重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

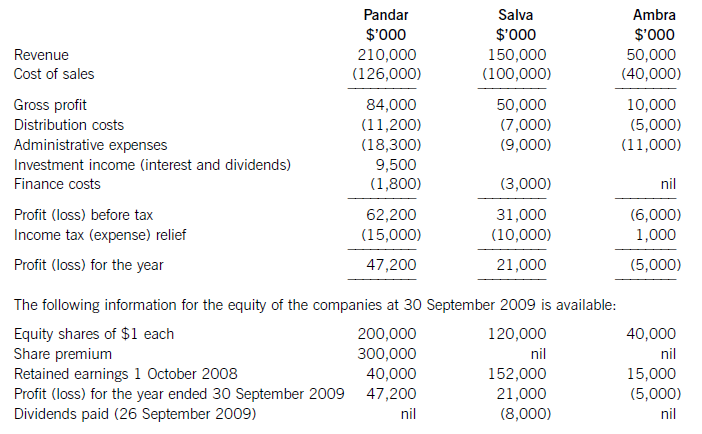

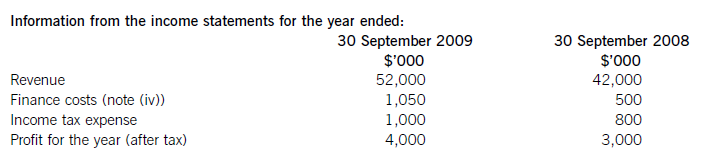

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

更多“On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was th”相关的问题

更多“On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was th”相关的问题

第1题

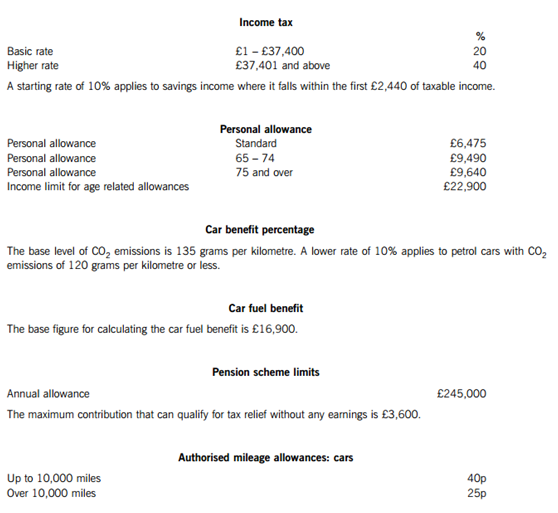

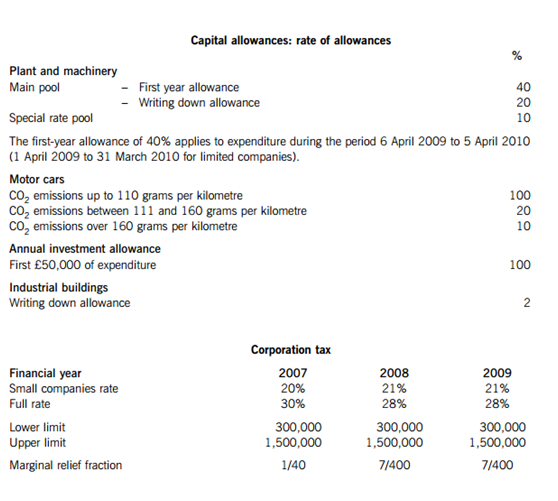

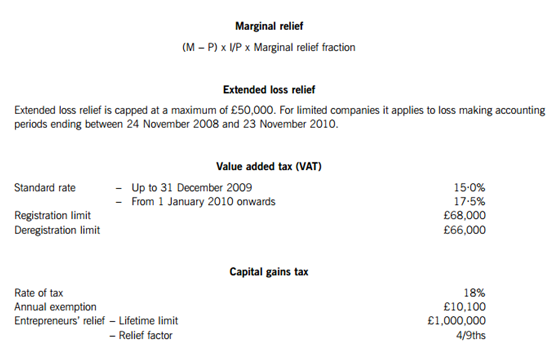

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest £.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

