重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Which of the following statements is correct?

A.A bonus issue can be used to raise new equity finance

B.A share repurchase scheme can increase both earnings per share and gearing

C.Miller and Modigliani argued that the financing decision is more important than the dividend decision

D.Shareholders usually have the power to increase dividends at annual general meetings of a company

更多“Which of the following statements is correct?A.A bonus issue can be used to raise new equi”相关的问题

更多“Which of the following statements is correct?A.A bonus issue can be used to raise new equi”相关的问题

第1题

$3·10 per share. The total shareholder return for the year was 19·7%. What is the current share price?

A.$3·50

B.$3·71

C.$3·31

D.$3·35

第2题

The following financial information relates to MFZ Co, a listed company:

MFZ Co has 12 million ordinary shares in issue and has not issued any new shares in the period under review. The company is financed entirely by equity, and is considering investing $9·2 million of new finance in order to expand existing business operations. This new finance could be either long-term debt finance or new equity via a rights issue. The rights issue price would be at a 20% discount to the current share price. Issue costs of $200,000 would have to be met from the cash raised, whether the new finance was equity or debt.

The annual report of MFZ Co states that the company has three financial objectives:

Objective 1: To achieve growth in profit before interest and tax of 4% per year

Objective 2: To achieve growth in earnings per share of 3·5% per year

Objective 3: To achieve total shareholder return of 5% per year

MFZ Co has a cost of equity of 12% per year.

Required:

(a) Analyse and discuss the extent to which MFZ Co has achieved each of its stated objectives. (7 marks)

(b) Calculate the total equity market value of MFZ Co for 2014 using the dividend growth model and briefly discuss why the dividend growth model value may differ from the current equity market value. (5 marks)

(c) Calculate the theoretical ex rights price per share for the proposed rights issue. (5 marks)

(d) Discuss the sources and characteristics of long-term debt finance which may be available to MFZ Co. (8 marks)

第3题

The market value of each ordinary share is $7·50. The company is also financed by 7% bonds with a nominal value of $100 per bond, which will be redeemed in seven years’ time at nominal value. The bonds have a total nominal value of $14 million. Interest on the bonds has just been paid and the current market value of each bond is $107·14.

Fence Co plans to invest in a project which is different to its existing business operations and has identified a company in the same business area as the project, Hex Co. The equity beta of Hex Co is 1·2 and the company has an equity market value of $54 million. The market value of the debt of Hex Co is $12 million.

The risk-free rate of return is 4% per year and the average return on the stock market is 11% per year. Both companies pay corporation tax at a rate of 20% per year.

Required:

(a) Calculate the current weighted average cost of capital of Fence Co. (7 marks)

(b) Calculate a cost of equity which could be used in appraising the new project. (4 marks)

(c) Explain the difference between systematic and unsystematic risk in relation to portfolio theory and the capital asset pricing model. (6 marks)

(d) Discuss the differences between weak form, semi-strong form. and strong form. capital market efficiency, and discuss the significance of the efficient market hypothesis (EMH) for the financial manager. (8 marks)

第4题

ws:

For the year to end of March 2014, CSZ Co had domestic and foreign sales of $40 million, all on credit, while cost of sales was $26 million. Trade payables related to both domestic and foreign suppliers.

For the year to end of March 2015, CSZ Co has forecast that credit sales will remain at $40 million while cost of sales will fall to 60% of sales. The company expects current assets to consist of inventory and trade receivables, and current liabilities to consist of trade payables and the company’s overdraft.

CSZ Co also plans to achieve the following target working capital ratio values for the year to the end of March 2015:

Required:

(a) Calculate the working capital cycle (cash collection cycle) of CSZ Co at the end of March 2014 and discuss whether a working capital cycle should be positive or negative. (6 marks)

(b) Calculate the target quick ratio (acid test ratio) and the target ratio of sales to net working capital of CSZ Co at the end of March 2015. (5 marks)

(c) Analyse and compare the current asset and current liability positions for March 2014 and March 2015, and discuss how the working capital financing policy of CSZ Co would have changed. (8 marks)

(d) Briefly discuss THREE internal methods which could be used by CSZ Co to manage foreign currency transaction risk arising from its continuing business activities. (6 marks)

第5题

and is preparing its capital budget. The company is considering five projects, as follows:

All five projects have a project life of four years. Projects A, B, C and D are divisible, and Projects B and D are mutually exclusive. All net present values are in nominal, after-tax terms.

