重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Ethan, a public limited company, develops, operates and sells investment properties.

(a) Ethan focuses mainly on acquiring properties where it foresees growth potential, through rental income as well as value appreciation. The acquisition of an investment property is usually realised through the acquisition of the entity, which holds the property.

In Ethan’s consolidated financial statements, investment properties acquired through business combinations are recognised at fair value, using a discounted cash flow model as approximation to fair value. There is currently an active market for this type of property. The difference between the fair value of the investment property as determined under the accounting policy, and the value of the investment property for tax purposes results in a deferred tax liability.

Goodwill arising on business combinations is determined using the measurement principles for the investment properties as outlined above. Goodwill is only considered impaired if and when the deferred tax liability is reduced below the amount at which it was first recognised. This reduction can be caused both by a reduction in the value of the real estate or a change in local tax regulations. As long as the deferred tax liability is equal to, or larger than, the prior year, no impairment is charged to goodwill. Ethan explained its accounting treatment by confirming that almost all of its goodwill is due to the deferred tax liability and that it is normal in the industry to account for goodwill in this way.

Since 2008, Ethan has incurred substantial annual losses except for the year ended 31 May 2011, when it made a small profit before tax. In year ended 31 May 2011, most of the profit consisted of income recognised on revaluation of investment properties. Ethan had announced early in its financial year ended 31 May 2012 that it anticipated substantial growth and profit. Later in the year, however, Ethan announced that the expected profit would not be achieved and that, instead, a substantial loss would be incurred. Ethan had a history of reporting considerable negative variances from its budgeted results. Ethan’s recognised deferred tax assets have been increasing year-on-year despite the deferred tax liabilities recognised on business combinations. Ethan’s deferred tax assets consist primarily of unused tax losses that can be carried forward which are unlikely to be offset against anticipated future taxable profits. (11 marks)

(b) Ethan wishes to apply the fair value option rules of IFRS 9 Financial Instruments to debt issued to finance its investment properties. Ethan’s argument for applying the fair value option is based upon the fact that the recognition of gains and losses on its investment properties and the related debt would otherwise be inconsistent. Ethan argued that there is a specific financial correlation between the factors, such as interest rates, that form. the basis for determining the fair value of both Ethan’s investment properties and the related debt. (7 marks)

(c) Ethan has an operating subsidiary, which has in issue A and B shares, both of which have voting rights. Ethan holds 70% of the A and B shares and the remainder are held by shareholders external to the group. The subsidiary is obliged to pay an annual dividend of 5% on the B shares. The dividend payment is cumulative even if the subsidiary does not have sufficient legally distributable profit at the time the payment is due.

In Ethan’s consolidated statement of financial position, the B shares of the subsidiary were accounted for in the same way as equity instruments would be, with the B shares owned by external parties reported as a non-controlling interest. (5 marks)

Required: Discuss how the above transactions and events should be recorded in the consolidated financial statements of Ethan. Note: The mark allocation is shown against each of the three transactions above. Professional marks will be awarded in question 3 for the quality of the discussion. (2 marks)

更多“Ethan, a public limited company, develops, operates and sells investment properties.(a) Et”相关的问题

更多“Ethan, a public limited company, develops, operates and sells investment properties.(a) Et”相关的问题

第1题

Section B – TWO questions ONLY to be attempted

William is a public limited company and would like advice in relation to the following transactions.

(a) William owned a building on which it raised finance. William sold the building for $5 million to a finance company on 1 June 2011 when the carrying amount was $3·5 million. The same building was leased back from the finance company for a period of 20 years, which was felt to be equivalent to the majority of the asset’s economic life. The lease rentals for the period are $441,000 payable annually in arrears. The interest rate implicit in the lease is 7%. The present value of the minimum lease payments is the same as the sale proceeds.

William wishes to know how to account for the above transaction for the year ended 31 May 2012. (7 marks)

(b) William operates a defined benefit scheme for its employees. At June 2011, the net pension liability recognised in the statement of financial position was $18 million, excluding an unrecognised actuarial gain of $15 million which William wishes to spread over the remaining working lives of the employees. The scheme was revised on 1 June 2011. This resulted in the benefits being enhanced for some members of the plan and because benefits do not vest for these members for five years, William wishes to spread the increased cost over that period. However, part of the scheme was to be closed, without any redundancy of employees.

William requires advice on how to account for the above scheme under IAS 19 Employee Benefits including the presentation and measurement of the pension expense. (7 marks)

(c) On 1 June 2009, William granted 500 share appreciation rights to each of its 20 managers. All of the rights vest after two years service and they can be exercised during the following two years up to 31 May 2013. The fair value of the right at the grant date was $20. It was thought that three managers would leave over the initial two-year period and they did so. The fair value of each right was as follows:

On 31 May 2012, seven managers exercised their rights when the intrinsic value of the right was $21.

