重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Domingo Gomez

(1) Domingo is aged 67.

(2) During the tax year 2008-09 he received the state pension of £4,500 and a private pension of £2,300.

(3) In addition to his pension income Domingo received building society interest of £14,400 and interest of £600 on the maturity of a savings certificate from the National Savings and Investments Bank during the tax year 2008–09. These were the actual cash amounts received.

(4) During the tax year 2008–09 Domingo made donations of £300 (gross) to local charities. These were not made under the gift aid scheme.

Erigo Gomez

(1) Erigo is aged 56.

(2) He is employed as a business journalist by Economical plc, a magazine publishing company. During the tax year 2008–09 Erigo was paid a gross annual salary of £36,000.

(3) During the tax year 2008–09 Erigo used his private motor car for business purposes. He drove 18,000 miles in the performance of his duties for Economical plc, for which the company paid an allowance of 20 pence per mile.

(4) During June 2008 Economical plc paid £11,400 towards the cost of Erigo’s relocation when he was required to move his place of employment. Erigo’s previous main residence was 140 miles from his new place of employment with the company. The £11,400 covered the cost of disposing of Erigo’s old property and of acquiring a new property.

(5) Erigo contributed 6% of his gross salary of £36,000 into Economical plc’s HM Revenue and Customs’ registered occupational pension scheme.

(6) During the tax year 2008–09 Erigo donated £100 (gross) per month to charity under the payroll deduction scheme.

Fargo Gomez

(1) Fargo is aged 53.

(2) He commenced self-employment as a business consultant on 6 July 2008. Fargo’s tax adjusted trading profit based on his draft accounts for the nine-month period ended 5 April 2009 is £64,800. This figure is before making any adjustments required for:

(i) Advertising expenditure of £2,600 incurred during May 2008. This expenditure has not been deducted in

calculating the profit of £64,800.

(ii) Capital allowances.

(3) The only item of plant and machinery owned by Fargo is his motor car. This cost £11,000 on 6 July 2008.

During the nine-month period ended 5 April 2009 Fargo drove a total of 24,000 miles, of which 8,000 were for private journeys.

(4) During the tax year 2008-09 Fargo contributed £5,200 (gross) into a personal pension scheme, and made gift aid donations totalling £2,400 (net) to national charities.

Tax returns

For the tax year 2008–09 Domingo wants to file a paper self-assessment tax return and have HM Revenue and Customs prepare a self-assessment on his behalf. Erigo also wants to file a paper tax return but will prepare his own self-assessment. Fargo wants to file his tax return online.

Required:

(a) Calculate the respective income tax liabilities for the tax year 2008–09 of:

(i) Domingo Gomez; (6 marks)

(ii) Erigo Gomez; (6 marks)

(iii) Fargo Gomez. (7 marks)

(b) Advise Domingo, Erigo and Fargo Gomez of the latest dates by which their respective self-assessment tax returns for the tax year 2008–09 will have to be submitted given their stated filing preferences. (3 marks)

(c) Advise Domingo, Erigo and Fargo Gomez as to how long they must retain the records used in preparing their respective tax returns for the tax year 2008–09, and the potential consequences of not retaining the records for the required period. (3 marks)

更多“Domingo, Erigo and Fargo Gomez are three brothers. The following information is available”相关的问题

更多“Domingo, Erigo and Fargo Gomez are three brothers. The following information is available”相关的问题

第1题

The following

information is available in respect of the year ended 5 April 2009:

(1) Andrew received gross income of £50,000 from Slick-Productions Ltd. He works a set number of hours each week and is paid an hourly rate for the work that he does. When Andrew works more than the set number of hours he is paid overtime.

(2) Andrew is under an obligation to accept the work offered to him by Slick-Productions Ltd, and the work is carried out under the control of the company’s production manager. He is obliged to do the work personally, and this is all performed at Slick-Productions Ltd’s premises.

(3) All of the equipment that Andrew uses is provided by Slick-Productions Ltd.

Andrew has several friends who are cameramen, and they are all treated as self-employed. He therefore considers that he should be treated as self-employed as well in relation to his work for Slick-Productions Ltd.

Required:

(a) List those factors that indicate that Andrew Zoom should be treated as an employee in relation to his work for Slick-Productions Ltd rather than as self-employed.

