重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

At 31 March 2015, Jasim had shareholders’ funds (equity) of $200,000 and debt of $100,000.

Which of the following transactions would increase Jasim’s gearing compared to what it would have been had the transaction NOT taken place?

Gearing should be taken as debt/(debt + equity). Each transaction should be considered separately.

A.During the year a property was revalued upwards by $20,000

B.A bonus issue of equity shares of 1 for 4 was made during the year using other components of equity

C.A provision for estimated damages was reduced during the year from $21,000 to $15,000 based on the most recent legal advice

D.An asset with a fair value of $25,000 was acquired under a finance lease on 31 March 2015

更多“At 31 March 2015, Jasim had shareholders’ funds (e...”相关的问题

更多“At 31 March 2015, Jasim had shareholders’ funds (e...”相关的问题

第1题

A、pluralistic systems

B、voting rights

C、religious system

D、company constitution

第2题

Huinan Company has three shareholders, A, B and C, of which C invested by contributing a patent to the company. After the patent is contributed, C himself continue to use the patented technology. Which of the following items is correct? A、 B deems that since C can continue to use the patented technology, he and A can also use it. B、 A deems if C continue to use this patent, he need to pay fees to Huinan Company. C、 C deems that he can continue to use the patent in the original scope. D、 C deems that if A and B use the patent, they should get his written consent.

第3题

A、$0

B、$10,000

C、$25,000

D、$30,000

E、$50,000

第4题

The following 2 question refer to the data above.

For the year shown, other than 1987, in which the percent return on shareholders' equity for Manufacturer X was most nearly equal to that for 1987, what was the percent return for all United States manufacturers?

A.8%

B.12.5%

C.15.5%

D.17%

E.17.5%

第5题

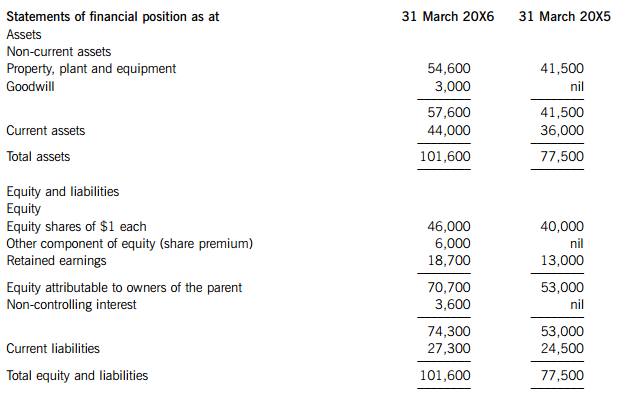

The summarised financial statements of Gregory Co as a single entity at 31 March 20X5 and as a group at 31 March 20X6 are:

Other information:

(i) Each month since the acquisition, Gregory Co’s sales to Tamsin Co were consistently $2m. Gregory Co had chosen to only make a gross profit margin of 10% on these sales as Tamsin Co is part of the group.

(ii) The values of property, plant and equipment held by both companies have been rising for several years.

(iii) On reviewing the above financial statements, Gregory Co’s chief executive officer (CEO) made the following observations:

(1) I see the profit for the year has increased by $1m which is up 20% on last year, but I thought it would be more as Tamsin Co was supposed to be a very profitable company.

(2) I have calculated the earnings per share (EPS) for 20X6 at 13 cents (6,000/46,000 x 100) and for 20X5 at 12·5 cents (5,000/40,000 x 100) and, although the profit has increased 20%, our EPS has barely changed.

(3) I am worried that the low price at which we are selling goods to Tamsin Co is undermining our group’s overall profitability.

(4) I note that our share price is now $2·30, how does this compare with our share price immediately before we bought Tamsin Co?

