重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The following two issues relate to Spiko Co’s mining activities:

Issue 1: Spiko Co began operating a new mine in January 20X3 under a five-year government licence which required Spiko Co to landscape the area after mining ceased at an estimated cost of $100,000.

Issue 2: During 20X4, Spiko Co’s mining activities caused environmental pollution on an adjoining piece of government land. There is no legislation which requires Spiko Co to rectify this damage, however, Spiko Co does have a published environmental policy which includes assurances that it will do so. The estimated cost of the rectification is $1,000,000.

In accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets, which of the following statements is correct in respect of Spiko Co’s financial statements for the year ended 31 December 20X4?

A.A provision is required for the cost of both issues 1 and 2

B.Both issues 1 and 2 require disclosure only

C.A provision is required for the cost of issue 1 but issue 2 requires disclosure only

D.Issue 1 requires disclosure only and issue 2 should be ignored

更多“The following two issues relate to Spiko Co’s mining activities:Issue 1: Spiko Co began op”相关的问题

更多“The following two issues relate to Spiko Co’s mining activities:Issue 1: Spiko Co began op”相关的问题

第1题

cently purchased investments in publically-traded equity shares:

Investment 1 – 10% of the issued share capital of Haruka Co. This shareholding was acquired as a long-term investment as Zinet Co wishes to participate as an active shareholder of Haruka Co.

Investment 2 – 10% of the issued share capital of Lukas Co. This shareholding was acquired for speculative purposes and Zinet Co expects to sell these shares in the near future.

Neither of these shareholdings gives Zinet Co significant influence over the investee companies.

Wherever possible, the directors of Zinet Co wish to avoid taking any fair value movements to profit or loss, so as to minimise volatility in reported earnings.

How should the fair value movements in these investments be reported in Zinet Co’s financial statements for the year ended 31 March 20X9?

A.In profit or loss for both investments

B.In other comprehensive income for both investments

C.In profit or loss for investment 1 and in other comprehensive income for investment 2

D.In other comprehensive income for investment 1 and in profit or loss for investment 2

第2题

se of its equipment.

Which of the following correctly reflects what this change represents and how it should be applied?

A.It is a change of accounting policy and must be applied prospectively

B.It is a change of accounting policy and must be applied retrospectively

C.It is a change of accounting estimate and must be applied retrospectively

D.It is a change of accounting estimate and must be applied prospectively

第3题

which cost $90,000 and had a useful life of six years. The grant was netted off against the cost of the equipment. On 1 January 20X7, when the equipment had a carrying amount of $50,000, its use was changed so that it was no longer being used in accordance with the grant. This meant that the grant needed to be repaid in full but by 31 December 20X7, this had not yet been done.

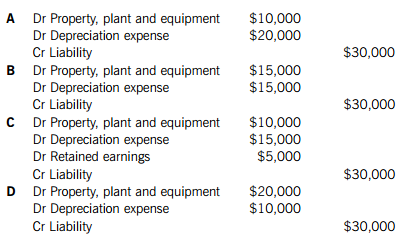

Which journal entry is required to reflect the correct accounting treatment of the government grant and the equipment in the financial statements of Gardenbugs Co for the year ended 31 December 20X7?

A.A

B.B

C.C

D.D

第4题

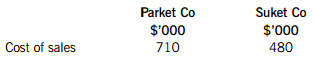

from the individual statements of profit or loss for the year ended 31 March 20X7: Parket Co consistently made sales of $20,000 per month to Suket Co throughout the year. At the year end, Suket Co held $20,000 of this in inventory.

Parket Co made a mark-up on cost of 25% on all sales to Suket Co.

What is Parket Co’s consolidated cost of sales for the year ended 31 March 20X7?

A.$954,000

B.$950,000

C.$774,000

D.$766,000

第5题

?

(1) The acquisition of 60% of Zakron Co’s equity share capital on 1 March 20X7. Zakron Co’s activities are significantly different from the rest of the Poulgo group of companies

(2) The offer to acquire 70% of Unto Co’s equity share capital on 1 November 20X7. The negotiations were finally signed off during January 20X8

(3) The acquisition of 45% of Speeth Co’s equity share capital on 31 December 20X7. Poulgo Co is able to appoint three of the ten members of Speeth Co’s board

A.1 only

B.2 and 3

C.3 only

D.1 and 2

第6题

Which of the following is NOT a duty of the IFRS Interpretations Committee?

A.To interpret the application of International Financial Reporting Standards

B.To work directly with national standard setters to bring about convergence with IFRS

C.To provide guidance on financial reporting issues not specifically addressed in IFRSs

D.To publish draft interpretations for public comment

第7题

The following trial balance relates to Downing Co as at 31 March 2016:

The following notes are relevant:

(i) Revenue includes an amount of $16 million for a sale made on 1 April 2015. The sale relates to a single product and includes ongoing servicing from Downing Co for four years. The normal selling price of the product and the servicing would be $18 million and $500,000 per annum ($2 million in total) respectively.

