC of £5,141 is after deducting the £2,000 employment allowance.

Required:

Calculate the overall saving of tax and NIC for the year ended 5 April 2016 if Joe had instead paid himself gross director’s remuneration of £8,000 and net dividends of £45,600.

Notes:

1. You are expected to calculate the income tax payable by Joe, the class 1 NIC payable by both Joe and OK-Joe Ltd, and the corporation tax liability of OK-Joe Ltd for the year ended 5 April 2016. 2. You should assume that the rate of corporation tax remains unchanged.

第9题

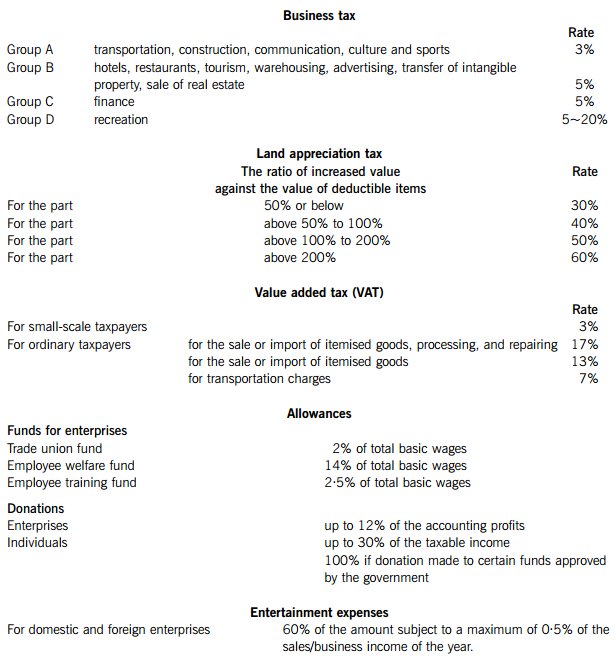

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

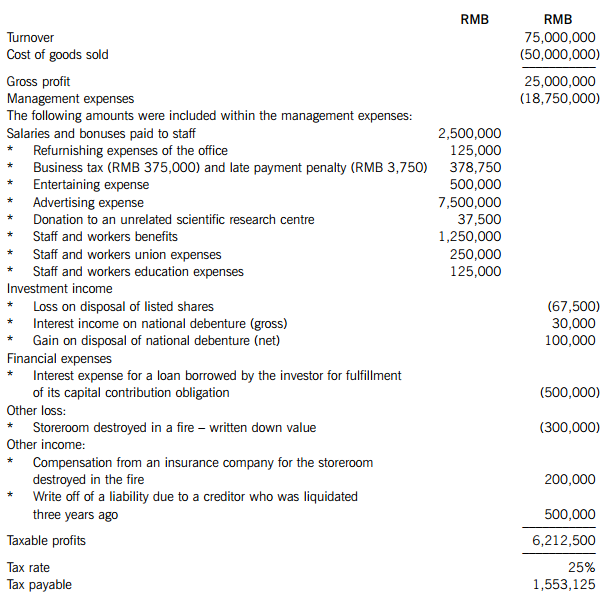

(a) Company L is a manufacturing joint venture enterprise which was established and started operations on 1 January 2010. The statement of enterprise income tax (EIT) payable prepared by the accountant of Company L for the year 2011 is as follows:

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 15 items marked with an asterisk (*); (15 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company L for the year 2011. (8 marks)

(b) State under what circumstances a company intending to launch a sales promotion involving the giving of gifts to its individual customers is/is not required to withhold the individual income tax (IIT). (7 marks)

(c) Company L is considering the following two alternatives for launching a sales promotion.

(i) An individual customer will get a gift with a market value equal to RMB100 (cost of purchase RMB80) for free if he/she has accumulated purchases within any single business day of RMB1,000 during the sales promotion period.

(ii) An individual customer will get a gift with a market value equal to RMB200 (cost of purchase RMB100) for free if he/she wins the lottery. A customer will be able to join the lottery for one time when he/she has accumulated purchases within any single business day of RMB1,000 during the sales promotion period.

Required:

Calculate the enterprise income tax (EIT) and individual income tax (IIT), if any, payable for each of the alternatives, assuming that Company L will bear any IIT due.

The following mark allocation is provided as guidance for this requirement:

(i) 2 marks

(ii) 3 marks

2.

(a) Mr Huang, a Chinese national, is the technical officer of Company J. He had the following receipts in the year 2011:

(1) In April, he provided technical services to an enterprise and received RMB 30,000. The related individual income tax was borne by the enterprise.

(2) Mr Huang together with three other people jointly started a partnership with equal shares on 1 October 2011. The profits of the partnership were RMB 300,000 in 2011.

(3) A net gain of RMB 18,000 from trading in the A-shares market.

(4) Euro 10,000 of income received in Country G for the transfer of a patent. Individual income tax equivalent to RMB 15,000 was paid in Country G.

(5) During his visit to Country K, he was invited to give a lecture in a university and was paid income of USD 1,500. Individual income tax equivalent to RMB 1,800 was paid in Country K.

(6) Received RMB 17,000 as insurance compensation.

(7) He won a lottery prize of RMB 30,000, but donated half of this amount to an approved charity.