Note: you should confine your answer to the information given in the question. (4 marks)

(b) Calculate Andrew Zoom’s income tax liability and national insurance contributions for the tax year 2008–09 if he is treated:

(i) As an employee in respect of his work for Slick-Productions Ltd;

Note: You are not required to calculate employers’ national insurance contributions. (3 marks)

(ii) As self-employed in respect of his work for Slick-Productions Ltd. (3 marks)

第2题

5 Assume today’s date is 1 May 2005.

On 1 April 1999, Alan set up his own company, Alantech Ltd to design and produce technology components in mobile

phones. He personally owns 100% of the share capital. Accounts are drawn up to 31 December each year.

The company was successful, and the profits made allowed Alantech to buy 7.5% of the ordinary shares in another

technology company, Mobile Ltd, on 1 July 2001. The price paid for the shares was £75,000. At this time, the

remaining ordinary shares in Mobile were held by Boron Ltd (7.5%), Carbon plc (40%) and Diamond Ltd (45%).

Technology companies faced difficult trading during this time, and although Alantech Ltd continued to make profits,

other companies suffered. This allowed Alantech Ltd to buy 100% of the shares of Boron Ltd (together with its 100%

subsidiary, Bubble Ltd) at a low price as both companies were performing poorly. The acquisition took place on 1

July 2004, and was funded by the sale of a building used in Alantech Ltd’s trade. The building had cost £150,000

on 1 September 1999, and was sold for £250,000 on 1 May 2004.

Trading results for the companies are as follows:

Additional information:

– Boron Ltd’s chargeable gain took place prior to its acquisition by Alantech Ltd.

– Bubble Ltd has brought forward Schedule D Case I losses of £25,000 as at 1 January 2004.

– It is anticipated that Boron Ltd will make a small Schedule D Case I loss in 2005.

– Mobile Ltd is profit making.

Alan believes that to improve the Boron Ltd business, the company needs to invest in new high-tech fixed machinery

within the next year. The projected cost of the fixed machinery is £200,000. In order to raise funds, Alantech Ltd and

Boron Ltd will have to sell the shares in Mobile Ltd. From an examination of Boron Ltd’s accounting records, Alan

understands that Boron Ltd’s holding of shares in Mobile Ltd was bought on 1 November 2000 for £55,000.

Alan has identified a possible sale of the group’s entire shareholdings (15%) in Mobile Ltd for £300,000 to Carbon

plc, as this will give Carbon plc a controlling shareholding in Mobile Ltd. He plans to sell the shares at the beginning

of June 2005. Alan has heard that there is a form. of tax relief available to companies selling shares and would like

advice on whether or not it applies to his situation.

In addition, Alan has struggled to deal with the VAT returns for each company in the group, in particular the intragroup

transactions, and wonders if there is any way in which the VAT accounting for the group can be simplified.

Required:

(a) Calculate the chargeable gain arising on Alantech Ltd’s disposal of the building in May 2004. State clearly

any reliefs available, and the conditions to be satisfied to obtain such reliefs. (6 marks)

第3题

1 Today’s date is 8 June 2005.

David and Debbie were an elderly couple who had worked hard and over a number of years they built up a successful

family company, Dee Limited. Their success allowed them to accumulate a series of investments. David died in May

2005. Debbie is 66 and still in good health.

The couple had two children, Andrew and Allison. Andrew, aged 37, is single but is shortly to be married. He is the

managing director of the family trading company, Dee Limited, which was set up 30 years ago by David and Debbie.

Both Andrew and Allison are shareholders in the company, although Allison does not work for the company. She is

32, and lives abroad with her husband and two children (aged 2 and 4) in a villa gifted to her by Debbie in June

2003. The villa was worth £180,000 at that time, but the current value has fallen to £110,000 as a result of

exchange rate movements.

Dee Limited is currently worth £1,260,000 in total, and the value is unlikely to change in the foreseeable future. The

shareholdings in the company at the date of David’s death (May 2005) were held as follows:

Required:

(a) Calculate the inheritance tax (IHT) that will be payable as a result of David’s death. Your answer should

include calculations of the tax arising on any lifetime transfers and give reasons for any reliefs given.

(12 marks)

第4题

5 Gloria Seaford is UK resident and ordinarily resident but is not domiciled in the UK.

Gloria has owned and run a shop selling books, cards and small gifts as a sole trader since June 1992. She

purchased her current premises, which were built in 1990, in July 2005 for £267,000. Gloria is registered for value

added tax. Gloria will be 66 on 4 January 2007 and, with this in mind, on 1 November 2006 she started looking

for a buyer for the business so that she could retire.

