重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

On 31 March 2016, Angus sold a house, which he had bought on 31 March 2002.

Angus occupied the house as his main residence until 31 March 2007, when he left for employment abroad.

Angus returned to the UK on 1 April 2009 and lived in the house until 31 March 2010, when he bought a flat in a neighbouring town and made that his principal private residence.

What is Angus’ total number of qualifying months of occupation for principal private residence relief on the sale of the house?

A.72 months

B.54 months

C.114 months

D.96 months

更多“On 31 March 2016, Angus sold a house, which he had...”相关的问题

更多“On 31 March 2016, Angus sold a house, which he had...”相关的问题

第1题

On 31 March 2016, Angus sold a house, which he had bought on 31 March 2002.

Angus occupied the house as his main residence until 31 March 2007, when he left for employment abroad.

Angus returned to the UK on 1 April 2009 and lived in the house until 31 March 2010, when he bought a flat in a neighbouring town and made that his principal private residence.

What is Angus’ total number of qualifying months of occupation for principal private residence relief on the sale of the house?

A.72 months

B.54 months

C.114 months

D.96 months

第2题

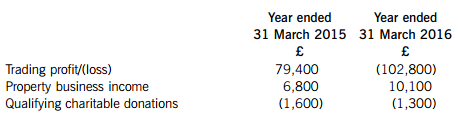

Oblong Ltd has had the following results:

If Oblong Ltd makes a claim to relieve its trading loss of £102,800 for the year ended 31 March 2016 against total profits for the year ended 31 March 2015, how much of this loss will remain unrelieved?

A.£6,500

B.£16,600

C.£9,400

D.£23,400

第3题

A.SHIPMENT NOT LATER THAN MARCH 31 2016

B.SHIPMENT PERIOD MARCH 2016

C.xpired day :2016-04-15

D.PRESENT PERIOD WITHIN 15 DAYS AFTER DATE OF SHIPMENT

第4题

The selling price of the car was $25,300. Latterly paid $12,650 (half of the cost) on 1 April 2014 and would pay the remaining $12,650 on 31 March 2016 (two years after the sale). Hindberg’s cost of capital is 10% per annum.

What is the total amount which Hindberg should credit to profit or loss in respect of this transaction in the year ended 31 March 2015?

A.$23,105

B.$23,000

C.$20,909

D.$24,150

第5题

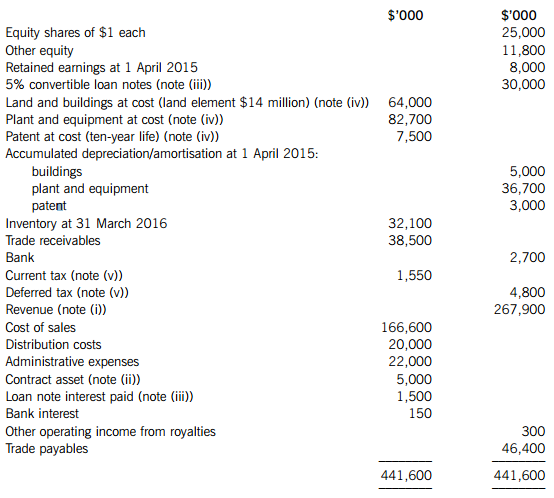

The following trial balance relates to Downing Co as at 31 March 2016:

The following notes are relevant:

(i) Revenue includes an amount of $16 million for a sale made on 1 April 2015. The sale relates to a single product and includes ongoing servicing from Downing Co for four years. The normal selling price of the product and the servicing would be $18 million and $500,000 per annum ($2 million in total) respectively.

(ii) The contract asset is comprised of contract costs incurred at 31 March 2016 of $15 million less a payment of $10 million from the customer. The agreed transaction price for the total contract is $30 million and the total expected costs are $24 million. Downing Co uses an input method based on costs incurred to date relative to the total expected costs to determine the progress towards completion of its contracts.

