重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Section B – TWO questions ONLY to be attempted

Levante Co has identified a new project for which it will need to increase its long-term borrowings from $250 million to $400 million. This amount will cover a significant proportion of the total cost of the project and the rest of the funds will come from cash held by the company.

The current $250 million borrowing is in the form. of a 4% bond which is trading at $98·71 per $100 and is due to be redeemed at par in three years. The issued bond has a credit rating of AA. The new borrowing will also be raised in the form. of a traded bond with a par value of $100 per unit. It is anticipated that the new project will generate sufficient cash flows to be able to redeem the new bond at $100 par value per unit in five years. It can be assumed that coupons on both bonds are paid annually.

Both bonds would be ranked equally for payment in the event of default and the directors expect that as a result of the new issue, the credit rating for both bonds will fall to A. The directors are considering the following two alternative options when issuing the new bond:

(i) Issue the new bond at a fixed coupon of 5% but at a premium or discount, whichever is appropriate to ensure full take up of the bond; or

(ii) Issue the new bond at a coupon rate where the issue price of the new bond will be $100 per unit and equal to its par value.

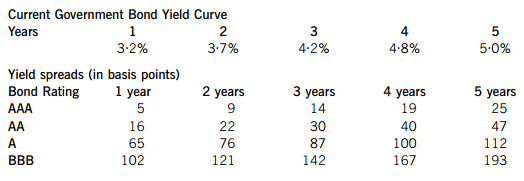

The following extracts are provided on the current government bond yield curve and yield spreads for the sector in which Levante Co operates:

Required:

(a) Calculate the expected percentage fall in the market value of the existing bond if Levante Co’s bond credit rating falls from AA to A. (3 marks)

(b) Advise the directors on the financial implications of choosing each of the two options when issuing the new bond. Support the advice with appropriate calculations. (7 marks)

(c) Among the criteria used by credit agencies for establishing a company’s credit rating are the following: industry risk, earnings protection, financial flexibility and evaluation of the company’s management.

Briefly explain each criterion and suggest factors that could be used to assess it. (8 marks)

更多“Section B – TWO questions ONLY to be attemptedLevante Co has identified a new project for”相关的问题

更多“Section B – TWO questions ONLY to be attemptedLevante Co has identified a new project for”相关的问题

第1题

our months’ time on 1 May 2012. It expects to make a full repayment of the borrowed amount nine months from now. Currently there is some uncertainty in the markets, with higher than normal rates of inflation, but an expectation that the inflation level may soon come down. This has led some economists to predict a rise in interest rates and others suggesting an unchanged outlook or maybe even a small fall in interest rates over the next six months.

Although Alecto Co is of the opinion that it is equally likely that interest rates could increase or fall by 0·5% in four months, it wishes to protect itself from interest rate fluctuations by using derivatives. The company can borrow at LIBOR plus 80 basis points and LIBOR is currently 3·3%. The company is considering using interest rate futures, options on interest rate futures or interest rate collars as possible hedging choices.

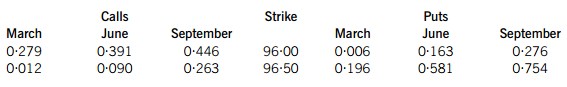

The following information and quotes from an appropriate exchange are provided on Euro futures and options. Margin requirements may be ignored.

Three month Euro futures, €1,000,000 contract, tick size 0·01% and tick value €25

March 96·27

June 96·16

September 95·90

Options on three month Euro futures, €1,000,000 contract, tick size 0·01% and tick value €25. Option premiums are in annual %.

It can be assumed that settlement for both the futures and options contracts is at the end of the month. It can also be assumed that basis diminishes to zero at contract maturity at a constant rate and that time intervals can be counted in months.

Required:

(a) Briefly discuss the main advantage and disadvantage of hedging interest rate risk using an interest rate collar instead of options. (4 marks)

(b) Based on the three hedging choices Alecto Co is considering and assuming that the company does not face any basis risk, recommend a hedging strategy for the €22,000,000 loan. Support your recommendation with appropriate comments and relevant calculations in €. (17 marks)

(c) Explain what is meant by basis risk and how it would affect the recommendation made in part (b) above. (4 marks)

第2题

Section A – BOTH questions are compulsory and MUST be attempted

Tramont Co is a listed company based in the USA and manufactures electronic devices. One of its devices, the X-IT, is produced exclusively for the American market. Tramont Co is considering ceasing the production of the X-IT gradually over a period of four years because it needs the manufacturing facilities used to make the X-IT for other products.