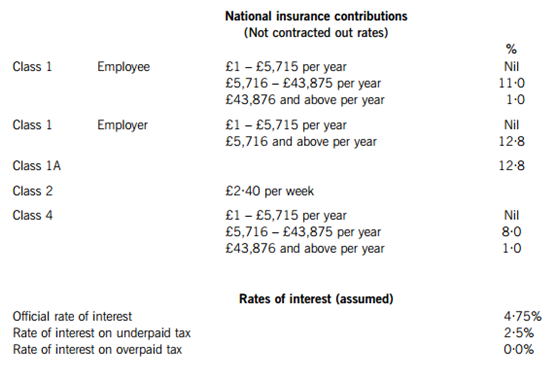

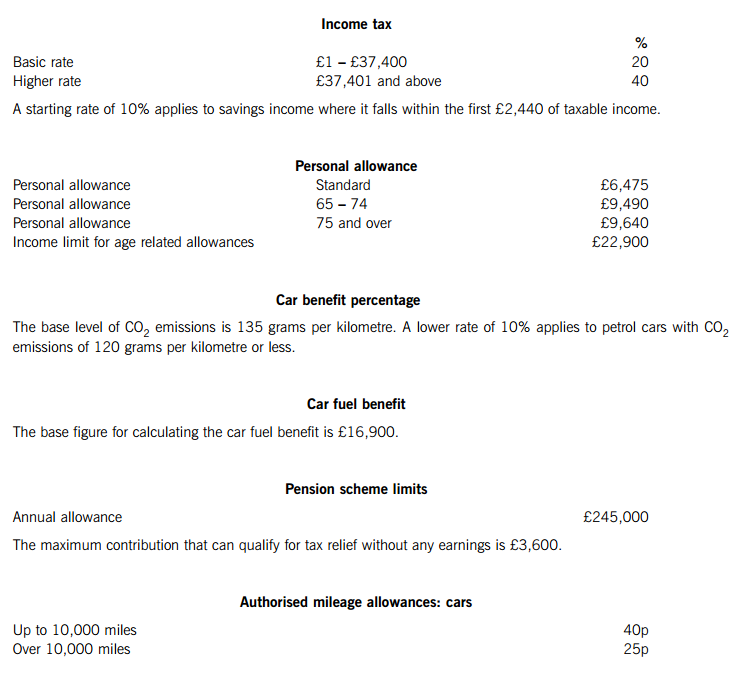

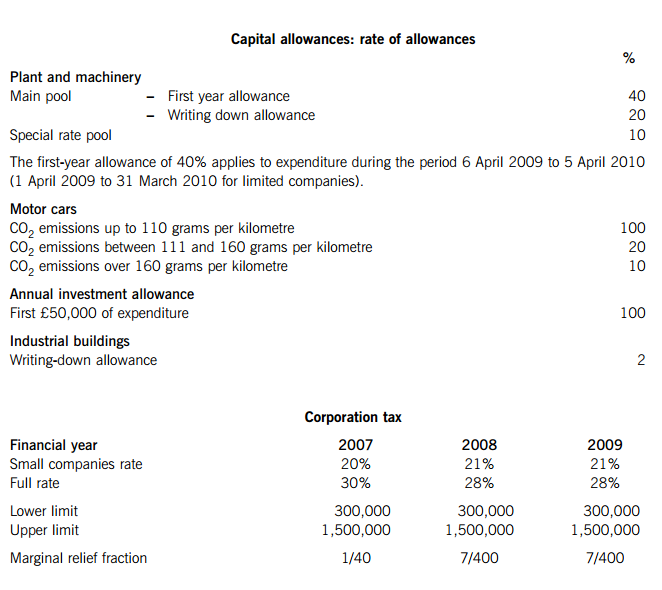

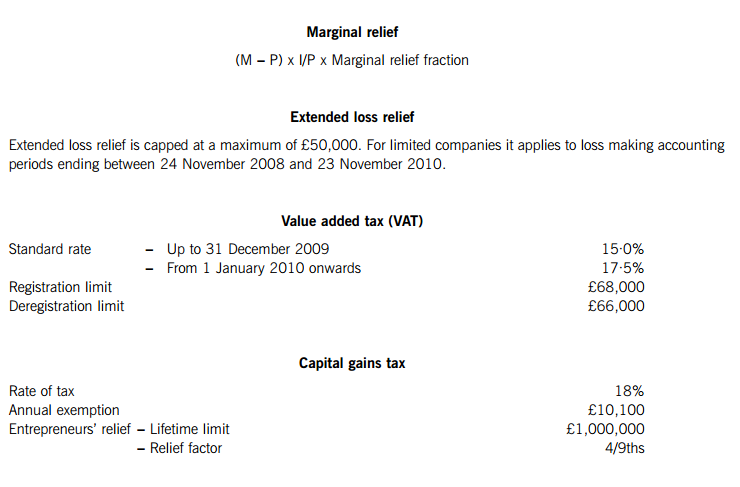

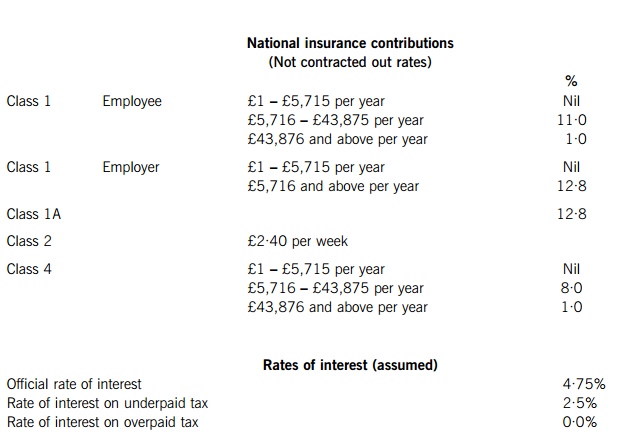

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

On 31 December 2009 Joe Jones resigned as an employee of Firstly plc, and on 1 January 2010 commenced employment with Secondly plc. Joe was employed by both companies as a financial analyst. The following information is available for the tax year 2009–10:

Employment with Firstly plc

(1) From 6 April 2009 to 31 December 2009 Joe was paid a salary of £11,400 per month. In addition to his salary, Joe was paid a bonus of £12,000 on 12 May 2009. He had become entitled to this bonus on 22 March 2009.

(2) Joe contributed 6% of his monthly gross salary of £11,400 into Firstly plc’s HM Revenue and Customs’ registered occupational pension scheme.

(3) On 1 May 2009 Firstly plc provided Joe with an interest free loan of £120,000 so that he could purchase a holiday cottage. Joe repaid £50,000 of the loan on 31 July 2009, and repaid the balance of the loan of £70,000 when he ceased employment with Firstly plc on 31 December 2009.

(4) During the period from 6 April 2009 to 31 December 2009 Joe’s three-year-old daughter was provided with a place at Firstly plc’s workplace nursery. The total cost to the company of providing this nursery place was £11,400 (190 days at £60 per day).

(5) During the period 6 April 2009 to 31 December 2009 Firstly plc paid gym membership fees of £1,050 for Joe.

(6) Firstly plc provided Joe with a home entertainment system for his personal use costing £4,400 on 6 April 2009. The company gave the home entertainment system to Joe for free, when he left the company on 31 December 2009, although its market value at that time was £3,860.

Employment with Secondly plc

(1) From 1 January 2010 to 5 April 2010 Joe was paid a salary of £15,200 per month.

(2) During the period 1 January 2010 to 5 April 2010 Joe contributed a total of £3,000 (gross) into a personal pension scheme.

(3) From 1 January 2010 to 5 April 2010 Secondly plc provided Joe with living accommodation. The property has an annual value of £10,400 and is rented by Secondly plc at a cost of £2,250 per month. On 1 January 2010 Secondly plc purchased furniture for the property at a cost of £16,320. The company pays for all of the running costs relating to the property, and for the period 1 January 2010 to 5 April 2010 these amounted to £1,900.