William wishes to know what the liability and expense will be at 31 May 2012. (5 marks)

(d) William acquired another entity, Chrissy, on 1 May 2012. At the time of the acquisition, Chrissy was being sued as there is an alleged mis-selling case potentially implicating the entity. The claimants are suing for damages of $10 million. William estimates that the fair value of any contingent liability is $4 million and feels that it is more likely than not that no outflow of funds will occur.

William wishes to know how to account for this potential liability in Chrissy’s entity financial statements and whether the treatment would be the same in the consolidated financial statements. (4 marks)

Required: Discuss, with suitable computations, the advice that should be given to William in accounting for the above events.

Note: The mark allocation is shown against each of the four events above.

Professional marks will be awarded in question 2 for the quality of the discussion. (2 marks)

第2题

Section A – THIS ONE question is compulsory and MUST be attempted

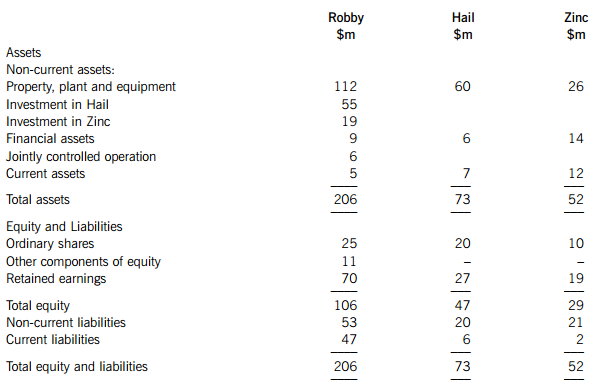

The following draft statements of financial position relate to Robby, Hail and Zinc, all public limited companies, as at 31 May 2012:

The following information needs to be taken into account in the preparation of the group financial statements of Robby:

(i) On 1 June 2010, Robby acquired 80% of the equity interests of Hail. The purchase consideration comprised cash of $50 million. Robby has treated the investment in Hail at fair value through other comprehensive income (OCI).

A dividend received from Hail on 1 January 2012 of $2 million has similarly been credited to OCI.

It is Robby’s policy to measure the non-controlling interest at fair value and this was $15 million on 1 June 2010.

On 1 June 2010, the fair value of the identifiable net assets of Hail were $60 million and the retained earnings of Hail were $16 million. The excess of the fair value of the net assets is due to an increase in the value of non-depreciable land.

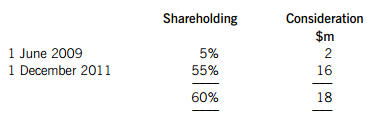

(ii) On 1 June 2009, Robby acquired 5% of the ordinary shares of Zinc. Robby had treated this investment at fair value through profit or loss in the financial statements to 31 May 2011.

On 1 December 2011, Robby acquired a further 55% of the ordinary shares of Zinc and gained control of the company.

The consideration for the acquisitions was as follows:

At 1 December 2011, the fair value of the equity interest in Zinc held by Robby before the business combination was $5 million.

It is Robby’s policy to measure the non-controlling interest at fair value and this was $9 million on 1 December 2011.

The fair value of the identifiable net assets at 1 December 2011 of Zinc was $26 million, and the retained earnings were $15 million. The excess of the fair value of the net assets is due to an increase in the value of property, plant and equipment (PPE), which was provisional pending receipt of the final valuations. These valuations were received on 1 March 2012 and resulted in an additional increase of $3 million in the fair value of PPE at the date of acquisition. This increase does not affect the fair value of the non-controlling interest at acquisition. PPE is to be depreciated on the straight-line basis over a remaining period of five years.

(iii) Robby has a 40% share of a joint operation, a natural gas station. Assets, liabilities, revenue and costs are apportioned on the basis of shareholding.

The following information relates to the joint arrangement activities:

– The natural gas station cost $15 million to construct and was completed on 1 June 2011 and is to be dismantled at the end of its life of 10 years. The present value of this dismantling cost to the joint arrangement at 1 June 2011, using a discount rate of 5%, was $2 million.

– In the year, gas with a direct cost of $16 million was sold for $20 million. Additionally, the joint arrangement incurred operating costs of $0·5 million during the year.

Robby has only contributed and accounted for its share of the construction cost, paying $6 million. The revenue and costs are receivable and payable by the other joint operator who settles amounts outstanding with Robby after the year end.

