重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.11.8 percent

B.14.7 percent

C.18.2 percent

D.22.5 percent

答案

答案

更多“You own a portfolio which consists of 150 shares of stock A, 100 sharesof stock B and 300”相关的问题

更多“You own a portfolio which consists of 150 shares of stock A, 100 sharesof stock B and 300”相关的问题

第1题

A.Configurethesharedmodemtousesoftwarehandshaking

B.Configurethedial-upconnectiontoenableon-demanddialing.

C.Configurethedial-upconnectiontoenabletheInternetconnectionsharing.

D.Configurealltheothercomputerstohaveadial-upconnectionthatusesthesharedmodem.

E.AttachthemodemtooneoftheWindows2000Professionalcomputer,andcreateadial-upconnectiontotheISP.

F.AttachthemodemtooneoftheWindows2000Professionalcomputers,andsharethe modemonthenetwork.

第2题

Several laser print devices are attached to the UNIX computers. You want to enable the Windows 2000 Professional computers to print to these printers. You want to make the minimum number of configuration changes necessary to achieve this goal.

What should you do?

A.Install Simple TCP/IP services on the Windows 2000 Server computer. Configure printers on the Windows 2000 Server computer to print to the print device attached to the UNIX computers.

B.Install Print Services for UNIX on the Windows 2000 Server computer. Configure shared printers on the Windows 2000 Server computer. Configure the UNIX computers to print to these shared printers.

C.Disconnect the print devices from the UNIX computers and connect them to the Windows 2000 Server computer. Share the printers, and configure the Windows 2000 Professional computers and the UNIX computers to print to the shared printers.

D.On the Windows 2000 Server computer, configure shared printers that connect to the print devices attached to the UNIX computers. Configure the Windows 2000 Professional computers to print to the shared printers on the Windows 2000 Server computer.

第3题

Directions: In this section, you will hear 3 short passages. At the end of each passage, you will hear some questions. Both the passage and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked A, B, C and D.

听力原文: People who buy shares of stock in a company may make money in two ways. They may begin to make money right away. The company shares its profit with the investors. The money that is shared is called a dividend. Dividends are usually sent to investors once every three months while they own the stock. A second way that investors may make money is to sell the stock at a higher price than the price they paid when they bought it.

Here is an example of how this process works. Mr. and Mrs. Smith want to invest in the stock market with $1000. They talk to a stockbroker, who is licensed to buy and sell stock on the stock market. The broker tells Mr. and Mrs. Smith about the Ward Pencil Company, which is making a lot of money and is selling shares of stock. The shares cost $5 each. The Smiths decide to buy 100 shares. The broker fills this order, and the Smiths own these 100 shares. In three months, the Ward Pencil Company issues a dividend of $1 per share. The Smiths have 100 shares, so they get a $100 dividend. Then the company expands. The price of the stock goes up to $6 for each share. Mr. and Mrs. Smith decide to sell their stock at $6 a share. They get back $600, plus all of the money they have received in dividends. This is a very good investment.

(27)

A.It is a share of profits that a stockholder receives from a company.

B.It is the money that an investor shares with a company.

C.It is the money sent to the investor every three months.

D.It is what an employee gets from the company where he works.

第4题

The Retail Company you work for is investigating ways of increasing market share, including a plan to make use of the Internet. You are members of a group, which has been asked to consider the proposal.

Discuss, and decide together:

What benefits might there be for the company in using the Internet?

What resources would be required to implement the plan?

第5题

A. Configure the share permissions on Sales to assign the Allow - Change permission to the Everyone group. Configure the NTSF permissions on SalesForecast to assign the Allow - Write permission to the SalesManagers group.

B. Configure the share permissions on Sales to assign the Allow - Change permissions to the SalesManagers group. Configure the NTSF permissions on Sales to assign the Allow - Write permissions to the SalesManagers group.

C. Configure the share permissions on Sales to assign the Allow - Change permissions to the Everyone group. Configure the NTFS permissions on Sales to assign the Allow - Modify permission to the SalesManagers group.

D. Configure the share permissions on Sales to assign theAllow - Change permission to the SalesManagers group. Configure the NTFS permissions on Sales to assign the Allow - Modify permission to the SalesManagers group.