Gloria has received an offer of £335,000 for the shop premises from Ned Skillet who intends to convert the building

into a restaurant. It can be assumed that the sale will take place on 28 February 2007 and that Gloria will cease to

trade on that day.

Gloria estimates that on 28 February 2007 she will be able to sell the shelving and other shop fittings to local

businesses for £1,400 (no item will be sold for more than cost). She has agreed to sell all stock on hand on

28 February 2007 to a competitor at cost plus 5%. This is expected to result in sales revenue of £8,300. The only

other business asset is a van that is currently used 85% for business purposes. The van is expected to be worth

£4,700 on 28 February 2007 and Gloria will keep it for her private use.

Gloria’s tax adjusted trading profit for the year ended 31 October 2006 was £39,245. The forecast tax adjusted

trading profit for the period ending 28 February 2007, before taking account of the final sale of the business assets

on that date and before deduction of capital allowances, is £11,500. Gloria has overlap profits brought forward of

£15,720.

The tax written down value on the capital allowance general pool at 31 October 2006 was £4,050. Gloria purchased

equipment for £820 in November 2006. The tax written down value of the van at 31 October 2006 was £4,130.

In 2006/07 Gloria will have a taxable retirement pension of £4,300 and bank interest of £13,500 credited to her

bank account.

On 1 November 2004 Gloria inherited the following assets from her aunt.

第5题

to make direct to

the Revenue in respect of the years of assessment 2005/06 and 2006/07, clearly identifying for each

payment listed, the amount, the nature of the liability/liabilities, and the due date. (5 marks)

第6题

uires advice in respect of a loan to the partnership, the calculation of her share of profits and the tax treatment of her redundancy payment.

Bex:

– Is resident and domiciled in the UK.

– Received an annual salary of £120,000 from her former employer, Cape Ltd.

– Was made redundant by Cape Ltd on 30 September 2015.

– Joined Amy, a sole trader, to form. a partnership on 1 January 2016.

– Has no other source of income.

Amy and Bex partnership:

– Will prepare its first set of accounts for the 16-month period to 30 April 2017.

– Is expected to make a tax-adjusted profit of £255,000 (before deducting interest and capital allowances) for the period ending 30 April 2017.

– The tax written down value on its main pool at 1 January 2016 is £nil.

– Except for the computer referred to below, no further assets will be purchased by either Amy or Bex for use in the partnership in the period ending 30 April 2017.

Profit sharing arrangements:

– The partnership’s profit sharing agreement is as follows:

Bex – loans:

– In addition to her capital contribution, Bex will make a £20,000 loan to the partnership on 1 August 2016. The partnership will use this money wholly for business purposes.

– This loan will be financed by a £25,000 personal loan from Bex’s bank, taken out on the same date.

– The remaining £5,000 of the bank loan will be used to purchase a computer for use in the partnership. Bex will have 20% private use of this computer.

– Both the loan from Bex to the partnership and the personal bank loan to Bex will carry interest at the rate of 5% per annum.

Bex – redundancy package from Cape Ltd:

– The package comprised a £22,000 statutory redundancy payment and an additional ex-gratia payment of £48,000.

– Bex also received three months’ salary in lieu of notice, as specified in her contract of employment.

Required:

(a) (i) Explain, with the aid of calculations, the tax deductions which will be available in respect of the loan interest payable on both the loan from Bex to the partnership and the personal bank loan to Bex. (7 marks)

(ii) In respect of the period ending 30 April 2017, show the allocation between the partners of the taxable trading profit of the partnership. (4 marks)

(iii) Calculate Bex’s taxable trading income in respect of her share of the partnership profits for all relevant tax years. Note: Your answer to (a)(iii) should clearly state the tax years and basis periods involved. (3 marks)

(b) Explain the income tax implications for Bex of the receipt of the redundancy package from Cape Ltd and calculate her total income tax liability for the tax year 2015/16. (6 marks)

第7题

ria. Maria wants advice on the tax consequences of selling some of her shares back to Granada Ltd. Granada Ltd wants advice on the corporation tax and value added tax (VAT) implications of the recent acquisition of an unincorporated business.

Maria:

– Is resident and domiciled in the UK.

– Is a higher rate taxpayer and will remain so in the future.