Required:

Calculate the individual income tax (IIT) payable on each of the items (1) to (7) received by Mr Huang for the year 2011. Clearly state if any of the items of income are exempt from IIT.

Note: the following exchange rates are to be used:

Euro: RMB – 1:9·5

USD: RMB – 1:7 (10 marks)

(b) (i) Briefly explain the individual income tax (IIT) treatment of an annual one-off bonus where the IIT payable is partly borne by the employer as:

(1) a fixed amount; and (1 mark)

(2) a percentage of the IIT payable. (3 marks)

(ii) Company B is considering awarding an annual one-off bonus of RMB 100,000 to its general manager with the IIT being partly borne by the company. The general manager’s normal monthly salary exceeds the monthly deduction.

Required:

Calculate the individual income tax (IIT) payable and the amount to be borne by the general manager (as employee) if:

(1) Company B bears the fixed amount of RMB 20,000 of the total IIT payable by the general manager; and

(2) Company B bears 20% of the total IIT payable by the general manager. (6 marks)

3.

(a) Company M, a coal company, had the following transactions in the month of March 2011:

(1) Bought an excavator for RMB 720,000 plus value added tax (VAT) of RMB 122,400 and paid the related transportation fee of RMB 48,000 (invoice value).

(2) Bought low-value consumption goods for RMB 96,000 plus VAT of RMB 6,720.

(3) Sold 10,000 tons of coal by instalment to a customer for RMB 600 per ton (excluding VAT). One quarter of the payment was due in the month, but only RMB 1,000,000 (excluding VAT) was received. Separately RMB 72,000 was paid for transportation relating to the delivery.

(4) 250 tons of coal was used to provide heating for the staff dormitory and 600 tons of coal was given to customers as gifts.

(5) Sold 150 thousand cubic metres of natural gas acquired while mining for RMB 300,000 (excluding VAT).

Required:

Calculate the value added tax (VAT) liability of Company M for the month of March 2011. (6 marks)

(b) Define ‘Small-scale taxpayer’ for value added tax (VAT) purposes and state how their VAT liability is calculated and the type of VAT invoices they should use. (4 marks)

(c) Company N, a construction company, had the following transactions in the month of March 2011:

(1) Signed a contract with a metal company to build a factory. Partial payment of RMB 9,600,000 was received when the contract was signed. 15% of the building was constructed at the end of the month.

(2) Signed a contract with a country club for laying cables. The contract sum was RMB 1,200,000 which included the value of the cables provided by the country club of RMB 200,000. The job was finished and the money was received before the end of the month.

(3) Signed a contract with a metro company to provide mud engineering services and received RMB 2,000,000.

(4) Signed a contract with a supermarket for decoration services, including labour costs of RMB 450,000, management fees of RMB 50,000 and material costs of RMB200,000. The supermarket provided an additional RMB 150,000 of materials.

(5) Sold a self-constructed house to a member of staff for RMB 1,500,000, plus a gas pipe installation fee of RMB 10,000 and building repair funds of RMB 150,000. The cost of the building construction was RMB 600,000. The profit ratio for the construction as set by the local tax bureau is 20%.

Required:

Calculate the business tax payable by Company N for each of the transactions (1) to (5) relating to the month of March 2011.

(d) State how the tax bureau may assess business tax on service income if it considers the income declared to be too low and without proper justification and list the methods that may be used. (4 marks)

4.

(a) A trading company, Company S, imported some cosmetic goods costing USD 1,680,000. The additional costs of importing these goods were freight and insurance charges of USD 252,000, customs handling fees of USD 140,000 and a service fee to an overseas agent of USD 28,000.

Company S repacked the cosmetic goods into 10,000 sets for sale in China. 9,000 sets were sold to a wholesaler for USD 6,000,000 and 1,000 sets were sold by retail for USD 900,000. Both these sales figures include value added tax (VAT).

Required:

(i) Calculate the consumption tax, customs duty and value added tax (VAT) payable on the importation of the cosmetic goods; (5 marks)

(ii) Calculate the consumption tax and VAT payable on the sale of the cosmetic goods. (5 marks)

Notes:

(1) The customs tariff rate is 40%

(2) The consumption tax rate for cosmetic goods is 30%

(3) The USD:RMB exchange rate is 1:7·5

(b) List the methods by which Customs may assess the dutiable value of an import if it considers the value declared to be too low and without proper justification. (5 marks)

5.

Company C and its overseas branch, Branch D, both started business in 2010. Company C had a taxable loss of RMB 1,000,000 for the year 2010 and income of RMB 3,000,000 for the year 2011, while Branch D had taxable income of RMB 1,000,000 and paid foreign tax of RMB 300,000 for each of the years, 2010 and 2011. Both Company C and Branch D are subject to an income tax rate of 25%.

Required:

(a) In relation to foreign tax paid by a Chinese taxpayer, state the general tax treatment and the limitations on the amount of credit available. (3 marks)

(b) Calculate the enterprise income tax (EIT) payable by Company C for each of the years 2010 and 2011, clearly identifying the foreign tax credit used in each year and the unused tax credit carried forward, if any. (5 marks)

(c) Briefly explain the EIT provisional and annual filing requirements for a domestic registered enterprise with branches registered in different regions in China. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!