第6题

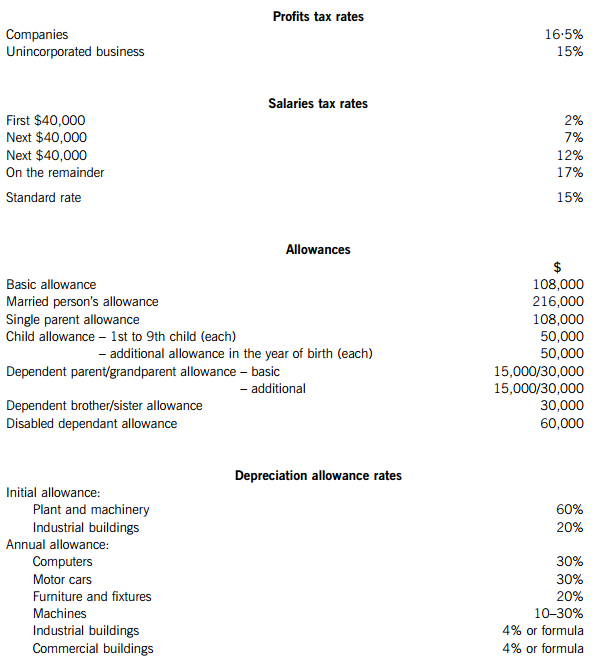

1. You should assume that the tax rates and allowances shown below will continue to apply for the foreseeable future.

2. Calculations and workings should be rounded down to the nearest HK$.

3. Apportionments need only be made to the nearest month, unless the law and prevailing practice require otherwise.

4. All workings should be shown.

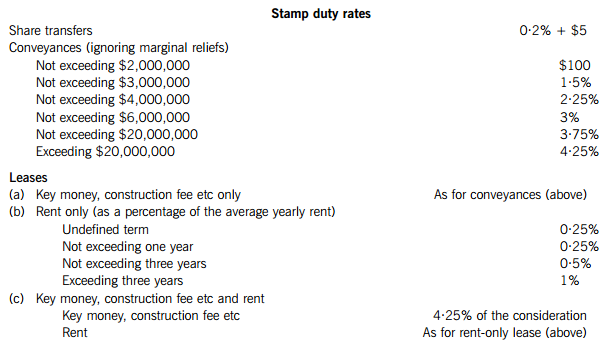

TAX RATES AND ALLOWANCES

The following 2010/11 tax rates and allowances are to be used in answering the questions.

Section A – BOTH questions are compulsory and MUST be attempted

1.

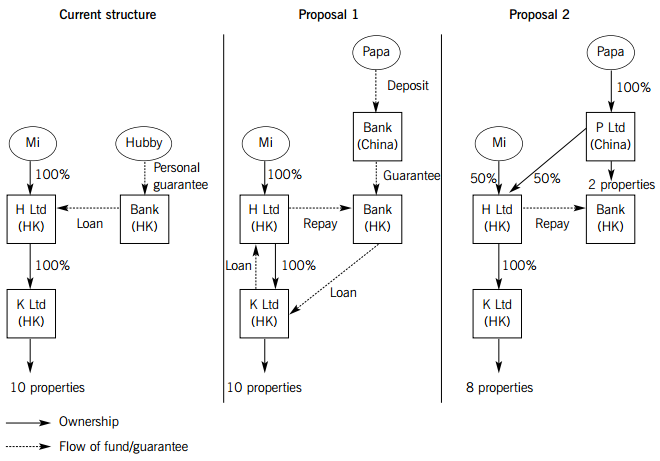

Ms Mi (Mi) is the sole shareholder of H Ltd, which was incorporated in Hong Kong during December 2010 for the purpose of acquiring the shares in K Ltd at the cost of $50 million. K Ltd is a Hong Kong incorporated company holding ten properties in Hong Kong. These properties are classified as ‘trading stock’ in K Ltd’s accounts on the basis that they are held for sale at a profit. The acquisition cost was financed by a bank loan which was secured by a personal guarantee given by Mi’s husband (Hubby). The current structure is illustrated on the left hand side of the diagram below:

You recently met Mi who advised you that she was going to divorce her husband. Thereafter, her husband will withdraw his personal guarantee on the bank loan, leading to the loan to be called back by the bank. Mi has sought help from her father (Papa), who has given two proposals for her consideration. These two proposals, as illustrated in the diagrams above, have the following details:

Proposal 1: A new bank loan will be extended from the bank to K Ltd, which is secured by a deposit placed by Papa with the Bank’s associate in China. K Ltd will on-lend the bank loan money to H Ltd interest free, to enable H Ltd to repay the old bank loan. Papa’s deposit will earn interest at the same rate that K Ltd pays on the new bank loan minus a 0.5% bank fee.