(iv) Robby purchased PPE for $10 million on 1 June 2009. It has an expected useful life of 20 years and is depreciated on the straight-line method. On 31 May 2011, the PPE was revalued to $11 million. At 31 May 2012, impairment indicators triggered an impairment review of the PPE. The recoverable amount of the PPE was $7·8 million. The only accounting entry posted for the year to 31 May 2012 was to account for the depreciation based on the revalued amount as at 31 May 2011. Robby’s accounting policy is to make a transfer of the excess depreciation arising on the revaluation of PPE.

(v) Robby held a portfolio of trade receivables with a carrying amount of $4 million at 31 May 2012. At that date, the entity entered into a factoring agreement with a bank, whereby it transfers the receivables in exchange for $3·6 million in cash. Robby has agreed to reimburse the factor for any shortfall between the amount collected and $3·6 million. Once the receivables have been collected, any amounts above $3·6 million, less interest on this amount, will be repaid to Robby. Robby has derecognised the receivables and charged $0·4 million as a loss to profit or loss.

(vi) Immediately prior to the year end, Robby sold land to a third party at a price of $16 million with an option to purchase the land back on 1 July 2012 for $16 million plus a premium of 3%. The market value of the land is $25 million on 31 May 2012 and the carrying amount was $12 million. Robby accounted for the sale, consequently eliminating the bank overdraft at 31 May 2012.

Required:

(a) Prepare a consolidated statement of financial position of the Robby Group at 31 May 2012 in accordance with International Financial Reporting Standards. (35 marks)

(b) (i) In the above scenario (information point (v)), Robby holds a portfolio of trade receivables and enters into a factoring agreement with a bank, whereby it transfers the receivables in exchange for cash. Robby additionally agreed to other terms with the bank as regards any collection shortfall and repayment of any monies to Robby. Robby derecognised the receivables. This is an example of the type of complex transaction that can arise out of normal terms of trade. The rules regarding derecognition are quite complex and are often not understood by entities.

Describe the rules of IFRS 9 Financial Instruments relating to the derecognition of a financial asset and how these rules affect the treatment of the portfolio of trade receivables in Robby’s financial statements. (9 marks)

(ii) Discuss the legitimacy of Robby selling land just prior to the year end in order to show a better liquidity position for the group and whether this transaction is consistent with an accountant’s responsibilities to users of financial statements.

Note: Your answer should include reference to the above scenario. (6 marks)

第3题

any companies following the current provisions of US GAAP. The revenue recognition standard, IAS 18 Revenue, has been criticised because an entity applying the standards might recognise amounts in the financial statements that do not faithfully represent the nature of the transactions. It has been further argued that current standards are inconsistent with principles used in other accounting standards, and further that the notion of the risks and rewards of ownership has also been subjectively applied in sale transactions.

Required:

(a) (i) Discuss the main weaknesses in the current standard on revenue recognition; (11 marks)

(ii) Discuss the reasons why it might be relevant to take into account credit risk and the time value of money in assessing revenue recognition. (5 marks)

Professional marks will be awarded in part (a) for clarity and expression of your discussion. (2 marks)

(b) (i) Venue enters into a contract with a customer to provide computers at a value of $1 million. The terms are that payment is due one month after the sale of the goods. On the basis of experience with other contractors with similar characteristics, Venue considers that there is a 5% risk that the customer will not pay the amount due after the goods have been delivered and the property transferred. Venue subsequently felt that the financial condition of the customer has deteriorated and that the trade receivable is further impaired by $100,000.

(ii) Venue has also sold a computer hardware system to a customer and, because of the current difficulties in the market, Venue has agreed to defer receipt of the selling price of $2 million until two years after the hardware has been transferred to the customer.

Venue has also been offering discounts to customers if products were sold with terms whereby payment was due now but the transfer of the product was made in one year. A sale had been made under these terms and payment of $3 million had been received. A discount rate of 4% should be used in any calculations.

Required: Discuss how both of the above transactions would be treated in subsequent financial statements under IAS 18 and also whether there would be difference in treatment if the collectability of the debt and the time value of money were taken into account. (7 marks)

第4题

Scramble, a public limited company, is a developer of online computer games.