(4) During the period 1 January 2010 to 5 April 2010 Secondly plc provided Joe with 13 weeks of childcare vouchers costing £100 per week. Joe used the vouchers to provide childcare for his three-year-old daughter at a registered nursery near to his workplace.

(5) During the period 1 January 2010 to 5 April 2010 Joe used Secondly plc’s company gym which is only open to employees of the company. The cost to Secondly plc of providing this benefit to Joe was £340.

(6) During the period 1 January 2010 to 5 April 2010 Secondly plc provided Joe with a mobile telephone costing £560. The company paid for all of Joe’s business and private telephone calls.

Required:

(a) Calculate Joe Jones’ taxable income for the tax year 2009–10. (17 marks)

(b) (i) Briefly explain the basis of calculating Joe Jones’ PAYE tax code for the tax year 2009–10, and the purpose of this code; (2 marks)

(ii) For each of the PAYE forms P45, P60 and P11D, briefly describe the circumstances in which the form. will be completed, state who will provide it, the information to be included, and the dates by which they should have been provided to Joe Jones for the tax year 2009–10. (6 marks)

Note: your answer to both sub-parts (i) and (ii) should be confined to the details that are relevant to Joe Jones.

2.

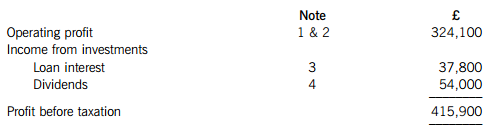

(a) Neung Ltd is a UK resident company that runs a business providing financial services. The company’s business is mainly based in the UK, but Neung Ltd also has two overseas branches. The company’s summarised profit and loss account for the year ended 31 March 2010 is as follows:

Note 1 – Operating profit

The operating profit does not include the results from either of Neung Ltd’s two overseas branches (see note (2) below).

Depreciation of £11,830 and amortisation of leasehold property of £7,000 have been deducted in arriving at the operating profit of £324,100.

Note 2 – Overseas branches

Neung Ltd’s first overseas branch made a trading profit of £41,000 for the year ended 31 March 2010. No overseas corporation tax was paid on this profit.

The second overseas branch made a trading loss of £15,700 for the year ended 31 March 2010.

Note 3 – Loan interest receivable

The loan was made for non-trading purposes on 1 July 2009. Loan interest of £25,200 was received on 31 December 2009, and interest of £12,600 was accrued at 31 March 2010.

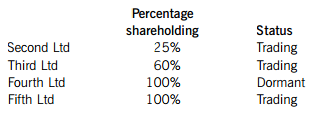

Note 4 – Dividends received

Neung Ltd holds shares in four UK resident companies as follows:

During the year ended 31 March 2010 Neung Ltd received a dividend of £37,800 from Second Ltd, and a dividend of £16,200 from Third Ltd. These figures were the actual cash amounts received.

Additional information

Leasehold property

On 1 April 2009 Neung Ltd acquired a leasehold office building, paying a premium of £140,000 for the grant of a 20-year lease. The office building was used for business purposes by Neung Ltd throughout the year ended 31 March 2010.

Plant and machinery

On 1 April 2009 the tax written down values of Neung Ltd’s plant and machinery were as follows:

The company purchased the following assets during the year ended 31 March 2010:

Motor car [1] has a emission rate of 220 grams per kilometre. Motor car [2] purchased on 19 July 2009 has a

emission rate of 220 grams per kilometre. Motor car [2] purchased on 19 July 2009 has a emission rate of 242 grams per kilometre. Motor car [3] purchased on 12 December 2009 has a

emission rate of 242 grams per kilometre. Motor car [3] purchased on 12 December 2009 has a emission rate of 148 grams per kilometre.

emission rate of 148 grams per kilometre.

The ventilation system purchased on 20 December 2009 for £62,000 is integral to the freehold office building in which it was installed.

Required:

(i) State, giving reasons, which companies will be treated as being associated with Neung Ltd for corporation tax purposes; (2 marks)

(ii) Calculate Neung Ltd’s corporation tax liability for the year ended 31 March 2010; Note: you should assume that the whole of the annual investment allowance is available to Neung Ltd, and that the company wishes to maximise its capital allowances claim. (15 marks)

(iii) Advise Neung Ltd of the taxation disadvantages of converting its two overseas branches (see note (2)) into 100% overseas subsidiary companies. (3 marks)

(b) Note that in answering this part of the question you are not expected to take account of any of the information provided in part (a) above.

The following information is available in respect of Neung Ltd’s value added tax (VAT) for the quarter ended 31 March 2010:

(1) Invoices were issued for sales of £44,600 to VAT registered customers. Of this figure, £35,200 was in respect of exempt sales and the balance in respect of standard rated sales. The standard rated sales figure is exclusive of VAT.

(2) In addition to the above, on 1 March 2010 Neung Ltd issued a VAT invoice for £8,000 plus VAT of £1,400 to a VAT registered customer. This was in respect of a contract for standard rated financial services that will be completed on 15 April 2010. The customer paid for the contracted services in two instalments of £4,700 on 31 March 2010 and 30 April 2010 respectively.

(3) Invoices were issued for sales of £289,300 to non-VAT registered customers. Of this figure, £242,300 was in respect of exempt sales and the balance in respect of standard rated sales. The standard rated sales figure is inclusive of VAT.

(4) The managing director of Neung Ltd is provided with free fuel for private mileage driven in her company motor car. During the quarter ended 31 March 2010 this fuel cost Neung Ltd £260. The relevant quarterly scale charge is £390. Both these figures are inclusive of VAT.

For the quarters ended 30 September 2008 and 30 June 2009 Neung Ltd was one month late in submitting its VAT returns and in paying the related VAT liabilities. All of the company’s other VAT returns have been submitted on time.

