重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

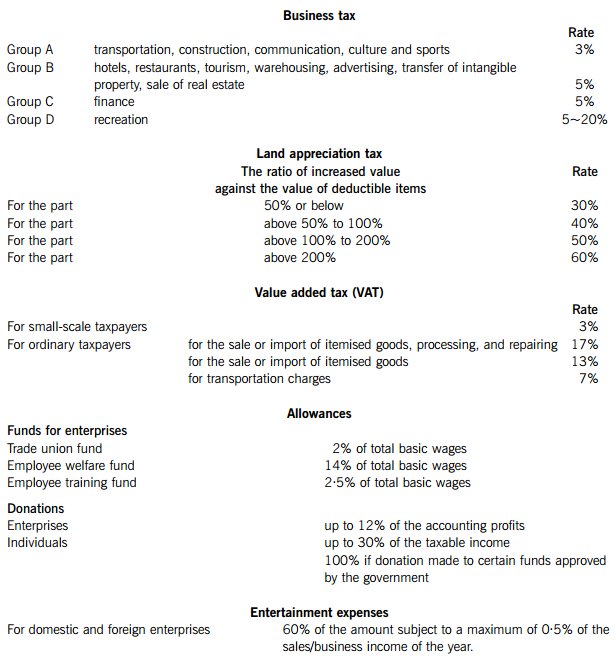

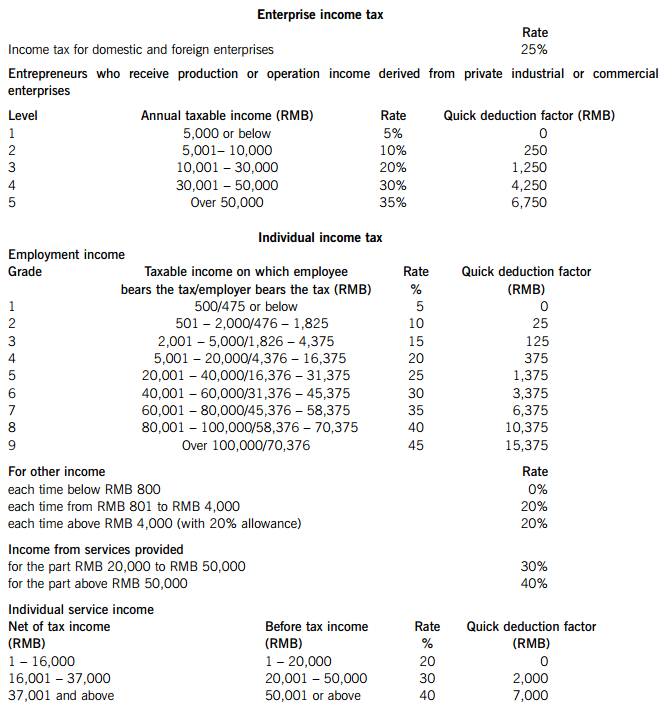

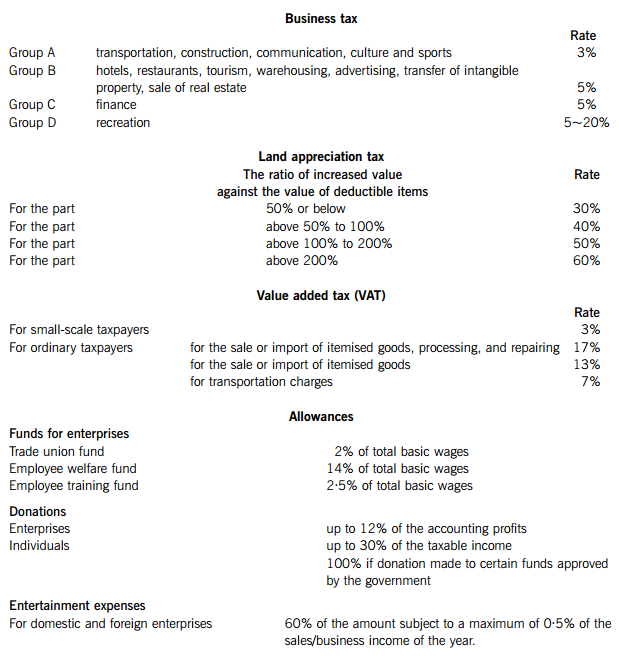

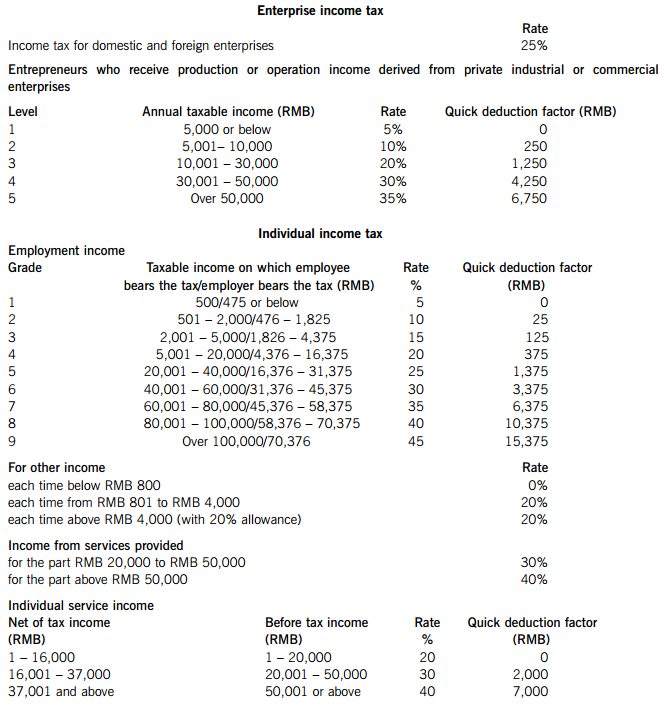

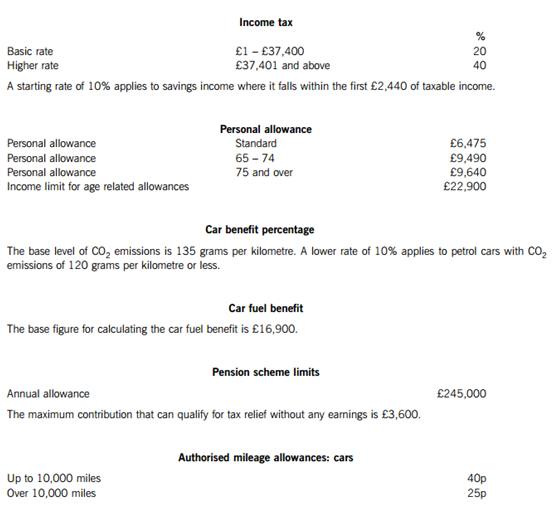

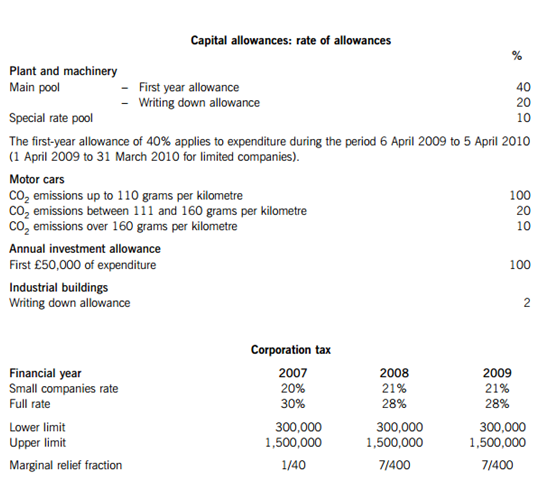

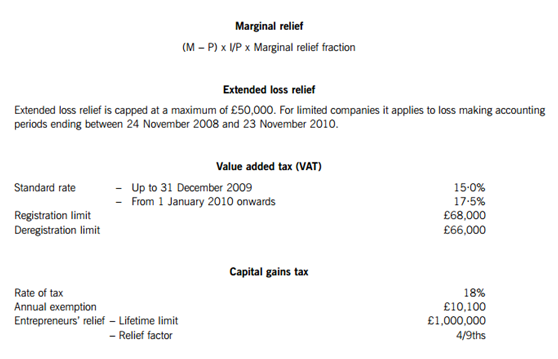

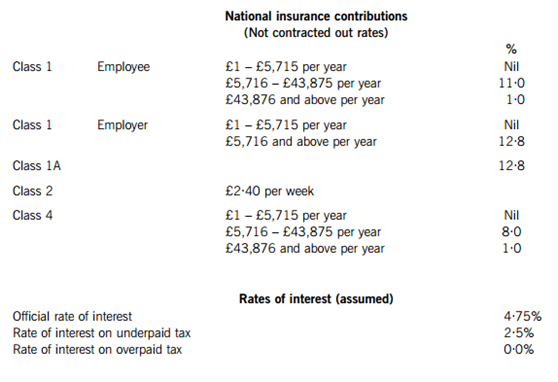

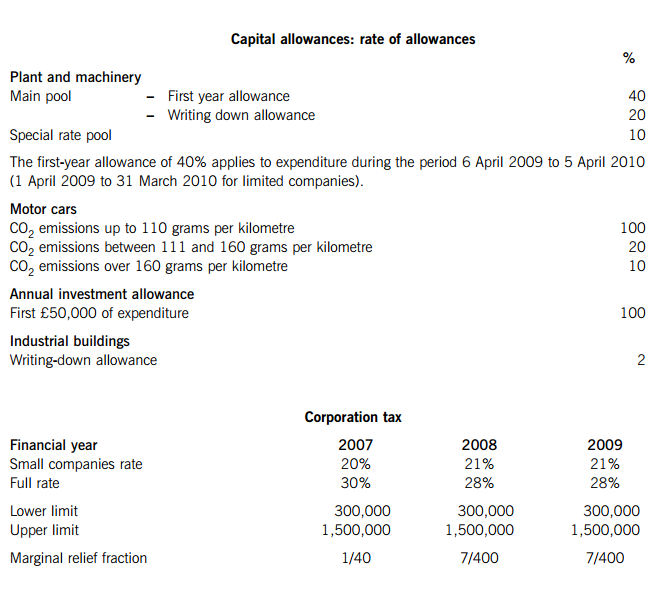

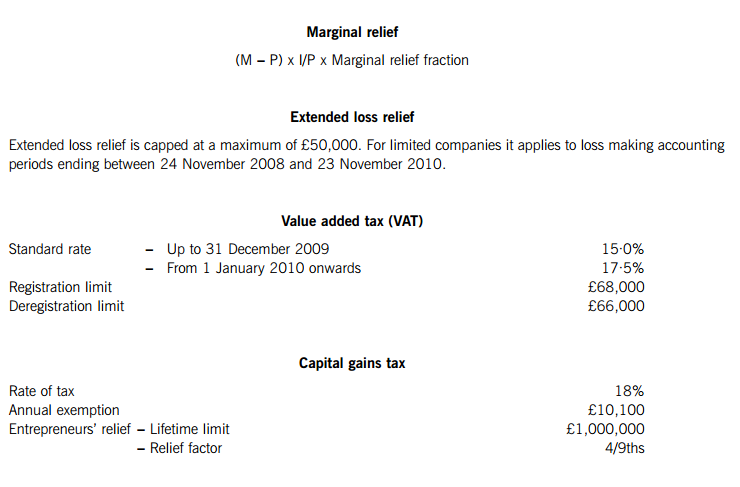

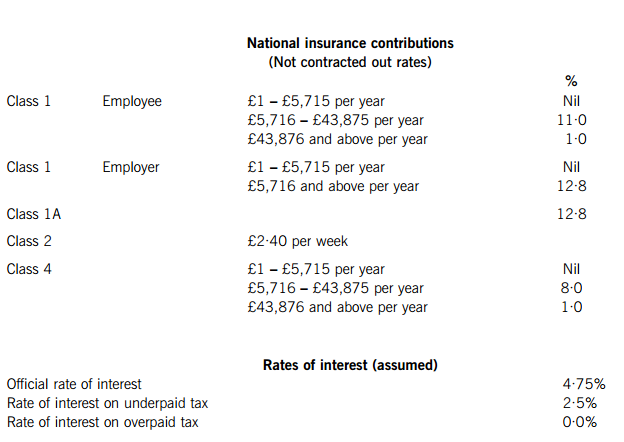

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

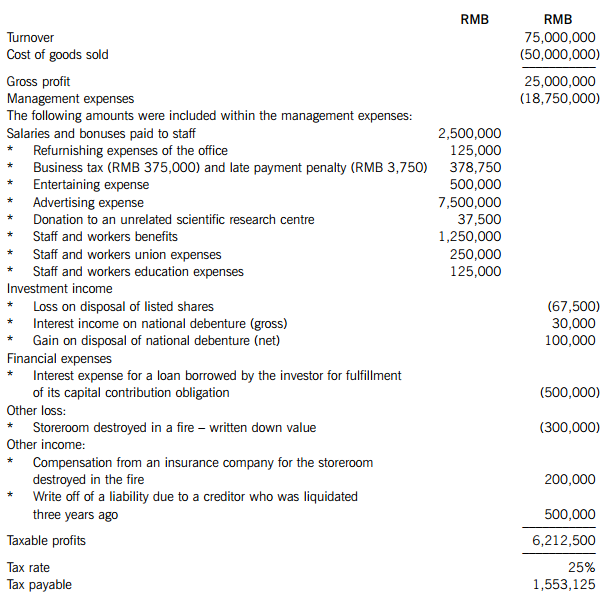

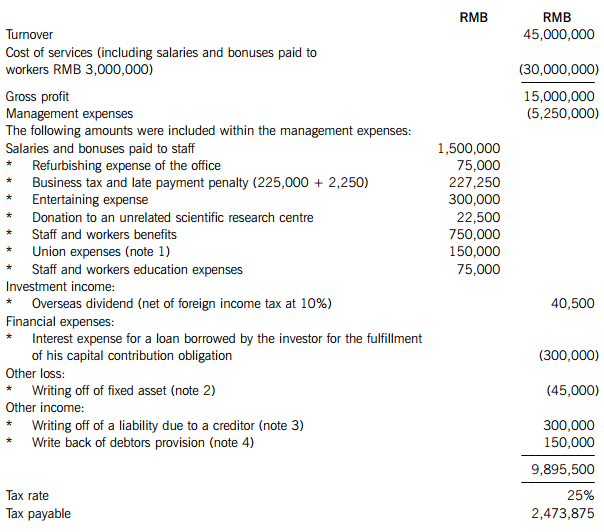

(a) Company L is a manufacturing joint venture enterprise which was established and started operations on 1 January 2010. The statement of enterprise income tax (EIT) payable prepared by the accountant of Company L for the year 2011 is as follows:

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 15 items marked with an asterisk (*); (15 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company L for the year 2011. (8 marks)

(b) State under what circumstances a company intending to launch a sales promotion involving the giving of gifts to its individual customers is/is not required to withhold the individual income tax (IIT). (7 marks)

(c) Company L is considering the following two alternatives for launching a sales promotion.

(i) An individual customer will get a gift with a market value equal to RMB100 (cost of purchase RMB80) for free if he/she has accumulated purchases within any single business day of RMB1,000 during the sales promotion period.

(ii) An individual customer will get a gift with a market value equal to RMB200 (cost of purchase RMB100) for free if he/she wins the lottery. A customer will be able to join the lottery for one time when he/she has accumulated purchases within any single business day of RMB1,000 during the sales promotion period.

Required:

