重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Tenth Ltd

(1) For the final four-month period of trading ended 31 July 2015, Tenth Ltd had a tax adjusted trading profit of £52,400. This figure is before taking account of capital allowances.

(2) On 1 April 2015, the tax written down value of the company’s main pool was £12,400. On 3 June 2015, Tenth Ltd purchased a laptop computer for £1,800.

On 31 July 2015, the company sold all of the items included in the main pool at the start of the period for £28,200 and the laptop computer for £1,300. None of the items included in the main pool was sold for more than its original cost.

(3) On 31 July 2015, Tenth Ltd sold the company’s freehold office building for £180,300. The building was purchased on 3 May 2011 for £150,100, and its indexed cost on 31 July 2015 was £164,500.

(4) During the four-month period ended 31 July 2015, Tenth Ltd let out one floor of its freehold office building which was always surplus to requirements. The floor was rented at £1,200 per month, but the tenant left owing the rent for July 2015 which Tenth Ltd was unable to recover. The total running costs of the office building for the four-month period ended 31 July 2015 were £6,300, of which one-third related to the let floor. The other two-thirds of the running costs have been deducted in calculating Tenth Ltd’s tax-adjusted trading profit of £52,400.

(5) During the four-month period ended 31 July 2015, Tenth Ltd made qualifying charitable donations of £800.

Eleventh Ltd

(1) Eleventh Ltd’s operating profit for the six-month period ended 31 March 2016 is £122,900. Depreciation of £2,580 and amortisation of leasehold property of £2,000 (see note (2) below) have been deducted in arriving at this figure.

(2) On 1 October 2015, Eleventh Ltd acquired a leasehold office building, paying a premium of £60,000 for the grant of a 15-year lease. The office building was used for business purposes by Eleventh Ltd throughout the six-month period ended 31 March 2016.

(3) On 1 October 2015, Eleventh Ltd purchased two motor cars. The first motor car cost £12,600, and has a emission rate of 110 grams per kilometre. This motor car is used as a pool car by the company’s employees. The second motor car cost £13,200, and has a

emission rate of 110 grams per kilometre. This motor car is used as a pool car by the company’s employees. The second motor car cost £13,200, and has a emission rate of 60 grams per kilometre. This motor car is used by Mable, and 45% of the mileage is for private journeys.

emission rate of 60 grams per kilometre. This motor car is used by Mable, and 45% of the mileage is for private journeys.

(4) On 1 October 2015, Mable made a loan of £100,000 to Eleventh Ltd at an annual interest rate of 5%. This is a commercial rate of interest, and no loan repayments were made during the period ended 31 March 2016. The loan was used to finance the company’s trading activities.

Required:

(a) Calculate Tenth Ltd’s taxable total profits for the four-month period ended 31 July 2015. (7 marks)

(b) Calculate Eleventh Ltd’s tax adjusted trading profit for the six-month period ended 31 March 2016. (8 marks)

更多“Mable is a serial entrepreneur, regularly starting and disposing of businesses. On 31 July”相关的问题

更多“Mable is a serial entrepreneur, regularly starting and disposing of businesses. On 31 July”相关的问题

第1题

Ashura has been employed by Rift plc since 1 January 2013. She has also been self-employed since 1 July 2015, preparing her first accounts for the nine-month period ended 5 April 2016. The following information is available for the tax year 2015–16:

Employment

(1) During the tax year 2015–16, Ashura was paid a gross annual salary of £56,200.

(2) On 1 January 2016, Ashura personally paid two subscriptions. The first was a professional subscription of £320 paid to an HM Revenue and Customs’ (HMRC’s) approved professional body. The second was a subscription of £680 to a health club which Ashura regularly uses to meet Rift plc’s clients. Ashura was not reimbursed for the costs of either of these subscriptions by Rift plc.

(3) During the tax year 2015–16, Ashura used her private motor car for business purposes. She drove 3,400 miles in the performance of her duties for Rift plc, for which the company paid her an allowance of 55 pence per mile.