Project E

This is a strategically important project which the Board of OAP Co have decided must be undertaken in order for the company to remain competitive, regardless of its financial acceptability. Information relating to the future cash flows of this project is as follows:

These forecasts are before taking account of selling price inflation of 5·0% per year, variable cost inflation of 6·0% per year and fixed cost inflation of 3·5% per year. The fixed costs are incremental fixed costs which are associated with Project E. At the end of four years, machinery from the project will be sold for scrap with a value of $400,000. Tax allowable depreciation on the initial investment cost of Project E is available on a 25% reducing balance basis and OAP Co pays corporation tax of 28% per year, one year in arrears. A balancing charge or allowance is available at the end of the fourth year of operation.

OAP Co has a nominal after-tax cost of capital of 13% per year.

Required:

(a) Calculate the nominal after-tax net present value of Project E and comment on the financial acceptability of this project. (14 marks)

(b) Calculate the maximum net present value which can be obtained from investing the fund of $10 million, assuming here that the nominal after-tax NPV of Project E is zero. (5 marks)

(c) Discuss the reasons why the Board of OAP Co may have decided to limit investment funds for the next year. (6 marks)

第6题

l analysts. The value of the company has therefore been a matter of public debate in recent weeks and the following financial information is available:

The shares of GWW Co have a nominal (par) value of 50c per share and a market value of $4·00 per share. The cost of equity of the company is 9% per year. The business sector of GWW Co has an average price/earnings ratio of 17 times. The 8% bonds are redeemable at nominal (par) value of $100 per bond in seven years’ time and the before-tax cost of debt of GWW Co is 6% per year.

The expected net realisable values of the non-current assets and the inventory are $86·0m and $4·2m, respectively. In the event of liquidation, only 80% of the trade receivables are expected to be collectible.

Required:

(a) Calculate the value of GWW Co using the following methods:

(i) market capitalisation (equity market value);

(ii) net asset value (liquidation basis);

(iii) price/earnings ratio method using the business sector average price/earnings ratio;

(iv) dividend growth model using:

(1) the average historic dividend growth rate;

The total marks will be split equally between each part. (10 marks)

(b) Discuss the relative merits of the valuation methods in part (a) above in determining a purchase price for GWW Co.

(c) Calculate the following values for GWW Co:

(i) the before-tax market value of the bonds of GWW Co;

(ii) debt/equity ratio (book value basis);

(iii) debt/equity ratio (market value basis).

Discuss the usefulness of the debt/equity ratio in assessing the financial risk of GWW Co.

The total marks will be split equally between each part. (7 marks)

第7题

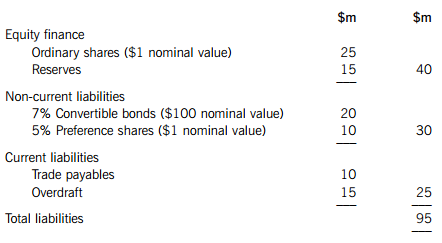

The statement of financial position of BKB Co provides the following information:

BKB Co has an equity beta of 1·2 and the ex-dividend market value of the company’s equity is $125 million. The ex-interest market value of the convertible bonds is $21 million and the ex-dividend market value of the preference shares is $6·25 million.

The convertible bonds of BKB Co have a conversion ratio of 19 ordinary shares per bond. The conversion date and redemption date are both on the same date in five years’ time. The current ordinary share price of BKB Co is expected to increase by 4% per year for the foreseeable future.

The overdraft has a variable interest rate which is currently 6% per year and BKB Co expects this to increase in the near future. The overdraft has not changed in size over the last financial year, although one year ago the overdraft interest rate was 4% per year. The company’s bank will not allow the overdraft to increase from its current level.

The equity risk premium is 5% per year and the risk-free rate of return is 4% per year. BKB Co pays profit tax at an annual rate of 30% per year.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of BKB Co, explaining clearly any assumptions you make. (12 marks)

(b) Discuss why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (4 marks)

(c) Comment on the interest rate risk faced by BKB Co and discuss briefly how this risk can be managed. (5 marks)

(d) Discuss the attractions to a company of convertible debt compared to a bank loan of a similar maturity as a source of finance. (4 marks)

第8题

KXP Co is an e-business which trades solely over the internet. In the last year the company had sales of $15 million. All sales were on 30 days’ credit to commercial customers.