The government of Gamala, a country based in south-east Asia, is keen to develop its manufacturing industry and has offered Tramont Co first rights to produce the X-IT in Gamala and sell it to the USA market for a period of four years. At the end of the four-year period, the full production rights will be sold to a government-backed company for Gamalan Rupiahs (GR) 450 million after tax (this amount is not subject to inflationary increases). Tramont Co has to decide whether to continue production of the X-IT in the USA for the next four years or to move the production to Gamala immediately.

Currently each X-IT unit sold makes a unit contribution of $20. This unit contribution is not expected to be subject to any inflationary increase in the next four years. Next year’s production and sales estimated at 40,000 units will fall by 20% each year for the following three years. It is anticipated that after four years the production of the X-IT will stop. It is expected that the financial impact of the gradual closure over the four years will be cost neutral (the revenue from sale of assets will equal the closure costs). If production is stopped immediately, the excess assets would be sold for $2·3 million and the costs of closure, including redundancy costs of excess labour, would be $1·7 million.

The following information relates to the production of the X-IT moving to Gamala. The Gamalan project will require an initial investment of GR 230 million, to pay for the cost of land and buildings (GR 150 million) and machinery (GR 80 million). The cost of machinery is tax allowable and will be depreciated on a straight-line basis over the next four years, at the end of which it will have a negligible value.

Tramont Co will also need GR 40 million for working capital immediately. It is expected that the working capital requirement will increase in line with the annual inflation rate in Gamala. When the project is sold, the working capital will not form. part of the sale price and will be released back to Tramont Co.

Production and sales of the device are expected to be 12,000 units in the first year, rising to 22,000 units, 47,000 units and 60,000 units in the next three years respectively.

The following revenues and costs apply to the first year of operation: – Each unit will be sold for $70;

– The variable cost per unit comprising of locally sourced materials and labour will be GR 1,350, and;

– In addition to the variable cost above, each unit will require a component bought from Tramont Co for $7, on which Tramont Co makes $4 contribution per unit;

– Total fixed costs for the first year will be GR 30 million.

The costs are expected to increase by their countries’ respective rates of inflation, but the selling price will remain fixed at $70 per unit for the four-year period.

The annual corporation tax rate in Gamala is 20% and Tramont Co currently pays corporation tax at a rate of 30% per year. Both countries’ corporation taxes are payable in the year that the tax liability arises. A bi-lateral tax treaty exists between the USA and Gamala, which permits offset of overseas tax against any USA tax liability on overseas earnings. The USA and Gamalan tax authorities allow losses to be carried forward and written off against future profits for taxation purposes.

Tramont Co has decided to finance the project by borrowing the funds required in Gamala. The commercial borrowing rate is 13% but the Gamalan government has offered Tramont Co a 6% subsidised loan for the entire amount of the initial funds required. The Gamalan government has agreed that it will not ask for the loan to be repaid as long as Tramont Co fulfils its contract to undertake the project for the four years. Tramont Co can borrow dollar funds at an interest rate of 5%.

Tramont Co’s financing consists of 25 million shares currently trading at $2·40 each and $40 million 7% bonds trading at $1,428 per $1,000. Tramont Co’s quoted beta is 1·17. The current risk free rate of return is estimated at 3% and the market risk premium is 6%. Due to the nature of the project, it is estimated that the beta applicable to the project if it is all-equity financed will be 0·4 more than the current all-equity financed beta of Tramont Co. If the Gamalan project is undertaken, the cost of capital applicable to the cash flows in the USA is expected to be 7%.

The spot exchange rate between the dollar and the Gamalan Rupiah is GR 55 per $1. The annual inflation rates are currently 3% in the USA and 9% in Gamala. It can be assumed that these inflation rates will not change for the foreseeable future. All net cash flows arising from the project will be remitted back to Tramont Co at the end of each year.