(4) During the tax year 2015–16, Ashura contributed £2,800 into Rift plc’s HMRC registered occupational pension scheme and £3,400 (gross) into a personal pension scheme.

Self-employment

(1) Ashura’s tax adjusted trading loss based on her draft accounts for the nine-month period ended 5 April 2016 is £3,300. This figure is before making any adjustments required for:

(i) Advertising expenditure of £800 incurred during January 2015. This expenditure has not been deducted in calculating the loss of £3,300.

(ii) The cost of Ashura’s office (see note (2) below).

(iii) Capital allowances.

(2) Ashura runs her business using one of the five rooms in her private house as an office. The total running costs of the house for the nine-month period ended 5 April 2016 were £4,350. No deduction has been made for the cost of the office in calculating the loss of £3,300.

(3) On 10 June 2015, Ashura purchased a laptop computer for £2,600.

On 1 July 2015, Ashura purchased a motor car for £19,200. The motor car has a emission rate of 137 grams per kilometre. During the nine-month period ended 5 April 2016, Ashura drove a total of 8,000 miles, of which 2,500 were for self-employed business journeys.

emission rate of 137 grams per kilometre. During the nine-month period ended 5 April 2016, Ashura drove a total of 8,000 miles, of which 2,500 were for self-employed business journeys.

Other information

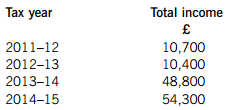

Ashura’s total income for the previous four tax years is as follows:

Required:

(a) State TWO advantages for Ashura of choosing 5 April as her accounting date rather than a date early in the tax year such as 30 April. (2 marks)

(b) Calculate Ashura’s revised tax adjusted trading loss for the nine-month period ended 5 April 2016. (6 marks)

(c) Explain why it would not be beneficial for Ashura to claim loss relief under the provisions giving relief to a loss incurred in the early years of trade. Note: You should assume that the tax rates and allowances for the tax year 2015–16 also applied in all previous tax years. (2 marks)

(d) Assuming that Ashura claims loss relief against her total income for the tax year 2015–16, calculate her taxable income for this tax year. (5 marks)

第2题

he entire profits of the company as director’s remuneration, but given a recent increase in profitability he wants to know whether this basis of extracting the profits is beneficial.

For the year ended 5 April 2016, OK-Joe Ltd’s taxable total profits, before taking account of director’s remuneration, are £65,000. After allowing for employer’s class 1 national insurance contributions (NIC) of £5,141, Joe’s gross director’s remuneration is £59,859.

The figure for employer’s NIC of £5,141 is after deducting the £2,000 employment allowance.

Required:

Calculate the overall saving of tax and NIC for the year ended 5 April 2016 if Joe had instead paid himself gross director’s remuneration of £8,000 and net dividends of £45,600.

Notes:

1. You are expected to calculate the income tax payable by Joe, the class 1 NIC payable by both Joe and OK-Joe Ltd, and the corporation tax liability of OK-Joe Ltd for the year ended 5 April 2016. 2. You should assume that the rate of corporation tax remains unchanged.

第3题

The following scenario relates to questions 11–15.

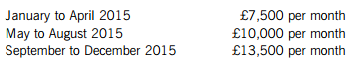

Alisa commenced trading on 1 January 2015. Her sales since commencement have been as follows:

The above figures are stated exclusive of value added tax (VAT). Alisa only supplies services, and these are all standard rated for VAT purposes. Alisa notified her liability to compulsorily register for VAT by the appropriate deadline.

For each of the eight months prior to the date on which she registered for VAT, Alisa paid £240 per month (inclusive of VAT) for website design services and £180 per month (exclusive of VAT) for advertising. Both of these supplies are standard rated for VAT purposes and relate to Alisa’s business activity after the date from when she registered for VAT.

After registering for VAT, Alisa purchased a motor car on 1 January 2016. The motor car is used 60% for business mileage. During the quarter ended 31 March 2016, Alisa spent £456 on repairs to the motor car and £624 on fuel for both her business and private mileage. The relevant quarterly scale charge is £294.