– Has already realised chargeable gains of £15,000 in the tax year 2015/16.

Shares in Granada Ltd:

– Maria subscribed for 10,000 £1 ordinary shares in Granada Ltd at par in June 2006.

– Maria is one of four equal shareholders and directors of Granada Ltd.

– Maria intends to sell either 2,700 or 3,200 shares back to the company on 31 March 2016 at their current market value of £12·80 per share.

– All of the conditions for capital treatment are satisfied, except for, potentially, the condition relating to the reduction in the level of shareholding.

Granada Ltd:

– Is a UK resident trading company which manufactures knitwear.

– Prepares accounts to 31 December each year.

– Is registered for VAT.

– Acquired the trade and assets of an unincorporated business, Starling Partners, on 1 January 2016.

Starling Partners:

– Had been trading as a partnership for many years as a wholesaler of handbags within the UK.

– Starling Partners’ main assets comprise a freehold commercial building and its ‘Starling’ brand, which were valued on acquisition by Granada Ltd at £105,000 and £40,000 respectively.

– Is registered for VAT.

– The transfer of its trade and assets to Granada Ltd qualified as a transfer of a going concern (TOGC) for VAT purposes.

– The business is forecast to make a trading loss of £130,000 in the year ended 31 December 2016.

Granada Ltd – results and proposed expansion:

– The knitwear business is expected to continue making a taxable trading profit of around £100,000 each year.

– Granada Ltd has no non-trading income but realised a chargeable gain of £10,000 on 1 March 2016.

– Granada Ltd is considering expanding the wholesale handbag trade acquired from Starling Partners into the export market from 1 January 2017.

– Granada Ltd anticipates that this expansion will result in the wholesale handbag trade returning a profit of £15,000 in the year ended 31 December 2017.

Required:

(a) (i) Explain, with the aid of calculations, why the capital treatment WILL NOT apply if Maria sells 2,700 of her shares back to Granada Ltd, but WILL apply if, alternatively, she sells back 3,200 shares. (4 marks)

(ii) Calculate Maria’s after-tax proceeds per share if she sells:

(1) 2,700 shares back to Granada Ltd; and alternatively

(2) 3,200 shares back to Granada Ltd. (4 marks)

(b) (i) Describe the corporation tax treatment of the acquisition of the ‘Starling’ brand by Granada Ltd, if no charge for amortisation was required in its statement of profit or loss. (3 marks)

(ii) Discuss how Granada Ltd could obtain relief for the trading loss expected to be incurred by the trade acquired from Starling Partners, if it does not wish to carry any of the loss back. (5 marks)

(c) Explain the value added tax (VAT) implications for Granada Ltd in respect of the acquisition of the business of Starling Partners, and the additional information needed in relation to the building to fully clarify the VAT position. (4 marks)

第8题

Section B – TWO questions ONLY to be attempted

Your client, Eric, requires advice on the capital gains tax implications arising from the receipt of insurance proceeds and the disposal of some shares, and the inheritance tax reliefs available in respect of assets in his estate at death. His son Zak requires advice regarding the application of the personal service company (IR35) legislation.

Eric:

– Is UK resident and domiciled.

– Is a higher rate taxpayer.

– Is in ill health and is expected to die within the next few months.

Capital transactions in the tax year 2014/15:

– Eric made no disposals for capital gains tax purposes in the tax year 2014/15 other than those detailed below.

– Eric received insurance proceeds of £10,000 following damage to a valuable painting.

– Eric sold half of his shareholding in Malaga plc for £11·50 per share.

Damaged painting:

– Eric purchased the painting for £46,000 in July 2012.

– The painting was damaged in October 2014 such that immediately afterwards its value fell to £38,000.

– The insurance proceeds of £10,000 were received by Eric on 1 December 2014.

– Eric has not had the painting repaired.

Malaga plc shares:

– Malaga plc is a quoted trading company with 200,000 issued shares.

– 80% of Malaga plc’s chargeable assets have always been chargeable business assets.

– Eric was given 12,000 shares in Malaga plc by his sister on 1 April 2010, when they were valued at £126,000.

– Eric’s sister had purchased the shares for £96,000 on 1 March 2009.

– Gift relief was claimed in respect of the gift of the shares to Eric on 1 April 2010.

– Eric paid the inheritance tax arising in respect of this gift following his sister’s death on 1 September 2011.

– Eric has never worked for Malaga plc.

