重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Section A – This ONE question is compulsory and MUST be attempted

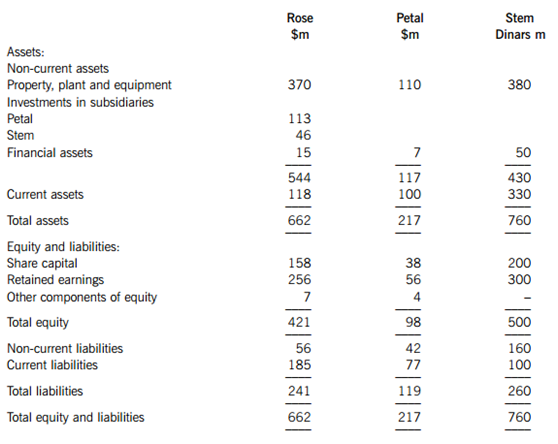

Rose, a public limited company, operates in the mining sector. The draft statements of financial position are as follows, at 30 April 2011:

The following information is relevant to the preparation of the group financial statements:

1 On 1 May 2010, Rose acquired 70% of the equity interests of Petal, a public limited company. The purchase consideration comprised cash of $94 million. The fair value of the identifiable net assets recognised by Petal was $120 million excluding the patent below. The identifiable net assets of Petal at 1 May 2010 included a patent which had a fair value of $4 million. This had not been recognised in the financial statements of Petal. The patent had a remaining term of four years to run at that date and is not renewable. The retained earnings of Petal were $49 million and other components of equity were $3 million at the date of acquisition. The remaining excess of the fair value of the net assets is due to an increase in the value of land.

Rose wishes to use the ‘full goodwill’ method. The fair value of the non-controlling interest in Petal was $46 million on 1 May 2010. There have been no issues of ordinary shares since acquisition and goodwill on acquisition is not impaired.

Rose acquired a further 10% interest from the non-controlling interest in Petal on 30 April 2011 for a cash consideration of $19 million.

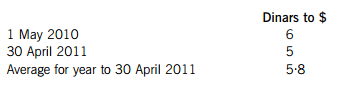

2 Rose acquired 52% of the ordinary shares of Stem on 1 May 2010 when Stem’s retained earnings were 220 million dinars. The fair value of the identifiable net assets of Stem on 1 May 2010 was 495 million dinars. The excess of the fair value over the net assets of Stem is due to an increase in the value of land. The fair value of the non-controlling interest in Stem at 1 May 2010 was 250 million dinars.

Stem is located in a foreign country and operates a mine. The income of Stem is denominated and settled in dinars. The output of the mine is routinely traded in dinars and its price is determined initially by local supply and demand. Stem pays 40% of its costs and expenses in dollars with the remainder being incurred locally and settled in dinars. Stem’s management has a considerable degree of authority and autonomy in carrying out the operations of Stem and is not dependent upon group companies for finance.

Rose wishes to use the ‘full goodwill’ method to consolidate the financial statements of Stem. There have been no issues of ordinary shares and no impairment of goodwill since acquisition.

The following exchange rates are relevant to the preparation of the group financial statements:

3 Rose has a property located in the same country as Stem. The property was acquired on 1 May 2010 and is carried at a cost of 30 million dinars. The property is depreciated over 20 years on the straight-line method. At 30 April 2011, the property was revalued to 35 million dinars. Depreciation has been charged for the year but the revaluation has not been taken into account in the preparation of the financial statements as at 30 April 2011.

4 Rose commenced a long-term bonus scheme for employees at 1 May 2010. Under the scheme employees receive a cumulative bonus on the completion of five years service. The bonus is 2% of the total of the annual salary of the employees. The total salary of employees for the year to 30 April 2011 was $40 million and a discount rate of 8% is assumed. Additionally at 30 April 2011, it is assumed that all employees will receive the bonus and that salaries will rise by 5% per year.

5 Rose purchased plant for $20 million on 1 May 2007 with an estimated useful life of six years. Its estimated residual value at that date was $1·4 million. At 1 May 2010, the estimated residual value changed to $2·6 million. The change in the residual value has not been taken into account when preparing the financial statements as at 30 April 2011.