There are two main political parties in Gamala: the Gamala Liberal (GL) Party and the Gamala Republican (GR) Party. Gamala is currently governed by the GL Party but general elections are due to be held soon. If the GR Party wins the election, it promises to increase taxes of international companies operating in Gamala and review any commercial benefits given to these businesses by the previous government.

Required:

Prepare a report for the Board of Directors of Tramont Co that

(i) Evaluates whether or not Tramont Co should undertake the project to produce the X-IT in Gamala and cease its production in the USA immediately. In the evaluation, include all relevant calculations in the form. of a financial assessment and explain any assumptions made;

Note: it is suggested that the financial assessment should be based on present value of the operating cash flows from the Gamalan project, discounted by an appropriate all-equity rate, and adjusted by the present value of all other relevant cash flows. (27 marks)

(ii) Discusses the potential change in government and other business factors that Tramont Co should consider before making a final decision. (8 marks)

Professional marks will be awarded in question 1 for the format, structure and presentation of the answer. (4 marks)

第3题

les from countries in South America, Africa and Asia, and packages them in steel cans, plastic tubs and as frozen foods, for sale to supermarkets around Europe. Its suppliers range from individual farmers to Government run cooperatives, and farms run by its own subsidiary companies. In the past, Mezza Co has been very successful in its activities, and has an excellent corporate image with its customers, suppliers and employees. Indeed Mezza Co prides itself on how it has supported local farming communities around the world and has consistently highlighted these activities in its annual reports.

However, in spite of buoyant stock markets over the last couple of years, Mezza Co’s share price has remained static. It is thought that this is because there is little scope for future growth in its products. As a result the company’s directors are considering diversifying into new areas. One possibility is to commercialise a product developed by a recently acquired subsidiary company. The subsidiary company is engaged in researching solutions to carbon emissions and global warming, and has developed a high carbon absorbing variety of plant that can be grown in warm, shallow sea water. The plant would then be harvested into carbon-neutral bio-fuel. This fuel, if widely used, is expected to lower carbon production levels.

Currently there is a lot of interest among the world’s governments in finding solutions to climate change. Mezza Co’s directors feel that this venture could enhance its reputation and result in a rise in its share price. They believe that the company’s expertise would be ideally suited to commercialising the product. On a personal level, they feel that the venture’s success would enhance their generous remuneration package which includes share options. It is hoped that the resulting increase in the share price would enable the options to be exercised in the future.

Mezza Co has identified the coast of Maienar, a small country in Asia, as an ideal location, as it has a large area of warm, shallow waters. Mezza Co has been operating in Maienar for many years and as a result, has a well developed infrastructure to enable it to plant, monitor and harvest the crop. Mezza Co’s directors have strong ties with senior government officials in Maienar and the country’s politicians are keen to develop new industries, especially ones with a long-term future.

The area identified by Mezza Co is a rich fishing ground for local fishermen, who have been fishing there for many generations. However, the fishermen are poor and have little political influence. The general perception is that the fishermen contribute little to Maienar’s economic development. The coastal area, although naturally beautiful, has not been well developed for tourism. It is thought that the high carbon absorbing plant, if grown on a commercial scale, may have a negative impact on fish stocks and other wildlife in the area. The resulting decline in fish stocks may make it impossible for the fishermen to continue with their traditional way of life.

Required:

Discuss the key issues that the directors of Mezza Co should consider when making the decision about whether or not to commercialise the new product, and suggest how these issues may be mitigated or resolved.

第4题

game based on an adventure film due to be released in 22 months. It is expected that the game will be available to buy two months after the film’s release, by which time it will be possible to judge the popularity of the film with a high degree of certainty. However, at present, there is considerable uncertainty about whether the film, and therefore the game, is likely to be successful. Although MMC would pay for the exclusive rights to develop and sell the game now, the directors are of the opinion that they should delay the decision to produce and market the game until the film has been released and the game is available for sale.

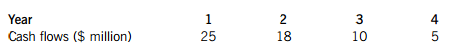

MMC has forecast the following end of year cash flows for the four-year sales period of the game.