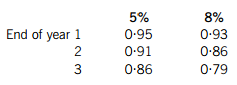

(iii) Downing Co issued 300,000 $100 5% convertible loan notes on 1 April 2015. The loan notes can be converted to equity shares on the basis of 25 shares for each $100 loan note on 31 March 2018 or redeemed at par for cash on the same date. An equivalent loan note without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(iv) Non-current assets:

Due to rising property prices, Downing Co decided to revalue its land and buildings on 1 April 2015 to their market value. The values were confirmed at that date as land $16 million and buildings $52·2 million with the buildings having an estimated remaining life of 18 years at the date of revaluation. Downing Co intends to make a transfer from the revaluation surplus to retained earnings in respect of the annual realisation of the revaluation surplus. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

During the current year, the income from royalties relating to the patent had declined considerably and the directors are concerned that the value of the patent may be impaired. A study at the year end concluded that the present value of the future estimated net cash flows from the patent at 31 March 2016 is $3·25 million; however, Downing Co also has a confirmed offer of $3·4 million to sell the patent immediately at that date.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2016. All depreciation/amortisation is charged to cost of sales.

There were no acquisitions or disposals of non-current assets during the year.

(v) The directors estimate a provision for income tax for the year ended 31 March 2016 of $11·4 million is required. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2015. At 31 March 2016, Downing Co had taxable temporary differences of $18·5 million requiring a provision for deferred tax. Any deferred tax movement should be reported in profit or loss. The income tax rate applicable to Downing Co is 20%.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Downing Co for the year ended 31 March 2016.

(b) Prepare the statement of changes in equity for Downing Co for the year ended 31 March 2016.

(c) Prepare the statement of financial position of Downing Co as at 31 March 2016.

Notes to the financial statements are not required. Work to the nearest $1,000.

The following mark allocation is provided as guidance for these requirements:

(a) 11 marks

(b) 4 marks

(c) 10 marks

(d) The finance director of Downing Co has correctly calculated the company’s basic and diluted earnings per share (EPS) to be disclosed in the financial statements for the year ended 31 March 2016 at 148·2 cents and 119·4 cents respectively.

On seeing these figures, the chief executive officer (CEO) is concerned that the market will react badly knowing that the company’s EPS in the near future will be only 119·4 cents, a fall of over 19% on the current year’s basic EPS.

Required:

Explain why and what aspect of Downing Co’s capital structure is causing the basic EPS to be diluted and comment on the validity of the CEO’s concerns. (5 marks)

第6题

Section A暂缺

Section B – ALL THREE questions are compulsory and MUST be attempted

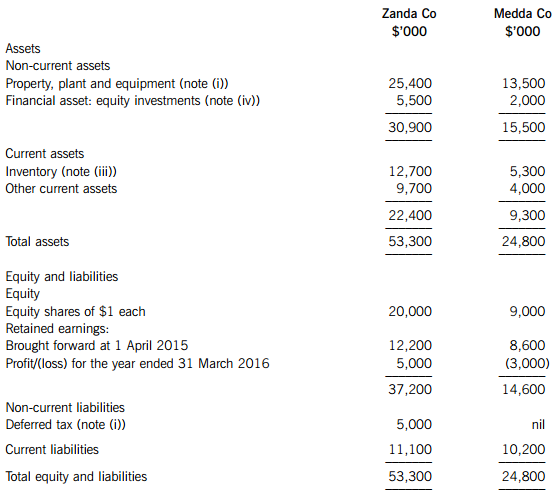

On 1 October 2015, Zanda Co acquired 60% of Medda Co’s equity shares by means of a share exchange of one new share in Zanda Co for every two acquired shares in Medda Co. In addition, Zanda Co will pay a further $0·54 per acquired share on 30 September 2016.

Zanda Co has not recorded any of the purchase consideration and its cost of capital is 8% per annum.

The market value of Zanda Co’s shares at 1 October 2015 was $3·00 each.

The summarised statements of financial position of the two companies as at 31 March 2016 are:

The following information is relevant:

(i) At the date of acquisition, Zanda Co conducted a fair value exercise on Medda Co’s net assets which were equal to their carrying amounts (including Medda Co’s financial asset equity investments) with the exception of an item of plant which had a fair value of $2·5 million below its carrying amount. The plant had a remaining useful life of 30 months at 1 October 2015.

