重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

更多“The definition of financial management is the management of the finances of an organisation in order…”相关的问题

更多“The definition of financial management is the management of the finances of an organisation in order…”相关的问题

第1题

responsibilities as members of the accounting profession setting out the distinguishing features of a

profession and the privileges that society gives to a profession. (Your answer should include reference to the

above scenario.) (7 marks)

Note: requirement (c) includes 2 marks for the quality of the discussion.

第2题

Required:

(a) (i) Describe the current presentation requirements relating to the statement of profit or loss and other comprehensive income. (4 marks)

(ii) Discuss, with examples, the nature of a reclassification adjustment and the arguments for and against allowing reclassification of items to profit or loss. Note: A brief reference should be made in your answer to the IASB’s Discussion Paper on the Conceptual Framework. (5 marks)

(iii) Discuss the principles and key components of the IIRC’s Framework, and any concerns which could question the Framework’s suitability for assessing the prospects of an entity. (8 marks)

(b) Cloud, a public limited company, regularly purchases steel from a foreign supplier and designates a future purchase of steel as a hedged item in a cash flow hedge. The steel was purchased on 1 May 2014 and at that date, a cumulative gain on the hedging instrument of $3 million had been credited to other comprehensive income. At the year end of 30 April 2015, the carrying amount of the steel was $8 million and its net realisable value was $6 million. The steel was finally sold on 3 June 2015 for $6·2 million.

On a separate issue, Cloud purchased an item of property, plant and equipment for $10 million on 1 May 2013. The asset is depreciated over five years on the straight line basis with no residual value. At 30 April 2014, the asset was revalued to $12 million. At 30 April 2015, the asset’s value has fallen to $4 million. The entity makes a transfer from revaluation surplus to retained earnings for excess depreciation, as the asset is used.

Required:

Show how the above transactions would be dealt with in the financial statements of Cloud from the date of the purchase of the assets.

Note: Candidates should ignore any deferred taxation effects. (6 marks)

Professional marks will be awarded in question 4 for clarity and quality of presentation. (2 marks)

第3题

Required:

(i) Discuss the key classification differences between debt and equity under International Financial Reporting Standards.

Note: Examples should be given to illustrate your answer. (9 marks)

(ii) Explain why it is important for entities to understand the impact of the classification of a financial instrument as debt or equity in the financial statements. (5 marks)

(b) The directors of Avco, a public limited company, are reviewing the financial statements of two entities which are acquisition targets, Cavor and Lidan.They have asked for clarification on the treatment of the following financial instruments within the financial statements of the entities.

Cavor has two classes of shares: A and B shares. A shares are Cavor’s ordinary shares and are correctly classed as equity. B shares are not mandatorily redeemable shares but contain a call option allowing Cavor to repurchase them. Dividends are payable on the B shares if, and only if, dividends have been paid on the A ordinary shares. The terms of the B shares are such that dividends are payable at a rate equal to that of the A ordinary shares. Additionally, Cavor has also issued share options which give the counterparty rights to buy a fixed number of its B shares for a fixed amount of $10 million. The contract can be settled only by the issuance of shares for cash by Cavor.

Lidan has in issue two classes of shares: A shares and B shares. A shares are correctly classified as equity. Two million B shares of nominal value of $1 each are in issue. The B shares are redeemable in two years’ time at the option of Lidan. Lidan has a choice as to the method of redemption of the B shares. It may either redeem the B shares for cash at their nominal value or it may issue one million A shares in settlement. A shares are currently valued at $10 per share. The lowest price for Lidan’s A shares since its formation has been $5 per share.

