重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Casasophia Co, based in a European country that uses the Euro (€), constructs and maintains advanced energy efficient commercial properties around the world. It has just completed a major project in the USA and is due to receive the final payment of US$20 million in four months.

Casasophia Co is planning to commence a major construction and maintenance project in Mazabia, a small African country, in six months’ time. This government-owned project is expected to last for three years during which time Casasophia Co will complete the construction of state-of-the-art energy efficient properties and provide training to a local Mazabian company in maintaining the properties. The carbon-neutral status of the building project has attracted some grant funding from the European Union and these funds will be provided to the Mazabian government in Mazabian Shillings (MShs).

Casasophia Co intends to finance the project using the US$20 million it is due to receive and borrow the rest through a € loan. It is intended that the US$ receipts will be converted into € and invested in short-dated treasury bills until they are required. These funds plus the loan will be converted into MShs on the date required, at the spot rate at that time.

Mazabia’s government requires Casasophia Co to deposit the MShs2·64 billion it needs for the project, with Mazabia’s central bank, at the commencement of the project. In return, Casasophia Co will receive a fixed sum of MShs1·5 billion after tax, at the end of each year for a period of three years. Neither of these amounts is subject to inflationary increases. The relevant risk adjusted discount rate for the project is assumed to be 12%.

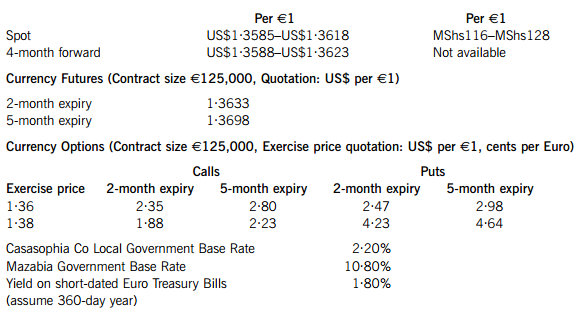

Financial Information

Exchange Rates available to Casasophia

Mazabia’s current annual inflation rate is 9·7% and is expected to remain at this level for the next six months. However, after that, there is considerable uncertainty about the future and the annual level of inflation could be anywhere between 5% and 15% for the next few years. The country where Casasophia Co is based is expected to have a stable level of inflation at 1·2% per year for the foreseeable future. A local bank in Mazabia has offered Casasophia Co the opportunity to swap the annual income of MShs1.5 billion receivable in each of the next three years for Euros, at the estimated annual MShs/€ forward rates based on the current government base rates.

Required:

(a) Advise Casasophia Co on, and recommend, an appropriate hedging strategy for the US$ income it is due to receive in four months. Include all relevant calculations. (15 marks)

(b) Provide a reasoned estimate of the additional amount of loan finance Casasophia Co needs to obtain to undertake the project in Mazabia in six months. (5 marks)

(c) Given that Casasophia Co agrees to the local bank’s offer of the swap, calculate the net present value of the project, in six months’ time, in €. Discuss whether the swap would be beneficial to Casasophia Co. (10 marks)

更多“Casasophia Co, based in a European country that uses the Euro (€), constructs and maintain”相关的问题

更多“Casasophia Co, based in a European country that uses the Euro (€), constructs and maintain”相关的问题

第1题

Section A – BOTH questions are compulsory and MUST be attempted

Pursuit Co, a listed company which manufactures electronic components, is interested in acquiring Fodder Co, an unlisted company involved in the development of sophisticated but high risk electronic products. The owners of Fodder Co are a consortium of private equity investors who have been looking for a suitable buyer for their company for some time. Pursuit Co estimates that a payment of the equity value plus a 25% premium would be sufficient to secure the purchase of Fodder Co. Pursuit Co would also pay off any outstanding debt that Fodder Co owed. Pursuit Co wishes to acquire Fodder Co using a combination of debt finance and its cash reserves of $20 million, such that the capital structure of the combined company remains at Pursuit Co’s current capital structure level.

Information on Pursuit Co and Fodder Co

Pursuit Co

Pursuit Co has a market debt to equity ratio of 50:50 and an equity beta of 1·18. Currently Pursuit Co has a total firm value (market value of debt and equity combined) of $140 million.