MMC will spend $7 million at the start of each of the next two years to develop the game, the gaming platform, and to pay for the exclusive rights to develop and sell the game. Following this, the company will require $35 million for production, distribution and marketing costs at the start of the four-year sales period of the game.

It can be assumed that all the costs and revenues include inflation. The relevant cost of capital for this project is 11% and the risk free rate is 3·5%. MMC has estimated the likely volatility of the cash flows at a standard deviation of 30%.

Required:

(a) Estimate the financial impact of the directors’ decision to delay the production and marketing of the game. The Black-Scholes Option Pricing model may be used, where appropriate. All relevant calculations should be shown. (12 marks)

(b) Briefly discuss the implications of the answer obtained in part (a) above. (5 marks)

第5题

Section B – TWO questions ONLY to be attempted

GNT Co is considering an investment in one of two corporate bonds. Both bonds have a par value of $1,000 and pay coupon interest on an annual basis. The market price of the first bond is $1,079?68. Its coupon rate is 6% and it is due to be redeemed at par in five years. The second bond is about to be issued with a coupon rate of 4% and will also be redeemable at par in five years. Both bonds are expected to have the same gross redemption yields (yields to maturity).

GNT Co considers duration of the bond to be a key factor when making decisions on which bond to invest.

Required:

(a) Estimate the Macaulay duration of the two bonds GNT Co is considering for investment. (9 marks)

(b) Discuss how useful duration is as a measure of the sensitivity of a bond price to changes in interest rates. (8 marks)

第6题

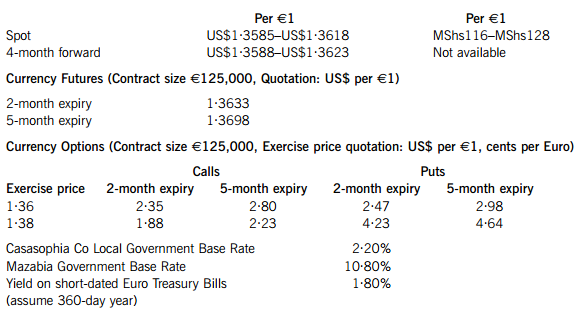

s advanced energy efficient commercial properties around the world. It has just completed a major project in the USA and is due to receive the final payment of US$20 million in four months.

Casasophia Co is planning to commence a major construction and maintenance project in Mazabia, a small African country, in six months’ time. This government-owned project is expected to last for three years during which time Casasophia Co will complete the construction of state-of-the-art energy efficient properties and provide training to a local Mazabian company in maintaining the properties. The carbon-neutral status of the building project has attracted some grant funding from the European Union and these funds will be provided to the Mazabian government in Mazabian Shillings (MShs).

Casasophia Co intends to finance the project using the US$20 million it is due to receive and borrow the rest through a € loan. It is intended that the US$ receipts will be converted into € and invested in short-dated treasury bills until they are required. These funds plus the loan will be converted into MShs on the date required, at the spot rate at that time.

Mazabia’s government requires Casasophia Co to deposit the MShs2·64 billion it needs for the project, with Mazabia’s central bank, at the commencement of the project. In return, Casasophia Co will receive a fixed sum of MShs1·5 billion after tax, at the end of each year for a period of three years. Neither of these amounts is subject to inflationary increases. The relevant risk adjusted discount rate for the project is assumed to be 12%.

Financial Information

Exchange Rates available to Casasophia

Mazabia’s current annual inflation rate is 9·7% and is expected to remain at this level for the next six months. However, after that, there is considerable uncertainty about the future and the annual level of inflation could be anywhere between 5% and 15% for the next few years. The country where Casasophia Co is based is expected to have a stable level of inflation at 1·2% per year for the foreseeable future. A local bank in Mazabia has offered Casasophia Co the opportunity to swap the annual income of MShs1.5 billion receivable in each of the next three years for Euros, at the estimated annual MShs/€ forward rates based on the current government base rates.

