重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A、Expense Prepayment $93,000 $8,000

B、Expense Prepayment $93,000 $16,000

C、Expense Prepayment $94,000 $8,000

D、Expense Prepayment $94,000 $16,000

更多“Theta prepares its financial statements for the year to 30 April each year. The company pa”相关的问题

更多“Theta prepares its financial statements for the year to 30 April each year. The company pa”相关的问题

第1题

A.asset account of $800,000.

B.asset account of $720,000.

C.liability account of $80,000.

D.liability account of $720,000.

第2题

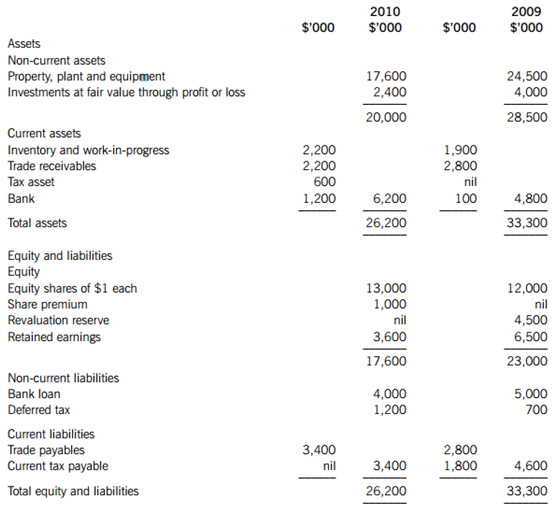

Income statements for the year ended 30 September:

Statements of fi nancial position as at 30 September:

The following information has been obtained from the Chairman’s Statement and the notes to the fi nancial statements:

‘Market conditions during the year ended 30 September 2010 proved very challenging due largely to diffi culties in the global economy as a result of a sharp recession which has led to steep falls in share prices and property values. Hardy has not been immune from these effects and our properties have suffered impairment losses of $6 million in the year.’

The excess of these losses over previous surpluses has led to a charge to cost of sales of $1·5 million in addition to the normal depreciation charge.

‘Our portfolio of investments at fair value through profi t or loss has been ‘marked to market’ (fair valued) resulting in a loss of $1·6 million (included in administrative expenses).’

There were no additions to or disposals of non-current assets during the year

‘In response to the downturn the company has unfortunately had to make a number of employees redundant incurring severance costs of $1·3million (included in cost of sales) and undertaken cost savings in advertising and other administrative expenses.’

‘The diffi culty in the credit markets has meant that the fi nance cost of our variable rate bank loan has increased from 4·5% to 8%. In order to help cash fl ows, the company made a rights issue during the year and reduced the dividend per share by 50%.’

‘Despite the above events and associated costs, the Board believes the company’s underlying performance has been quite resilient in these diffi cult times.’

Required:

Analyse and discuss the fi nancial performance and position of Hardy as portrayed by the above fi nancial statements and the additional information provided.

Your analysis should be supported by profi tability, liquidity and gearing and other appropriate ratios (up to 10 marks available).

第3题

statements for the year ended 31 May 2006 and has asked for advice on how to deal with the following items:

(i) Tyre requires customers to pay a deposit of 20% of the purchase price when placing an order for a vehicle. If the

customer cancels the order, the deposit is not refundable and Tyre retains it. If the order cannot be fulfilled by

Tyre, the company repays the full amount of the deposit to the customer. The balance of the purchase price

becomes payable on the delivery of the vehicle when the title to the goods passes. Tyre proposes to recognise

the revenue from the deposits immediately and the balance of the purchase price when the goods are delivered

to the customer. The cost of sales for the vehicle is recognised when the balance of the purchase price is paid.