Calculate the enterprise income tax (EIT) and individual income tax (IIT), if any, payable for each of the alternatives, assuming that Company L will bear any IIT due.

The following mark allocation is provided as guidance for this requirement:

(i) 2 marks

(ii) 3 marks

2.

(a) Mr Huang, a Chinese national, is the technical officer of Company J. He had the following receipts in the year 2011:

(1) In April, he provided technical services to an enterprise and received RMB 30,000. The related individual income tax was borne by the enterprise.

(2) Mr Huang together with three other people jointly started a partnership with equal shares on 1 October 2011. The profits of the partnership were RMB 300,000 in 2011.

(3) A net gain of RMB 18,000 from trading in the A-shares market.

(4) Euro 10,000 of income received in Country G for the transfer of a patent. Individual income tax equivalent to RMB 15,000 was paid in Country G.

(5) During his visit to Country K, he was invited to give a lecture in a university and was paid income of USD 1,500. Individual income tax equivalent to RMB 1,800 was paid in Country K.

(6) Received RMB 17,000 as insurance compensation.

(7) He won a lottery prize of RMB 30,000, but donated half of this amount to an approved charity.

Required:

Calculate the individual income tax (IIT) payable on each of the items (1) to (7) received by Mr Huang for the year 2011. Clearly state if any of the items of income are exempt from IIT.

Note: the following exchange rates are to be used:

Euro: RMB – 1:9·5

USD: RMB – 1:7 (10 marks)

(b) (i) Briefly explain the individual income tax (IIT) treatment of an annual one-off bonus where the IIT payable is partly borne by the employer as:

(1) a fixed amount; and (1 mark)

(2) a percentage of the IIT payable. (3 marks)

(ii) Company B is considering awarding an annual one-off bonus of RMB 100,000 to its general manager with the IIT being partly borne by the company. The general manager’s normal monthly salary exceeds the monthly deduction.