Required:

(a) (i) Discuss and apply the principles set out in IAS 21 The Effects of Changes in Foreign Exchange Rates in order to determine the functional currency of Stem. (7 marks)

(ii) Prepare a consolidated statement of financial position of the Rose Group at 30 April 2011, in accordance with International Financial Reporting Standards (IFRS), showing the exchange difference arising on the translation of Stem’s net assets. Ignore deferred taxation. (35 marks)

(b) Rose was considering acquiring a service company. Rose stated that the acquisition may be made because of the value of the human capital and the opportunity for synergies and cross-selling opportunities. Rose estimated the fair value of the assets based on what it was prepared to pay for them. Rose further stated that what it was willing to pay was influenced by its future plans for the business.

The company to be acquired had contract-based customer relationships with well-known domestic and international companies and some mining companies. Rose estimated that the fair value of all of these customer relationships to be zero because Rose already enjoyed relationships with the majority of those customers.

Required:

Discuss the validity of the accounting treatment proposed by Rose and whether such a proposed treatment raises any ethical issues. (6 marks)

Professional marks will be awarded in part (b) for clarity and quality of the presentation and discussion. (2 marks)

更多“Section A – This ONE question is compulsory and MUST be attemptedRose, a public limited co”相关的问题

更多“Section A – This ONE question is compulsory and MUST be attemptedRose, a public limited co”相关的问题

第1题

ements of increased

disclosure of information in financial statements. (14 marks)

Quality of discussion and reasoning. (2 marks)

第2题

ions to improve it are

sometimes questioned on the basis that the marketplace for capital can determine the nature and quality of corporate

reporting. It could be argued that additional accounting and disclosure standards would only distort a market

mechanism that already works well and would add costs to the reporting mechanism, with no apparent benefit. It

could be said that accounting standards create costly, inefficient, and unnecessary regulation. It could be argued that

increased disclosure reduces risks and offers a degree of protection to users. However, increased disclosure has several

costs to the preparer of financial statements.

Required:

(a) Explain why accounting standards are needed to help the market mechanism work effectively for the benefit

of preparers and users of corporate reports. (9 marks)

第3题

mber 2008 to account

for:(c) the purchase of handsets and the recognition of revenue from customers and dealers. (8 marks)

Appropriateness and quality of discussion. (2 marks)

第4题

Required:

Discuss the principles and practices which should be used in the financial year to 30 November 2008 to account

for:(b) the costs incurred in extending the network; (7 marks)

第5题

ry is capital intensive with

heavy investment in licences and network infrastructure. Competition in the sector is fierce and technological

advances are a characteristic of the industry. Johan has responded to these factors by offering incentives to customers

and, in an attempt to acquire and retain them, Johan purchased a telecom licence on 1 December 2006 for

$120 million. The licence has a term of six years and cannot be used until the network assets and infrastructure are

ready for use. The related network assets and infrastructure became ready for use on 1 December 2007. Johan could

not operate in the country without the licence and is not permitted to sell the licence. Johan expects its subscriber

base to grow over the period of the licence but is disappointed with its market share for the year to 30 November

2008. The licence agreement does not deal with the renewal of the licence but there is an expectation that the

regulator will grant a single renewal for the same period of time as long as certain criteria regarding network build

quality and service quality are met. Johan has no experience of the charge that will be made by the regulator for the

renewal but other licences have been renewed at a nominal cost. The licence is currently stated at its original cost of

$120 million in the statement of financial position under non-current assets.

Johan is considering extending its network and has carried out a feasibility study during the year to 30 November

2008. The design and planning department of Johan identified five possible geographical areas for the extension of

its network. The internal costs of this study were $150,000 and the external costs were $100,000 during the year

to 30 November 2008. Following the feasibility study, Johan chose a geographical area where it was going to install

a base station for the telephone network. The location of the base station was dependent upon getting planning

permission. A further independent study has been carried out by third party consultants in an attempt to provide a

preferred location in the area, as there is a need for the optimal operation of the network in terms of signal quality

and coverage. Johan proposes to build a base station on the recommended site on which planning permission has

been obtained. The third party consultants have charged $50,000 for the study. Additionally Johan has paid

$300,000 as a single payment together with $60,000 a month to the government of the region for access to the land

upon which the base station will be situated. The contract with the government is for a period of 12 years and

commenced on 1 November 2008. There is no right of renewal of the contract and legal title to the land remains with

the government.

Johan purchases telephone handsets from a manufacturer for $200 each, and sells the handsets direct to customers

for $150 if they purchase call credit (call card) in advance on what is called a prepaid phone. The costs of selling the

handset are estimated at $1 per set. The customers using a prepaid phone pay $21 for each call card at the purchase

date. Call cards expire six months from the date of first sale. There is an average unused call credit of $3 per card

after six months and the card is activated when sold.