Proposal 2: Papa will invest, via P Ltd, a company incorporated in China, into H Ltd as a 50% shareholder. H Ltd could use the additional fund to repay the bank loan. However, he is neutral as to whether the 50% shareholding is acquired by way of new shares issued by H Ltd to him directly, or the sale of shares in H Ltd from Mi to him. If Mi sells her 50% shareholding to Papa, she will lend the money, interest-free, to H Ltd. Mi anticipates that she will make a significant profit on the sale and since K Ltd is trading in properties, she is concerned that her profit from the sale of the shares will also be taxed. Moreover, under this proposal, Papa also requests that after the shareholding change, K Ltd will sell two properties to P Ltd at cost, which is about 30% below the current market price.

Apart from the above two proposals from Papa, Mi also discussed with you the following alternative:

Proposal 3: K Ltd will change the strategy for holding the properties from trading to investment. These properties will be leased out to earn rental income. K Ltd will then assign its income rights under these leases to an independent party for a lump sum consideration. The lump sum will either be paid up as dividend or lent to H Ltd interest-free, to enable H Ltd to repay the existing bank loan.

As a friend of Mi as well as a professional tax consultant, you have promised Mi to review the above proposals from a Hong Kong tax perspective, and write a report to her.

Required:

Prepare a report for Ms Mi addressing the tax issues set out below, including supporting calculations where appropriate.

(a) Current structure – Comment on the tax effectiveness of the current funding structure in terms of the funding cost incurred by H Ltd. (2 marks)

(b) Proposal 1 – As compared with the current funding structure, advise whether there are any profits tax implications arising from Proposal 1 for:

(i) H Ltd; and (1 mark)

(ii) K Ltd. (4 marks)

(c) Proposal 2 – Advise on:

(i) The profits tax and stamp duty implications for H Ltd and P Ltd, if P Ltd subscribes for new shares to be issued by H Ltd directly to P Ltd; (2 marks)

(ii) The profits tax and stamp duty implications for Ms Mi if she sells 50% of her shareholding in H Ltd to P Ltd. Discuss also whether Ms Mi’s concern that her tax position will be affected by K Ltd’s property trading business is valid; and (15 marks)

(iii) The profits tax and stamp duty implications for K Ltd if it sells the two properties to P Ltd at cost. (8 marks)

(d) Proposal 3 – Advise on the profits tax implications for K Ltd arising from the change of holding strategy for the properties and the subsequent assignment of its income rights under the leases. (4 marks)

Notes:

1. Where appropriate, the effect of the HK–China Double Tax Arrangement (the DTA) on the transactions should be mentioned, but you are not required to discuss the detailed provisions in the DTA.

2. You should ignore provisional tax and overseas tax throughout this question.

3. You are not required to discuss any accounting treatments, and their relevant standards or principles in relation to the transactions in this case.

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the report and the effectiveness with which its advice is communicated. (2 marks)

2.

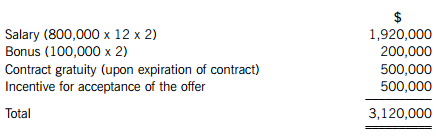

Kelvin King, a Canadian resident, has been offered a new job in a Hong Kong resident company (the Company) under a two-year contract from 1 April 2012 to 31 March 2014. The following draft total remuneration package has been offered for his consideration:

Other major terms of the contract include:

(1) Kelvin is not allowed to work for another company engaged in the same business or industry for 12 months after the cessation or expiration of his contract with the Company.

(2) Subject to application by Kelvin and approval by the Company, a staff quarter can be provided by the Company at a rent equivalent to 5% of Kelvin’s monthly salary. Details of the choices of quarters are available in the Personnel Department upon request.

(3) Kelvin is entitled to benefit from the Company’s medical insurance scheme, which allows him to receive outpatient services at no cost. The annual premium per employee paid by the Company under the scheme is $6,000.

(4) Kelvin is entitled to annual leave of three weeks.

(5) Kelvin is given an option to choose one of two share-based benefits under the Company’s Staff Incentive Scheme:

(i) Share option benefit – Kelvin will be granted an option to purchase 30,000 shares in the Company at a favourable option price. The options are unconditional.

(ii) Share award benefit – Kelvin will be granted 25,000 shares in the Company. Half of the share award has no vesting period, while the other half has a vesting period of 18 months during which Kelvin is required to remain in employment with the Company; and he is only entitled to these shares at the end of the vesting period.