Additionally, Tyre had sold a fleet of cars to Hub and gave Hub a discount of 30% of the retail price on the

transaction. The discount given is normal for this type of transaction. Tyre has given Hub a buyback option which

entitles Hub to require Tyre to repurchase the vehicles after three years for 40% of the purchase price. The normal

economic life of the vehicles is five years and the buyback option is expected to be exercised. (8 marks)

Required:

Advise the directors of Tyre on how to treat the above items in the financial statements for the year ended

31 May 2006.

(The mark allocation is shown against each of the above items)

第4题

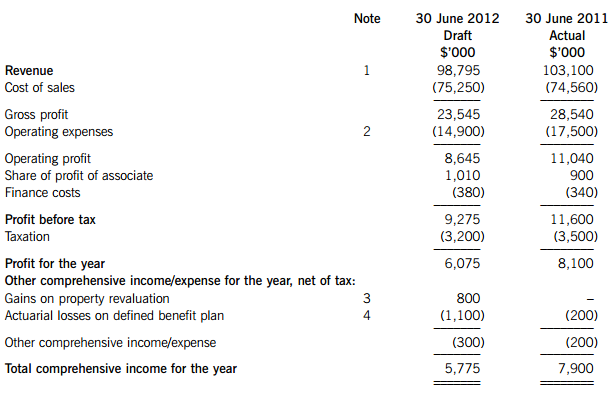

You are working on the audit of the Group’s financial statements for the year ended 30 June 2012. This morning the audit engagement partner left a note for you:

‘Hello

The audit senior has provided you with the draft consolidated financial statements and accompanying notes which summarise the key audit findings and some background information.

At the planning stage, materiality was initially determined to be $900,000, and was calculated based on the assumption that the Jovi Group is a high risk client due to its listed status. During the audit, a number of issues arose which meant that we needed to revise the materiality level for the financial statements as a whole. The revised level of materiality is now determined to be $700,000. One of the audit juniors was unsure as to why the materiality level had been revised. There are two matters you need to deal with:

(i) Explain why auditors may need to reassess materiality as the audit progresses. (4 marks)

(ii) Assess the implications of the key audit findings for the completion of the audit. Your assessment must consider whether the key audit findings indicate a risk of material misstatement. Where the key audit findings refer to audit evidence, you must also consider the adequacy of the audit evidence obtained, but you do not need to recommend further specific procedures. (18 marks)

Thank you’

The Group’s draft consolidated financial statements, with notes referenced to key audit findings, are shown below:

Draft consolidated statement of comprehensive income

Notes: Key audit findings – statement of comprehensive income

1. Revenue has been stable for all components of the Group with the exception of one subsidiary, Copeland Co, which has recognised a 25% decrease in revenue.

2. Operating expenses for the year to June 2012 is shown net of a profit on a property disposal of $2 million. Our evidence includes agreeing the cash receipts to bank statement and sale documentation, and we have confirmed that the property has been removed from the non-current asset register. The audit junior noted when reviewing the sale document, that there is an option to repurchase the property in five years time, but did not discuss the matter with management.

3. The property revaluation relates to the Group’s head office. The audit team have not obtained evidence on the revaluation, as the gain was immaterial based on the initial calculation of materiality.

4. The actuarial loss is attributed to an unexpected stock market crash. The Group’s pension plan is managed by Axle Co – a firm of independent fund managers who maintain the necessary accounting records relating to the plan. Axle Co has supplied written representation as to the value of the defined benefit plan’s assets and liabilities at 30 June 2012. No other audit work has been performed other than to agree the figure from the financial statements to supporting documentation supplied by Axle Co.

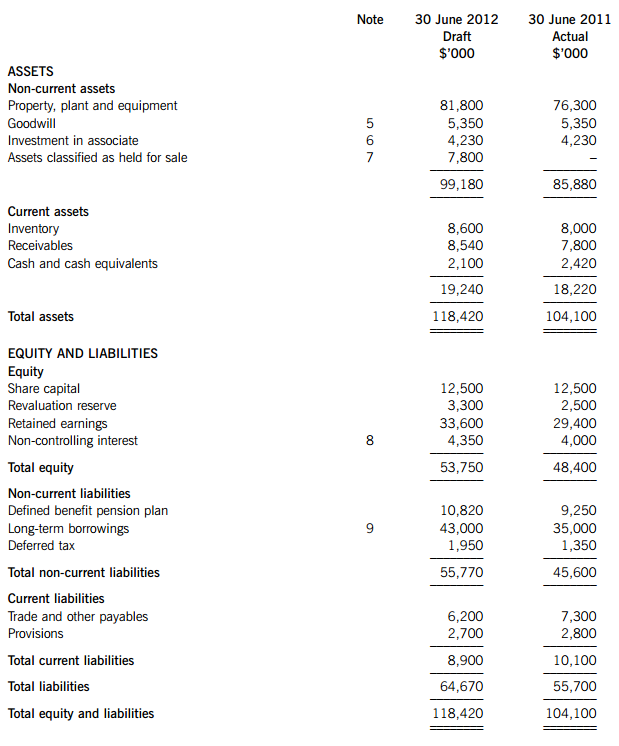

Draft consolidated statement of financial position

Notes: Key audit findings – statement of financial position

5. The goodwill relates to each of the subsidiaries in the Group. Management has confirmed in writing that goodwill is stated correctly, and our other audit procedure was to arithmetically check the impairment review conducted by management.