(a) At 30 November 2011, 65% of Scramble’s total assets were mainly represented by internally developed intangible assets comprising the capitalised costs of the development and production of online computer games. These games generate all of Scramble’s revenue. The costs incurred in relation to maintaining the games at the same standard of performance are expensed to the statement of comprehensive income. The accounting policy note states that intangible assets are valued at historical cost. Scramble considers the games to have an indefinite useful life, which is reconsidered annually when the intangible assets are tested for impairment. Scramble determines value in use using the estimated future cash flows which include maintenance expenses, capital expenses incurred in developing different versions of the games and the expected increase in turnover resulting from the above mentioned cash outflows. Scramble does not conduct an analysis or investigation of differences between expected and actual cash flows. Tax effects were also taken into account. (7 marks)

(b) Scramble has two cash generating units (CGU) which hold 90% of the internally developed intangible assets. Scramble reported a consolidated net loss for the period and an impairment charge in respect of the two CGUs representing 63% of the consolidated profit before tax and 29% of the total costs in the period. The recoverable amount of the CGUs is defined, in this case, as value in use. Specific discount rates are not directly available from the market, and Scramble estimates the discount rates, using its weighted average cost of capital. In calculating the cost of debt as an input to the determination of the discount rate, Scramble used the risk-free rate adjusted by the company specific average credit spread of its outstanding debt, which had been raised two years previously. As Scramble did not have any need for additional financing and did not need to repay any of the existing loans before 2014, Scramble did not see any reason for using a different discount rate. Scramble did not disclose either the events and circumstances that led to the recognition of the impairment loss or the amount of the loss recognised in respect of each cash-generating unit. Scramble felt that the events and circumstances that led to the recognition of a loss in respect of the first CGU were common knowledge in the market and the events and the circumstances that led to the recognition loss of the second CGU were not needed to be disclosed. (7 marks)

(c) Scramble wished to diversify its operations and purchased a professional football club, Rashing. In Rashing’s financial statements for the year ended 30 November 2011, it was proposed to include significant intangible assets which related to acquired players’ registration rights comprising registration and agents’ fees. The agents’ fees were paid by the club to players’ agents either when a player is transferred to the club or when the contract of a player is extended. Scramble believes that the registration rights of the players are intangible assets but that the agents fees do not meet the criteria to be recognised as intangible assets as they are not directly attributable to the costs of players’ contracts. Additionally, Rashing has purchased the rights to 25% of the revenue from ticket sales generated by another football club, Santash, in a different league. Rashing does not sell these tickets nor has any discretion over the pricing of the tickets. Rashing wishes to show these rights as intangible assets in its financial statements. (9 marks)

Required:

Discuss the validity of the accounting treatments proposed by Scramble in its financial statements for the year ended 30 November 2011.

The mark allocation is shown against each of the three accounting treaments above. Professional marks will be awarded for clarity and expression of your discussion. (2 marks)

第5题

Section B – TWO questions ONLY to be attempted

Decany owns 100% of the ordinary share capital of Ceed and Rant. All three entities are public limited companies. The group operates in the shipbuilding industry, which is currently a depressed market. Rant has made losses for the last three years and its liquidity is poor. The view of the directors is that Rant needs some cash investment. The directors have decided to put forward a restructuring plan as at 30 November 2011. Under this plan:

1. Ceed is to purchase the whole of Decany’s investment in Rant. The purchase consideration is to be $98 million payable in cash to Decany and this amount will then be loaned on a long-term unsecured basis to Rant; and

2. Ceed will purchase land with a carrying amount of $10 million from Rant for a total purchase consideration of $15 million. The land has a mortgage outstanding on it of $4 million. The total purchase consideration of $15 million comprises both five million $1 nominal value non-voting shares issued by Ceed to Rant and the $4 million mortgage liability which Ceed will assume; and

3. A dividend of $25 million will be paid from Ceed to Decany to reduce the accumulated reserves of Ceed.

The Statements of Financial Position of Decany and its subsidiaries at 30 November 2011 are summarised below:

As a result of the restructuring, several of Ceed’s employees will be made redundant. According to the detailed plan, the costs of redundancy will be spread over two years with $4 million being payable in one year’s time and $6 million in two years’ time. The market yield of high quality corporate bonds is 3%. The directors feel that the overall restructure will cost $2 million.

Required:

(a) (i) Prepare the individual entity statements of financial position after the proposed restructuring plan; (13 marks)

(ii) Set out the requirements of IAS 27 Consolidated and Separate Financial Statements as regards the reorganisation and payment of dividends between group companies, discussing any implications for the restructuring plan. (5 marks)

(b) Discuss the key implications of the proposed plans for the restructuring of the group. (5 marks) Professional marks will be awarded in part (b) for clarity and expression of your discussion. (2 marks)

第6题

Section A – THIS ONE question is compulsory and MUST be attempted

Traveler, a public limited company, operates in the manufacturing sector. The draft statements of financial position are as follows at 30 November 2011:

The following information is relevant to the preparation of the group financial statements:

1 On 1 December 2010, Traveler acquired 60% of the equity interests of Data, a public limited company. The purchase consideration comprised cash of $600 million. At acquisition, the fair value of the non-controlling interest in Data was $395 million. Traveler wishes to use the ‘full goodwill’ method. On 1 December 2010, the fair value of the identifiable net assets acquired was $935 million and retained earnings of Data were $299 million and other components of equity were $26 million. The excess in fair value is due to non-depreciable land.