All of these figures are inclusive of VAT. All of Alisa’s customers are registered for VAT, so she appreciates that she has to issue VAT invoices when services are supplied.

From what date would Alisa have been required to be compulsorily registered for VAT and therefore have had to charge output VAT on her supplies of services?

A.30 September 2015

B.1 November 2015

C.1 October 2015

D.30 October 2015

What amount of pre-registration input VAT would Alisa have been able to recover in respect of inputs incurred prior to the date on which she registered for VAT?A.£468

B.£608

C.£536

D.£456

How and by when does Alisa have to pay any VAT liability for the quarter ended 31 March 2016?A.Using any payment method by 30 April 2016

B.Electronically by 7 May 2016

C.Electronically by 30 April 2016

D.Using any payment method by 7 May 2016

Which of the following items of information is Alisa NOT required to include on a valid VAT invoice?A.The customer’s VAT registration number

B.An invoice number

C.The customer’s address

D.A description of the services supplied

What is the maximum amount of input VAT which Alisa can reclaim in respect of her motor expenses for the quarter ended 31 March 2016?A.£108

B.£138

C.£180

D.£125

请帮忙给出每个问题的正确答案和分析,谢谢!

第4题

The following scenario relates to questions 6–10.

Kitten is the controlling shareholder in Kat Ltd, an unquoted trading company.

Kat Ltd

Kat Ltd sold a freehold factory on 31 May 2015 for £364,000, which resulted in a chargeable gain of £120,700. The factory was purchased on 1 October 2003 for £138,600, and further capital improvements were immediately made at a cost of £23,400 during the month of purchase. Further improvements to the factory were made during the month of disposal. The relevant retail prices indexes (RPIs) are as follows:

October 2003 182·6

May 2015 258·0

Kat Ltd is unsure how to reinvest the proceeds from the sale of the factory. The company is considering either purchasing a freehold warehouse for £272,000, or acquiring a leasehold office building on a 40-year lease for a premium of £370,000. If either reinvestment is made, it will take place on 30 September 2016.

All of the above buildings have been, or will be, used for the purposes of Kat Ltd’s trade.

Kitten K

itten sold 20,000 £1 ordinary shares in Kat Ltd on 5 October 2015, which resulted in a chargeable gain of £142,200. This disposal qualified for entrepreneurs’ relief.

Kitten had originally subscribed for 90,000 shares in Kat Ltd on 7 July 2008 at their par value. On 22 September 2011, Kat Ltd made a 2 for 3 rights issue. Kitten took up her allocation under the rights issue in full, paying £6·40 for each new share issued.

Kitten also sold an antique vase on 16 January 2016, which resulted in a chargeable gain of £27,900.

For the tax year 2015–16, Kitten had taxable income of £12,000.

What amount of indexation allowance will have been deducted in calculating the chargeable gain of £120,700 on the disposal of Kat Ltd’s factory?

A.£47,304

B.£40,471

C.£66,906

D.£57,242

If Kat Ltd decides to purchase the freehold warehouse and makes a claim to roll over the chargeable gain on the factory under the rollover relief rules, what will be the base cost of the warehouse for chargeable gains purposes?

A.£243,300

B.£272,000

C.£180,000

D.£151,300

What cost figure will have been used in calculating the chargeable gain on Kitten’s disposal of 20,000 ordinary shares in Kat Ltd?

A.£12,000

B.£63,200

C.£84,800

D.£20,000

If Kat Ltd decides to acquire the leasehold office building and makes a claim to hold over the chargeable gain on the factory under the rollover relief rules, what is the latest date by which the held-over gain will crystallise?

A.Ten years from 31 May 2015

B.The date when the office building is sold

C.40 years from 30 September 2016

D.Ten years from 30 September 2016

What is Kitten’s capital gains tax (CGT) liability for the tax year 2015–16?

A.£17,244

B.£22,032

C.£20,053

D.£18,924

请帮忙给出每个问题的正确答案和分析,谢谢!

第5题

The following scenario relates to questions 1–5.