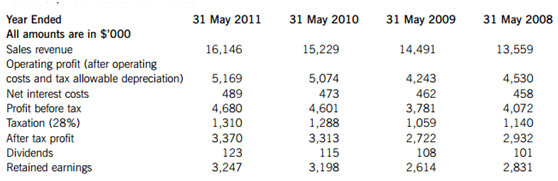

Fodder Co, Income Statement Extracts

Fodder Co has a market debt to equity ratio of 10:90 and an estimated equity beta of 1·53. It can be assumed that its tax allowable depreciation is equivalent to the amount of investment needed to maintain current operational levels. However, Fodder Co will require an additional investment in assets of 22c per $1 increase in sales revenue, for the next four years. It is anticipated that Fodder Co will pay interest at 9% on its future borrowings.

For the next four years, Fodder Co’s sales revenue will grow at the same average rate as the previous years. After the forecasted four-year period, the growth rate of its free cash flows will be half the initial forecast sales revenue growth rate for the foreseeable future.

Information about the combined company

Following the acquisition, it is expected that the combined company’s sales revenue will be $51,952,000 in the first year, and its profit margin on sales will be 30% for the foreseeable futue. After the first year the growth rate in sales revenue will be 5·8% per year for the following three years. Following the acquisition, it is expected that the combined company will pay annual interest at 6·4% on future borrowings.

The combined company will require additional investment in assets of $513,000 in the first year and then 18c per $1 increase in sales revenue for the next three years. It is anticipated that after the forecasted four-year period, its free cash flow growth rate will be half the sales revenue growth rate.

It can be assumed that the asset beta of the combined company is the weighted average of the individual companies’ asset betas, weighted in proportion of the individual companies’ market value.

Other information

The current annual government base rate is 4·5% and the market risk premium is estimated at 6% per year. The relevant annual tax rate applicable to all the companies is 28%.

SGF Co’s interest in Pursuit Co

There have been rumours of a potential bid by SGF Co to acquire Pursuit Co. Some financial press reports have suggested that this is because Pursuit Co’s share price has fallen recently. SGF Co is in a similar line of business as Pursuit Co and until a couple of years ago, SGF Co was the smaller company. However, a successful performance has resulted in its share price rising, and SGF Co is now the larger company.

The rumours of SGF Co’s interest have raised doubts about Pursuit Co’s ability to acquire Fodder Co. Although SGF Co has made no formal bid yet, Pursuit Co’s board is keen to reduce the possibility of such a bid. The Chief Financial Officer has suggested that the most effective way to reduce the possibility of a takeover would be to distribute the $20 million in its cash reserves to its shareholders in the form. of a special dividend. Fodder Co would then be purchased using debt finance. He conceded that this would increase Pursuit Co’s gearing level but suggested it may increase the company’s share price and make Pursuit Co less appealing to SGF Co.

Required:

Prepare a report to the Board of Directors of Pursuit Co that

(i) Evaluates whether the acquisition of Fodder Co would be beneficial to Pursuit Co and its shareholders. The free cash flow to firm method should be used to estimate the values of Fodder Co and the combined company assuming that the combined company’s capital structure stays the same as that of Pursuit Co’s current capital structure. Include all relevant calculations; (16 marks)

(ii) Discusses the limitations of the estimated valuations in part (i) above; (4 marks)

(iii) Estimates the amount of debt finance needed, in addition to the cash reserves, to acquire Fodder Co and concludes whether Pursuit Co’s current capital structure can be maintained; (3 marks)

(iv) Explains the implications of a change in the capital structure of the combined company, to the valuation method used in part (i) and how the issue can be resolved; (4 marks)

(v) Assesses whether the Chief Financial Officer’s recommendation would provide a suitable defence against a bid from SGF Co and would be a viable option for Pursuit Co. (5 marks)

Professional marks will be awarded in question 1 for the format, structure and presentation of the report. (4 marks)

第2题

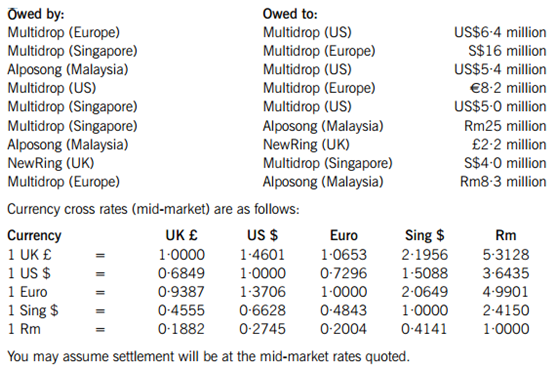

idiary businesses in North America, Europe, and Singapore. It also has foreign currency balances outstanding with two non-group companies in the UK and Malaysia. Last year the transaction costs of ad-hoc settlements both within the group and with non-group companies were significant and this year you have reached agreement with the non-group companies to enter into a netting agreement to clear indebtedness with the minimum of currency flows. It has been agreed that Multidrop (Europe) will be the principal in the netting arrangement and that all settlements will be made in Euros at the prevailing spot rate.