On 30 November 2011, Traveler acquired a further 20% interest in Data for a cash consideration of $220 million.

2 On 1 December 2010, Traveler acquired 80% of the equity interests of Captive for a consideration of $541 million. The consideration comprised cash of $477 million and the transfer of non-depreciable land with a fair value of $64 million. The carrying amount of the land at the acquisition date was $56 million. At the year end, this asset was still included in the non-current assets of Traveler and the sale proceeds had been credited to profit or loss.

At the date of acquisition, the identifiable net assets of Captive had a fair value of $526 million, retained earnings were $90 million and other components of equity were $24 million. The excess in fair value is due to non-depreciable land. This acquisition was accounted for using the partial goodwill method in accordance with IFRS 3 (Revised) Business Combinations.

3 Goodwill was impairment tested after the additional acquisition in Data on 30 November 2011. The recoverable amount of Data was $1,099 million and that of Captive was $700 million.

4 Included in the financial assets of Traveler is a ten-year 7% loan. At 30 November 2011, the borrower was in financial difficulties and its credit rating had been downgraded. Traveler has adopted IFRS 9 Financial Instruments and the loan asset is currently held at amortised cost of $29 million. Traveler now wishes to value the loan at fair value using current market interest rates. Traveler has agreed for the loan to be restructured; there will only be three more annual payments of $8 million starting in one year’s time. Current market interest rates are 8%, the original effective interest rate is 6·7% and the effective interest rate under the revised payment schedule is 6·3%.

5 Traveler acquired a new factory on 1 December 2010. The cost of the factory was $50 million and it has a residual value of $2 million. The factory has a flat roof, which needs replacing every five years. The cost of the roof was $5 million. The useful economic life of the factory is 25 years. No depreciation has been charged for the year. Traveler wishes to account for the factory and roof as a single asset and depreciate the whole factory over its economic life. Traveler uses straight-line depreciation.

6 The actuarial value of Traveler’s pension plan showed a surplus at 1 December 2010 of $72 million, represented by the fair value of the assets of $250 million, the present value of the defined benefit obligation of $200 million and net unrecognised actuarial losses of $22 million. The average remaining working lives of the employees is 10 years. Traveler uses the corridor approach for recognising actuarial gains and losses. The aggregate of the current service cost, interest cost and expected return on assets amounted to a cost of $55 million for the year. After consulting with the actuaries, the company decided to reduce its contributions for the year to $45 million. The contributions were paid on 7 December 2011. No entries had been made in the financial statements for the above amounts. At the year end, the unrecognised actuarial losses were $20 million and the present value of available future refunds and reductions in future contributions was $18 million.

Required:

(a) Prepare a consolidated statement of financial position for the Traveler Group for the year ended 30 November 2011. (35 marks)

(b) Traveler has three distinct business segments. The management has calculated the net assets, turnover and profit before common costs, which are to be allocated to these segments. However, they are unsure as to how they should allocate certain common costs and whether they can exercise judgement in the allocation process. They wish to allocate head office management expenses; pension expense; the cost of managing properties and interest and related interest bearing assets. They also are uncertain as to whether the allocation of costs has to be in conformity with the accounting policies used in the financial statements.

Required:

Advise the management of Traveler on the points raised in the above paragraph. (7 marks)

(c) Segmental information reported externally is more useful if it conforms to information used by management in making decisions. The information can differ from that reported in the financial statements. Although reconciliations are required, these can be complex and difficult to understand. Additionally, there are other standards where subjectivity is involved and often the profit motive determines which accounting practice to follow. The directors have a responsibility to shareholders in disclosing information to enhance corporate value but this may conflict with their corporate social responsibility.

Required:

Discuss how the ethics of corporate social responsibility disclosure are difficult to reconcile with shareholder expectations. (6 marks)

Professional marks will be awarded in part (c) for clarity and expression of your discussion. (2 marks)

第7题

tage of a three-part project to replace IAS 39 Financial Instruments: Recognition and Measurement with a new standard. The new standard purports to enhance the ability of investors and other users of financial information to understand the accounting of financial assets and reduces complexity.