Adana died on 17 March 2016, and inheritance tax (IHT) of £566,000 is payable in respect of her chargeable estate. Under the terms of her will, Adana left her entire estate to her children.

At the date of her death, Adana had the following debts and liabilities:

(1) An outstanding interest-only mortgage of £220,000.

(2) Income tax of £43,700 payable in respect of the tax year 2015–16.

(3) Legal fees of £4,600 incurred by Adana’s sister which Adana had verbally promised to pay.

Adana’s husband had died on 28 May 2006, and only 20% of his inheritance tax nil rate band was used on his death. The nil rate band for the tax year 2006–07 was £285,000.

On 22 April 2006, Adana had made a chargeable lifetime transfer of shares valued at £500,000 to a trust. Adana paid the lifetime IHT of £52,250 arising from this gift. If Adana had not made this gift, her chargeable estate at the time of her death would have been £650,000 higher than it otherwise was. This was because of the subsequent increase in the value of the gifted shares.

What is the maximum nil rate band which will have been available when calculating the IHT of £566,000 payable in respect of Adana’s chargeable estate?

A.£325,000

B.£553,000

C.£390,000

D.£585,000

What is the total amount of deductions which would have been permitted in calculating Adana’s chargeable estate for IHT purposes?A.£263,700

B.£268,300

C.£43,700

D.£220,000

Who will be responsible for paying the IHT of £566,000 in respect of Adana’s chargeable estate, and what is the due date for the payment of this liability?A.The beneficiaries of Adana’s estate (her children) on 30 September 2016

B.The beneficiaries of Adana’s estate (her children) on 17 September 2016

C.The personal representatives of Adana’s estate on 30 September 2016

D.The personal representatives of Adana’s estate on 17 September 2016

How much IHT did Adana save by making the chargeable lifetime transfer of £500,000 to a trust on 22 April 2006, rather than retaining the gifted investments until her death?A.£260,000

B.£207,750

C.£147,750

D.£200,000

How much of the IHT payable in respect of Adana’s estate would have been saved if, under the terms of her will, Adana had made specific gifts of £400,000 to a trust and £200,000 to her grandchildren, instead of leaving her entire estate to her children?A.£240,000

B.£160,000

C.£0

D.£80,000

请帮忙给出每个问题的正确答案和分析,谢谢!

第6题

Cora made a cash gift of £300,000 to her niece on 30 April 2010.

She then made a cash gift of £500,000 to her nephew on 31 May 2011.

Both of these amounts are stated after deducting available exemptions.

Cora subsequently died on 31 October 2015.

What amount of inheritance tax was payable as a result of Cora’s death in respect of the cash gift of £500,000 to her nephew?

A.£190,000

B.£110,000

C.£114,000

D.£105,000

第7题

or the tax year 2015–16 and paid these on the due dates.

Rajesh paid the correct balancing payment of £1,200 for the tax year 2015–16 on 30 June 2017.

What penalties and interest may Rajesh be charged as a result of his late balancing payment for the tax year 2015–16?

A.Interest of £15 only

B.Interest of £36 only

C.Interest of £36 and a penalty of £60

D.Interest of £15 and a penalty of £60

第8题

r ended 31 May 2015 was £48,000 and for the year ended 31 May 2016 was £43,200.

What is the amount of class 4 national insurance contributions (NIC) payable by Paloma for the tax year 2015–16?

A.£3,121

B.£3,595

C.£3,105

D.£3,201

第9题

year 2015–16 are £4,840. Her income tax liability and class 4 NICs for the tax year 2014–15 were £6,360.

What is the lowest amount to which Eva could make a claim to reduce each of her payments on account for the tax year 2015–16 without being charged interest?

A.£4,840

B.£0

C.£3,180

D.£2,420

第10题

rship) prior to the asset’s disposal can be sensible capital gains tax (CGT) planning.

Which of the following CANNOT be achieved as a direct result of using this type of tax planning?

A.Making the best use of annual exempt amounts

B.Deferring the CGT due date

C.Reducing the amount of CGT payable

D.Making the best use of capital losses

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!