重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

What is the type of offence Zeta Ltd has committed under the Tax Collection and Administrative Law?

A.Transfer pricing

B.Tax avoidance

C.Tax evasion

D.Fraudulence in the issuance of an invoice

更多“The accountant of Zeta Ltd altered the amount charged on an invoice for purchases from RMB”相关的问题

更多“The accountant of Zeta Ltd altered the amount charged on an invoice for purchases from RMB”相关的问题

第1题

ght for RMB10 million and incurred construction costs of RMB12 million. The shopping mall was sold for RMB32 million.

What is the amount of business tax payable on the sale of the shopping mall?

A.RMB1·6 million

B.RMB1·1 million

C.RMB0·5 million

D.RMB1 million

第2题

. The supermarket agreed to bear all of the taxes for the winners of the lucky draw.

What is the individual income tax (IIT) payable on Ms Wang’s lucky draw prize and who will be responsible for paying it to the tax bureau?

A.A

B.B

C.C

D.D

第3题

rchased light bulbs for RMB100,000 (excluding value added tax (VAT)) and a VAT special invoice was obtained. Carti Ltd exported the light bulbs to Europe for RMB150,000. The export VAT refund rate for light bulbs is 16%.

What is the amount of the value added tax (VAT) refund which Carti Ltd can receive?

A.RMB16,000

B.RMB24,000

C.RMB8,000

D.RMB500

第4题

from China customs duty?

(1) The importation of goods into a China free trade zone

(2) The importation of equipment under an operating lease

(3) The importation of raw materials under a processing trade

(4) The importation of raw materials under a general trade

A.1, 2, 3 and 4

B.1, 2 and 3 only

C.1 and 3 only

D.2 and 4 only

第5题

ate of 25%. Xuno Ltd’s taxable profits (losses) since its inception are summarised below:

What is the amount of enterprise income tax (EIT) payable by Xuno Ltd in 2014?

A.RMB34,250

B.RMB90,000

C.RMB127,500

D.RMB60,000

第6题

A computer trading company took ten computers from its warehouse.

Which of the following uses of the computers will be classed as a deemed sale for BOTH value added tax (VAT) and enterprise income tax (EIT)?

A.To be used in the company’s offices as fixed assets

B.To be given as souvenirs to the company’s customers

C.To be sent to the company’s branch office for sale

D.To be scrapped as they were no longer saleable

第7题

Which of the following transactions is NOT subject to land appreciation tax (LAT)?

A.A state-owned enterprise contributed its land use right as capital to its subsidiary for the subsidiary to build a shopping mall

B.A local government transferred a land use right to a property developer

C.A property developer sold a standard residential property with a land appreciation value of 63%

D.An individual sold his self-used residence after owning it for one year

第8题

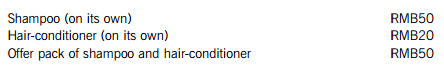

shampoo with a free bottle of hair-conditioner. This is termed as a ‘buy-one-get-one-free’ offer. The retail price (i.e. inclusive of value added tax (VAT)) of the items is as below:

In January 2015, the supermarket sold 2,000 of the offer packs.

What is the amount of value added tax (VAT) charged on the sale of the 2,000 offer packs?

A.RMB14,530

B.RMB17,000

C.RMB20,342

D.RMB23,800

第9题

25%. KINO Ltd has a wholly (100%) owned subsidiary, Company A, set up in Country X.

In 2014, Company A had a profit of USD200,000 and paid enterprise income tax in Country X at the rate of 15% (USD30,000). Company A declared a dividend of USD170,000 and paid this to KINO Ltd after deduction of withholding income tax of 10% (USD17,000).

What is the additional enterprise income tax (EIT) which KINO Ltd will pay on the dividend income received from its subsidiary, Company A?

A.USD25,500

B.USD3,000

C.USD42,500

D.USD0

第10题

Section A – ALL 15 questions are compulsory and MUST be attempted

Which government authorities promulgated the Enterprise Income Tax Law and the Consumption Tax Provisional Regulations?

A.The Standard Committee of the National People’s Congress and the State Council

B.The State Council and the Ministry of Finance

C.The Ministry of Finance and the State Administration of Taxation

D.The State Administration of Taxation and the Standard Committee of the National People’s Congress

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!