Required:

(a) (i) Discuss the approach taken by IFRS 9 in measuring and classifying financial assets and the main effect that IFRS 9 will have on accounting for financial assets. (11 marks)

(ii) Grainger, a public limited company, has decided to adopt IFRS 9 prior to January 2012 and has decided to restate comparative information under IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. The entity has an investment in a financial asset which was carried at amortised cost under IAS 39 but will be valued at fair value through profit and loss (FVTPL) under IFRS 9. The carrying value of the assets was $105,000 on 30 April 2010 and $110,400 on 30 April 2011. The fair value of the asset was $106,500 on 30 April 2010 and $111,000 on 30 April 2011. Grainger has determined that the asset will be valued at FVTPL at 30 April 2011.

Required:

Discuss how the financial asset will be accounted for in the financial statements of Grainger in the year ended 30 April 2011. (4 marks)

(b) Recently, criticisms have been made against the current IFRS impairment model for financial assets (the incurred loss model). The issue with the incurred loss model is that impairment losses (and resulting write-downs in the reported value of financial assets) can only be recognised when there is evidence that they exist and have been incurred. Reporting entities are not allowed currently to consider the effects of expected losses. There is a view that earlier recognition of loan losses could potentially reduce the problems incurred in a credit crisis.

Grainger has a portfolio of loans of $5 million which was initially recognised on 1 May 2010. The loans mature in 10 years and carry an interest rate of 16%. Grainger estimates that no loans will default in the first two years, but from the third year onwards, loans will default at an annual rate of about 9%. If the loans default as expected, the rate of return from the portfolio will be approximately 9·07%. The number of loans are fixed without any new lending or any other impairment provisions.

Required:

(i) Discuss briefly the issues related to considering the effects of expected losses in dealing with impairment of financial assets. (4 marks)

(ii) Calculate the impact on the financial statements up to the year ended 30 April 2013 if Grainger anticipated the expected losses on the loan portfolio in year three. (4 marks)

Professional marks will be awarded in question 4 for clarity and quality of discussion. (2 marks)

第8题

ructures.

(a) In November 2010, Alexandra defaulted on an interest payment on an issued bond loan of $100 million repayable in 2015. The loan agreement stipulates that such default leads to an obligation to repay the whole of the loan immediately, including accrued interest and expenses. The bondholders, however, issued a waiver postponing the interest payment until 31 May 2011. On 17 May 2011, Alexandra felt that a further waiver was required, so requested a meeting of the bondholders and agreed a further waiver of the interest payment to 5 July 2011, when Alexandra was confident it could make the payments. Alexandra classified the loan as long-term debt in its statement of financial position at 30 April 2011 on the basis that the loan was not in default at the end of the reporting period as the bondholders had issued waivers and had not sought redemption. (6 marks)

(b) Alexandra enters into contracts with both customers and suppliers. The supplier solves system problems and provides new releases and updates for software. Alexandra provides maintenance services for its customers. In previous years, Alexandra recognised revenue and related costs on software maintenance contracts when the customer was invoiced, which was at the beginning of the contract period. Contracts typically run for two years.

During 2010, Alexandra had acquired Xavier Co, which recognised revenue, derived from a similar type of maintenance contract as Alexandra, on a straight-line basis over the term of the contract. Alexandra considered both its own and the policy of Xavier Co to comply with the requirements of IAS 18 Revenue but it decided to adopt the practice of Xavier Co for itself and the group. Alexandra concluded that the two recognition methods did not, in substance, represent two different accounting policies and did not, therefore, consider adoption of the new practice to be a change in policy.

In the year to 30 April 2011, Alexandra recognised revenue (and the related costs) on a straight-line basis over the contract term, treating this as a change in an accounting estimate. As a result, revenue and cost of sales were adjusted, reducing the year’s profits by some $6 million. (5 marks)

(c) Alexandra has a two-tier board structure consisting of a management and a supervisory board. Alexandra remunerates its board members as follows:

– Annual base salary

– Variable annual compensation (bonus)

– Share options

In the group financial statements, within the related parties note under IAS 24 Related Party Disclosures, Alexandra disclosed the total remuneration paid to directors and non-executive directors and a total for each of these boards. No further breakdown of the remuneration was provided.