Required:

Calculate the individual income tax (IIT) payable and the amount to be borne by the general manager (as employee) if:

(1) Company B bears the fixed amount of RMB 20,000 of the total IIT payable by the general manager; and

(2) Company B bears 20% of the total IIT payable by the general manager. (6 marks)

3.

(a) Company M, a coal company, had the following transactions in the month of March 2011:

(1) Bought an excavator for RMB 720,000 plus value added tax (VAT) of RMB 122,400 and paid the related transportation fee of RMB 48,000 (invoice value).

(2) Bought low-value consumption goods for RMB 96,000 plus VAT of RMB 6,720.

(3) Sold 10,000 tons of coal by instalment to a customer for RMB 600 per ton (excluding VAT). One quarter of the payment was due in the month, but only RMB 1,000,000 (excluding VAT) was received. Separately RMB 72,000 was paid for transportation relating to the delivery.

(4) 250 tons of coal was used to provide heating for the staff dormitory and 600 tons of coal was given to customers as gifts.

(5) Sold 150 thousand cubic metres of natural gas acquired while mining for RMB 300,000 (excluding VAT).

Required:

Calculate the value added tax (VAT) liability of Company M for the month of March 2011. (6 marks)

(b) Define ‘Small-scale taxpayer’ for value added tax (VAT) purposes and state how their VAT liability is calculated and the type of VAT invoices they should use. (4 marks)

(c) Company N, a construction company, had the following transactions in the month of March 2011:

(1) Signed a contract with a metal company to build a factory. Partial payment of RMB 9,600,000 was received when the contract was signed. 15% of the building was constructed at the end of the month.

(2) Signed a contract with a country club for laying cables. The contract sum was RMB 1,200,000 which included the value of the cables provided by the country club of RMB 200,000. The job was finished and the money was received before the end of the month.

(3) Signed a contract with a metro company to provide mud engineering services and received RMB 2,000,000.

(4) Signed a contract with a supermarket for decoration services, including labour costs of RMB 450,000, management fees of RMB 50,000 and material costs of RMB200,000. The supermarket provided an additional RMB 150,000 of materials.

(5) Sold a self-constructed house to a member of staff for RMB 1,500,000, plus a gas pipe installation fee of RMB 10,000 and building repair funds of RMB 150,000. The cost of the building construction was RMB 600,000. The profit ratio for the construction as set by the local tax bureau is 20%.

Required:

Calculate the business tax payable by Company N for each of the transactions (1) to (5) relating to the month of March 2011.

(d) State how the tax bureau may assess business tax on service income if it considers the income declared to be too low and without proper justification and list the methods that may be used. (4 marks)

4.

(a) A trading company, Company S, imported some cosmetic goods costing USD 1,680,000. The additional costs of importing these goods were freight and insurance charges of USD 252,000, customs handling fees of USD 140,000 and a service fee to an overseas agent of USD 28,000.

Company S repacked the cosmetic goods into 10,000 sets for sale in China. 9,000 sets were sold to a wholesaler for USD 6,000,000 and 1,000 sets were sold by retail for USD 900,000. Both these sales figures include value added tax (VAT).

Required:

(i) Calculate the consumption tax, customs duty and value added tax (VAT) payable on the importation of the cosmetic goods; (5 marks)

(ii) Calculate the consumption tax and VAT payable on the sale of the cosmetic goods. (5 marks)

Notes:

(1) The customs tariff rate is 40%

(2) The consumption tax rate for cosmetic goods is 30%

(3) The USD:RMB exchange rate is 1:7·5

(b) List the methods by which Customs may assess the dutiable value of an import if it considers the value declared to be too low and without proper justification. (5 marks)

5.

Company C and its overseas branch, Branch D, both started business in 2010. Company C had a taxable loss of RMB 1,000,000 for the year 2010 and income of RMB 3,000,000 for the year 2011, while Branch D had taxable income of RMB 1,000,000 and paid foreign tax of RMB 300,000 for each of the years, 2010 and 2011. Both Company C and Branch D are subject to an income tax rate of 25%.

Required:

(a) In relation to foreign tax paid by a Chinese taxpayer, state the general tax treatment and the limitations on the amount of credit available. (3 marks)

(b) Calculate the enterprise income tax (EIT) payable by Company C for each of the years 2010 and 2011, clearly identifying the foreign tax credit used in each year and the unused tax credit carried forward, if any. (5 marks)

(c) Briefly explain the EIT provisional and annual filing requirements for a domestic registered enterprise with branches registered in different regions in China. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

更多“SUPPLEMENTARY INSTRUCTIONS 1. Calculations and workings need only be made to the nearest R”相关的问题

更多“SUPPLEMENTARY INSTRUCTIONS 1. Calculations and workings need only be made to the nearest R”相关的问题

第1题

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. Apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

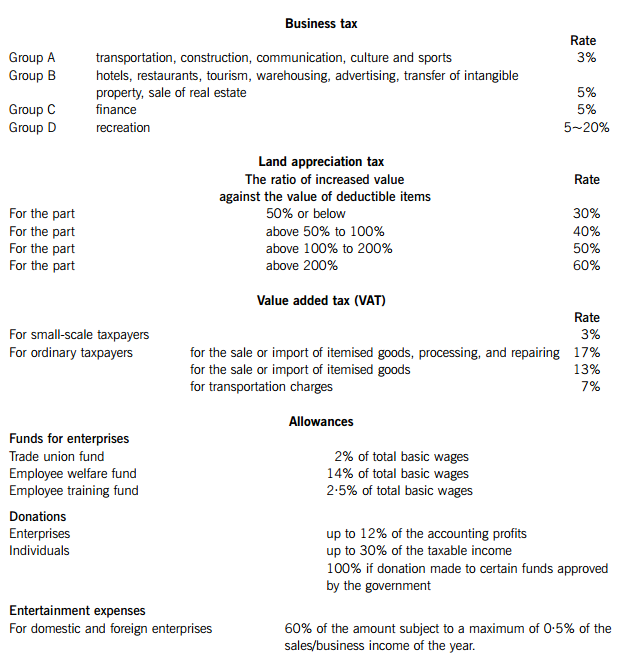

(a) The following is the statement of enterprise income tax (EIT) payable prepared by the accountant of Company P for the year 2010:

Notes:

(1) The union has not yet been set up and the expense is a general provision.

(2) The original cost of the fixed asset was RMB 150,000 and the accumulated depreciation was RMB 105,000, while the accumulated tax allowances claimed were RMB 120,000.

(3) The creditor had been liquidated three years ago.

(4) Last year (2009) was the first year a debtors provision was made. A general provision of RMB 500,000 was made but the whole amount was disallowed by the tax bureau. This year the management decided to write back part of provision amounting to RMB 150,000.

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 12 items marked with an asterisk (*) in the income tax calculation sheet; (17 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company P for the year 2010. (6 marks)

(b) Briefly explain the term ‘arm’s length principle’ in the context of transactions between associated enterprises pursuant to the enterprise income tax law, together with the adjustment methods that may be used by the tax bureau in cases where this principle is not complied with. (6 marks)

(c) Company C, a limited company with equity of RMB 1,000,000, borrowed two loans from related companies:

– RMB 1,000,000 at a 7% annual interest rate from Company A; and

– RMB 2,000,000 at an 8% annual interest rate from Company B.

The market interest rate for the equivalent loans is a 6% annual interest rate.

In 2010, the interest paid to Company A and Company B was RMB 70,000 and RMB 160,000 respectively. The total amount of interest of RMB 230,000 was allocated RMB 140,000 to interest expense and RMB 90,000 to construction in progress in Company C’s accounts.

Required:

Calculate the amount of interest that will be disallowed for enterprise income tax under each of the account headings: interest expense and construction in progress. (6 marks)

2.

(a) Mr Y, a local Chinese national, a professional writer and artist, had the following income during 2010:

(1) Received income of RMB 45,000 for publishing the first edition of a book, and of RMB 15,000 for the second edition of the same book. The book was also published in a newspaper and he was paid RMB 5,250 for this.

(2) Sold one of his paintings for RMB 5,400.

(3) Gave a speech and was paid RMB 28,500.

(4) Acted as a translator for a movie and was paid RMB 60,000.

(5) Gave a speech in overseas country M and was paid the gross equivalent of RMB 27,000, from which the equivalent of RMB 6,750 in overseas tax was deducted at source.

(6) Sold one of his paintings in overseas country H, and was paid the gross equivalent of RMB 15,000, from which the equivalent of RMB 2,250 in overseas tax was deducted at source.

(7) Received interest of RMB 7,500 on a loan he had made to a domestic enterprise.