6. The associate is a 30% holding in James Co, purchased to provide investment income. The audit team have not obtained evidence regarding the associate as there is no movement in the amount recognised in the statement of financial position.

7. The assets held for sale relate to a trading division of one of the subsidiaries, which represents one third of that subsidiary’s net assets. The sale of the division was announced in May 2012, and is expected to be complete by 31 December 2012. Audit evidence obtained includes a review of the sales agreement and confirmation from the buyer, obtained in July 2012, that the sale will take place.

8. Two of the Group’s subsidiaries are partly owned by shareholders external to the Group.

9. A loan of $8 million was taken out in October 2011, carrying an interest rate of 2%, payable annually in arrears. The terms of the loan have been confirmed to documentation provided by the bank.

Required:

Respond to the note from the audit engagement partner. (22 marks)

Note: The split of the mark allocation is shown within the partner’s note.

(b) The audit engagement partner now sends a further note regarding the Jovi Group:

‘The Group finance director has just informed me that last week the Group purchased 100% of the share capital of May Co, a company located overseas in Farland. The Group audit committee has suggested that due to the distant location of May Co, a joint audit could be performed, starting with the next financial statements for the year ending 30 June 2013. May Co’s current auditors are a small local firm called Moore & Co who operate only in Farland.’

Required:

Discuss the advantages and disadvantages of a joint audit being performed on the financial statements of May Co. (6 marks)

第5题

Issue 1: Spiko Co began operating a new mine in January 20X3 under a five-year government licence which required Spiko Co to landscape the area after mining ceased at an estimated cost of $100,000.

Issue 2: During 20X4, Spiko Co’s mining activities caused environmental pollution on an adjoining piece of government land. There is no legislation which requires Spiko Co to rectify this damage, however, Spiko Co does have a published environmental policy which includes assurances that it will do so. The estimated cost of the rectification is $1,000,000.

In accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets, which of the following statements is correct in respect of Spiko Co’s financial statements for the year ended 31 December 20X4?

A.A provision is required for the cost of both issues 1 and 2

B.Both issues 1 and 2 require disclosure only

C.A provision is required for the cost of issue 1 but issue 2 requires disclosure only

D.Issue 1 requires disclosure only and issue 2 should be ignored

第6题

On 25 June 20X9 Cambridge Co received an order from a new customer, Circus Co, for products with a sales value of $900,000. Circus Co enclosed a deposit with the order of $90,000. On 30 June Cambridge Co had not completed credit checks on Circus and had not despatched any goods. Cambridge is considering the following possible entries for this transaction in its financial statements for the year ended 30 June 20X9. (i)Include $900,000 in revenue for the year (ii)Include $90,000 in revenue for the year (iii)Do not include anything in revenue for the year (iv)Create a trade receivable for $810,000 (v)Show $90,000 as a current liability According to IFRS 15 Revenue from Contracts with Customers, how should Cambridge Co record this transaction in its financial statements for the year ended 30 June 20X9?

A、(i) and (iv)

B、(ii) and (v)

C、(ii) and (iv)

D、(iii) and (v)

第7题

Investment 1 – 10% of the issued share capital of Haruka Co. This shareholding was acquired as a long-term investment as Zinet Co wishes to participate as an active shareholder of Haruka Co.

Investment 2 – 10% of the issued share capital of Lukas Co. This shareholding was acquired for speculative purposes and Zinet Co expects to sell these shares in the near future.

Neither of these shareholdings gives Zinet Co significant influence over the investee companies.

Wherever possible, the directors of Zinet Co wish to avoid taking any fair value movements to profit or loss, so as to minimise volatility in reported earnings.

How should the fair value movements in these investments be reported in Zinet Co’s financial statements for the year ended 31 March 20X9?