The management board comprises both the executive and non-executive directors. The remuneration of the non-executive directors, however, was not included in the key management disclosures. Some members of the supervisory and management boards are of a particular nationality. Alexandra was of the opinion that in that jurisdiction, it is not acceptable to provide information about remuneration that could be traced back to individuals. Consequently, Alexandra explained that it had provided the related party information in the annual accounts in an ambiguous way to prevent users of the financial statements from tracing remuneration information back to specific individuals. (5 marks)

(d) Alexandra’s pension plan was accounted for as a defined benefit plan in 2010. In the year ended 30 April 2011, Alexandra changed the accounting method used for the scheme and accounted for it as a defined contribution plan, restating the comparative 2010 financial information. The effect of the restatement was significant. In the 2011 financial statements, Alexandra explained that, during the year, the arrangements underlying the retirement benefit plan had been subject to detailed review. Since the pension liabilities are fully insured and indexation of future liabilities can be limited up to and including the funds available in a special trust account set up for the plan, which is not at the disposal of Alexandra, the plan qualifies as a defined contribution plan under IAS 19 Employee Benefits rather than a defined benefit plan. Furthermore, the trust account is built up by the insurance company from the surplus yield on investments. The pension plan is an average pay plan in respect of which the entity pays insurance premiums to a third party insurance company to fund the plan. Every year 1% of the pension fund is built up and employees pay a contribution of 4% of their salary, with the employer paying the balance of the contribution. If an employee leaves Alexandra and transfers the pension to another fund, Alexandra is liable for, or is refunded the difference between the benefits the employee is entitled to and the insurance premiums paid. (7 marks)

Professional marks will be awarded in question 3 for clarity and quality of discussion. (2 marks)

Required:

Discuss how the above transactions should be dealt with in the financial statements of Alexandra for the year ended 30 April 2011.

第9题

Section B – TWO questions ONLY to be attempted

Lockfine, a public limited company, operates in the fishing industry and has recently made the transition to International Financial Reporting Standards (IFRS). Lockfine’s reporting date is 30 April 2011.

(a) In the IFRS opening statement of financial position at 1 May 2009, Lockfine elected to measure its fishing fleet at fair value and use that fair value as deemed cost in accordance with IFRS 1 First Time Adoption of International Financial Reporting Standards. The fair value was an estimate based on valuations provided by two independent selling agents, both of whom provided a range of values within which the valuation might be considered acceptable. Lockfine calculated fair value at the average of the highest amounts in the two ranges provided. One of the agents’ valuations was not supported by any description of the method adopted or the assumptions underlying the calculation. Valuations were principally based on discussions with various potential buyers. Lockfine wished to know the principles behind the use of deemed cost and whether agents’ estimates were a reliable form. of evidence on which to base the fair value calculation of tangible assets to be then adopted as deemed cost. (6 marks)

(b) Lockfine was unsure as to whether it could elect to apply IFRS 3 Business Combinations retrospectively to past business combinations on a selective basis, because there was no purchase price allocation available for certain business combinations in its opening IFRS statement of financial position.

As a result of a major business combination, fishing rights of that combination were included as part of goodwill. The rights could not be recognised as a separately identifiable intangible asset at acquisition under the local GAAP because a reliable value was unobtainable for the rights. The fishing rights operated for a specified period of time.

On transition from local GAAP to IFRS, the fishing rights were included in goodwill and not separately identified because they did not meet the qualifying criteria set out in IFRS 1, even though it was known that the fishing rights had a finite life and would be fully impaired or amortised over the period specified by the rights. Lockfine wished to amortise the fishing rights over their useful life and calculate any impairment of goodwill as two separate calculations. (6 marks)

(c) Lockfine has internally developed intangible assets comprising the capitalised expenses of the acquisition and production of electronic map data which indicates the main fishing grounds in the world. The intangible assets generate revenue for the company in their use by the fishing fleet and are a material asset in the statement of financial position. Lockfine had constructed a database of the electronic maps. The costs incurred in bringing the information about a certain region of the world to a higher standard of performance are capitalised. The costs related to maintaining the information about a certain region at that same standard of performance are expensed. Lockfine’s accounting policy states that intangible assets are valued at historical cost. The company considers the database to have an indefinite useful life which is reconsidered annually when it is tested for impairment. The reasons supporting the assessment of an indefinite useful life were not disclosed in the financial statements and neither did the company disclose how it satisfied the criteria for recognising an intangible asset arising from development.

(d) The Lockfine board has agreed two restructuring projects during the year to 30 April 2011:

Plan A involves selling 50% of its off-shore fleet in one year’s time. Additionally, the plan is to make 40% of its seamen redundant. Lockfine will carry out further analysis before deciding which of its fleets and related employees will be affected. In previous announcements to the public, Lockfine has suggested that it may restructure the off-shore fleet in the future.

Plan B involves the reorganisation of the headquarters in 18 months time, and includes the redundancy of 20% of the headquarters’ workforce. The company has made announcements before the year end but there was a three month consultation period which ended just after the year end, whereby Lockfine was negotiating with employee representatives. Thus individual employees had not been notified by the year end. Lockfine proposes recognising a provision in respect of Plan A but not Plan B. (5 marks)

Professional marks will be awarded in question 2 for clarity and quality of discussion. (2 marks)

Required:

Discuss the principles and practices to be used by Lockfine in accounting for the above valuation and recognition issues.