Required:

(i) Calculate the individual income tax (IIT) payable by Mr Y in respect of each of the items (1) to (7); (12 marks)

(ii) State how and when any IIT due on Mr Y&39;s overseas income will be reported and paid. (3 marks)

(b)

(i) State when a withholding agent must report and pay the individual income tax (IIT) deducted on a monthly basis from employment income; (1 mark)

(ii) List ANY FOUR situations in which an individual taxpayer needs to do self-reporting for IIT purposes. (4 marks)

3.

(a) Enterprise G, a general value added tax payer incorporated in Shenzhen for more than 20 years, had the following transactions in the month of May 2010. Some of the enterprises sales are subject to the standard value added tax (VAT) rate, while others are exempt (VAT) activities. All figures are stated including any applicable VAT:

(1) Sold product A (a standard VAT rate item) for RMB 400,000 and product B (a VAT exempt item) for RMB 350,000.

(2) In addition to the sales in (1) above, distributed product A with a market value of RMB 20,000 for staff welfare benefit.

(3) Purchased RMB 500,000 production materials, of which RMB 50,000 was used for a self-constructed building.

(4) Purchased RMB 200,000 agriculture product, of which RMB 20,000 was used for staff welfare benefit.

(5) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise G for the month of May 2010. (7 marks)

(b) Enterprise H, a small-scale value added tax payer, had the following transactions in the month of May 2010. All figures are stated including VAT:

(1) Sold product for RMB 20,000.

(2) Purchased RMB 500,000 of production materials.

(3) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise H on each of the above transactions, giving brief explanations of their treatment. (4 marks)

(c) Company X, a property developer, had the following transactions in 2010:

(1) Donated a new building to a high school. The cost of construction of the building was RMB 500,000 and the deemed profit rate is 10%.

(2) Contributed an office building as part of a capital contribution. The cost of the building was RMB 600,000 and the market value RMB 800,000.

(3) Sold an equity holding of unlisted stock for RMB 900,000. The equity holding had been obtained by the contribution of a factory building by Company X which had cost RMB 300,000.

(4) Obtained a six-month bank loan of RMB 2,000,000 from 1 July 2010 with the pledge of a shop owned by the company. During the loan period, the bank did not charge any interest, but instead the bank had the right to use the shop rent free. The market interest rate for a similar loan is 6% per year. At the end of the loan period, Company X sold the shop for a price which gave it RMB 1,000,000 more than the amount needed to repay the bank loan.

Required:

Calculate the business tax (BT) payable by Company X as a result of each of the above transactions (1) to (4), giving brief explanations of their treatment. (6 marks)

(d) State the THREE conditions that must be met for a transportation fee paid by the seller to be excluded from the sale consideration for the purposes of value added tax (VAT). (3 marks)

4.

(a) Company K carried out the following transactions:

(1) Imported a vehicle costing RMB 300,000 and paid transportation costs of USD 10,000 for the journey from the overseas supplier to the port in China.

(2) Shipped a machine with a value of RMB 500,000 overseas for repair and paid for materials of USD 10,000 and a repairing fee of USD 30,000. The machine was shipped back to China in the same month.

(3) Subcontracted some domestic raw materials valued at RMB 200,000 to an overseas company. The related fee and transportation costs were USD 100,000 and USD 20,000 respectively.

(4) Imported raw materials costing RMB 30,000,000 and paid transportation costs of USD 50,000 for the journey from the overseas supplier to the port in China. After the arrival of the materials, Company K discovered that 20% of the materials had a quality problem. The supplier agreed to ship a further 20% replacement materials at no cost to Company K in the same month. Both parties agreed that the quality problem goods should be kept in China.

Required:

Calculate the customs tariff, consumption tax (CT) and value added tax (VAT) payable by Company K as a result of each of the above transactions.

Note: for the purposes of your calculations you should assume that:

(1) The customs tariff for all kinds of imported goods is 20%.

(2) The rate of consumption tax (CT) is 10%.

(3) The USD:RMB exchange rate is 1:6·6

(b) Briefly explain the procedures, including any time limits, for the declaration and payment of the customs

5.

Briefly explain the consequences of the following actions, including any fines or other penalty that may be imposed:

(a) Failure to keep or maintain proper accounting records/vouchers. (2 marks)

(b) Failure to file a return within the prescribed time limit. (2 marks)

(c) Failure to file a return and hence not paying or paying less tax than is duly payable. (1 mark)

(d) Failure to pay tax by concealment of property. (3 marks)

(e) Refusal to pay tax by violence or menace. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第2题

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. Apportionments should be made to the nearest month.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.3. All workings should be shown.

1.

(a) Company F is a manufacturing joint venture enterprise, which was established and started operations on 1 January 2010.

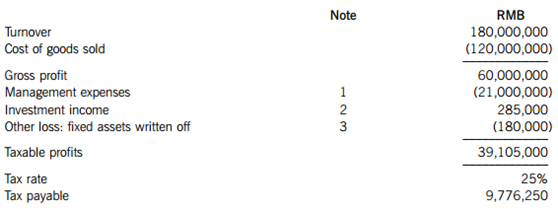

Company F’s statement of enterprise income tax (EIT) payable for the year 2010, as prepared by the company’s accountant is summarised below:

Notes:

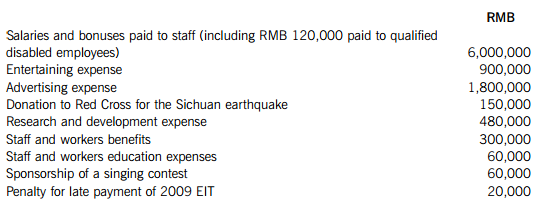

(1) The management and finance expenses included the following:

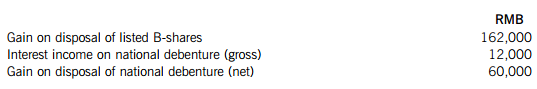

(2) The investment income included the following:

(3) The original cost of the fixed assets written off was RMB 600,000, the accumulated depreciation was RMB 420,000, and the accumulated tax allowances claimed were RMB 480,000.

Required:

(i) Briefly explain the treatment of each of the 13 items referred to in notes 1 to 3 for the purposes of enterprise income tax (EIT); (13 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company F for the year 2010. Note: you should start your computation with the taxable profit calculated by the accountant of RMB 39,105,000 and indicating by the use of ‘0’ any items for which no adjustment is required. (7 marks)

(b) For the purposes of enterprise income tax (EIT) define the term ‘non-resident enterprise’ and explain the scope of such an enterprises EIT assessment. (4 marks)

(c) An overseas underground train building company, Company H is a non-resident enterprise for enterprise income tax (EIT) purposes. Company H signed a sales contract for RMB 100,000,000 for the supply of ten underground trains with a PRC company, Company K. The amount also included after-sales services (such as, installation, technical training, etc) but the service fee is not separately specified in the sales contract. The training will last two years and will be provided in China by Company H personnel from overseas.

Required:

Explain the enterprise income tax (EIT) and business tax (BT) implications in China for Company H and Company K if the tax bureau applies the lowest deemed income and profit rates that are specified in the relevant EIT laws and regulations. (7 marks)

(d) State the withholding tax rate for enterprise income tax (EIT) applicable to the following items paid to a non-resident enterprise:

(i) Dividends paid out of both pre-2008 and post-2008 retained earnings; (2 marks)

(ii) Interest; (1 mark)

(iii) Royalties on the licensing of trademarks, copyright, etc. (1 mark)

2.

(a) Mr Wu, a Chinese citizen, is a photographer for a newspaper. He had the following income for the month of September 2010:

(1) Monthly employment income of RMB 15,000 and a bonus for the year 2009 of RMB 20,000.

(2) Income of USD 5,000 (gross) from which tax of USD 750 was withheld from publishing an album overseas.

(3) Income of RMB 5,000 for publishing five of his photos as a postcard.

(4) A net gain of RMB 15,000 from trading in the A-shares market.

(5) Received RMB 200,000 from the sale of a property (50 square metres) that he had lived in for four years, which he had acquired for RMB 160,000.

(6) Gross interest income of RMB 6,000 from a bank deposit.

(7) Received RMB 11,000 as insurance compensation.

(8) Received RMB 50,000 as net proceeds from the sale of an antique, which he had originally acquired in 2004 for RMB 20,000.

(9) Income of Euro 300 for giving a lecture at a university during his visit to France. Individual income tax equivalent to RMB 400 was paid in France on this income.

Required:

Calculate the individual income tax (IIT) payable by Mr Wu on each of items (1) to (9) for the month of September 2010, clearly identifying any amounts which are tax exempt and briefly explaining any reliefs available.