Required:

(i) Calculate the amount of output VAT payable by Neung Ltd for the quarter ended 31 March 2010; (4 marks)

(ii) Advise Neung Ltd of the default surcharge implications if it is one month late in submitting its VAT return for the quarter ended 31 March 2010 and in paying the related VAT liability; (3 marks)

(iii) State the circumstances in which Neung Ltd is and is not required to issue a VAT invoice, and the period during which such an invoice should be issued. (3 marks)

3.

Lim Lam is the controlling shareholder and managing director of Mal-Mil Ltd, an unquoted trading company that provides support services to the oil industry.

Lim Lam

Lim disposed of the following assets during the tax year 2009–10:

(1) On 8 April 2009 Lim sold five acres of land to Mal-Mil Ltd for £260,000, which was the market value of the land on that date. The land had been inherited by Lim upon the death of her mother on 17 January 2003, when the land was valued at £182,000. Lim’s mother had originally purchased the land for £137,000.

(2) On 13 August 2009 Lim made a gift of 5,000 £1 ordinary shares in Oily plc, a quoted trading company, to her sister. On that date the shares were quoted on the Stock Exchange at £7·40–£7·56, with recorded bargains of £7·36, £7·38 and £7·60.

Lim had originally purchased 1,000 shares in Greasy plc on 8 July 2003 for £18,200. On 23 November 2003 Greasy plc was taken over by Oily plc. Lim received five £1 ordinary shares and two £1 preference shares in Oily plc for each £1 ordinary share held in Greasy plc. Immediately after the takeover each £1 ordinary share in Oily plc was quoted at £3·50 and each £1 preference share was quoted at £1·25.

Entrepreneurs’ relief and holdover relief are not available in respect of this disposal.

(3) On 22 March 2010 Lim sold 40,000 £1 ordinary shares in Mal-Mil Ltd for £280,000. She had originally purchased 125,000 shares in the company on 8 June 2002 for £142,000, and had purchased a further 60,000 shares on 23 May 2004 for £117,000. Mal-Mil Ltd has a total share capital of 250,000 £1 ordinary shares. Lim has made no previous disposals eligible for entrepreneurs’ relief.

Mal-Mil Ltd

On 20 December 2009 Mal-Mil Ltd sold two of the five acres of land that had been purchased from Lim on 8 April 2009. The sale proceeds were £162,000 and legal fees of £3,800 were incurred in connection with the disposal. The market value of the unsold three acres of land as at 20 December 2009 was £254,000. During April 2009 Mal-Mil Ltd had spent £31,200 levelling the five acres of land. The relevant retail price indexes (RPIs) are as follows:

Mal-Mil Ltd’s only other income for the year ended 31 December 2009 was a trading profit of £163,000.

Required:

(a) Explain why Lim Lam’s disposal of 40,000 £1 ordinary shares in Mal-Mil Ltd on 22 March 2010 qualifies for entrepreneurs’ relief. (2 marks)

(b) Calculate Lim Lam’s capital gains tax liability for the tax year 2009–10, and state by when this should be paid. (11 marks)

(c) Calculate Mal-Mil Ltd’s corporation tax liability for the year ended 31 December 2009, and state by when this should be paid. (7 marks)

4.

You should assume that today’s date is 20 March 2009.

Sammi Smith is a director of Smark Ltd. The company has given her the choice of being provided with a leased company motor car or alternatively being paid additional director’s remuneration and then privately leasing the same motor car herself.

Company motor car

The motor car will be provided throughout the tax year 2009–10, and will be leased by Smark Ltd at an annual cost of £26,540. The motor car will be petrol powered, will have a list price of £92,000, and will have an official CO2 emission rate of 320 grams per kilometre.

The lease payments will cover all the costs of running the motor car except for fuel. Smark Ltd will not provide Sammi with any fuel for private journeys.

Additional director’s remuneration

As an alternative to having a company motor car, Sammi will be paid additional gross director’s remuneration of £26,000 during the tax year 2009–10. She will then privately lease the motor car at an annual cost of £26,540.

Other information

The amount of business journeys that will be driven by Sammi will be immaterial and can therefore be ignored.

Sammi’s current annual director’s remuneration is in excess of £100,000. Smark Ltd prepares its accounts to 5 April, and pays corporation tax at the full rate of 28%. The lease of the motor car will commence on 6 April 2009.

Required:

(a) Advise Sammi Smith of the income tax and national insurance contribution implications for the tax year 2009–10 if she (1) is provided with the company motor car, and (2) receives additional director’s remuneration of £26,000. (5 marks)

(b) Advise Smark Ltd of the corporation tax and national insurance contribution implications for the year ended 5 April 2010 if the company (1) provides Sammi Smith with the company motor car, and (2) pays Sammi Smith additional director’s remuneration of £26,000. Note: you should ignore value added tax (VAT). (5 marks)

(c) Determine which of the two alternatives is the most beneficial from each of the respective points of view of Sammi Smith and Smark Ltd. (5 marks)

5.

Goff Green has been a self-employed manufacturer of golf equipment since 6 April 2000. For the year ended 5 April 2010 he made a trading loss of £85,000. Goff’s recent trading profits are as follows:

For each of the tax years from 2005–06 to 2009–10 Goff received gross building society interest of £3,800.

On 16 June 2009 Goff disposed of an investment and this resulted in a chargeable gain of £19,700. He disposed of another investment on 19 January 2010 and this resulted in a capital loss of £4,800.

Required:

(a) Calculate Goff Green’s taxable income and taxable gains for each of the tax years from 2005–06 to 2009–10 on the assumption that he relieves the maximum possible amount of the trading loss of £85,000 for the year ended 5 April 2010 as early as possible, but without unnecessarily wasting his personal allowances. Your answer should clearly show the amount of the trading loss that is unrelieved.

Note: you should assume that the tax allowances for the tax year 2009–10 apply throughout. (7 marks)

(b) Assuming that for the year ended 5 April 2011 Goff Green will make a trading profit of £40,000, explain why it would probably not be beneficial for him to make a loss relief claim against the chargeable gain of £19,700 arising on the disposal of the investment on 16 June 2009.

