重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The government of Kayland has been focused on delivering rapid economic growth over the last 15 years. However, there are increasing signs that the environment is paying a large price for this growth with public health suffering. There is now a growing environmental pressure group, Green Kayland (GK), which is organising protests against the companies that they see as being the major polluters.

Kayland’s government wishes to react to the concerns of the public and the pressure groups. It has requested that companies involved in heavy industry contribute to a general improvement in the treatment of the environment in Kayland.

As a major participant in the oil industry with ties to the nationalised oil exploration company (Kayex), PLX believes it will be strategically important to be at the forefront of environmental developments. It is working with other companies in the oil industry to improve environmental reporting since there is a belief that this will lead to improved public perception and economic efficiency of the industry. PLX has had a fairly good compliance record in Kayland, with only two major fines being levied in the last eight years for safety breaches and river pollution ($1m each).

The existing information systems within PLX focus on financial performance. They support financial reporting obligations and allow monitoring of key performance metrics such as earnings per share and operating margins. Recent publications on environmental accounting have suggested there are a number of techniques (such as input/output analysis, activity-based costing (ABC) and a lifecycle view) that may be relevant in implementing improvements to these systems.

PLX is considering a major capital expenditure programme to enhance capacity, safety and efficiency at the refinery. This will involve demolishing certain older sections of the refinery and building on newly acquired land adjacent to the site. Overall, the refinery will increase its land area by 20%.

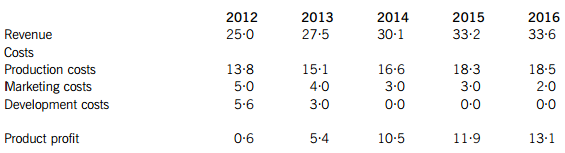

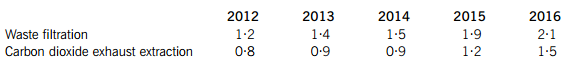

Part of the refinery extension will also manufacture a new plastic, Kayplas. Kayplas is expected to have a limited market life of five years after which it will be replaced by Kayplas2. The refinery accounting team have forecast the following data associated with this product and calculated PLX’s traditional performance measure of product profit for the new product:

All figures are $m’s

Subsequently, the following environmental costs have been identified from PLX’s general overheads as associated with Kayplas production.

Additionally, other costs associated with closing down and recycling the equipment in Kayplas production are estimated at $18m in 2016.

The board wishes to consider how it can contribute to the oil industry’s performance in environmental accounting, how it can implement the changes that this might require and how these changes will benefit the company.

Required:

(a) Discuss different cost categories that would aid transparency in environmental reporting both internally and externally at PLX. (4 marks)

(b) Explain and evaluate how the three environmental accounting techniques mentioned can assist in managing the environmental and strategic performance of PLX. (9 marks)

(c) Evaluate the costing approach used for Kayplas’s performance compared to a lifecycle costing approach, performing appropriate calculations. (7 marks)

更多“PLX Refinery Co is a large oil refinery business in Kayland. Kayland is a developing count”相关的问题

更多“PLX Refinery Co is a large oil refinery business in Kayland. Kayland is a developing count”相关的问题

第1题

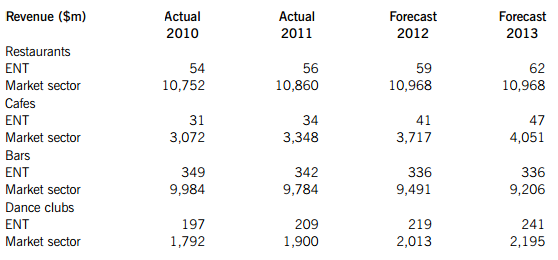

. The company’s objective is the maximisation of shareholder wealth for its family owners. It has four divisions:

1. Restaurants

2. Cafes

3. Bars

4. Dance clubs

Recently, ENT’s board have identified that there are problems in managing such a diversified company. They have employed consultants who have recommended that they should perform. a Boston Consulting Group (BCG) analysis to understand whether they have the right mix of businesses. The chief executive officer (CEO) has questioned whether using this analysis is helpful in managing the group’s performance. A business analyst has prepared information on each division in the table below.

In Teeland, the economy is generally growing at about 2% per annum. The restaurant, cafe and bar sectors are all highly fragmented with many small operators. Consequently, a market share of more than 3·0% is considered large as that is comparable to the share of the largest operators in each sector. There are fewer small late night dance club operators and the market leader currently holds a 15·0% market share. There have not been many new developments within the divisions except for a new wine bar format launched by the bars division which has surprised the board by its success.

Each of the division’s performance is measured by economic value-added (EVA?). The divisional managers have a remuneration package that is made up in two equal parts by a salary set according to industry norms and a bonus element which is based on achieving the cost budget numbers set by the company board. The chairman of the board has been examining the consistency of the overall objective of the business, the divisional performance measure and the remuneration packages at divisional level. He has expressed the worry that these are not properly aligned and that this might lead to dysfunctional behaviour by the divisional management.