Kelvin does not own a property in Hong Kong, nor does he have any plan to buy one in the short term. It is likely that he will rent a furnished apartment near his workplace as he has been advised that the Company quarter is unfurnished and has no club facilities.

Kelvin plans to return to Canada after the contract expires on 31 March 2014. He is thinking of choosing the share option benefit as he believes that if he exercises the share option after he returns to Canada, no Hong Kong tax will be payable.

The Company will allow Kelvin to restructure his two-year remuneration package as long as the total remuneration package (other than the share-based benefits) at the end of the contract does not exceed $3,120,000.

Required:

As tax consultant to Kelvin King, write a letter to him giving advice on the following:

(a) The Hong Kong salaries tax position of the draft package. Note: you are NOT required to calculate his assessable/chargeable income or tax payable. (20 marks)

(b) How Kelvin should restructure his remuneration package so as to minimise the amount of salaries tax he will have to pay in Hong Kong. (6 marks)

Professional marks will be awarded in question 2 for the appropriateness of the format and presentation of the letter and the effectiveness with which its advice is communicated. (2 marks)

Section B – TWO questions ONLY to be attempted

3.

(a) AB Ltd, a Hong Kong resident company, is organising a pop music concert to be staged in Hong Kong in January 2012. AB Ltd has appointed another Hong Kong resident company, CD Ltd, to procure performances by various overseas artists at the concert. CD Ltd has entered into an agreement with Mr X, the US resident manager of a US resident pop star, for the performance of that pop star at the concert for a fee of $3,000,000. AB Ltd will pay $3,300,000 to CD Ltd, which will then pay $3,000,000 to Mr X. The fee payable by Mr X to the US pop star is $2,700,000.

Required:

Explain the withholding obligations, if any, imposed under the Inland Revenue Ordinance on each of the parties concerned and compute, with explanations, the amount of tax to be withheld. (8 marks)

(b) KK Ltd is carrying on a trading business in Hong Kong, preparing accounts to 31 March each year. On 1 February 2011, it entered into a lease agreement to lease a motor vehicle, which has since been used in KK Ltd’s business, from an unrelated leasing company. The lease agreement is for a term of 24 months, with a monthly lease payment of $45,000 commencing from 1 February 2011. The cash cost of the motor vehicle was $840,000. The agreement provides KK Ltd with an option to acquire the motor vehicle at the end of the lease period upon payment of a small residual amount; and it is expected that the residual value will be higher than the exercise price.

Required:

Explain the tax implications of the lease agreement to KK Ltd, clearly identifying the expenditures it is entitled to claim with respect to the motor vehicle for the year of assessment 2010/11. (9 marks)

4.

MRS (HK) Ltd (MRS-HK) is a Hong Kong-incorporated company, which is resident and carrying on business in Hong Kong. During the month of July 2011, MRS-HK sent a team of five specialist staff to its associated company in China, MRS (China) Ltd (MRS-China), to work for them on a China project for a period of two weeks. All the associated costs including accommodation and meals were settled by MRS-China.

After the assignment, MRS-HK intended to issue a debit note to MRS-China seeking to recover the related employment costs of the five specialist staff on this project in the amount of HK$50,000. However, MRS-HK was subsequently advised by MRS-China that recharging these employment costs would result in China individual income tax being payable by the five specialist staff. All five of the specialist staff members are resident in Hong Kong.

Required:

(a) Discuss the Hong Kong salaries tax positions of the five specialist staff of MRS (HK) Ltd in respect of their services performed in China during July 2011.

Note: For the purpose of this part of the question only, you should answer based on the Hong Kong Inland Revenue Ordinance, and ignore the application of the double tax arrangement between Hong Kong and the PRC. (6 marks)

(b) Based on Article 14 of the double taxation agreement (DTA) signed between Hong Kong and the PRC, which is extracted below, explain how the recharge by MRS (HK) Ltd to recover the employment costs from MRS (China) Ltd may affect the exemption from China tax available to the five specialist staff members. You should clearly identify the crucial factors necessary for the DTA exemption to be available.

‘Article 14 Income from Employment

1. Subject to the provisions of Articles 15, 17, 18, 19 and 20, salaries, wages and other similar remuneration derived by a resident of One Side in respect of an employment shall be taxable only in that Side unless the employment is exercised in the Other Side. If the employment is exercised in the Other Side, such remuneration as is derived therefrom may be taxed in that Other Side.