Note: you should assume that the tax rates and allowances for the tax year 2009–10 will continue to apply. (3 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第2题

根据下列所提供的信用证条款的主要内容及有关信息,填写海运集装箱提单有关项目。

Irrevocable documentary credit

Number: LC666-12345678

Date: March 5,2009

Applicable Rules: UCP Latest Version

Date and Place of Expiry : April 30, 2009 Qingdao, China

Advising Bank: Bank of China, Shandong Branch

Beneficiary: Qingdao AAA Textile Import and Export Corp., Ltd.

Applicant: Thailand BBB Corp.

Shipment from Qingdao to Bangkok,on or about April 10, 2009

Partial Shipments: Not allowed

Transshipment: Not allowed

Description of Goods: 100% Cotton Towel as per S/C No. CH2009 Dated on Jan. 15, 2009

Total amount: USD20000 (SAY US DOLLARS TWENTY THOUSANDS ONLY)

Total quantity: 200 Cartons

Total gross weight: 15000KGS

Total measurement: 28CBM

Price term: CIF Bangkok,Thailand

Following documents required:

+Signed commercial invoice in triplicate

+Packing list in triplicate

+Full set of three clean on board ocean bills of lading made out to order of shipper and endorsed in blank and marked "freight prepaid" and notify applicant.

+Insurance Policy in duplicate for full CIF value plus 10% covering All Risks as per Ocean Marine Cargo Clauses of the PICC dated 1/1/1981 and stating claims payable in Bangkok, Thailand in the currency of the credit.

Additional Conditions: Bills of lading only acceptable if issued and titled by one of the following shipping companies: ABC Shipping Co. ; CDE Shipping Co.; EFG Shipping Co.

Other Information.

Goods Marks & Nos.: CT Bangkok NO. 1-200

Ocean Vessel: "Green Star" Voy. No.: 006S , Cargo loaded on board April 12, 2009

B/L No. 110688, Place and date of Issue. Qingdao April 12, 2009

Container No. : CBHU0180286

第3题

(a) Apex is a publicly listed supermarket chain. During the current year it started the building of a new store. The directors are aware that in accordance with IAS 23 Borrowing costs certain borrowing costs have to be capitalised.

Required:

Explain the circumstances when, and the amount at which, borrowing costs should be capitalised in accordance with IAS 23. (5 marks)

(b) Details relating to construction of Apex’s new store:

Apex issued a $10 million unsecured loan with a coupon (nominal) interest rate of 6% on 1 April 2009. The loan is redeemable at a premium which means the loan has an effective fi nance cost of 7?5% per annum. The loan was specifi cally issued to fi nance the building of the new store which meets the defi nition of a qualifying asset in IAS 23. Construction of the store commenced on 1 May 2009 and it was completed and ready for use on 28 February 2010, but did not open for trading until 1 April 2010. During the year trading at Apex’s other stores was below expectations so Apex suspended the construction of the new store for a two-month period during July and August 2009. The proceeds of the loan were temporarily invested for the month of April 2009 and earned interest of $40,000.

Required:

Calculate the net borrowing cost that should be capitalised as part of the cost of the new store and the fi nance cost that should be reported in the income statement for the year ended 31 March 2010. (5 marks)

第4题

On 31 March 2016, Angus sold a house, which he had bought on 31 March 2002.

Angus occupied the house as his main residence until 31 March 2007, when he left for employment abroad.

Angus returned to the UK on 1 April 2009 and lived in the house until 31 March 2010, when he bought a flat in a neighbouring town and made that his principal private residence.

What is Angus’ total number of qualifying months of occupation for principal private residence relief on the sale of the house?

A.72 months

B.54 months

C.114 months

D.96 months

第5题

根据下列所提供的信用证条款的主要内容及有关信息,填写集装箱海运提单有关项目。

Irrevocable documentary credit

Number :LC666-12345678

Date: March 5, 2009

Applicable Rules: UCP Latest Version

Date and Place of Expiry: April, 30,2009 Qingdao, China

Advising Bank : Bank of China, Shandong Branch

Beneficiary: Qingdao AAA Textile Import and Export Corp., LtD.

Applicant: Thailand BBB Corp.

Shipment from Qingdao to Bangkok, on or about April 10,2009

Partial Shipments: Not allowed

Transshipment: Not allowed

Description of Goods: 100% Cotton Towel as per S/C No. CH2009 Dated on Jan 15, 2009

Total amount: USD20000 (SAY US DOLLARS TWENTY THOUSANDS ONLY )

Total quantity: 200 Cartons

Total gross weight: 15000kgs

Total measurement: 28 cbm

Price term: CIF Bangkok, Thailand

Following documents required:www.examda.com

+Signed commercial Invoice in triplicate

+Packing list triplicate

+Full set of three clean on board ocean bills of lading made out to order of shipper and endorsed in blank and marked “freight prepaid” and notify applicant.

+Insurance Policy in duplicate for full CIF value plus 10% covering All Risks as per Ocean Marine Cargo Clauses of the PICC dated 1/1/1981 and stating claims payable in Bangkok, Thailand in the currency of the credit.

Additional conditions: Bill of Lading only acceptable if issued and titled by one of the following shipping companies: ABC Shipping Co., CDE Shipping Co., EFG Shipping Co.

Other Information:

Goods Marks & Nos: CT Bangkok No. 1-200

Ocean Vessel: “Green Star” Voy. No. 006S, Cargo loaded on board April 12,2009

B/L No. 110688, Place and date of Issue: Qingdao April 12,2009

Container No. CBHU0180286

(提单中黑体字部分为答案 )

第6题

Which can NOT be learned from Channel 3 on April 25th, 2009?

A.Pinyin

B.English

C.Japanese

D.Miao People's language

第7题

On 31 March 2016, Angus sold a house, which he had bought on 31 March 2002.

Angus occupied the house as his main residence until 31 March 2007, when he left for employment abroad.