第10题

Section A – This ONE question is compulsory and MUST be attempted

Rose, a public limited company, operates in the mining sector. The draft statements of financial position are as follows, at 30 April 2011:

The following information is relevant to the preparation of the group financial statements:

1 On 1 May 2010, Rose acquired 70% of the equity interests of Petal, a public limited company. The purchase consideration comprised cash of $94 million. The fair value of the identifiable net assets recognised by Petal was $120 million excluding the patent below. The identifiable net assets of Petal at 1 May 2010 included a patent which had a fair value of $4 million. This had not been recognised in the financial statements of Petal. The patent had a remaining term of four years to run at that date and is not renewable. The retained earnings of Petal were $49 million and other components of equity were $3 million at the date of acquisition. The remaining excess of the fair value of the net assets is due to an increase in the value of land.

Rose wishes to use the ‘full goodwill’ method. The fair value of the non-controlling interest in Petal was $46 million on 1 May 2010. There have been no issues of ordinary shares since acquisition and goodwill on acquisition is not impaired.

Rose acquired a further 10% interest from the non-controlling interest in Petal on 30 April 2011 for a cash consideration of $19 million.

2 Rose acquired 52% of the ordinary shares of Stem on 1 May 2010 when Stem’s retained earnings were 220 million dinars. The fair value of the identifiable net assets of Stem on 1 May 2010 was 495 million dinars. The excess of the fair value over the net assets of Stem is due to an increase in the value of land. The fair value of the non-controlling interest in Stem at 1 May 2010 was 250 million dinars.

Stem is located in a foreign country and operates a mine. The income of Stem is denominated and settled in dinars. The output of the mine is routinely traded in dinars and its price is determined initially by local supply and demand. Stem pays 40% of its costs and expenses in dollars with the remainder being incurred locally and settled in dinars. Stem’s management has a considerable degree of authority and autonomy in carrying out the operations of Stem and is not dependent upon group companies for finance.

Rose wishes to use the ‘full goodwill’ method to consolidate the financial statements of Stem. There have been no issues of ordinary shares and no impairment of goodwill since acquisition.

The following exchange rates are relevant to the preparation of the group financial statements:

3 Rose has a property located in the same country as Stem. The property was acquired on 1 May 2010 and is carried at a cost of 30 million dinars. The property is depreciated over 20 years on the straight-line method. At 30 April 2011, the property was revalued to 35 million dinars. Depreciation has been charged for the year but the revaluation has not been taken into account in the preparation of the financial statements as at 30 April 2011.

4 Rose commenced a long-term bonus scheme for employees at 1 May 2010. Under the scheme employees receive a cumulative bonus on the completion of five years service. The bonus is 2% of the total of the annual salary of the employees. The total salary of employees for the year to 30 April 2011 was $40 million and a discount rate of 8% is assumed. Additionally at 30 April 2011, it is assumed that all employees will receive the bonus and that salaries will rise by 5% per year.

5 Rose purchased plant for $20 million on 1 May 2007 with an estimated useful life of six years. Its estimated residual value at that date was $1·4 million. At 1 May 2010, the estimated residual value changed to $2·6 million. The change in the residual value has not been taken into account when preparing the financial statements as at 30 April 2011.

Required:

(a) (i) Discuss and apply the principles set out in IAS 21 The Effects of Changes in Foreign Exchange Rates in order to determine the functional currency of Stem. (7 marks)

(ii) Prepare a consolidated statement of financial position of the Rose Group at 30 April 2011, in accordance with International Financial Reporting Standards (IFRS), showing the exchange difference arising on the translation of Stem’s net assets. Ignore deferred taxation. (35 marks)

(b) Rose was considering acquiring a service company. Rose stated that the acquisition may be made because of the value of the human capital and the opportunity for synergies and cross-selling opportunities. Rose estimated the fair value of the assets based on what it was prepared to pay for them. Rose further stated that what it was willing to pay was influenced by its future plans for the business.

The company to be acquired had contract-based customer relationships with well-known domestic and international companies and some mining companies. Rose estimated that the fair value of all of these customer relationships to be zero because Rose already enjoyed relationships with the majority of those customers.

Required:

Discuss the validity of the accounting treatment proposed by Rose and whether such a proposed treatment raises any ethical issues. (6 marks)

Professional marks will be awarded in part (b) for clarity and quality of the presentation and discussion. (2 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!