重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.施工合同要求

B.建设单位要求

C.施工图设计文件

D.工程建设强制性标准

E.法律法规、标准规范

更多“《汶川地震灾后恢复重建条例》规定,施工单位应当按照()进行施工,并对施工质量负责。A.施工合同要”相关的问题

更多“《汶川地震灾后恢复重建条例》规定,施工单位应当按照()进行施工,并对施工质量负责。A.施工合同要”相关的问题

第1题

(b) Explain the corporation tax and value added tax (VAT) implications of the following aspects of the proposed

restructuring of the Rapier Ltd group.

(i) The immediate tax implications of the restructuring. (6 marks)

第2题

(ii) The UK value added tax (VAT) implications for Razor Ltd of selling tools to and purchasing tools from

Cutlass Inc; (2 marks)

第3题

(b) Write a letter to Joanne setting out the value added tax (VAT) registration requirements and advising on

whether or not she should or could register for VAT and if registered if she could recover the VAT suffered on

the consultancy fees and computer purchased in October 2005. (7 marks)

第4题

(b) Advise Maureen on deregistration for the purposes of value added tax (VAT) and any possible alternative

strategy. (8 marks)

An additional mark will be awarded for the effectiveness with which the information is communicated.

(1 mark)

第5题

Alpha Trading Ltd (Alpha) is a value added tax (VAT) general taxpayer. On 1 January 2014, Alpha lent RMB200,000 to Beta Ltd at an interest rate of 10% per annum.

What is the type and amount of turnover tax which Alpha Trading Ltd will pay on the interest income received for the year 2014?

A.Business tax of RMB1,053

B.Business tax of RMB1,000

C.Value added tax of RMB3,400

D.Value added tax of RMB1,200

第6题

(c) Assuming that Joanne registers for value added tax (VAT) with effect from 1 April 2006:

(i) Calculate her income tax (IT) and capital gains tax (CGT) payable for the year of assessment 2005/06.

You are not required to calculate any national insurance liabilities in this sub-part. (6 marks)

第7题

What is the amount of the value added tax (VAT) refund which Carti Ltd can receive?

A.RMB16,000

B.RMB24,000

C.RMB8,000

D.RMB500

第8题

Which of the following is NOT TRUE of VAT?

A.VAT is the acronym of Value Added Tax.

B.VAT is a tax charged on most goods in Britain.

C.VAT is not charged on different services in Britain.

D.A foreigner can get VAT back when he leaves Britain under the Retail Export Scheme.

第9题

Which of the following is NOT TRUE of VAT?

A.VAT is the acronym of Value Added Tax.

B.VAT is a tax charged on most goods in Britain.

C.VAT is not charged on different services in Britain.

D.A foreigner can get VAT back when he leaves Britain under the Retail Export Scheme.

第10题

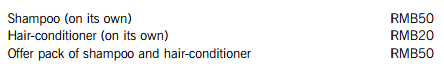

In January 2015, the supermarket sold 2,000 of the offer packs.

What is the amount of value added tax (VAT) charged on the sale of the 2,000 offer packs?

A.RMB14,530

B.RMB17,000

C.RMB20,342

D.RMB23,800

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!