Angus returned to the UK on 1 April 2009 and lived in the house until 31 March 2010, when he bought a flat in a neighbouring town and made that his principal private residence.

What is Angus’ total number of qualifying months of occupation for principal private residence relief on the sale of the house?

A.72 months

B.54 months

C.114 months

D.96 months

第8题

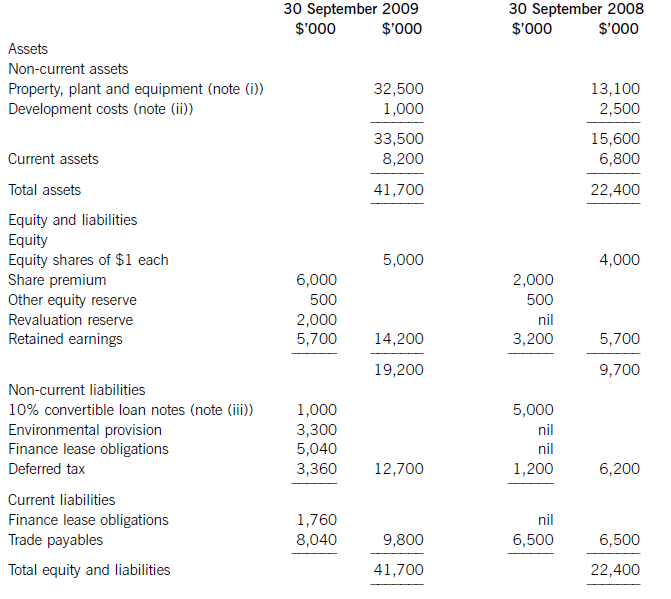

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

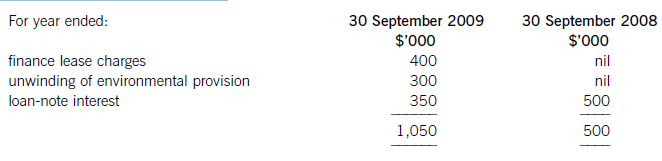

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

第9题

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest £.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

ALL FIVE questions are compulsory and MUST be attempted

1.Auy Man and Bim Men have been in partnership since 6 April 2000 as management consultants. The following information is available for the tax year 2009–10:

Personal information

Auy is aged 32. During the tax year 2009–10 she spent 190 days in the United Kingdom. Bim is aged 56. During the tax year 2009–10 she spent 100 days in the United Kingdom. Bim has spent the same amount of time in the United Kingdom for each of the previous five tax years.

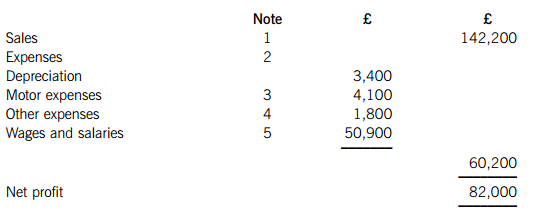

Profit and loss account for the year ended 5 April 2010

The partnership’s summarised profit and loss account for the year ended 5 April 2010 is as follows:

(1) The sales figure of £142,200 is exclusive of output value added tax (VAT) of £21,600.

(2) The expenses figures are exclusive of recoverable input VAT of:

Motor expenses £180

Other expenses £140

(3) The figure of £4,100 for motor expenses includes £2,600 in respect of the partners’ motor cars, with 30% of this amount being in respect of private journeys.

(4) The figure of £1,800 for other expenses includes £720 for entertaining employees. The remaining expenses are all allowable.

(5) The figure of £50,900 for wages and salaries includes the annual salary of £4,000 paid to Bim (see the profit sharing note below), and the annual salary of £15,000 paid to Auy’s husband, who works part-time for the partnership. Another part-time employee doing the same job is paid a salary of £10,000 per annum.

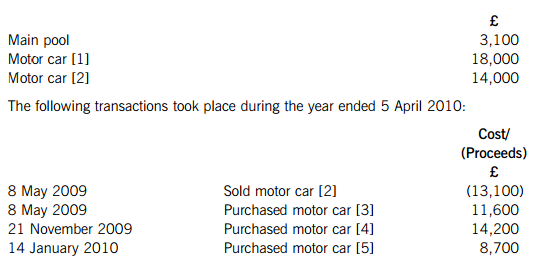

Plant and machinery

On 6 April 2009 the tax written down values of the partnership’s plant and machinery were as follows:

Motor car [1] has a CO2 emission rate of 185 grams per kilometre. It is used by Auy, and 70% of the mileage is for business journeys.

Motor car [4] purchased on 21 November 2009 has a CO2 emission rate of 135 grams per kilometre. Motor car [5] purchased on 14 January 2010 has a CO2 emission rate of 200 grams per kilometre. These two motor cars are used by employees of the business.

Profit sharing

Profits are shared 80% to Auy and 20% to Bim. This is after paying an annual salary of £4,000 to Bim, and interest at the rate of 5% on the partners’ capital account balances. The capital account balances are:

VAT

The partnership has been registered for VAT since 6 April 2000. However, the partnership has recently started invoicing for its services on new payment terms, and the partners are concerned about output VAT being accounted for at the appropriate time.

Required:

(a) Explain why both Auy Man and Bim Men will each be treated for tax purposes as resident in the United Kingdom for the tax year 2009–10.

(b) Calculate the partnership’s tax adjusted trading profit for the year ended 5 April 2010, and the trading income assessments of Auy Man and Bim Men for the tax year 2009–10.

Note: Your computation should commence with the net profit figure of £82,000, and should also list all of the items referred to in notes (2) to (5) indicating by the use of zero (0) any items that do not require adjustment. (15 marks)

(c) Calculate the class 4 national insurance contributions payable by Auy Man and Bim Men for the tax year 2009–10.

