重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

An agreement for the selling of shares can be quite a complex document. As well as (1)… exactly what shares are to be sold, the agreement will usually involve many other elements. The pricing (2)… are crucial, as it is vital to set out what form the price will take and when it will be (3)…. If the price is linked to the future (4)… of the company in an agreement referred to by lawyers as an (5)…--out arrangement, it is then vital to determine precisely which (6)…policies will be used to determine whether the profitability targets have been (7)…. If the purchase price is to be paid in instalments, it is vital that the seller is satisfied that the buyer can pay each instalment when it (8)… due. The agreement will also usually contain (9)…covenants. The buyer will not want to (10)… shares, or indeed the entire company, and then find that the seller intends to set up a new business in direct competition. A. Provisions B. Specifying C. Performance D. Paid E. Accounting F. Earn G. Falls H. Met I. Acquire J. Restrictive

更多“An agreement for the selling of shares can be quit...”相关的问题

更多“An agreement for the selling of shares can be quit...”相关的问题

第1题

A.the value of the firm for the shareholders

B.the asset of the firm for the debtors

C.the liquidity assets for the debtors

D.the stockholding plans for the employees

第2题

Several months later Qian intended to transfer his shares to a listed company for profit and sent notices to the other three shareholders asking for their consent. Zhao agreed and also expressed his willingness to buy Qian’s shares if the price was reasonable. Sun disagreed and claimed his right of priority to buy Qian’s shares. However, Zhao and Sun could not reach an agreement as to the proportion of shares to buy. Lee kept silent upon receipt of the notice.

Since Sun offered a price lower than that of the listed company, Qian entered into a contract to sell his shares to the listed company, which caused a dispute among the four shareholders. Under such circumstances, Lee decided to leave the company and requested the company to purchase his shares.

Required:

In accordance with the relevant provisions of the Company Law:

(a) State how Zhao and Sun’s failure to reach an agreement on the proportion of shares to purchase should be dealt with. (2 marks)

(b) State whether Lee’s request for the company to purchase his shares should be upheld if the dispute was brought to court. (2 marks)

(c) State whether Qian was entitled to transfer his shares to the listed company. (2 marks)

第3题

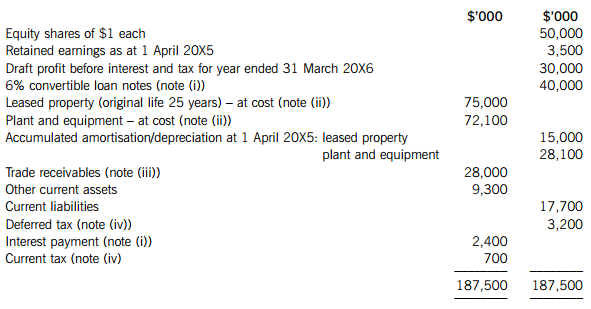

The following notes are relevant:

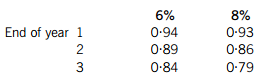

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

第4题

1. This passage is mainly about ().

A. why different forms of business run

B. when different forms of business raise money

C. how different forms of business are organized

2. What is usually needed to decide the portion of the partnership each person controls?()

A. A rule.

B. An agreement.

C. A regulation.

3. Who are not included in limited liability partnerships?()

A. Full partners.

B. Limited partners.

C. Unlimited partners.

4. How can corporations raise money?()

A. By selling stock.

B. By buying stock.

C. By holding corporation shares.

5. Who controls corporate policies in a corporation?()

A. Chairman of the board.

B. A board of directors.

C. The owner of the corporation.

第5题

In addition to this Picant agreed to pay a further amount on 1 April 2010 that was contingent upon the post-acquisition performance of Sander. At the date of acquisition Picant assessed the fair value of this contingent consideration at $4·2 million, but by 31 March 2010 it was clear that the actual amount to be paid would be only $2·7 million (ignore discounting). Picant has recorded the share exchange and provided for the initial estimate of $4·2 million for the contingent consideration.

On 1 October 2009 Picant also acquired 40% of the equity shares of Adler paying $4 in cash per acquired share and issuing at par one $100 7% loan note for every 50 shares acquired in Adler. This consideration has also been recorded by Picant.

Picant has no other investments.

The summarised statements of fi nancial position of the three companies at 31 March 2010 are:

(i) At the date of acquisition the fair values of Sander’s property, plant and equipment was equal to its carrying amount with the exception of Sander’s factory which had a fair value of $2 million above its carrying amount. Sander has not adjusted the carrying amount of the factory as a result of the fair value exercise. This requires additional annual depreciation of $100,000 in the consolidated fi nancial statements in the post-acquisition period.

Also at the date of acquisition, Sander had an intangible asset of $500,000 for software in its statement of fi nancial position. Picant’s directors believed the software to have no recoverable value at the date of acquisition and Sander wrote it off shortly after its acquisition.