(ii) The contract asset is comprised of contract costs incurred at 31 March 2016 of $15 million less a payment of $10 million from the customer. The agreed transaction price for the total contract is $30 million and the total expected costs are $24 million. Downing Co uses an input method based on costs incurred to date relative to the total expected costs to determine the progress towards completion of its contracts.

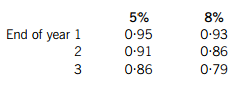

(iii) Downing Co issued 300,000 $100 5% convertible loan notes on 1 April 2015. The loan notes can be converted to equity shares on the basis of 25 shares for each $100 loan note on 31 March 2018 or redeemed at par for cash on the same date. An equivalent loan note without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(iv) Non-current assets:

Due to rising property prices, Downing Co decided to revalue its land and buildings on 1 April 2015 to their market value. The values were confirmed at that date as land $16 million and buildings $52·2 million with the buildings having an estimated remaining life of 18 years at the date of revaluation. Downing Co intends to make a transfer from the revaluation surplus to retained earnings in respect of the annual realisation of the revaluation surplus. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

During the current year, the income from royalties relating to the patent had declined considerably and the directors are concerned that the value of the patent may be impaired. A study at the year end concluded that the present value of the future estimated net cash flows from the patent at 31 March 2016 is $3·25 million; however, Downing Co also has a confirmed offer of $3·4 million to sell the patent immediately at that date.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2016. All depreciation/amortisation is charged to cost of sales.

There were no acquisitions or disposals of non-current assets during the year.

(v) The directors estimate a provision for income tax for the year ended 31 March 2016 of $11·4 million is required. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2015. At 31 March 2016, Downing Co had taxable temporary differences of $18·5 million requiring a provision for deferred tax. Any deferred tax movement should be reported in profit or loss. The income tax rate applicable to Downing Co is 20%.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Downing Co for the year ended 31 March 2016.

(b) Prepare the statement of changes in equity for Downing Co for the year ended 31 March 2016.

(c) Prepare the statement of financial position of Downing Co as at 31 March 2016.

Notes to the financial statements are not required. Work to the nearest $1,000.

The following mark allocation is provided as guidance for these requirements:

(a) 11 marks

(b) 4 marks

(c) 10 marks

(d) The finance director of Downing Co has correctly calculated the company’s basic and diluted earnings per share (EPS) to be disclosed in the financial statements for the year ended 31 March 2016 at 148·2 cents and 119·4 cents respectively.

On seeing these figures, the chief executive officer (CEO) is concerned that the market will react badly knowing that the company’s EPS in the near future will be only 119·4 cents, a fall of over 19% on the current year’s basic EPS.

Required:

Explain why and what aspect of Downing Co’s capital structure is causing the basic EPS to be diluted and comment on the validity of the CEO’s concerns. (5 marks)

第8题

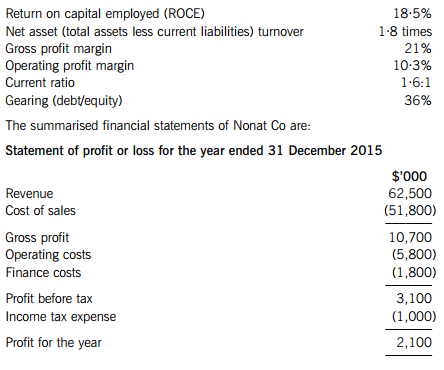

s for the year ended 31 December 2015 as they show a continuing improvement over recent past performance. However, the finance director says that a better assessment of the company’s performance would be made by a comparison to other companies in the same sector. The finance director has obtained some ratios for Nonat Co’s business sector, based on a year end of 31 December 2015, which are:

Required:

(a) Prepare for Nonat Co the equivalent ratios to those of its sector.

Note: The finance lease obligations should be treated as debt in the ROCE and gearing calculations. (6 marks)

(b) Analyse the financial performance and position of Nonat Co for the year to 31 December 2015 in comparison to the sector averages. (9 marks)

第9题

Section A暂缺

Section B – ALL THREE questions are compulsory and MUST be attempted

On 1 October 2015, Zanda Co acquired 60% of Medda Co’s equity shares by means of a share exchange of one new share in Zanda Co for every two acquired shares in Medda Co. In addition, Zanda Co will pay a further $0·54 per acquired share on 30 September 2016.

Zanda Co has not recorded any of the purchase consideration and its cost of capital is 8% per annum.

The market value of Zanda Co’s shares at 1 October 2015 was $3·00 each.

The summarised statements of financial position of the two companies as at 31 March 2016 are:

The following information is relevant:

(i) At the date of acquisition, Zanda Co conducted a fair value exercise on Medda Co’s net assets which were equal to their carrying amounts (including Medda Co’s financial asset equity investments) with the exception of an item of plant which had a fair value of $2·5 million below its carrying amount. The plant had a remaining useful life of 30 months at 1 October 2015.