Required:

Discuss whether the above arrangements regarding the B shares of each of Cavor and Lidan should be treated as liabilities or equity in the financial statements of the respective issuing companies. (9 marks)

Professional marks will be awarded in question 4 for clarity and quality of presentation. (2 marks)

第4题

Required:

Describe the process the auditor should undertake to assess whether the PRECONDITIONS for an audit are present. (3 marks)

(b) List FOUR examples of matters the auditor may consider when obtaining an understanding of the entity. (2 marks)

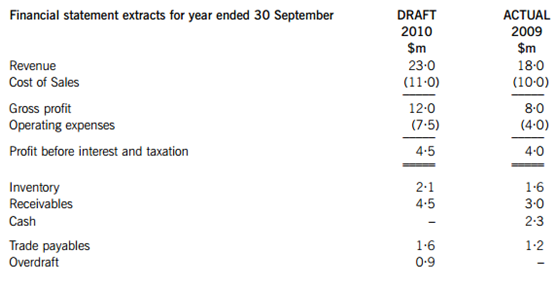

(c) You are the audit senior of White & Co and are planning the audit of Redsmith Co for the year ended 30 September 2010. The company produces printers and has been a client of your firm for two years; your audit manager has already had a planning meeting with the finance director. He has provided you with the following notes of his meeting and financial statement extracts.

Redsmith’s management were disappointed with the 2009 results and so in 2010 undertook a number of strategies to improve the trading results. This included the introduction of a generous sales-related bonus scheme for their salesmen and a high profile advertising campaign. In addition, as market conditions are difficult for their customers, they have extended the credit period given to them.

The finance director of Redsmith has reviewed the inventory valuation policy and has included additional overheads incurred this year as he considers them to be production related. He is happy with the 2010 results and feels that they are a good reflection of the improved trading levels.

Required:

Using the information above:

(i) Calculate FIVE ratios, for BOTH years, which would assist the audit senior in planning the audit; and (5 marks)

(ii) From a review of the above information and the ratios calculated, explain the audit risks that arise and describe the appropriate response to these risks. (10 marks)

第5题

‘Budgeting is a waste of time. I don’t see the point of it. It tells us what we can’t afford but it doesn’t keep us from buying it. It simply makes us invent new ways of manipulating figures. If all levels of management aren’t involved in the setting of the budget, they might as well not bother preparing one.’

Required:

(a) Identify and explain SIX objectives of a budgetary control system. (9 marks)

(b) Discuss the concept of a participative style. of budgeting in terms of the six objectives identified in part (a). (11 marks)

第6题

A、Good publicity

B、The generation of goodwill

C、It can attract future employees.

D、It can encourage consumers to support the organisation.

第7题

A decision is a choice made from among alternative courses of action that are available. The purpose of making a decision is to establish and achieve organizational goals and objectives. The __11___for making a decision is that a problem exists, goals or objectives are wrong, or something is __12__ in the way of accomplishing them.

Thus the decision-making process is fundamental to management. Almost everything a manager does__ 13__ decisions. Indeed, some suggest that the management process is decision making. _ 14_ managers cannot predict the future, many of their decisions require that they_ 15_ possible future events. Often managers must make a best guess at what the future will be and try to leave as little as possible to _ 16__. But since uncertainty is always there, risk accompanies decisions. Sometimes the consequences of a poor decision are__ 17 __; at other times they are serious.

People often assume that a decision is an isolated phenomenon. _18_ from a systems point of view, problems have multiple causes, and decisions have intended and unintended consequences. An organization is an ongoing entity, and a decision made today may have consequences far _ 19_ the future. Thus the skilled manager looks toward the future consequences of_ 20_ decisions.

11、

A. aim

B. effort

C. example

D. reason

12、

A. preceding

B. turning

C. spoiling

D. standing

13、

A. changes

B. achieves

C. involves

D. makes

14、

A. Since

B. Although

C. Unless

D. Until

15、

A. must consider

B. will consider

C. considered

D. consider

16、

A. chance

B. future

C. reality

D. action

17、

A. obvious

B. desirable

C. slight

D. natural

18、

A. Still

B. Then

C. But

D. Hence

19、

A. over

B. into

C. beyond

D. above

20、

A. current

B. common

C. conservative

D. casual

第8题

A.The marks left by an auditor when a document has been inspected

B.The working papers of an auditor

C.The pursuit of a fraud by an auditor

D.The trail of a transaction from source document to financial statement

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!