Note: the following exchange rates are to be used:

1 1 USD = 7 RMB

2 1 Euro = 9·5 RMB (12 marks)

(b) Explain the treatment for individual income tax (IIT) of directorship fees. (3 marks)

(c) Explain the criteria used to determine whether an individual is a resident taxpayer in the PRC. (5 marks)

3.

(a) During the month of November 2010, Company Z, a food producer company, carried out the following transactions:

(1) Acquired five tons of wheat for RMB 50,000 (excluding value added tax (VAT)) from a farmer and paid RMB 1,200 (including VAT) to a manufacturing company, Company A, for flouring services.

(2) Purchased production tools for RMB 5,000 (including VAT) from a small-scale tools company.

(3) Produced eight tons of corn flour; sold seven tons of the corn flour for RMB 140,000 (excluding VAT), and distributed the remaining one ton to its own staff.

(4) Sold biscuits to several commercial entities by issuing general invoices and received RMB 80,000 (excluding VAT).

(5) Some wheat acquired in the previous month rotted due to improper keeping. The stock loss cost (excluding VAT) was RMB 6,000 including gross freight charges of RMB 800.

(6) Sold a used machine for RMB 7,000 (including VAT), which had been bought in June 2009 for RMB 9,000.

Required: Calculate the input and output value added tax (VAT) in respect of each of the above transactions and the VAT payable by Company Z for the month of November 2010. (12 marks)

(b) Company B had the following events during December 2010:

(i) stock costing RMB 12,000 (including transportation of RMB 6,000) was damaged in Warehouse A due to an earthquake; and

(ii) stock costing RMB 32,000 (including transportation of RMB 2,000) was damaged in Warehouse A due to mismanagement.

All figures are stated excluding any applicable value added tax (VAT)

Required:

Explain the treatment for value added tax (VAT) and enterprise income tax (EIT) of each of these stock losses, and calculate any deductible/non-deductible amounts. (5 marks)

(c) State the time limits (deadlines) for the reporting and payment of value added tax (VAT) for a taxpayer with:

(i) an assessable period of one month; and (1 mark)

(ii) an assessable period of less than one month. (2 marks)

4.

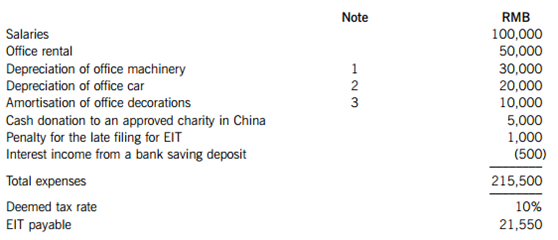

A representative office, Office X has agreed with the tax bureau to use the cost-plus basis for its enterprise income tax (EIT). The accountant of Office X prepared the following EIT calculation for the year 2010, the first year of Office X’s operation:

Notes:

1 The original cost of the office machinery was RMB 300,000 with a ten year economic life and no residual value.

2 The original cost of the office car was RMB 100,000 with a five year economic life and no residual value.

3 The original cost of the office decorations was RMB 30,000 with a three year economic life and no residual value.

Additional information:

The following payments, not included by the accountant when preparing the calculation above, were made in the year 2010:

RMB 100,000 for the purchase of goods from Office X’s head office, located overseas;

RMB 6,000 for samples of goods from Office X’s head office overseas; and

RMB 4,000 for the hire of a translator for the visit of head office staff to China.

Required:

Calculate the enterprise income tax (EIT) payable by Office X if the correct deemed profit rate is 15%, giving brief explanations of any items which were incorrectly treated by the accountant.

5.

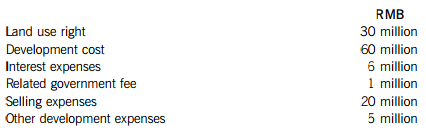

(a) A property developer, Company R, had the following transactions in 2010:

(1) Sold a land use right for RMB 56 million, which had cost it RMB 42 million and with related legal costs of RMB 1 million.

(2) Sold a factory building for RMB 180 million, which had the following associated costs:

Required:

Calculate the land appreciation tax (LAT) payable on the above transactions by Company R. (6 marks)

(b) List the preferential enterprise income tax (EIT) treatment that applies to each of the following types of project:

(i) income derived from an agricultural/forestry/animal husbandry project;

(ii) income derived from a cultivation of flower/tea/sea farming project;

(iii) income derived from an approved infrastructure project; and

(iv) income derived from an approved environmental protection/energy/water conservation project. (4 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第3题

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest £.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

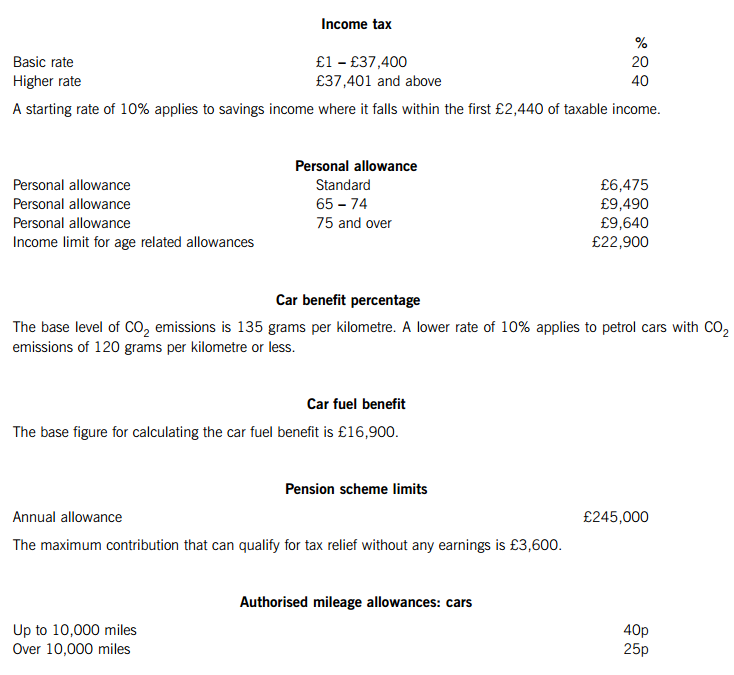

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

On 31 December 2009 Joe Jones resigned as an employee of Firstly plc, and on 1 January 2010 commenced employment with Secondly plc. Joe was employed by both companies as a financial analyst. The following information is available for the tax year 2009–10:

Employment with Firstly plc

(1) From 6 April 2009 to 31 December 2009 Joe was paid a salary of £11,400 per month. In addition to his salary, Joe was paid a bonus of £12,000 on 12 May 2009. He had become entitled to this bonus on 22 March 2009.

(2) Joe contributed 6% of his monthly gross salary of £11,400 into Firstly plc’s HM Revenue and Customs’ registered occupational pension scheme.

(3) On 1 May 2009 Firstly plc provided Joe with an interest free loan of £120,000 so that he could purchase a holiday cottage. Joe repaid £50,000 of the loan on 31 July 2009, and repaid the balance of the loan of £70,000 when he ceased employment with Firstly plc on 31 December 2009.

(4) During the period from 6 April 2009 to 31 December 2009 Joe’s three-year-old daughter was provided with a place at Firstly plc’s workplace nursery. The total cost to the company of providing this nursery place was £11,400 (190 days at £60 per day).

(5) During the period 6 April 2009 to 31 December 2009 Firstly plc paid gym membership fees of £1,050 for Joe.

(6) Firstly plc provided Joe with a home entertainment system for his personal use costing £4,400 on 6 April 2009. The company gave the home entertainment system to Joe for free, when he left the company on 31 December 2009, although its market value at that time was £3,860.

Employment with Secondly plc

(1) From 1 January 2010 to 5 April 2010 Joe was paid a salary of £15,200 per month.

(2) During the period 1 January 2010 to 5 April 2010 Joe contributed a total of £3,000 (gross) into a personal pension scheme.

(3) From 1 January 2010 to 5 April 2010 Secondly plc provided Joe with living accommodation. The property has an annual value of £10,400 and is rented by Secondly plc at a cost of £2,250 per month. On 1 January 2010 Secondly plc purchased furniture for the property at a cost of £16,320. The company pays for all of the running costs relating to the property, and for the period 1 January 2010 to 5 April 2010 these amounted to £1,900.

(4) During the period 1 January 2010 to 5 April 2010 Secondly plc provided Joe with 13 weeks of childcare vouchers costing £100 per week. Joe used the vouchers to provide childcare for his three-year-old daughter at a registered nursery near to his workplace.

(5) During the period 1 January 2010 to 5 April 2010 Joe used Secondly plc’s company gym which is only open to employees of the company. The cost to Secondly plc of providing this benefit to Joe was £340.

(6) During the period 1 January 2010 to 5 April 2010 Secondly plc provided Joe with a mobile telephone costing £560. The company paid for all of Joe’s business and private telephone calls.