(ii) At 31 March 2010 Picant’s current account with Sander was $3·4 million (debit). This did not agree with the equivalent balance in Sander’s books due to some goods-in-transit invoiced at $1·8 million that were sent by Picant on 28 March 2010, but had not been received by Sander until after the year end. Picant sold all these goods at cost plus 50%.

(iii) Picant’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Sander’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest.

(iv) Impairment tests were carried out on 31 March 2010 which concluded that the value of the investment in Adler was not impaired but, due to poor trading performance, consolidated goodwill was impaired by $3·8 million.

The following information is relevant:

(v) Assume all profi ts accrue evenly through the year.

Required:

(a) Prepare the consolidated statement of fi nancial position for Picant as at 31 March 2010. (21 marks)

(b) Picant has been approached by a potential new customer, Trilby, to supply it with a substantial quantity of goods on three months credit terms. Picant is concerned at the risk that such a large order represents in the current diffi cult economic climate, especially as Picant’s normal credit terms are only one month’s credit. To support its application for credit, Trilby has sent Picant a copy of Tradhat’s most recent audited consolidated fi nancial statements. Trilby is a wholly-owned subsidiary within the Tradhat group. Tradhat’s consolidated fi nancial statements show a strong statement of fi nancial position including healthy liquidity ratios.

Required:

Comment on the importance that Picant should attach to Tradhat’s consolidated fi nancial statements when deciding on whether to grant credit terms to Trilby. (4 marks)

第6题

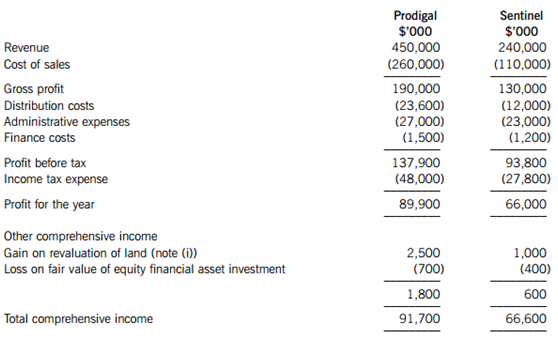

The summarised statements of comprehensive income for the two companies for the year ended 31 March 2011 are:

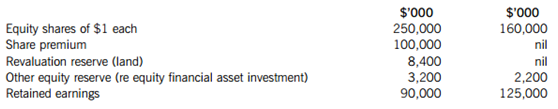

The following information for the equity of the companies at 1 April 2010 (i.e. before the share exchange took place) is available:

The following information is relevant:

(i) Prodigal’s policy is to revalue the group’s land to market value at the end of each accounting period. Prior to its acquisition Sentinel’s land had been valued at historical cost. During the post acquisition period Sentinel’s land had increased in value over its value at the date of acquisition by $1 million. Sentinel has recognised the revaluation within its own financial statements.

(ii) Immediately after the acquisition of Sentinel on 1 October 2010, Prodigal transferred an item of plant with a carrying amount of $4 million to Sentinel at an agreed value of $5 million. At this date the plant had a remaining life of two and half years. Prodigal had included the profit on this transfer as a reduction in its depreciation costs. All depreciation is charged to cost of sales.

(iii) After the acquisition Sentinel sold goods to Prodigal for $40 million. These goods had cost Sentinel $30 million. $12 million of the goods sold remained in Prodigal’s closing inventory.

(iv) Prodigal’s policy is to value the non-controlling interest of Sentinel at the date of acquisition at its fair value which the directors determined to be $100 million.

(v) The goodwill of Sentinel has not suffered any impairment.

(vi) All items in the above statements of comprehensive income are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Prepare the consolidated statement of comprehensive income of Prodigal for the year ended 31 March 2011;

(ii) Prepare the equity section (including the non-controlling interest) of the consolidated statement of financial position of Prodigal as at 31 March 2011.

Note: you are NOT required to calculate consolidated goodwill or produce the statement of changes in equity.

The following mark allocation is provided as guidance for this requirement:

(i) 14 marks

(ii) 7 marks (21 marks)

(b) IFRS 3 Business combinations permits a non-controlling interest at the date of acquisition to be valued by one of two methods:

(i) at its proportionate share of the subsidiary’s identifiable net assets; or

(ii) at its fair value (usually determined by the directors of the parent company).

Required:

Explain the difference that the accounting treatment of these alternative methods could have on the consolidated financial statements, including where consolidated goodwill may be impaired. (4 marks)

第7题

an immediate payment of $4 per share on 1 October 2010; and

a further amount deferred until 1 October 2011 of $5·4 million.

The immediate payment has been recorded in Paladin’s financial statements, but the deferred payment has not been recorded. Paladin’s cost of capital is 8% per annum.

On 1 February 2011, Paladin also acquired 25% of the equity shares of Augusta paying $10 million in cash. The summarised statements of financial position of the three companies at 30 September 2011 are:

The following information is relevant:

(i) Paladin’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose the directors of Paladin considered a share price for Saracen of $3·50 per share to be appropriate.