2. Notwithstanding the provisions of paragraph 1 of this Article, remuneration derived by a resident of One Side in respect of an employment exercised in the Other Side shall be taxable only in the first-mentioned Side if all the following conditions are satisfied:

(a) the recipient is present in the Other Side for a period or periods not exceeding in the aggregate 183 days in any 12-month period commencing or ending in the taxable period concerned, and

(b) the remuneration is paid by, or on behalf of, an employer who is not a resident of the Other Side, and

(c) the remuneration is not borne by a permanent establishment which the employer has in the Other Side.’ (6 marks)

(c) Assuming that both Hong Kong salaries tax and China individual income tax will be imposed on the five specialist staff in relation to the services rendered in China, advise on the possible relief or measures that are available to them to avoid double taxation, based on the Hong Kong Inland Revenue Ordinance and Article 21 of the double taxation agreement signed between Hong Kong and the PRC as extracted below.

‘Article 21 Methods for Elimination of Double Taxation

2. In the Hong Kong Special Administrative Region, double taxation shall be avoided as follows:

Subject to the provisions of the tax laws of the Hong Kong Special Administrative Region … Mainland tax paid in the Mainland of China in accordance with the provisions of this Arrangement in respect of any item of income derived from sources in the Mainland of China by a resident of the Hong Kong Special Administrative Region shall be allowed as a credit against Hong Kong Special Administrative Region tax imposed on that resident. However, the amount of the credit shall not exceed the amount of Hong Kong Special Administrative Region tax in respect of that item of income computed in accordance with the tax laws and regulations of the Hong Kong Special Administrative Region.’ (5 marks)

5.

(a) Mr Look carries on a consultancy business in the form. of a sole proprietorship in Hong Kong. He closes his accounts on 31 December each year. In the course of preparing his profits tax computation for the year of assessment 2010/11, Mr Look discovered that an expense of $10,000, being the cost of hiring a member of temporary staff for a special project during the year ended 31 December 2005, had been omitted from his business accounts and thus this deduction was not claimed in the tax return for 2005/06. He wonders whether he can now ask the Inland Revenue Department to revise the assessment for 2005/06.

Required:

Advise Mr Look of his right of action, if any, to revise the assessment for 2005/06 to take into account the cost of hiring the temporary member of staff during the year 2005. (9 marks)

(b) David Pang owns a flat in Regent Court, a residential building in Causeway Bay. The residential building has 150 flats in total. According to the deed of mutual covenants, the roof of the residential building is part of the building common area, and each owner of an individual flat is entitled to the same number of undivided shares in the building common area.

On 1 June 2010, David Pang, as the chairman of the Incorporated Owner of Regent Court, entered into an agreement with a company, granting it the right to erect a neon advertising sign on the roof for a licence fee of $100,000 per annum. The licence fee is to be used to meet the building management expenses.

Recently, David Pang received from the Inland Revenue Department a property tax return for the year of assessment 2010/11. The return was addressed to ‘The Incorporated Owner of Regent Court’. As David Pang considers that the roof is not a flat, the Incorporated Owner of Regent Court is not the owner and the fee is not directly paid to the owners of the flats, he believes that they should not be liable to property tax.

Required:

Advise David Pang whether the Inland Revenue Department is empowered under the Inland Revenue Ordinance to issue a 2010/11 property tax return in the name of ‘The Incorporated Owner of Regent Court’; and whether it is liable to property tax. (8 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第7题

A. Modify the NTFS permissions so Lisa inherits permissions on Sales from \\TestKingA\TestKingData.

B. Remove Lisa from the Users group.

C. Assign the Allow - Modify NTFS permissions to the Creator Owner group.

D. Modify the share permissions for \\TestKingA\TestKingData to assign the Allow - Change permissions to the Everyone group.

第8题

You live in a room in college which you share with another student.

You find it very difficult to work there because your roommate always has friends visiting. He/she has parties in the room and sometimes borrows your things without asking you.

Write a letter to the Residence Assistant at the college and ask for a new room next term. You would prefer a single room. Explain your masons.

You should write at least 150 words.

You do NOT need to write your own address.

Begin your letter as follows:

Dear ______,

第9题

A. On Server2, enable Shadow Copies for all volumes.

B. On Server2, create an Automated System Recovery (ASR) backup.

C. Assign your user account the Full Control share permission to \\server2\data.

D. On the Customize tab in the \\server2\data properties, click Restore Default.

第10题

A. On Server2, enable Shadow Copies for all volumes.

B. On Server2, create an Automated System Recovery (ASR) backup.

C. Assign your user account the Full Control share permission to \\server2\data.

D. On the Customize tab in the \\server2\data properties, click Restore Default.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!