Required:

(a) Perform. a BCG analysis of ENT’s business and use this to evaluate the company’s performance. (7 marks)

(b) Critically evaluate this BCG analysis as a performance management system at ENT. (7 marks)

(c) Evaluate the divisional managers’ remuneration package in light of the divisional performance system and your BCG analysis. (6 marks)

第2题

Section B – TWO questions ONLY to be attempted

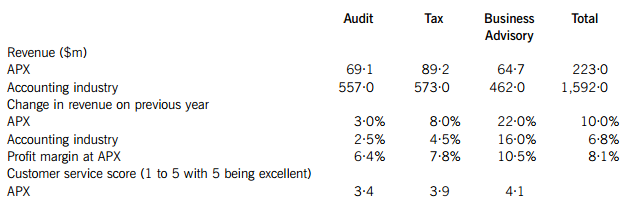

APX Accountancy (APX) is an accountancy partnership with 12 branches covering each of the main cities of Emland. The business is well established, having organically grown over the last 40 years to become the second largest non-international practice in Emland. The accountancy market is mature and expands and contracts along with the general economic performance of Emland.

APX offers accountancy, audit, tax and business advisory services. The current business environment in Emland is dominated by a recession and the associated insolvency work is covered within the business advisory area of APX.

At present, the practice collects the following information for strategic performance evaluation:

The above figures are for the most recent financial year and illustrate the metrics used by APX. Equivalent monthly figures are produced for each of the monthly partner meetings which review practice performance.

The staff are remunerated based on their grade, with non-partners obtaining a bonus of up to 10% of basic salary based on their line managers’ annual review. The partners receive a fixed salary with a share of profit which depends on their contractual responsibilities within the partnership.

The managing partner of APX is dissatisfied with the existing performance management system, as she is not convinced that it is helping to achieve the long-term goal of expanding and ultimately floating the business on the national stock exchange. Therefore, she has asked you to consider the impact of applying Fitzgerald and Moon’s building block approach to performance management in the practice.

Required:

(a) Briefly describe Fitzgerald and Moon’s building block model of performance management. (4 marks)

(b) Evaluate the existing performance management system at APX by applying the building block model. (8 marks)

(c) Explain the main improvements the introduction of a building block approach to performance management could provide, and suggest specific improvements to the existing system of performance measures at APX in light of the introduction of the building block model. (8 marks)

第3题

eland. It is one of the 100 largest listed companies on the national stock exchange. The company focuses on buying prospective drugs that have shown initial promise in testing from small bio-engineering companies. PT then leads these through three regulatory stages to launch in the general medical market. The three stages are:

1. to confirm the safety of the drug (does it harm humans?), in small scale trials;

2. to test the efficacy of the product (does it help cure?), again in small scale trials; and

3. finally, large scale trials to definitively decide on the safety and efficacy of the product.

The drugs are then marketed through the company’s large sales force to health care providers and end users (patients). The health care providers are paid by either health insurance companies or the national government dependent on the financial status of the patient.

The Beeland Drug Regulator (BDR) oversees this testing process and makes the final judgement about whether a product can be sold in the country.

Its objectives are to protect, promote and improve public health by ensuring that:

– medicines have an acceptable balance of benefit and risk;

– the users of these medicines understand this risk-benefit profile; and

– new beneficial product development is encouraged.

The regulator is governed by a board of trustees appointed by the government. It is funded directly by the government and also through fees charged to drug companies when granting licences to sell their products in Beeland.

PT has used share price and earnings per share as its principal measures of performance to date. However, the share price has underperformed the market and the health sector in the last two years. The chief executive officer (CEO) has identified that these measures are too narrow and is considering implementing a balanced scorecard approach to address this problem.

A working group has drawn up a suggested balanced scorecard. It began by identifying the objectives from the board’s medium term strategy:

– Create shareholder value by bringing commercially viable drugs to market

– Improve the efficiency of drug development

– Increase shareholder value by innovation in the drug approval process

The working group then considered the stakeholder perspectives:

– Shareholders want a competitive return on their investment

– Purchasers (governments, insurers and patients) want to pay a reasonable price for the drugs

– Regulators want an efficient process for the validation of drugs

– Doctors want safe and effective drug products

– Patients want to be cured

Finally, this leads to the proposed scorecard of performance measures:

– Financial – share price and earnings per share

– Customer – number of patients using PT products

– Internal business process – exceed industry-standard on design and testing; time to regulatory approval of a product

– Learning and growth – training days undertaken by staff; time to market of new product; percentage of drugs bought by PT that gain final approval.

The balanced scorecard now needs to be reviewed to ensure that it will address the company’s objectives and the issues that it faces in its business environment.

Required:

(a) Describe how the implementation of a balanced scorecard delivers a range of performance measures aligned with the corporate strategy. (4 marks)

(b) Evaluate the performance measures proposed for PT’s balanced scorecard. (10 marks)

(c) Identify and analyse the influence of four different external stakeholders on the regulator (BDR). (6 marks)

(d) Using your answer from part (c), describe how the application of the balanced scorecard approach at BDR would differ from the approach within PT. (7 marks)

第4题

been successful over the last five years and has built and maintained a loyal customer base by making a high quality machine backed by a three-year warranty. The warranty states that JHK will recover and repair any machine that breaks down in the warranty period at no cost. Additionally, JHK always maintains sufficient spare parts to be able to quote for a repair of any of its machines made within the previous 10 years.