(ii) At the date of acquisition, the fair values of Saracen’s property, plant and equipment was equal to its carrying amount with the exception of Saracen’s plant which had a fair value of $4 million above its carrying amount. At that date the plant had a remaining life of four years. Saracen uses straight-line depreciation for plant assuming a nil residual value. Also at the date of acquisition, Paladin valued Saracen’s customer relationships as a customer base intangible asset at fair value of $3 million. Saracen has not accounted for this asset. Trading relationships with Saracen’s customers last on average for six years.

(iii) At 30 September 2011, Saracen’s inventory included goods bought from Paladin (at cost to Saracen) of $2·6 million. Paladin had marked up these goods by 30% on cost. Paladin’s agreed current account balance owed by Saracen at 30 September 2011 was $1·3 million.

(iv) Impairment tests were carried out on 30 September 2011 which concluded that consolidated goodwill was not impaired, but, due to disappointing earnings, the value of the investment in Augusta was impaired by $2·5 million.

(v) Assume all profits accrue evenly through the year.

Required:

Prepare the consolidated statement of financial position for Paladin as at 30 September 2011.

第8题

•For each question (13-18), mark one letter (A, B, C or D) on your Answer Sheet.

Achieving a successful merger

However attractive the figures may look on paper, in the long run the success or failure of a merger depends on the human factor. When the agreement has been signed and the accountants have departed, the real problems may only just be beginning. If there is a culture clash between the two companies in the way their people work, then all the efforts of the financiers and lawyers to strike a deal may have been in vain.

According to Chris Bolton of KS Management Consultants, 70% of mergers fail to live up to their promise of shareholder value, not through any failure in economic terms but because the integration of people is unsuccessful. Corporates, he explains, concentrate their efforts before a merger on legal, technical and financial matters. They employ a range of experts to obtain the most favourable contract possible. But even at these early stages, people issues must be taken into consideration. The strengths and weaknesses of both organisations should be assessed and, if it is a merger of equals, then careful thought should be given to which personnel, from which side, should take on the key roles.

This was the issue in 2001 when' the proposed merger between two pharmaceutical companies promised to create one of the largest players in the industry. For both companies the merger was intended to reverse falling market share and shareholder value. However, although the companies' skill bases were compatible, the chief executives of the two companies could not agree which of them was to head up the new organisation. This illustrates the need to compromise if a merger is to take place.

But even in mergers that do go ahead, there can be culture dashes. One way to avoid this is to work with focus groups to see how employees view the existing culture of their organisation. In one example, where two global organisations in the food sector were planning to merge, focus groups discovered that the companies displayed very different profiles. One was sales-focused, knew exactly what it wanted to achieve and pushed initiatives through. The other got involved in lengthy discussions, trying out options methodically and making contingency plans. The first responded quickly to changes in the marketplace; the second took longer, but the option it eventually chose was usually the correct one. Neither company's approach would have worked for the other.

The answer is not to adopt one company's approach, or even to try to incorporate every aspect of both organlsations, but to create a totally new culture. This means taking the best from both sides and making a new organisation that everyone can accept. Or almost everyone. Inevitably there will be those who cannot adapt to a different culture. Research into the impact of mergers has found that companies .with differing management styles are the ones that need to work hardest at creating a new culture.

Another tool that can help to get the right cultural mix is intercultural analysis. This involves carrying out research that looks at the culture of a company and the business culture of the country in which it is based. It identifies how people, money and time are managed in a company, and investigates the business customs of the country and how its politics, economics and history impact on the way business is done.

According to the text, mergers can encounter problems when

A.contracts are signed too quickly.

B.experts cannot predict accurate figures.

C.conflicting attitudes cannot be resolved.

D.staff are opposed to the terms of the deal.

第9题

near to its old stadium, opinion was divided. Many of the club’s fans thought it a good idea because it would be more

comfortable for them when watching games. A number of problems arose, however, when it was pointed out that the

construction of the new stadium and its car parking would have a number of local implications. The local government

authority said that building the stadium would involve diverting roads and changing local traffic flow, but that it would

grant permission to build the stadium if those issues could be successfully addressed. A number of nearby residents

complained that the new stadium would be too near their homes and that it would destroy the view from their gardens.

Helen Yusri, who spoke on behalf of the local residents, said that the residents would fight the planning application

through legal means if necessary. A nearby local inner-city wildlife reservation centre said that the stadium’s

construction might impact on local water levels and therefore upset the delicate balance of animals and plants in the

wildlife centre. A local school, whose pupils often visited the wildlife centre, joined in the opposition, saying that whilst

the school supported the building of a new stadium in principle, it had concerns about disruption to the wildlife centre.

The football club’s board was alarmed by the opposition to its planned new stadium as it had assumed that it would

be welcomed because the club had always considered itself a part of the local community. The club chairman said

that he wanted to maintain good relations with all local people if possible, but at the same time he owed it to the fans

and the club’s investors to proceed with the building of the new stadium despite local concerns.

Required:

(a) Define ‘stakeholder’ and explain the importance of identifying all the stakeholders in the stadium project.

(10 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!