Johan also sells handsets to dealers for $150 and invoices the dealers for those handsets. The dealer can return the

handset up to a service contract being signed by a customer. When the customer signs a service contract, the

customer receives the handset free of charge. Johan allows the dealer a commission of $280 on the connection of a

customer and the transaction with the dealer is settled net by a payment of $130 by Johan to the dealer being the

cost of the handset to the dealer ($150) deducted from the commission ($280). The handset cannot be sold

separately by the dealer and the service contract lasts for a 12 month period. Dealers do not sell prepaid phones, and

Johan receives monthly revenue from the service contract.

The chief operating officer, a non-accountant, has asked for an explanation of the accounting principles and practices

which should be used to account for the above events.

Required:

Discuss the principles and practices which should be used in the financial year to 30 November 2008 to account

for:

(a) the licences; (8 marks)

第6题

in other entities and has asked

for advice on the impact of IFRS3 (Revised) ‘Business Combinations’ and IAS27 (Revised) ‘Consolidated and Separate

Financial Statements’. The company is particularly concerned about the impact on earnings, net assets and goodwill

at the acquisition date and any ongoing earnings impact that the new standards may have.

The company is considering purchasing additional shares in an associate, Josey, a public limited company. The

holding will increase from 30% stake to 70% stake by offering the shareholders of Josey, cash and shares in

Marrgrett. Marrgrett anticipates that it will pay $5 million in transaction costs to lawyers and bankers. Josey had

previously been the subject of a management buyout. In order that the current management shareholders may remain

in the business, Marrgrett is going to offer them share options in Josey subject to them remaining in employment for

two years after the acquisition. Additionally, Marrgrett will offer the same shareholders, shares in the holding company

which are contingent upon a certain level of profitability being achieved by Josey. Each shareholder will receive shares

of the holding company up to a value of $50,000, if Josey achieves a pre-determined rate of return on capital

employed for the next two years.

Josey has several marketing-related intangible assets that are used primarily in marketing or promotion of its products.

These include trade names, internet domain names and non-competition agreements. These are not currently

recognised in Josey’s financial statements.

Marrgrett does not wish to measure the non-controlling interest in subsidiaries on the basis of the proportionate

interest in the identifiable net assets, but wishes to use the ‘full goodwill’ method on the transaction. Marrgrett is

unsure as to whether this method is mandatory, or what the effects are of recognising ‘full goodwill’. Additionally the

company is unsure as to whether the nature of the consideration would affect the calculation of goodwill.

To finance the acquisition of Josey, Marrgrett intends to dispose of a partial interest in two subsidiaries. Marrgrett will

retain control of the first subsidiary but will sell the controlling interest in the second subsidiary which will become

an associate. Because of its plans to change the overall structure of the business, Marrgrett wishes to recognise a

re-organisation provision at the date of the business combination.

Required:

Discuss the principles and the nature of the accounting treatment of the above plans under International Financial

Reporting Standards setting out any impact that IFRS3 (Revised) ‘Business Combinations’ and IAS27 (Revised)

‘Consolidated and Separate Financial Statements’ might have on the earnings and net assets of the group.

Note: this requirement includes 2 professional marks for the quality of the discussion.

(25 marks)

第7题

tion of the statement

of cash flows, such as that suggested by the directors, does not occur. (5 marks)

Note: requirements (b) and (c) include 2 professional marks in total for the quality of the discussion.

第8题

flow of the company.

(10 marks)

第9题

ntry can have a

significant impact on financial statements prepared under IFRS. (6 marks)

Appropriateness and quality of discussion. (2 marks)

第10题

nge for companies as IFRSs

introduce significant changes in accounting practices that were often not required by national generally accepted

accounting practice. It is important that the interpretation and application of IFRSs is consistent from country to

country. IFRSs are partly based on rules, and partly on principles and management’s judgement. Judgement is more

likely to be better used when it is based on experience of IFRSs within a sound financial reporting infrastructure. It is

hoped that national differences in accounting will be eliminated and financial statements will be consistent and

comparable worldwide.

Required:

(a) Discuss how the changes in accounting practices on transition to IFRSs and choice in the application of

individual IFRSs could lead to inconsistency between the financial statements of companies. (17 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!