Required: (a) Reply to the four observations of the CEO. (8 marks)

(b) Using the above financial statements, calculate the following ratios for Gregory Co for the years ended 31 March 20X6 and 20X5 and comment on the comparative performance:

(i) Return on capital employed (ROCE)

(ii) Net asset turnover

(iii) Gross profit margin

(iv) Operating profit margin

Note: Four marks are available for the ratio calculations. (12 marks)

Note: Your answers to (a) and (b) should reflect the impact of the consolidation of Tamsin Co during the year ended 31 March 20X6.

第6题

第7题

A、A. Shareholders shall have full civil capacity

B、B. Shareholders qualify can be as inheritance

C、C. unincorporated organization cannot be the shareholders of the company

D、D. foreign natural person cannot be a shareholder of Chinese company

第8题

Adana died on 17 March 2016, and inheritance tax (IHT) of £566,000 is payable in respect of her chargeable estate. Under the terms of her will, Adana left her entire estate to her children.

At the date of her death, Adana had the following debts and liabilities:

(1) An outstanding interest-only mortgage of £220,000.

(2) Income tax of £43,700 payable in respect of the tax year 2015–16.

(3) Legal fees of £4,600 incurred by Adana’s sister which Adana had verbally promised to pay.

Adana’s husband had died on 28 May 2006, and only 20% of his inheritance tax nil rate band was used on his death. The nil rate band for the tax year 2006–07 was £285,000.

On 22 April 2006, Adana had made a chargeable lifetime transfer of shares valued at £500,000 to a trust. Adana paid the lifetime IHT of £52,250 arising from this gift. If Adana had not made this gift, her chargeable estate at the time of her death would have been £650,000 higher than it otherwise was. This was because of the subsequent increase in the value of the gifted shares.

What is the maximum nil rate band which will have been available when calculating the IHT of £566,000 payable in respect of Adana’s chargeable estate?

A.£325,000

B.£553,000

C.£390,000

D.£585,000

What is the total amount of deductions which would have been permitted in calculating Adana’s chargeable estate for IHT purposes?A.£263,700

B.£268,300

C.£43,700

D.£220,000

Who will be responsible for paying the IHT of £566,000 in respect of Adana’s chargeable estate, and what is the due date for the payment of this liability?A.The beneficiaries of Adana’s estate (her children) on 30 September 2016

B.The beneficiaries of Adana’s estate (her children) on 17 September 2016

C.The personal representatives of Adana’s estate on 30 September 2016

D.The personal representatives of Adana’s estate on 17 September 2016

How much IHT did Adana save by making the chargeable lifetime transfer of £500,000 to a trust on 22 April 2006, rather than retaining the gifted investments until her death?A.£260,000

B.£207,750

C.£147,750

D.£200,000

How much of the IHT payable in respect of Adana’s estate would have been saved if, under the terms of her will, Adana had made specific gifts of £400,000 to a trust and £200,000 to her grandchildren, instead of leaving her entire estate to her children?A.£240,000

B.£160,000

C.£0

D.£80,000

请帮忙给出每个问题的正确答案和分析,谢谢!

第9题

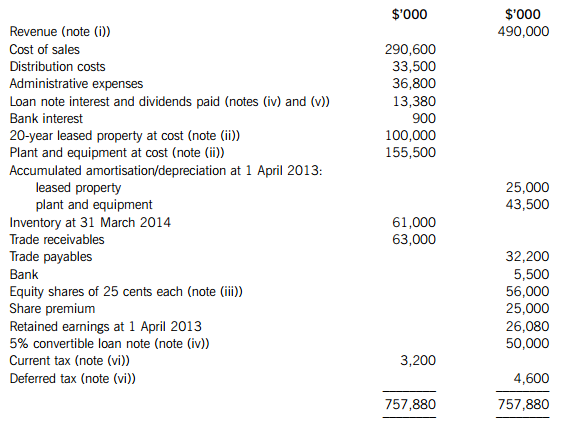

The following notes are relevant:

(i) Revenue includes an amount of $20 million for cash sales made through Xtol’s retail outlets during the year on behalf of Francais. Xtol, acting as agent, is entitled to a commission of 10% of the selling price of these goods. By 31 March 2014, Xtol had remitted to Francais $15 million (of the $20 million sales) and recorded this amount in cost of sales.