– Eric sold 6,000 shares in Malaga plc on 1 March 2015.

Assets owned by Eric and a previous lifetime gift:

– Eric owns farmland in the UK, which has been leased to a tenant farmer for the last ten years.

– The farmland has a market value of £420,000 and an agricultural value of £340,000.

– Eric’s other assets, excluding the remaining Malaga plc shares, are valued at £408,000.

– Eric has made only one previous lifetime gift, of £60,000 cash to his son Zak on 1 July 2009.

Zak:

– Is the sole shareholder, director and employee of Yoyo Ltd, a company which provides consultancy services.

– In the year ended 31 March 2016, Yoyo Ltd’s gross fee income from relevant engagements performed by Zak will be £110,000.

– In the tax year 2015/16, Zak will draw a salary of £24,000 and dividends of £50,000 from Yoyo Ltd.

– Neither Yoyo Ltd nor Zak has any other source of income.

Required:

(a) Calculate Eric’s total after-tax proceeds in respect of the two capital gains tax disposals in the tax year 2014/15. (6 marks)

(b) (i) On the assumption that Eric dies on 31 March 2016, advise on the availability and effect (if any), of agricultural property relief, business property relief and quick succession relief in respect of the farmland and the retained shares in Malaga plc.

Note: You are not required to prepare calculations for this part of the question. (6 marks)

(ii) Explain, with the aid of calculations, the impact on the inheritance tax liability arising on Eric’s death if Eric does not die until 1 August 2016. (3 marks)

(c) Calculate Zak’s taxable income for the tax year 2015/16 if the personal service company (IR35) legislation were to apply to the fee income received by Yoyo Ltd. (5 marks)

第9题

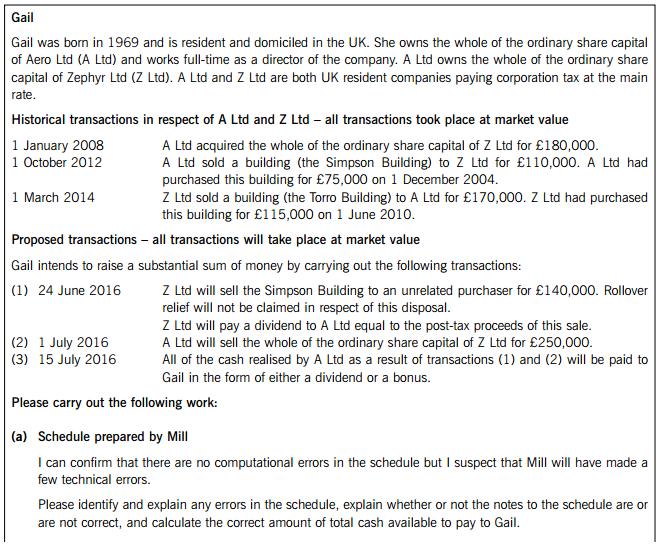

l of Aero Ltd. An email from your manager setting out the matters discussed in the meeting and a schedule prepared by Mill, a junior member of your firm’s tax department, are set out below.

Email from your manager – dated 9 June 2016

Schedule prepared by Mill

Required:

Carry out the work requested in the email from your manager. The following marks are available:

(a) Schedule prepared by Mill. (11 marks)

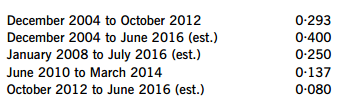

Note: The following movements in the Retail Prices Index should be used, where necessary.

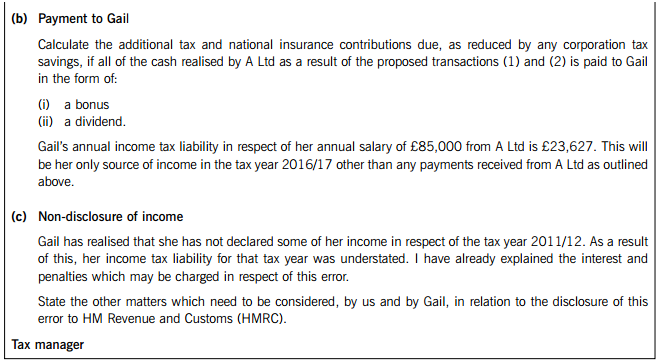

(b) Payment to Gail. (9 marks)

(c) Non-disclosure of income. (5 marks)

第10题

Section A – BOTH questions are compulsory and MUST be attempted

Your manager has received schedules of information from Ray and Shanira in connection with their personal tax affairs. These schedules and an extract from an email from your manager are set out below.