The directors of Zanda Co are of the opinion that an unrecorded deferred tax asset of $1·2 million at 1 October 2015, relating to Medda Co’s losses, can be relieved in the near future as a result of the acquisition. At 31 March 2016, the directors’ opinion has not changed, nor has the value of the deferred tax asset.

(ii) Zanda Co’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, a share price for Medda Co of $1·50 each is representative of the fair value of the shares held by the noncontrolling interest.

(iii) At 31 March 2016, Medda Co held goods in inventory which had been supplied by Zanda Co at a mark-up on cost of 35%. These goods had cost Medda Co $2·43 million.

(iv) The financial asset equity investments of Zanda Co and Medda Co are carried at their fair values at 1 April 2015. At 31 March 2016, these had fair values of $6·1 million and $1·8 million respectively, with the change in Medda Co’s investments all occurring since the acquisition on 1 October 2015.

(v) There is no impairment to goodwill at 31 March 2016.

Required:

Prepare the following extracts from the consolidated statement of financial position of Zanda Co as at 31 March 2016:

(i) Goodwill;

(ii) Retained earnings;

(iii) Non-controlling interest.

The following mark allocation is provided as guidance for this question:

(i) 6 marks

(ii) 7 marks

(iii) 2 marks

第7题

The following scenario relates to questions 11–15.

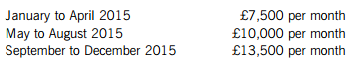

Alisa commenced trading on 1 January 2015. Her sales since commencement have been as follows:

The above figures are stated exclusive of value added tax (VAT). Alisa only supplies services, and these are all standard rated for VAT purposes. Alisa notified her liability to compulsorily register for VAT by the appropriate deadline.

For each of the eight months prior to the date on which she registered for VAT, Alisa paid £240 per month (inclusive of VAT) for website design services and £180 per month (exclusive of VAT) for advertising. Both of these supplies are standard rated for VAT purposes and relate to Alisa’s business activity after the date from when she registered for VAT.

After registering for VAT, Alisa purchased a motor car on 1 January 2016. The motor car is used 60% for business mileage. During the quarter ended 31 March 2016, Alisa spent £456 on repairs to the motor car and £624 on fuel for both her business and private mileage. The relevant quarterly scale charge is £294.

All of these figures are inclusive of VAT. All of Alisa’s customers are registered for VAT, so she appreciates that she has to issue VAT invoices when services are supplied.

From what date would Alisa have been required to be compulsorily registered for VAT and therefore have had to charge output VAT on her supplies of services?

A.30 September 2015

B.1 November 2015

C.1 October 2015

D.30 October 2015

What amount of pre-registration input VAT would Alisa have been able to recover in respect of inputs incurred prior to the date on which she registered for VAT?A.£468

B.£608

C.£536

D.£456

How and by when does Alisa have to pay any VAT liability for the quarter ended 31 March 2016?A.Using any payment method by 30 April 2016

B.Electronically by 7 May 2016

C.Electronically by 30 April 2016

D.Using any payment method by 7 May 2016

Which of the following items of information is Alisa NOT required to include on a valid VAT invoice?A.The customer’s VAT registration number

B.An invoice number

C.The customer’s address

D.A description of the services supplied

What is the maximum amount of input VAT which Alisa can reclaim in respect of her motor expenses for the quarter ended 31 March 2016?A.£108

B.£138

C.£180

D.£125

请帮忙给出每个问题的正确答案和分析,谢谢!

第8题

(a) Your assistant has been reading the IASB’s Framework for the preparation and presentation of financial statements (Framework) and as part of the qualitative characteristics of financial statements under the heading of ‘relevance’ he notes that the predictive value of information is considered important. He is aware that financial statements are prepared historically (i.e. after transactions have occurred) and offers the view that the predictive value of financial statements would be enhanced if forward-looking information (e.g. forecasts) were published rather than backward-looking historical statements.