(ii) Plant and equipment is depreciated at 12?% per annum on the reducing balance basis. All amortisation/depreciation of non-current assets is charged to cost of sales.

(iii) On 1 August 2013, Xtol made a fully subscribed rights issue of equity share capital based on two new shares at 60 cents each for every five shares held. The market price of Xtol’s shares before the issue was $1·02 each. The issue has been fully recorded in the trial balance figures.

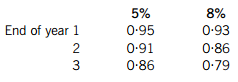

(iv) On 1 April 2013, Xtol issued a 5% $50 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2016.

The interest on an equivalent loan note without the conversion rights would be 8% per annum. The present values of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(v) An equity dividend of 4 cents per share was paid on 30 May 2013 and, after the rights issue, a further dividend of 2 cents per share was paid on 30 November 2013.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2013. A provision of $28 million is required for current tax for the year ended 31 March 2014 and at this date the deferred tax liability was assessed at $8·3 million.

Required:

(a) Prepare the statement of profit or loss for Xtol for the year ended 31 March 2014.

(b) Prepare the statement of changes in equity for Xtol for the year ended 31 March 2014.

(c) Prepare the statement of financial position for Xtol as at 31 March 2014.

(d) Calculate the basic earnings per share (EPS) for Xtol for the year ended 31 March 2014.

Note: Answers and workings (for parts (a) to (c)) should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 8 marks

(b) 6 marks

(c) 8 marks

(d) 3 marks

第10题

capital of Hira Ltd from Belgrove Ltd. Belgrove Ltd currently owns 100% of the share capital of Hira Ltd and has no

other subsidiaries. All three companies have their head offices in the UK and are UK resident.

Hira Ltd had trading losses brought forward, as at 1 April 2006, of £18,600 and no income or gains against which

to offset losses in the year ended 31 March 2006. In the year ending 31 March 2007 the company expects to make

further tax adjusted trading losses of £55,000 before deduction of capital allowances, and to have no other income

or gains. The tax written down value of Hira Ltd’s plant and machinery as at 31 March 2006 was £96,000 and

there will be no fixed asset additions or disposals in the year ending 31 March 2007. In the year ending 31 March

2008 a small tax adjusted trading loss is anticipated. Hira Ltd will surrender the maximum possible trading losses

to Belgrove Ltd and Dovedale Ltd.

The tax adjusted trading profit of Dovedale Ltd for the year ending 31 March 2007 is expected to be £875,000 and

to continue at this level in the future. The profits chargeable to corporation tax of Belgrove Ltd are expected to be

£38,000 for the year ending 31 March 2007 and to increase in the future.

On 1 February 2007 Dovedale Ltd will sell a small office building to Hira Ltd for its market value of £234,000.

Dovedale Ltd purchased the building in March 2005 for £210,000. In October 2004 Dovedale Ltd sold a factory

for £277,450 making a capital gain of £84,217. A claim was made to roll over the gain on the sale of the factory

against the acquisition cost of the office building.

On 1 April 2007 Dovedale Ltd intends to acquire the whole of the ordinary share capital of Atapo Inc, an unquoted

company resident in the country of Morovia. Atapo Inc sells components to Dovedale Ltd as well as to other

companies in Morovia and around the world.

It is estimated that Atapo Inc will make a profit before tax of £160,000 in the year ending 31 March 2008 and will

pay a dividend to Dovedale Ltd of £105,000. It can be assumed that Atapo Inc’s taxable profits are equal to its profit

before tax. The rate of corporation tax in Morovia is 9%. There is a withholding tax of 3% on dividends paid to

non-Morovian resident shareholders. There is no double tax agreement between the UK and Morovia.

Required:

(a) Advise Belgrove Ltd of any capital gains that may arise as a result of the sale of the shares in Hira Ltd. You

are not required to calculate any capital gains in this part of the question. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!