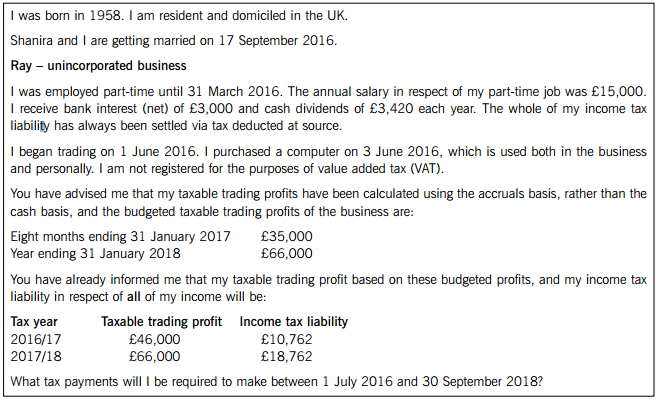

Schedule of information from Ray – dated 8 June 2016

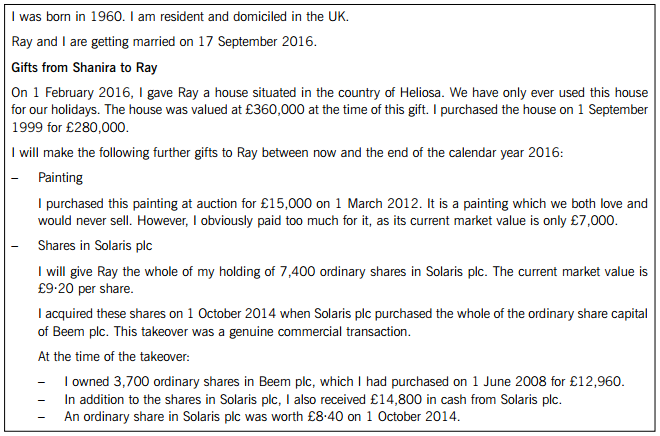

Schedule of information from Shanira – dated 8 June 2016

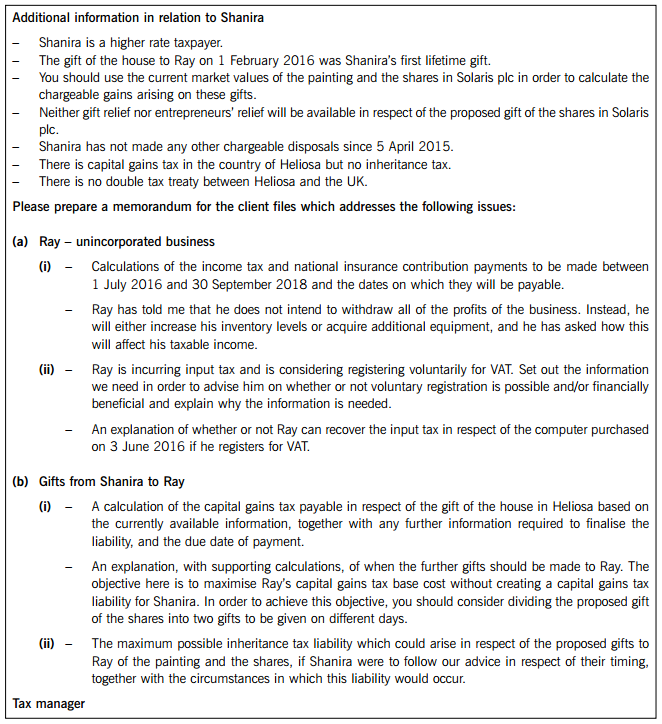

Extract from an email from your manager – dated 9 June 2016

Required:

Prepare the memorandum as requested in the email from your manager. The following marks are available:

(a) Ray – unincorporated business.

(i) Income tax and national insurance contribution payments, and the level of his taxable income. (11 marks)

(ii) Value added tax (VAT). (5 marks)

(b) Gifts from Shanira to Ray.

(i) Capital gains tax. (10 marks)

(ii) Inheritance tax. (5 marks)

Professional marks will be awarded for the approach taken to problem solving, the clarity of the explanations and calculations, the effectiveness with which the information is communicated and the overall presentation. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!