(d) (i) Advise the partnership of the VAT rules that determine the tax point in respect of a supply of services; (3 marks)

(ii) Calculate the amount of VAT paid by the partnership to HM Revenue & Customs throughout the year ended 5 April 2010;

Note: you should ignore the output VAT scale charges due in respect of fuel for private journeys. (2 marks)

(iii) Advise the partnership of the conditions that it must satisfy in order to join and continue to use the VAT flat rate scheme, and calculate the tax saving if the partnership had used the flat rate scheme to calculate the amount of VAT payable throughout the year ended 5 April 2010.

Note: you should assume that the relevant flat rate scheme percentage for the partnership’s trade was 11% throughout the whole of the year ended 5 April 2010. (5 marks)

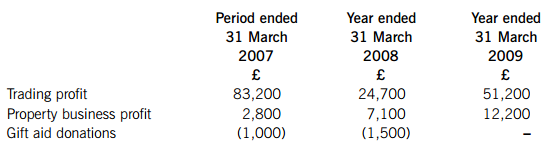

2.(a) You should assume that today’s date is 28 March 2010. Mice Ltd commenced trading on 1 July 2006 as a manufacturer of computer peripherals. The company prepares accounts to 31 March, and its results for the first three periods of trading were as follows:

The following information is available in respect of the year ended 31 March 2010:

Trading loss

Mice Ltd expects to make a trading loss of £180,000.

Business property income

Mice Ltd lets out three office buildings that are surplus to requirements.

The first office building is owned freehold. The property was let throughout the year ended 31 March 2010 at a quarterly rent of £3,200, payable in advance. Mice Ltd paid business rates of £2,200 and insurance of £460 in respect of this property for the year ended 31 March 2010. During June 2009 Mice Ltd repaired the existing car park for this property at a cost of £1,060, and then subsequently enlarged the car park at a cost f £2,640.

The second office building is owned leasehold. Mice Ltd pays an annual rent of £7,800 for this property, but did not pay a premium when the lease was acquired. On 1 April 2009 the property was sub-let to a tenant, with Mice Ltd receiving a premium of £18,000 for the grant of an eight-year lease. The company also received the annual rent of £6,000 which was payable in advance. Mice Ltd paid insurance of £310 in respect of this property for the year ended 31 March 2010.

The third office building is also owned freehold. Mice Ltd purchased the freehold of this building on 1 January 2010, and it will be empty until 31 March 2010. The building is to be let from 1 April 2010 at a monthly rent of £640, and on 15 March 2010 Mice Ltd received three months rent in advance. On 1 January 2010 Mice Ltd paid insurance of £480 in respect of this property for the year ended 31 December 2010, and during February 2010 spent £680 on advertising for tenants. Mice Ltd paid loan interest of £1,800 in respect of the period 1 January 2010 to 31 March 2010 on a loan that was taken out to purchase this property.

Loan interest received

On 1 July 2009 Mice Ltd made a loan for non-trading purposes. Loan interest of £6,400 was received on 31 December 2009, and £3,200 will be accrued at 31 March 2010.

Overseas dividend

On 15 October 2009 Mice Ltd received a dividend of £7,400 (net) from a 3% shareholding in USB Inc, a company that is resident overseas. Withholding tax was withheld from this dividend at the rate of 7?5%.

Chargeable gain

On 20 December 2009 Mice Ltd sold its 3% shareholding in USB Inc. The disposal resulted in a chargeable gain of £10,550, after taking account of indexation.

Required:

(i) Calculate Mice Ltd’s property business profit for the year ended 31 March 2010; (8 marks)

(ii) Assuming that Mice Ltd claims relief for its trading loss as early as possible, calculate the company’s profits chargeable to corporation tax for the nine-month period ended 31 March 2007, and each of the years ended 31 March 2008, 2009 and 2010. (7 marks)

(b) Mice Ltd has owned 100% of the ordinary share capital of Web-Cam Ltd since it began trading on 1 April 2009. For the three-month period ended 30 June 2009 Web-Cam Ltd made a trading profit of £28,000, and is expected to make a trading profit of £224,000 for the year ended 30 June 2010. Web-Cam Ltd has no other taxable profits or allowable losses.

Required:

Assuming that Mice Ltd does not make any loss relief claim against its own profits, advise Web-Cam Ltd as to the maximum amount of group relief that can be claimed from Mice Ltd in respect of the trading loss of £180,000 for the year ended 31 March 2010. (3 marks)

(c) Mice Ltd has surplus funds of £75,000 which it is planning to spend before 31 March 2010. The company will either purchase new equipment for £75,000, or alternatively it will purchase a new ventilation system for £75,000, which will be installed as part of its factory.

Mice Ltd has not made any other purchases of assets during the year ended 31 March 2010, and neither has its subsidiary company Web-Cam Ltd.

Required:

Explain the maximum amount of capital allowances that Mice Ltd will be able to claim for the year ended 31 March 2010 in respect of each of the two alternative purchases of assets.

Note: You are not expected to recalculate Mice Ltd’s trading loss for the year ended 31 March 2010, or redo any of the calculations made in parts (a) and (b) above. (4 marks)

(d) Mice Ltd is planning to pay its managing director a bonus of £40,000 on 31 March 2010. The managing director has already been paid gross director’s remuneration of £80,000 during the tax year 2009–10, and the bonus of £40,000 will be paid as additional director’s remuneration.

Required:

Advise the managing director as to the additional amount of income tax and national insurance contributions (both employee’s and employer’s) that will be payable as a result of the payment of the additional director’s remuneration of £40,000.

Note: You are not expected to recalculate Mice Ltd’s trading loss for the year ended 31 March 2010, or redo any of the calculations made in parts (a) and (b) above. (3 marks)

3.Problematic Ltd sold the following assets during the year ended 31 March 2010:

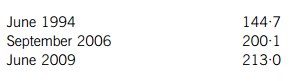

(1) On 14 June 2009 16,000 £1 ordinary shares in Easy plc were sold for £54,400. Problematic Ltd had originally purchased 15,000 shares in Easy plc on 26 June 1994 for £12,600. On 28 September 2006 Easy plc made a 1 for 3 rights issue. Problematic Ltd took up its allocation under the rights issue in full, paying £2?20 for each new share issued. The relevant retail prices indexes (RPIs) are as follows:

(2) On 1 October 2009 an office building owned by Problematic Ltd was damaged by a fire. The indexed cost of the office building on that date was £169,000. The company received insurance proceeds of £36,000 on 10 October 2009, and spent a total of £41,000 during October 2009 on restoring the office building. Problematic Ltd has made a claim to defer the gain arising from the receipt of the insurance proceeds. The office building has never been used for business purposes.