The directors of Zanda Co are of the opinion that an unrecorded deferred tax asset of $1·2 million at 1 October 2015, relating to Medda Co’s losses, can be relieved in the near future as a result of the acquisition. At 31 March 2016, the directors’ opinion has not changed, nor has the value of the deferred tax asset.

(ii) Zanda Co’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, a share price for Medda Co of $1·50 each is representative of the fair value of the shares held by the noncontrolling interest.

(iii) At 31 March 2016, Medda Co held goods in inventory which had been supplied by Zanda Co at a mark-up on cost of 35%. These goods had cost Medda Co $2·43 million.

(iv) The financial asset equity investments of Zanda Co and Medda Co are carried at their fair values at 1 April 2015. At 31 March 2016, these had fair values of $6·1 million and $1·8 million respectively, with the change in Medda Co’s investments all occurring since the acquisition on 1 October 2015.

(v) There is no impairment to goodwill at 31 March 2016.

Required:

Prepare the following extracts from the consolidated statement of financial position of Zanda Co as at 31 March 2016:

(i) Goodwill;

(ii) Retained earnings;

(iii) Non-controlling interest.

The following mark allocation is provided as guidance for this question:

(i) 6 marks

(ii) 7 marks

(iii) 2 marks

第10题

mmediate share exchange of two shares in Palistar for five shares in Stretcher. The fair value of Palistar and Stretcher’s shares on 1 January 2015 were $4·00 and $3·00 respectively. In addition to the share exchange, Palistar will make a cash payment of $1·32 per acquired share, deferred until 1 January 2016. Palistar has not recorded any of the consideration for Stretcher in its financial statements. Palistar’s cost of capital is 10% per annum.

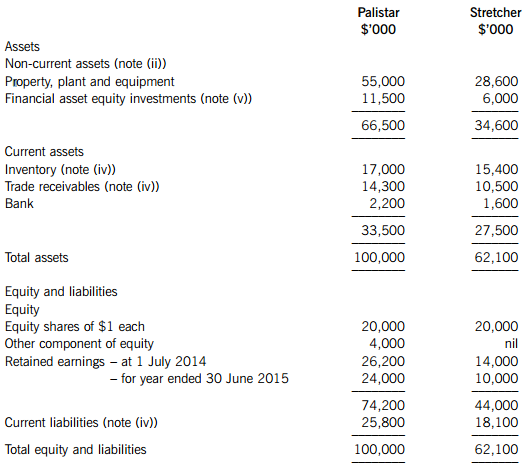

The summarised statements of financial position of the two companies as at 30 June 2015 are:

The following information is relevant:

(i) Stretcher’s business is seasonal and 60% of its annual profit is made in the period 1 January to 30 June each year.

(ii) At the date of acquisition, the fair value of Stretcher’s net assets was equal to their carrying amounts with the following exceptions:

An item of plant had a fair value of $2 million below its carrying value. At the date of acquisition it had a remaining life of two years.

The fair value of Stretcher’s investments was $7 million (see also note (v)).

Stretcher owned the rights to a popular mobile (cell) phone game. At the date of acquisition, a specialist valuer estimated that the rights were worth $12 million and had an estimated remaining life of five years.

(iii) Following an impairment review, consolidated goodwill is to be written down by $3 million as at 30 June 2015.

(iv) Palistar sells goods to Stretcher at cost plus 30%. Stretcher had $1·8 million of goods in its inventory at 30 June 2015 which had been supplied by Palistar. In addition, on 28 June 2015, Palistar processed the sale of $800,000 of goods to Stretcher, which Stretcher did not account for until their receipt on 2 July 2015. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Stretcher before the year end. At 30 June 2015, Palistar had a trade receivable balance of $2·4 million due from Stretcher which differed to the equivalent balance in Stretcher’s books due to the sale made on 28 June 2015.

(v) At 30 June 2015, the fair values of the financial asset equity investments of Palistar and Stretcher were $13·2 million and $7·9 million respectively.

(vi) Palistar’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Stretcher’s share price at that date is representative of the fair value of the shares held by the non-controlling interest.

Required:

Prepare the consolidated statement of financial position for Palistar as at 30 June 2015. (25 marks)

(b) For many years, Dilemma has owned 35% of the voting shares and held a seat on the board of Myno which has given Dilemma significant influence over Myno. The other shares (65%) in Myno were held by many other shareholders who all owned less than 10% of the share capital. On this basis, Dilemma considered Myno to be an associate and has used equity accounting to account for its investment.

In March 2015, Agresso made an offer to buy all of the shares of Myno. The offer was supported by the majority of Myno’s directors. Dilemma did not accept the offer and held on to its shares in Myno.

On 1 April 2015, Agresso announced that it had acquired the other 65% of the share capital of Myno and immediately convened a board meeting at which three of the previous directors of Myno were replaced, including the seat held by Dilemma.

Required:

Explain how the investment in Myno should be treated in the consolidated statement of profit or loss of Dilemma for the year ended 30 June 2015 and the consolidated statement of financial position at 30 June 2015. (5 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!