Required:

(a) Calculate Joe Jones’ taxable income for the tax year 2009–10. (17 marks)

(b) (i) Briefly explain the basis of calculating Joe Jones’ PAYE tax code for the tax year 2009–10, and the purpose of this code; (2 marks)

(ii) For each of the PAYE forms P45, P60 and P11D, briefly describe the circumstances in which the form. will be completed, state who will provide it, the information to be included, and the dates by which they should have been provided to Joe Jones for the tax year 2009–10. (6 marks)

Note: your answer to both sub-parts (i) and (ii) should be confined to the details that are relevant to Joe Jones.

2.

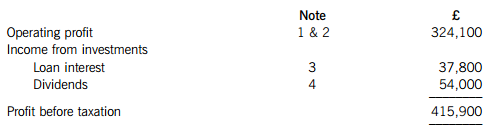

(a) Neung Ltd is a UK resident company that runs a business providing financial services. The company’s business is mainly based in the UK, but Neung Ltd also has two overseas branches. The company’s summarised profit and loss account for the year ended 31 March 2010 is as follows:

Note 1 – Operating profit

The operating profit does not include the results from either of Neung Ltd’s two overseas branches (see note (2) below).

Depreciation of £11,830 and amortisation of leasehold property of £7,000 have been deducted in arriving at the operating profit of £324,100.

Note 2 – Overseas branches

Neung Ltd’s first overseas branch made a trading profit of £41,000 for the year ended 31 March 2010. No overseas corporation tax was paid on this profit.

The second overseas branch made a trading loss of £15,700 for the year ended 31 March 2010.

Note 3 – Loan interest receivable

The loan was made for non-trading purposes on 1 July 2009. Loan interest of £25,200 was received on 31 December 2009, and interest of £12,600 was accrued at 31 March 2010.

Note 4 – Dividends received

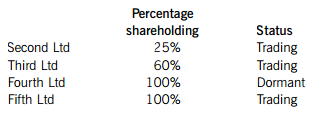

Neung Ltd holds shares in four UK resident companies as follows:

During the year ended 31 March 2010 Neung Ltd received a dividend of £37,800 from Second Ltd, and a dividend of £16,200 from Third Ltd. These figures were the actual cash amounts received.

Additional information

Leasehold property

On 1 April 2009 Neung Ltd acquired a leasehold office building, paying a premium of £140,000 for the grant of a 20-year lease. The office building was used for business purposes by Neung Ltd throughout the year ended 31 March 2010.

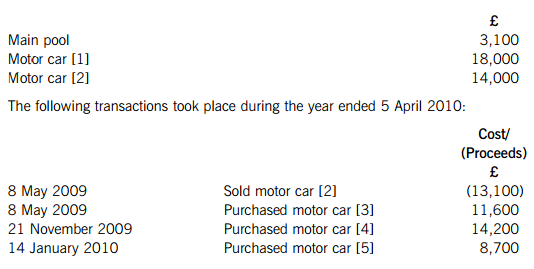

Plant and machinery

On 1 April 2009 the tax written down values of Neung Ltd’s plant and machinery were as follows:

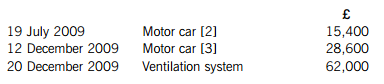

The company purchased the following assets during the year ended 31 March 2010:

Motor car [1] has a emission rate of 220 grams per kilometre. Motor car [2] purchased on 19 July 2009 has a

emission rate of 220 grams per kilometre. Motor car [2] purchased on 19 July 2009 has a emission rate of 242 grams per kilometre. Motor car [3] purchased on 12 December 2009 has a

emission rate of 242 grams per kilometre. Motor car [3] purchased on 12 December 2009 has a emission rate of 148 grams per kilometre.

emission rate of 148 grams per kilometre.

The ventilation system purchased on 20 December 2009 for £62,000 is integral to the freehold office building in which it was installed.

Required:

(i) State, giving reasons, which companies will be treated as being associated with Neung Ltd for corporation tax purposes; (2 marks)

(ii) Calculate Neung Ltd’s corporation tax liability for the year ended 31 March 2010; Note: you should assume that the whole of the annual investment allowance is available to Neung Ltd, and that the company wishes to maximise its capital allowances claim. (15 marks)

(iii) Advise Neung Ltd of the taxation disadvantages of converting its two overseas branches (see note (2)) into 100% overseas subsidiary companies. (3 marks)

(b) Note that in answering this part of the question you are not expected to take account of any of the information provided in part (a) above.

The following information is available in respect of Neung Ltd’s value added tax (VAT) for the quarter ended 31 March 2010:

(1) Invoices were issued for sales of £44,600 to VAT registered customers. Of this figure, £35,200 was in respect of exempt sales and the balance in respect of standard rated sales. The standard rated sales figure is exclusive of VAT.

(2) In addition to the above, on 1 March 2010 Neung Ltd issued a VAT invoice for £8,000 plus VAT of £1,400 to a VAT registered customer. This was in respect of a contract for standard rated financial services that will be completed on 15 April 2010. The customer paid for the contracted services in two instalments of £4,700 on 31 March 2010 and 30 April 2010 respectively.

(3) Invoices were issued for sales of £289,300 to non-VAT registered customers. Of this figure, £242,300 was in respect of exempt sales and the balance in respect of standard rated sales. The standard rated sales figure is inclusive of VAT.

(4) The managing director of Neung Ltd is provided with free fuel for private mileage driven in her company motor car. During the quarter ended 31 March 2010 this fuel cost Neung Ltd £260. The relevant quarterly scale charge is £390. Both these figures are inclusive of VAT.

For the quarters ended 30 September 2008 and 30 June 2009 Neung Ltd was one month late in submitting its VAT returns and in paying the related VAT liabilities. All of the company’s other VAT returns have been submitted on time.

Required:

(i) Calculate the amount of output VAT payable by Neung Ltd for the quarter ended 31 March 2010; (4 marks)

(ii) Advise Neung Ltd of the default surcharge implications if it is one month late in submitting its VAT return for the quarter ended 31 March 2010 and in paying the related VAT liability; (3 marks)

(iii) State the circumstances in which Neung Ltd is and is not required to issue a VAT invoice, and the period during which such an invoice should be issued. (3 marks)

3.

Lim Lam is the controlling shareholder and managing director of Mal-Mil Ltd, an unquoted trading company that provides support services to the oil industry.

Lim Lam

Lim disposed of the following assets during the tax year 2009–10:

(1) On 8 April 2009 Lim sold five acres of land to Mal-Mil Ltd for £260,000, which was the market value of the land on that date. The land had been inherited by Lim upon the death of her mother on 17 January 2003, when the land was valued at £182,000. Lim’s mother had originally purchased the land for £137,000.

(2) On 13 August 2009 Lim made a gift of 5,000 £1 ordinary shares in Oily plc, a quoted trading company, to her sister. On that date the shares were quoted on the Stock Exchange at £7·40–£7·56, with recorded bargains of £7·36, £7·38 and £7·60.

Lim had originally purchased 1,000 shares in Greasy plc on 8 July 2003 for £18,200. On 23 November 2003 Greasy plc was taken over by Oily plc. Lim received five £1 ordinary shares and two £1 preference shares in Oily plc for each £1 ordinary share held in Greasy plc. Immediately after the takeover each £1 ordinary share in Oily plc was quoted at £3·50 and each £1 preference share was quoted at £1·25.

Entrepreneurs’ relief and holdover relief are not available in respect of this disposal.

(3) On 22 March 2010 Lim sold 40,000 £1 ordinary shares in Mal-Mil Ltd for £280,000. She had originally purchased 125,000 shares in the company on 8 June 2002 for £142,000, and had purchased a further 60,000 shares on 23 May 2004 for £117,000. Mal-Mil Ltd has a total share capital of 250,000 £1 ordinary shares. Lim has made no previous disposals eligible for entrepreneurs’ relief.

Mal-Mil Ltd

On 20 December 2009 Mal-Mil Ltd sold two of the five acres of land that had been purchased from Lim on 8 April 2009. The sale proceeds were £162,000 and legal fees of £3,800 were incurred in connection with the disposal. The market value of the unsold three acres of land as at 20 December 2009 was £254,000. During April 2009 Mal-Mil Ltd had spent £31,200 levelling the five acres of land. The relevant retail price indexes (RPIs) are as follows:

Mal-Mil Ltd’s only other income for the year ended 31 December 2009 was a trading profit of £163,000.

Required:

(a) Explain why Lim Lam’s disposal of 40,000 £1 ordinary shares in Mal-Mil Ltd on 22 March 2010 qualifies for entrepreneurs’ relief. (2 marks)

(b) Calculate Lim Lam’s capital gains tax liability for the tax year 2009–10, and state by when this should be paid. (11 marks)

(c) Calculate Mal-Mil Ltd’s corporation tax liability for the year ended 31 December 2009, and state by when this should be paid. (7 marks)

4.