Required:

(a) Advise Casasophia Co on, and recommend, an appropriate hedging strategy for the US$ income it is due to receive in four months. Include all relevant calculations. (15 marks)

(b) Provide a reasoned estimate of the additional amount of loan finance Casasophia Co needs to obtain to undertake the project in Mazabia in six months. (5 marks)

(c) Given that Casasophia Co agrees to the local bank’s offer of the swap, calculate the net present value of the project, in six months’ time, in €. Discuss whether the swap would be beneficial to Casasophia Co. (10 marks)

第7题

Section A – BOTH questions are compulsory and MUST be attempted

Pursuit Co, a listed company which manufactures electronic components, is interested in acquiring Fodder Co, an unlisted company involved in the development of sophisticated but high risk electronic products. The owners of Fodder Co are a consortium of private equity investors who have been looking for a suitable buyer for their company for some time. Pursuit Co estimates that a payment of the equity value plus a 25% premium would be sufficient to secure the purchase of Fodder Co. Pursuit Co would also pay off any outstanding debt that Fodder Co owed. Pursuit Co wishes to acquire Fodder Co using a combination of debt finance and its cash reserves of $20 million, such that the capital structure of the combined company remains at Pursuit Co’s current capital structure level.

Information on Pursuit Co and Fodder Co

Pursuit Co

Pursuit Co has a market debt to equity ratio of 50:50 and an equity beta of 1·18. Currently Pursuit Co has a total firm value (market value of debt and equity combined) of $140 million.

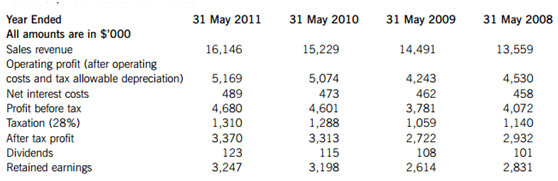

Fodder Co, Income Statement Extracts

Fodder Co has a market debt to equity ratio of 10:90 and an estimated equity beta of 1·53. It can be assumed that its tax allowable depreciation is equivalent to the amount of investment needed to maintain current operational levels. However, Fodder Co will require an additional investment in assets of 22c per $1 increase in sales revenue, for the next four years. It is anticipated that Fodder Co will pay interest at 9% on its future borrowings.

For the next four years, Fodder Co’s sales revenue will grow at the same average rate as the previous years. After the forecasted four-year period, the growth rate of its free cash flows will be half the initial forecast sales revenue growth rate for the foreseeable future.

Information about the combined company

Following the acquisition, it is expected that the combined company’s sales revenue will be $51,952,000 in the first year, and its profit margin on sales will be 30% for the foreseeable futue. After the first year the growth rate in sales revenue will be 5·8% per year for the following three years. Following the acquisition, it is expected that the combined company will pay annual interest at 6·4% on future borrowings.

The combined company will require additional investment in assets of $513,000 in the first year and then 18c per $1 increase in sales revenue for the next three years. It is anticipated that after the forecasted four-year period, its free cash flow growth rate will be half the sales revenue growth rate.

It can be assumed that the asset beta of the combined company is the weighted average of the individual companies’ asset betas, weighted in proportion of the individual companies’ market value.

Other information

The current annual government base rate is 4·5% and the market risk premium is estimated at 6% per year. The relevant annual tax rate applicable to all the companies is 28%.

SGF Co’s interest in Pursuit Co

There have been rumours of a potential bid by SGF Co to acquire Pursuit Co. Some financial press reports have suggested that this is because Pursuit Co’s share price has fallen recently. SGF Co is in a similar line of business as Pursuit Co and until a couple of years ago, SGF Co was the smaller company. However, a successful performance has resulted in its share price rising, and SGF Co is now the larger company.

The rumours of SGF Co’s interest have raised doubts about Pursuit Co’s ability to acquire Fodder Co. Although SGF Co has made no formal bid yet, Pursuit Co’s board is keen to reduce the possibility of such a bid. The Chief Financial Officer has suggested that the most effective way to reduce the possibility of a takeover would be to distribute the $20 million in its cash reserves to its shareholders in the form. of a special dividend. Fodder Co would then be purchased using debt finance. He conceded that this would increase Pursuit Co’s gearing level but suggested it may increase the company’s share price and make Pursuit Co less appealing to SGF Co.