The summarised list of year end indebtedness is as follows:

Required:

(a) Calculate the inter group and inter-company currency transfers that will be required for settlement by Multidrop (Europe). (12 marks)

(b) Discuss the advantages and disadvantages of netting arrangements with both group and non-group companies. (8 marks)

第3题

ision produces coins and notes for the national exchequer and generates 80% of the company’s revenues. The second, the LunarMint division, manufactures a brand of sweets which are very popular with traders in the financial markets. The company is considering disposing of its LunarMint division. The LunarMint business is no longer viewed as part of the core business of the MandM Company. The Chief Executive Officer commented that he could never understand why the company entered into sweet-making in the first place. The LunarMint business is profitable and low risk, but has not been a high priority for investment.

Required:

Outline the issues that should be considered when disposing of the LunarMint division noting the risks that might be involved.

第4题

Section B – TWO questions ONLY to be attempted

The finance division of GoSlo Motor Corporation has made a number of loans to customers with a current pool value of $200 million. The loans have an average term to maturity of four years. The loans generate a steady income to the business of 10·5% per annum. The company will use 95% of the loan’s pool as collateral for a collateralised loan obligation structured as follows:

– 80% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 140 basis points.

– 10% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 11%.

– 10% of the collateral value to support a tranche as subordinated certificates (unrated).

In order to minimise interest rate risk, the company has decided to enter into a fixed for variable rate swap on the A-rated floating rate notes exchanging LIBOR for 8·5%.

Service charges of $240,000 per annum will be charged for administering the income receivable from the loans.

You may ignore prepayment risk.

Required:

(a) Calculate the expected returns of the investments in each of the three tranches described above. Estimate the sensitivity of the subordinated certificates to a reduction of 1% in the returns generated by the pool. (10 marks)

(b) Explain the purpose and the methods of credit enhancement that can be employed on a securitisation such as this scheme. (4 marks)

(c) Discuss the risks inherent to the investors in a scheme such as this. (6 marks)

第5题

the potential bid price for an acquisition. You have been appointed as a consultant to advise the company’s management on the fi nancial aspects of the bid.

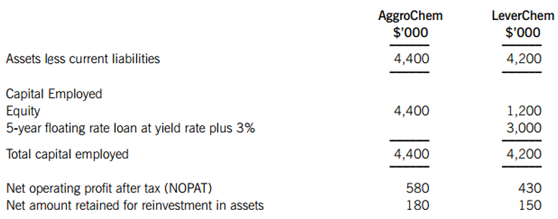

AggroChem is a fully listed company fi nanced wholly by equity. LeverChem is listed on an alternative investment market. Both companies have been trading for over 10 years and have shown strong levels of profi tability recently. However, both companies’ shares are thinly traded. It is thought that the current market value of LeverChem’s shares at higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

The following information is taken from the fi nancial statements of both companies at the start of the current year:

It can be assumed that the retained earnings for both companies are equal to the net reinvestment in assets.

The assets of both companies are stated at fair value. Discussions with the AtReast Bank have led to an agreement that the fl oating rate loan to LeverChem can be transferred to the combined business on the same terms. The current yield rate is 5% and the current equity risk premium is 6%. It can be assumed that the risk free rate of return is equivalent to the yield rate. AggroChem’s beta has been estimated to be 1·26.

AggroChem Co wants to use the Black-Scholes option pricing (BSOP) model to assess the value of the combined business and the maximum premium payable to LeverChem’s shareholders. AggroChem has conducted a review of the volatility of the NOPAT values of both companies since both were formed and has estimated that the volatility of the combined business assets, if the acquisition were to go ahead, would be 35%. The exercise price should be calculated as the present value of a discount (zero-coupon) bond with an identical yield and term to maturity of the current bond.