(3) On 28 January 2010 a freehold factory was sold for £171,000. The indexed cost of the factory on that date was £127,000. Problematic Ltd has made a claim to holdover the gain on the factory against the cost of a replacement leasehold factory under the rollover relief (replacement of business assets) rules. The leasehold factory has a lease period of 20 years, and was purchased on 10 December 2009 for £154,800. The two factory buildings have always been used entirely for business purposes.

(4) On 20 February 2010 an acre of land was sold for £130,000. Problematic Ltd had originally purchased four acres of land, and the indexed cost of the four acres on 20 February 2010 was £300,000. The market value of the unsold three acres of land as at 20 February 2010 was £350,000. Problematic Ltd incurred legal fees of £3,200 in connection with the disposal. The land has never been used for business purposes.

Problematic Ltd’s only other income for the year ended 31 March 2010 is a tax adjusted trading profit of £108,055.

Required:

(a) Calculate Problematic Ltd’s profits chargeable to corporation tax for the year ended 31 March 2010. (16 marks)

(b) Advise Problematic Ltd of the carried forward indexed base costs for capital gains purposes of any assets included in (1) to (4) above that are still retained at 31 March 2010. (4 marks)

4.You should assume that today’s date is 30 June 2011.

You are a trainee Chartered Certified Accountant and are dealing with the tax affairs of Ernest Vader.

Ernest’s self-assessment tax return for the tax year 2009–10 was submitted to HM Revenue & Customs (HMRC) on 15 May 2010, and Ernest paid the resulting income tax liability by the due date of 31 January 2011. However, you have just discovered that during the tax year 2009–10 Ernest disposed of a freehold property, the details of which were omitted from his self-assessment tax return. The capital gains tax liability in respect of this disposal is £18,000, and this amount has not been paid.

Ernest has suggested that since HMRC’s right to raise an enquiry into his self-assessment tax return for the tax year 2009–10 expired on 15 May 2011, no disclosure should be made to HMRC of the capital gain.

Required:

(a) Briefly explain the difference between tax evasion and tax avoidance, and how HMRC would view the situation if Ernest Vader does not disclose his capital gain. (3 marks)

(b) Briefly explain from an ethical viewpoint how you, as a trainee Chartered Certified Accountant, should deal with the suggestion from Ernest Vader that no disclosure is made to HMRC of his capital gain. (3 marks)

(c) State the action HMRC will take should they wish to obtain information from Ernest Vader regarding his capital gain. (1 mark)

(d) Explain why, even though the right to raise an enquiry has expired, HMRC will still be entitled to raise an assessment should they discover that Ernest Vader has not disclosed his capital gain. (2 marks)

(e) Assuming that HMRC discover the capital gain and raise an assessment in respect of Ernest Vader’s capital gains tax liability of £18,000 for the tax year 2009–10, and that this amount is then paid on 31 July 2011:

(i) Calculate the amount of interest that will be payable; Note: you should assume that the rates for the tax year 2009–10 continue to apply. (2 marks)

(ii) Advise Ernest Vader as to the amount of penalty that is likely to be charged as a result of the failure to notify HMRC, and how this could have been reduced if the capital gain had been disclosed. (4 marks)

5.For the year ended 31 January 2010 Quagmire plc had profits chargeable to corporation tax of £1,200,000 and franked investment income of £200,000. For the year ended 31 January 2009 the company had profits chargeable to corporation tax of £1,600,000 and franked investment income of £120,000.

Quagmire plc’s profits accrue evenly throughout the year.

Quagmire plc has one associated company. Required:

(a) Explain why Quagmire plc will have been required to make quarterly instalment payments in respect of its corporation tax liability for the year ended 31 January 2010. (3 marks)

(b) Calculate Quagmire plc’s corporation tax liability for the year ended 31 January 2010, and explain how and when this will have been paid. (3 marks)

(c) Explain how your answer to part (b) above would differ if Quagmire plc did not have an associated company. Your answer should include a calculation of the revised corporation tax liability for the year ended 31 January 2010. (4 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第10题

(a) An important aspect of the International Accounting Standards Board’s Framework for the preparation and presentation of fi nancial statements is that transactions should be recorded on the basis of their substance over their form.

Required:

Explain why it is important that fi nancial statements should refl ect the substance of the underlying transactions and describe the features that may indicate that the substance of a transaction may be different from its legal form. (5 marks)

(b) Wardle’s activities include the production of maturing products which take a long time before they are ready to retail. Details of one such product are that on 1 April 2009 it had a cost of $5 million and a fair value of $7 million. The product would not be ready for retail sale until 31 March 2012.

On 1 April 2009 Wardle entered into an agreement to sell the product to Easyfi nance for $6 million. The agreement gave Wardle the right to repurchase the product at any time up to 31 March 2012 at a fi xed price of $7,986,000, at which date Wardle expected the product to retail for $10 million. The compound interest Wardle would have to pay on a three-year loan of $6 million would be:

This interest is equivalent to the return required by Easyfi nance.

Required:

Assuming the above fi gures prove to be accurate, prepare extracts from the income statement of Wardle for the three years to 31 March 2012 in respect of the above transaction:

(i) Refl ecting the legal form. of the transaction;

(ii) Refl ecting the substance of the transaction.

Note: statement of fi nancial position extracts are NOT required.

The following mark allocation is provided as guidance for this requirement:

(i) 2 marks

(ii) 3 marks (5 marks)

(c) Comment on the effect the two treatments have on the income statements and the statements of fi nancial position and how this may affect an assessment of Wardle’s performance. (5 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!