Required:

Prepare a report to the Board of Directors of Pursuit Co that

(i) Evaluates whether the acquisition of Fodder Co would be beneficial to Pursuit Co and its shareholders. The free cash flow to firm method should be used to estimate the values of Fodder Co and the combined company assuming that the combined company’s capital structure stays the same as that of Pursuit Co’s current capital structure. Include all relevant calculations; (16 marks)

(ii) Discusses the limitations of the estimated valuations in part (i) above; (4 marks)

(iii) Estimates the amount of debt finance needed, in addition to the cash reserves, to acquire Fodder Co and concludes whether Pursuit Co’s current capital structure can be maintained; (3 marks)

(iv) Explains the implications of a change in the capital structure of the combined company, to the valuation method used in part (i) and how the issue can be resolved; (4 marks)

(v) Assesses whether the Chief Financial Officer’s recommendation would provide a suitable defence against a bid from SGF Co and would be a viable option for Pursuit Co. (5 marks)

Professional marks will be awarded in question 1 for the format, structure and presentation of the report. (4 marks)

第8题

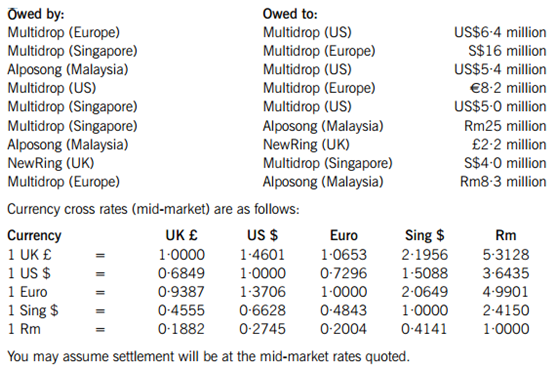

idiary businesses in North America, Europe, and Singapore. It also has foreign currency balances outstanding with two non-group companies in the UK and Malaysia. Last year the transaction costs of ad-hoc settlements both within the group and with non-group companies were significant and this year you have reached agreement with the non-group companies to enter into a netting agreement to clear indebtedness with the minimum of currency flows. It has been agreed that Multidrop (Europe) will be the principal in the netting arrangement and that all settlements will be made in Euros at the prevailing spot rate.

The summarised list of year end indebtedness is as follows:

Required:

(a) Calculate the inter group and inter-company currency transfers that will be required for settlement by Multidrop (Europe). (12 marks)

(b) Discuss the advantages and disadvantages of netting arrangements with both group and non-group companies. (8 marks)

第9题

ision produces coins and notes for the national exchequer and generates 80% of the company’s revenues. The second, the LunarMint division, manufactures a brand of sweets which are very popular with traders in the financial markets. The company is considering disposing of its LunarMint division. The LunarMint business is no longer viewed as part of the core business of the MandM Company. The Chief Executive Officer commented that he could never understand why the company entered into sweet-making in the first place. The LunarMint business is profitable and low risk, but has not been a high priority for investment.

Required:

Outline the issues that should be considered when disposing of the LunarMint division noting the risks that might be involved.

第10题

Section B – TWO questions ONLY to be attempted

The finance division of GoSlo Motor Corporation has made a number of loans to customers with a current pool value of $200 million. The loans have an average term to maturity of four years. The loans generate a steady income to the business of 10·5% per annum. The company will use 95% of the loan’s pool as collateral for a collateralised loan obligation structured as follows:

– 80% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 140 basis points.

– 10% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 11%.

– 10% of the collateral value to support a tranche as subordinated certificates (unrated).

In order to minimise interest rate risk, the company has decided to enter into a fixed for variable rate swap on the A-rated floating rate notes exchanging LIBOR for 8·5%.

Service charges of $240,000 per annum will be charged for administering the income receivable from the loans.

You may ignore prepayment risk.

Required:

(a) Calculate the expected returns of the investments in each of the three tranches described above. Estimate the sensitivity of the subordinated certificates to a reduction of 1% in the returns generated by the pool. (10 marks)

(b) Explain the purpose and the methods of credit enhancement that can be employed on a securitisation such as this scheme. (4 marks)

(c) Discuss the risks inherent to the investors in a scheme such as this. (6 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!