Extracts from the company’s most recent statement of financial position relating to working capital are as follows:

In order to encourage customers to pay on time, KXP Co proposes introducing an early settlement discount of 1% for payment within 30 days, while increasing its normal credit period to 45 days. It is expected that, on average, 50% of customers will take the discount and pay within 30 days, 30% of customers will pay after 45 days, and 20% of customers will not change their current paying behaviour.

KXP Co currently orders 15,000 units per month of Product Z, demand for which is constant. There is only one supplier of Product Z and the cost of Product Z purchases over the last year was $540,000. The supplier has offered a 2% discount for orders of Product Z of 30,000 units or more. Each order costs KXP Co $150 to place and the holding cost is 24 cents per unit per year.

KXP Co has an overdraft facility charging interest of 6% per year.

Required:

(a) Calculate the net benefit or cost of the proposed changes in trade receivables policy and comment on your findings. (6 marks)

(b) Calculate whether the bulk purchase discount offered by the supplier is financially acceptable and comment on the assumptions made by your calculation. (6 marks)

(c) Identify and discuss the factors to be considered in determining the optimum level of cash to be held by a company. (5 marks)

(d) Discuss the factors to be considered in formulating a trade receivables management policy. (8 marks)

第9题

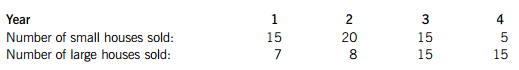

BQK Co, a house-building company, plans to build 100 houses on a development site over the next four years. The purchase cost of the development site is $4,000,000, payable at the start of the first year of construction. Two types of house will be built, with annual sales of each house expected to be as follows:

Houses are built in the year of sale. Each customer finances the purchase of a home by taking out a long-term personal loan from their bank. Financial information relating to each type of house is as follows:

Selling prices and variable cost of construction are in current price terms, before allowing for selling price inflation of 3% per year and variable cost of construction inflation of 4·5% per year.

Fixed infrastructure costs of $1,500,000 per year in current price terms would be incurred. These would not relate to any specific house, but would be for the provision of new roads, gardens, drainage and utilities. Infrastructure cost inflation is expected to be 2% per year.

BQK Co pays profit tax one year in arrears at an annual rate of 30%. The company can claim capital allowances on the purchase cost of the development site on a straight-line basis over the four years of construction.

BQK Co has a real after-tax cost of capital of 9% per year and a nominal after-tax cost of capital of 12% per year. New investments are required by the company to have a before-tax return on capital employed (accounting rate of return) on an average investment basis of 20% per year.

Required:

(a) Calculate the net present value of the proposed investment and comment on its financial acceptability. Work to the nearest $1,000. (13 marks)

(b) Calculate the before-tax return on capital employed (accounting rate of return) of the proposed investment on an average investment basis and discuss briefly its financial acceptability. (5 marks)

(c) Discuss the effect of a substantial rise in interest rates on the financing cost of BQK Co and its customers, and on the capital investment appraisal decision-making process of BQK Co. (7 marks)

第10题

inance. It plans to make a rights issue and to use the funds raised to pay off some of its debt. The rights issue will be at a 20% discount to its current ex-dividend share price of $7·50 per share and Bar Co plans to raise $90 million. Bar Co believes that paying off some of its debt will not affect its price/earnings ratio, which is expected to remain constant.

Income statement information

The 8% bonds are currently trading at $112·50 per $100 bond and bondholders have agreed that they will allow Bar Co to buy back the bonds at this market value. Bar Co pays tax at a rate of 30% per year.

Required:

(a) Calculate the theoretical ex rights price per share of Bar Co following the rights issue. (3 marks)

(b) Calculate and discuss whether using the cash raised by the rights issue to buy back bonds is likely to be financially acceptable to the shareholders of Bar Co, commenting in your answer on the belief that the current price/earnings ratio will remain constant. (7 marks)

(c) Calculate and discuss the effect of using the cash raised by the rights issue to buy back bonds on the financial risk of Bar Co, as measured by its interest coverage ratio and its book value debt to equity ratio. (4 marks)

(d) Compare and contrast the financial objectives of a stock exchange listed company such as Bar Co and the financial objectives of a not-for-profit organisation such as a large charity. (11 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!