Required:

Prepare a report for the management of AggroChem on the valuation of the combined business following acquisition and the maximum premium payable to the shareholders of LeverChem. Your report should:

(i) Using the free cash fl ow model, estimate the market value of equity for AggroChem Co, explaining any assumptions made. (9 marks)

(ii) Explain the circumstances in which the Black-Scholes option pricing (BSOP) model could be used to assess the value of a company, including the data required for the variables used in the model. (5 marks)

(iii) Using the BSOP methodology, estimate the maximum price and premium AggroChem may pay for LeverChem. (9 marks)

(iv) Discuss the appropriateness of the method used in part (iii) above, by considering whether the BSOP model can provide a meaningful value for a company. (5 marks)

Professional marks will be awarded in question 2 for the clarity and presentation of the report. (4 marks)

第6题

??Section A – BOTH questions are compulsory and MUST be attempted??

The Seal Island Nuclear Power Company has received initial planning consent for an Advanced Boiling Water Reactor. This project is one of a number that has been commissioned by the Government of Roseland to help solve the energy needs of its expanding population of 60 million and meet its treaty obligations by cutting CO2 emissions to 50% of their 2010 levels by 2030.

The project proposal is now moving to the detailed planning stage which will include a full investment appraisal within the financial plan. The financial plan so far developed has been based upon experience of this reactor design in Japan, the US and South Korea.

The core macro economic assumptions are that Roseland GDP will grow at an annual rate of 4% (nominal) and inflation will be maintained at the 2% target set by the Government.

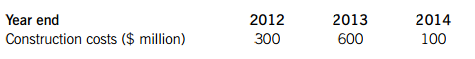

The construction programme is expected to cost $1 billion over three years, with construction commencing in January 2012. These capital expenditures have been projected, including expected future cost increases, as follows:

Generation of electricity will commence in 2015 and the annual operating surplus in cash terms is expected to be $100 million per annum (at 1 January 2015 price and cost levels). This value has been well validated by preliminary studies and includes the cost of fuel reprocessing, ongoing maintenance and systems replacement as well as the continuing operating costs of running the plant. The operating surplus is expected to rise in line with nominal GDP growth. The plant is expected to have an operating life of 30 years.

Decommissioning costs at the end of the project have been estimated at $600 million at current (2012) costs. Decommissioning costs are expected to rise in line with nominal GDP growth.

The company’s nominal cost of capital is 10% per annum. All estimates, unless otherwise stated, are at 1 January 2012 price and cost levels.

Required:

Produce a preliminary briefing note which, on the basis of the above information, includes:

(i) An estimate of the net present value for this project as at the commencement of construction in 2012. (11 marks)

(ii) A discussion of the principal uncertainties associated with this project. (7 marks)

(iii) A sensitivity of the project’s net present value (in percentage and in $), to changes in the construction cost, the annual operating surplus and the decommissioning cost. (Assume that the increase in construction costs would be proportional to the initial investment for each year.) (6 marks)

(iv) An explanation of how simulations, such as the Monte Carlo simulation, could be used to assess the volatility of the net present value of this project. (4 marks)

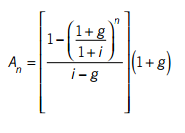

Note: the formula for an annuity discounted at an annual rate (i) and where cash flows are growing at an annual rate (g) is as follows:

第7题

f the portfolio is represented by a holding of 5,550,000 ordinary shares of Mondglobe plc. The managers are concerned about the effect on portfolio value if the price of Mondglobe’s shares should fall, and are considering selling the shares. Daylon’s investment bank has suggested that the risk of Mondglobe’s shares falling by more than 5% from their current value could be protected against by buying an over the counter option. The investment bank is prepared to sell an appropriate six month option to Daylon for £250,000.

Other information:

(i) The current market price of Mondglobe’s ordinary shares is 360 pence.

(ii) The annual volatility (variance) of Mondglobe’s shares for the last year was 169%.

(iii) The risk free rate is 4% per year.

(iv) No dividend is expected to be paid by Mondglobe during the next six months.

Required:

(a) Evaluate whether or not the price at which the investment bank is willing to sell the option is a fair price.(10 marks)

第8题

gy to increase gearing, and explain whether or not the estimates produced in (b) above are likely to be accurate. (10 marks)

第9题

the share repurchase on the company’s cost of capital and value. (5 marks)

第10题

ering a fall in their expected wealth, and discuss whether or not the directors of Paxis should proceed with the bid. (5 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!