Required:

By the use of specific examples, provide an explanation to your assistant of how IFRS presentation and disclosure requirements can assist the predictive role of historically prepared financial statements. (6 marks)

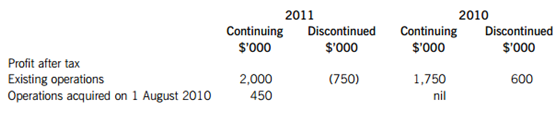

(b) The following summarised information is available in relation to Rebound, a publicly listed company:

Income statement extracts years ended 31 March:

Analysts expect profits from the market sector in which Rebound’s existing operations are based to increase by 6% in the year to 31 March 2012 and by 8% in the sector of its newly acquired operations.

On 1 April 2009 Rebound had:

$3 million of 25 cents equity shares in issue.

$5 million 8% convertible loan stock 2016; the terms of conversion are 40 equity shares in exchange for each

$100 of loan stock. Assume an income tax rate of 30%.

On 1 October 2010 the directors of Rebound were granted options to buy 2 million shares in the company for $1 each. The average market price of Rebound’s shares for the year ending 31 March 2011 was $2·50 each.

Required:

(i) Calculate Rebound’s estimated profit after tax for the year ending 31 March 2012 assuming the analysts’ expectations prove correct; (3 marks)

(ii) Calculate the diluted earnings per share (EPS) on the continuing operations of Rebound for the year ended 31 March 2011 and the comparatives for 2010. (6 marks)

第9题

Tenth Ltd

(1) For the final four-month period of trading ended 31 July 2015, Tenth Ltd had a tax adjusted trading profit of £52,400. This figure is before taking account of capital allowances.

(2) On 1 April 2015, the tax written down value of the company’s main pool was £12,400. On 3 June 2015, Tenth Ltd purchased a laptop computer for £1,800.

On 31 July 2015, the company sold all of the items included in the main pool at the start of the period for £28,200 and the laptop computer for £1,300. None of the items included in the main pool was sold for more than its original cost.

(3) On 31 July 2015, Tenth Ltd sold the company’s freehold office building for £180,300. The building was purchased on 3 May 2011 for £150,100, and its indexed cost on 31 July 2015 was £164,500.

(4) During the four-month period ended 31 July 2015, Tenth Ltd let out one floor of its freehold office building which was always surplus to requirements. The floor was rented at £1,200 per month, but the tenant left owing the rent for July 2015 which Tenth Ltd was unable to recover. The total running costs of the office building for the four-month period ended 31 July 2015 were £6,300, of which one-third related to the let floor. The other two-thirds of the running costs have been deducted in calculating Tenth Ltd’s tax-adjusted trading profit of £52,400.

(5) During the four-month period ended 31 July 2015, Tenth Ltd made qualifying charitable donations of £800.

Eleventh Ltd

(1) Eleventh Ltd’s operating profit for the six-month period ended 31 March 2016 is £122,900. Depreciation of £2,580 and amortisation of leasehold property of £2,000 (see note (2) below) have been deducted in arriving at this figure.

(2) On 1 October 2015, Eleventh Ltd acquired a leasehold office building, paying a premium of £60,000 for the grant of a 15-year lease. The office building was used for business purposes by Eleventh Ltd throughout the six-month period ended 31 March 2016.

(3) On 1 October 2015, Eleventh Ltd purchased two motor cars. The first motor car cost £12,600, and has a emission rate of 110 grams per kilometre. This motor car is used as a pool car by the company’s employees. The second motor car cost £13,200, and has a

emission rate of 110 grams per kilometre. This motor car is used as a pool car by the company’s employees. The second motor car cost £13,200, and has a emission rate of 60 grams per kilometre. This motor car is used by Mable, and 45% of the mileage is for private journeys.

emission rate of 60 grams per kilometre. This motor car is used by Mable, and 45% of the mileage is for private journeys.

(4) On 1 October 2015, Mable made a loan of £100,000 to Eleventh Ltd at an annual interest rate of 5%. This is a commercial rate of interest, and no loan repayments were made during the period ended 31 March 2016. The loan was used to finance the company’s trading activities.

Required:

(a) Calculate Tenth Ltd’s taxable total profits for the four-month period ended 31 July 2015. (7 marks)

(b) Calculate Eleventh Ltd’s tax adjusted trading profit for the six-month period ended 31 March 2016. (8 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!