You should assume that today’s date is 20 March 2009.

Sammi Smith is a director of Smark Ltd. The company has given her the choice of being provided with a leased company motor car or alternatively being paid additional director’s remuneration and then privately leasing the same motor car herself.

Company motor car

The motor car will be provided throughout the tax year 2009–10, and will be leased by Smark Ltd at an annual cost of £26,540. The motor car will be petrol powered, will have a list price of £92,000, and will have an official CO2 emission rate of 320 grams per kilometre.

The lease payments will cover all the costs of running the motor car except for fuel. Smark Ltd will not provide Sammi with any fuel for private journeys.

Additional director’s remuneration

As an alternative to having a company motor car, Sammi will be paid additional gross director’s remuneration of £26,000 during the tax year 2009–10. She will then privately lease the motor car at an annual cost of £26,540.

Other information

The amount of business journeys that will be driven by Sammi will be immaterial and can therefore be ignored.

Sammi’s current annual director’s remuneration is in excess of £100,000. Smark Ltd prepares its accounts to 5 April, and pays corporation tax at the full rate of 28%. The lease of the motor car will commence on 6 April 2009.

Required:

(a) Advise Sammi Smith of the income tax and national insurance contribution implications for the tax year 2009–10 if she (1) is provided with the company motor car, and (2) receives additional director’s remuneration of £26,000. (5 marks)

(b) Advise Smark Ltd of the corporation tax and national insurance contribution implications for the year ended 5 April 2010 if the company (1) provides Sammi Smith with the company motor car, and (2) pays Sammi Smith additional director’s remuneration of £26,000. Note: you should ignore value added tax (VAT). (5 marks)

(c) Determine which of the two alternatives is the most beneficial from each of the respective points of view of Sammi Smith and Smark Ltd. (5 marks)

5.

Goff Green has been a self-employed manufacturer of golf equipment since 6 April 2000. For the year ended 5 April 2010 he made a trading loss of £85,000. Goff’s recent trading profits are as follows:

For each of the tax years from 2005–06 to 2009–10 Goff received gross building society interest of £3,800.

On 16 June 2009 Goff disposed of an investment and this resulted in a chargeable gain of £19,700. He disposed of another investment on 19 January 2010 and this resulted in a capital loss of £4,800.

Required:

(a) Calculate Goff Green’s taxable income and taxable gains for each of the tax years from 2005–06 to 2009–10 on the assumption that he relieves the maximum possible amount of the trading loss of £85,000 for the year ended 5 April 2010 as early as possible, but without unnecessarily wasting his personal allowances. Your answer should clearly show the amount of the trading loss that is unrelieved.

Note: you should assume that the tax allowances for the tax year 2009–10 apply throughout. (7 marks)

(b) Assuming that for the year ended 5 April 2011 Goff Green will make a trading profit of £40,000, explain why it would probably not be beneficial for him to make a loss relief claim against the chargeable gain of £19,700 arising on the disposal of the investment on 16 June 2009.

Note: you should assume that the tax rates and allowances for the tax year 2009–10 will continue to apply. (3 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第4题

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest £.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

ALL FIVE questions are compulsory and MUST be attempted

1.Auy Man and Bim Men have been in partnership since 6 April 2000 as management consultants. The following information is available for the tax year 2009–10:

Personal information

Auy is aged 32. During the tax year 2009–10 she spent 190 days in the United Kingdom. Bim is aged 56. During the tax year 2009–10 she spent 100 days in the United Kingdom. Bim has spent the same amount of time in the United Kingdom for each of the previous five tax years.

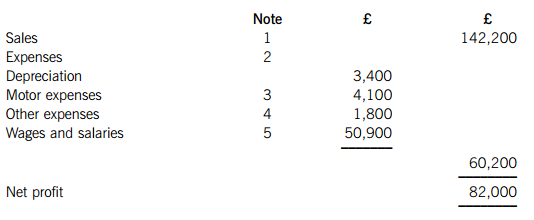

Profit and loss account for the year ended 5 April 2010

The partnership’s summarised profit and loss account for the year ended 5 April 2010 is as follows:

(1) The sales figure of £142,200 is exclusive of output value added tax (VAT) of £21,600.

(2) The expenses figures are exclusive of recoverable input VAT of:

Motor expenses £180

Other expenses £140

(3) The figure of £4,100 for motor expenses includes £2,600 in respect of the partners’ motor cars, with 30% of this amount being in respect of private journeys.

(4) The figure of £1,800 for other expenses includes £720 for entertaining employees. The remaining expenses are all allowable.

(5) The figure of £50,900 for wages and salaries includes the annual salary of £4,000 paid to Bim (see the profit sharing note below), and the annual salary of £15,000 paid to Auy’s husband, who works part-time for the partnership. Another part-time employee doing the same job is paid a salary of £10,000 per annum.

Plant and machinery

On 6 April 2009 the tax written down values of the partnership’s plant and machinery were as follows:

Motor car [1] has a CO2 emission rate of 185 grams per kilometre. It is used by Auy, and 70% of the mileage is for business journeys.

Motor car [4] purchased on 21 November 2009 has a CO2 emission rate of 135 grams per kilometre. Motor car [5] purchased on 14 January 2010 has a CO2 emission rate of 200 grams per kilometre. These two motor cars are used by employees of the business.

Profit sharing

Profits are shared 80% to Auy and 20% to Bim. This is after paying an annual salary of £4,000 to Bim, and interest at the rate of 5% on the partners’ capital account balances. The capital account balances are:

VAT

The partnership has been registered for VAT since 6 April 2000. However, the partnership has recently started invoicing for its services on new payment terms, and the partners are concerned about output VAT being accounted for at the appropriate time.

Required:

(a) Explain why both Auy Man and Bim Men will each be treated for tax purposes as resident in the United Kingdom for the tax year 2009–10.

(b) Calculate the partnership’s tax adjusted trading profit for the year ended 5 April 2010, and the trading income assessments of Auy Man and Bim Men for the tax year 2009–10.

Note: Your computation should commence with the net profit figure of £82,000, and should also list all of the items referred to in notes (2) to (5) indicating by the use of zero (0) any items that do not require adjustment. (15 marks)

(c) Calculate the class 4 national insurance contributions payable by Auy Man and Bim Men for the tax year 2009–10.

(d) (i) Advise the partnership of the VAT rules that determine the tax point in respect of a supply of services; (3 marks)

(ii) Calculate the amount of VAT paid by the partnership to HM Revenue & Customs throughout the year ended 5 April 2010;

Note: you should ignore the output VAT scale charges due in respect of fuel for private journeys. (2 marks)

(iii) Advise the partnership of the conditions that it must satisfy in order to join and continue to use the VAT flat rate scheme, and calculate the tax saving if the partnership had used the flat rate scheme to calculate the amount of VAT payable throughout the year ended 5 April 2010.

Note: you should assume that the relevant flat rate scheme percentage for the partnership’s trade was 11% throughout the whole of the year ended 5 April 2010. (5 marks)

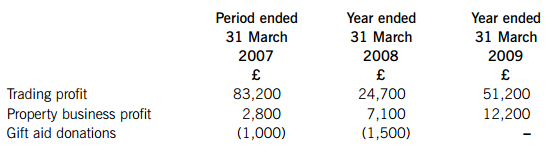

2.(a) You should assume that today’s date is 28 March 2010. Mice Ltd commenced trading on 1 July 2006 as a manufacturer of computer peripherals. The company prepares accounts to 31 March, and its results for the first three periods of trading were as follows:

The following information is available in respect of the year ended 31 March 2010:

Trading loss

Mice Ltd expects to make a trading loss of £180,000.

Business property income

Mice Ltd lets out three office buildings that are surplus to requirements.

The first office building is owned freehold. The property was let throughout the year ended 31 March 2010 at a quarterly rent of £3,200, payable in advance. Mice Ltd paid business rates of £2,200 and insurance of £460 in respect of this property for the year ended 31 March 2010. During June 2009 Mice Ltd repaired the existing car park for this property at a cost of £1,060, and then subsequently enlarged the car park at a cost f £2,640.

The second office building is owned leasehold. Mice Ltd pays an annual rent of £7,800 for this property, but did not pay a premium when the lease was acquired. On 1 April 2009 the property was sub-let to a tenant, with Mice Ltd receiving a premium of £18,000 for the grant of an eight-year lease. The company also received the annual rent of £6,000 which was payable in advance. Mice Ltd paid insurance of £310 in respect of this property for the year ended 31 March 2010.