A.In profit or loss for both investments

B.In other comprehensive income for both investments

C.In profit or loss for investment 1 and in other comprehensive income for investment 2

D.In other comprehensive income for investment 1 and in profit or loss for investment 2

第8题

medical innovations designed to improve the quality of life. (Proprietary foods are marketed under and protected by

registered names.) The draft consolidated financial statements for the year ended 30 September 2006 show revenue

of $74·4 million (2005 – $69·2 million), profit before taxation of $13·2 million (2005 – $15·8 million) and total

assets of $53·3 million (2005 – $40·5 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In 2001, Seymour had been awarded a 20-year patent on a new drug, Tournose, that was also approved for

food use. The drug had been developed at a cost of $4 million which is being amortised over the life of the

patent. The patent cost $11,600. In September 2006 a competitor announced the successful completion of

preliminary trials on an alternative drug with the same beneficial properties as Tournose. The alternative drug is

expected to be readily available in two years time. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

第9题

fish. The draft consolidated financial statements for the year ended 31 March 2007 show revenue of $67·0 million

(2006 – $62·3 million), profit before taxation of $11·9 million (2006 – $14·2 million) and total assets of

$48·0 million (2006 – $36·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In early 2007 a chemical leakage from refrigeration units owned by Lamont caused contamination of some of its

property. Lamont has incurred $0·3 million in clean up costs, $0·6 million in modernisation of the units to

prevent future leakage and a $30,000 fine to a regulatory agency. Apart from the fine, which has been expensed,

these costs have been capitalised as improvements. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

第10题

company applies newly issued IFRSs at the earliest opportunity. The group comprises three companies, Ashlee, the

holding company, and its 100% owned subsidiaries Pilot and Gibson, both public limited companies. The group

financial statements at first appeared to indicate that the group was solvent and in a good financial position. However,

after the year end, but prior to the approval of the financial statements mistakes have been found which affect the

financial position of the group to the extent that loan covenant agreements have been breached.

As a result the loan creditors require Ashlee to cut its costs, reduce its operations and reorganise its activities.

Therefore, redundancies are planned and the subsidiary, Pilot, is to be reorganised. The carrying value of Pilot’s net

assets, including allocated goodwill, was $85 million at 31 March 2005, before taking account of reorganisation

costs. The directors of Ashlee wish to include $4 million of reorganisation costs in the financial statements of Pilot for

the year ended 31 March 2005. The directors of Ashlee have prepared cash flow projections which indicate that the

net present value of future net cash flows from Pilot is expected to be $84 million if the reorganisation takes place

and $82 million if the reorganisation does not take place.

Ashlee had already decided prior to the year end to sell the other subsidiary, Gibson. Gibson will be sold after the

financial statements have been signed. The contract for the sale of Gibson was being negotiated at the time of the

preparation of the financial statements and it is expected that Gibson will be sold in June 2005.

The carrying amounts of Gibson and Pilot including allocated goodwill were as follows at the year end:

The fair value of the net assets of Gibson at the year end was $415 million and the estimated costs of selling the

company were $5 million.

Part of the business activity of Ashlee is to buy and sell property. The directors of Ashlee had signed a contract on

1 March 2005 to sell two of its development properties which are carried at the lower of cost and net realisable value

under IAS 2 ‘Inventories’. The sale was agreed at a figure of $40 million (carrying value $30 million). A receivable of

$40 million and profit of $10 million were recognised in the financial statements for the year ended 31 March 2005.

The sale of the properties was completed on 1 May 2005 when the legal title passed. The policy used in the prior

year was to recognise revenue when the sale of such properties had been completed.

Additionally, Ashlee had purchased, on 1 April 2004, 150,000 shares of a public limited company, Race, at a price

of $20 per share. Ashlee had incurred transaction costs of $100,000 to acquire the shares. The company is unsure

as to whether to classify this investment as ‘available for sale’ or ‘at fair value through profit and loss’ in the financial

statements for the year ended 31 March 2005. The quoted price of the shares at 31 March 2005 was $25 per share.

The shares purchased represent approximately 1% of the issued share capital of Race and are not classified as ‘held

for trading’.

There is no goodwill arising in the group financial statements other than that set out above.

Required:

Discuss the implications, with suitable computations, of the above events for the group financial statements of

Ashlee for the year ended 31 March 2005.

(25 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!