The third office building is also owned freehold. Mice Ltd purchased the freehold of this building on 1 January 2010, and it will be empty until 31 March 2010. The building is to be let from 1 April 2010 at a monthly rent of £640, and on 15 March 2010 Mice Ltd received three months rent in advance. On 1 January 2010 Mice Ltd paid insurance of £480 in respect of this property for the year ended 31 December 2010, and during February 2010 spent £680 on advertising for tenants. Mice Ltd paid loan interest of £1,800 in respect of the period 1 January 2010 to 31 March 2010 on a loan that was taken out to purchase this property.

Loan interest received

On 1 July 2009 Mice Ltd made a loan for non-trading purposes. Loan interest of £6,400 was received on 31 December 2009, and £3,200 will be accrued at 31 March 2010.

Overseas dividend

On 15 October 2009 Mice Ltd received a dividend of £7,400 (net) from a 3% shareholding in USB Inc, a company that is resident overseas. Withholding tax was withheld from this dividend at the rate of 7?5%.

Chargeable gain

On 20 December 2009 Mice Ltd sold its 3% shareholding in USB Inc. The disposal resulted in a chargeable gain of £10,550, after taking account of indexation.

Required:

(i) Calculate Mice Ltd’s property business profit for the year ended 31 March 2010; (8 marks)

(ii) Assuming that Mice Ltd claims relief for its trading loss as early as possible, calculate the company’s profits chargeable to corporation tax for the nine-month period ended 31 March 2007, and each of the years ended 31 March 2008, 2009 and 2010. (7 marks)

(b) Mice Ltd has owned 100% of the ordinary share capital of Web-Cam Ltd since it began trading on 1 April 2009. For the three-month period ended 30 June 2009 Web-Cam Ltd made a trading profit of £28,000, and is expected to make a trading profit of £224,000 for the year ended 30 June 2010. Web-Cam Ltd has no other taxable profits or allowable losses.

Required:

Assuming that Mice Ltd does not make any loss relief claim against its own profits, advise Web-Cam Ltd as to the maximum amount of group relief that can be claimed from Mice Ltd in respect of the trading loss of £180,000 for the year ended 31 March 2010. (3 marks)

(c) Mice Ltd has surplus funds of £75,000 which it is planning to spend before 31 March 2010. The company will either purchase new equipment for £75,000, or alternatively it will purchase a new ventilation system for £75,000, which will be installed as part of its factory.

Mice Ltd has not made any other purchases of assets during the year ended 31 March 2010, and neither has its subsidiary company Web-Cam Ltd.

Required:

Explain the maximum amount of capital allowances that Mice Ltd will be able to claim for the year ended 31 March 2010 in respect of each of the two alternative purchases of assets.

Note: You are not expected to recalculate Mice Ltd’s trading loss for the year ended 31 March 2010, or redo any of the calculations made in parts (a) and (b) above. (4 marks)

(d) Mice Ltd is planning to pay its managing director a bonus of £40,000 on 31 March 2010. The managing director has already been paid gross director’s remuneration of £80,000 during the tax year 2009–10, and the bonus of £40,000 will be paid as additional director’s remuneration.

Required:

Advise the managing director as to the additional amount of income tax and national insurance contributions (both employee’s and employer’s) that will be payable as a result of the payment of the additional director’s remuneration of £40,000.

Note: You are not expected to recalculate Mice Ltd’s trading loss for the year ended 31 March 2010, or redo any of the calculations made in parts (a) and (b) above. (3 marks)

3.Problematic Ltd sold the following assets during the year ended 31 March 2010:

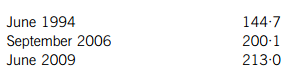

(1) On 14 June 2009 16,000 £1 ordinary shares in Easy plc were sold for £54,400. Problematic Ltd had originally purchased 15,000 shares in Easy plc on 26 June 1994 for £12,600. On 28 September 2006 Easy plc made a 1 for 3 rights issue. Problematic Ltd took up its allocation under the rights issue in full, paying £2?20 for each new share issued. The relevant retail prices indexes (RPIs) are as follows:

(2) On 1 October 2009 an office building owned by Problematic Ltd was damaged by a fire. The indexed cost of the office building on that date was £169,000. The company received insurance proceeds of £36,000 on 10 October 2009, and spent a total of £41,000 during October 2009 on restoring the office building. Problematic Ltd has made a claim to defer the gain arising from the receipt of the insurance proceeds. The office building has never been used for business purposes.

(3) On 28 January 2010 a freehold factory was sold for £171,000. The indexed cost of the factory on that date was £127,000. Problematic Ltd has made a claim to holdover the gain on the factory against the cost of a replacement leasehold factory under the rollover relief (replacement of business assets) rules. The leasehold factory has a lease period of 20 years, and was purchased on 10 December 2009 for £154,800. The two factory buildings have always been used entirely for business purposes.

(4) On 20 February 2010 an acre of land was sold for £130,000. Problematic Ltd had originally purchased four acres of land, and the indexed cost of the four acres on 20 February 2010 was £300,000. The market value of the unsold three acres of land as at 20 February 2010 was £350,000. Problematic Ltd incurred legal fees of £3,200 in connection with the disposal. The land has never been used for business purposes.

Problematic Ltd’s only other income for the year ended 31 March 2010 is a tax adjusted trading profit of £108,055.

Required:

(a) Calculate Problematic Ltd’s profits chargeable to corporation tax for the year ended 31 March 2010. (16 marks)

(b) Advise Problematic Ltd of the carried forward indexed base costs for capital gains purposes of any assets included in (1) to (4) above that are still retained at 31 March 2010. (4 marks)

4.You should assume that today’s date is 30 June 2011.

You are a trainee Chartered Certified Accountant and are dealing with the tax affairs of Ernest Vader.

Ernest’s self-assessment tax return for the tax year 2009–10 was submitted to HM Revenue & Customs (HMRC) on 15 May 2010, and Ernest paid the resulting income tax liability by the due date of 31 January 2011. However, you have just discovered that during the tax year 2009–10 Ernest disposed of a freehold property, the details of which were omitted from his self-assessment tax return. The capital gains tax liability in respect of this disposal is £18,000, and this amount has not been paid.

Ernest has suggested that since HMRC’s right to raise an enquiry into his self-assessment tax return for the tax year 2009–10 expired on 15 May 2011, no disclosure should be made to HMRC of the capital gain.

Required:

(a) Briefly explain the difference between tax evasion and tax avoidance, and how HMRC would view the situation if Ernest Vader does not disclose his capital gain. (3 marks)

(b) Briefly explain from an ethical viewpoint how you, as a trainee Chartered Certified Accountant, should deal with the suggestion from Ernest Vader that no disclosure is made to HMRC of his capital gain. (3 marks)

(c) State the action HMRC will take should they wish to obtain information from Ernest Vader regarding his capital gain. (1 mark)

(d) Explain why, even though the right to raise an enquiry has expired, HMRC will still be entitled to raise an assessment should they discover that Ernest Vader has not disclosed his capital gain. (2 marks)

(e) Assuming that HMRC discover the capital gain and raise an assessment in respect of Ernest Vader’s capital gains tax liability of £18,000 for the tax year 2009–10, and that this amount is then paid on 31 July 2011:

(i) Calculate the amount of interest that will be payable; Note: you should assume that the rates for the tax year 2009–10 continue to apply. (2 marks)

(ii) Advise Ernest Vader as to the amount of penalty that is likely to be charged as a result of the failure to notify HMRC, and how this could have been reduced if the capital gain had been disclosed. (4 marks)

5.For the year ended 31 January 2010 Quagmire plc had profits chargeable to corporation tax of £1,200,000 and franked investment income of £200,000. For the year ended 31 January 2009 the company had profits chargeable to corporation tax of £1,600,000 and franked investment income of £120,000.

Quagmire plc’s profits accrue evenly throughout the year.

Quagmire plc has one associated company. Required:

(a) Explain why Quagmire plc will have been required to make quarterly instalment payments in respect of its corporation tax liability for the year ended 31 January 2010. (3 marks)

(b) Calculate Quagmire plc’s corporation tax liability for the year ended 31 January 2010, and explain how and when this will have been paid. (3 marks)

(c) Explain how your answer to part (b) above would differ if Quagmire plc did not have an associated company. Your answer should include a calculation of the revised corporation tax liability for the year ended 31 January 2010. (4 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第5题

r the year ended

30 September 2005 should be submitted, and advise the company of the penalties that will be due if

the return is not submitted until 31 May 2007. (3 marks)

(ii) State the date by which Thai Curry Ltd’s corporation tax liability for the year ended 30 September 2005

should be paid, and advise the company of the interest that will be due if the liability is not paid until

31 May 2007. (3 marks)

第6题

under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!