JHK is structured into two divisions: manufacturing/sales (M/S) and service. The board are now considering ways to improve coordination of the activities of the divisions for the benefit of the company as a whole.

The company’s mission is to maximise shareholder wealth. Currently, the board use total shareholder return (TSR) as an overall corporate measure of performance and return on investment (ROI) as their main relative measure of performance between the two divisions. The board’s main concern is that the divisional managers’ performance is not being properly assessed by the divisional performance measure used. They now want to consider other measures of divisional performance. Residual income (RI) and economic value added have been suggested.

have been suggested.

A colleague has collected the following data which will allow calculation of ROI, RI and .

.

All operating costs are tax deductible.

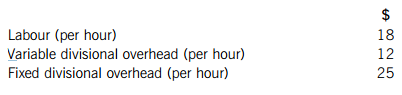

In addition to the divisional performance measures, the board want to consider the position of the service division. The standard costs within the service division are as follows:

overheads are allocated by labour hours

Currently, the service division does two types of work. There are repairs that are covered by JHK’s warranty and there are repairs done outside warranty at the customer’s request. The service division is paid by the customer for the out-of-warranty repairs while the repairs under warranty generate an annual fee of $10m, which is a recharge from the M/S division. The company sells 440,000 units per year and in the past, 9% of these have needed a repair within the three-year warranty. Parts are charged by the M/S division to the service division at cost and average $75 per repair. A repair takes two hours, on average, to complete.

The board are considering amending this existing $10m internal recharge agreement between M/S and service. There has been some discussion of tailoring one of the two transfer-pricing approaches (market price or cost plus) to meet the company’s objectives.

Although the service division has the capacity to cover all of the existing work available, it could outsource the warranty service work, as it is usually straightforward. It would retain the out-of-warranty service work as this is a higher margin business. It would then begin looking for other opportunities to earn revenue using its engineering experience. A local engineering firm has quoted a flat price of $200 per warranty service repair provided that they obtain a contract for all of the warranty repairs from JHK.

Finally, the board are also considering a change to the information systems at JHK. The existing systems are based in the individual functions (production, sales, service, finance and human resources). The board are considering the implementation of a new system based on an integrated, single database that would be accessible at any of the company’s five sites. The company network would be upgraded to allow real-time input and update of the database. The database would support a detailed management information system and a high-level executive information system.

Required:

Write a report to the finance director to:

(a) Evaluate the divisional performance at JHK and critically discuss the proposed measures of divisional performance. (12 marks)

(b) Outline the criteria for designing a transfer pricing system and evaluate the two methods discussed of calculating the transfer price between the service and M/S divisions. (Perform. appropriate calculations) (12 marks)

(c) Evaluate the potential impact of the introduction of the new executive information system at JHK on performance management. (5 marks)

Professional marks will be awarded for the format, style. and structure of the discussion of your answer. (4 marks)

第5题

d C. Each of them uses a pre-operative injection given by a nurse before the surgery. Thin Co currently rent an operating theatre from a neighbouring government hospital. Thin Co does have an operating theatre on its premises, but it has never been put into use since it would cost $750,000 to equip. The Managing Director of Thin Co is keen to maximise profits and has heard of something called ‘throughput accounting’, which may help him to do this. The following information is available:

1 All patients go through a five step process, irrespective of which procedure they are having:

– step 1: consultation with the advisor;

– step 2: pre-operative injection given by the nurse;

– step 3: anaesthetic given by anaesthetist;

–step 4: procedure performed in theatre by the surgeon;

– step 5: recovery with the recovery specialist.

2 The price of each of procedures A, B and C is $2,700, $3,500 and $4,250 respectively.

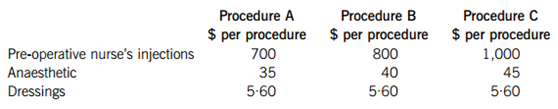

3 The only materials’ costs relating to the procedures are for the pre-operative injections given by the nurse, the anaesthetic and the dressings. These are as follows:

4 There are five members of staff employed by Thin Co. Each works a standard 40-hour week for 47 weeks of the year, a total of 1,880 hours each per annum. Their salaries are as follows:

– Advisor: $45,000 per annum;

– Nurse: $38,000 per annum;

– Anaesthetist: $75,000 per annum;

– Surgeon: $90,000 per annum;

– Recovery specialist: $50,000 per annum.

The only other hospital costs (comparable to ‘factory costs’ in a traditional manufacturing environment) are general overheads, which include the theatre rental costs, and amount to $250,000 per annum.

5 Maximum annual demand for A, B and C is 600, 800 and 1,200 procedures respectively. Time spent by each of the five different staff members on each procedure is as follows:

Part hours are shown as decimals e.g. 0·24 hours = 14·4 minutes (0·24 x 60).

Surgeon’s hours have been correctly identified as the bottleneck resource.

Required:

(a) Calculate the throughput accounting ratio for procedure C.

Note: It is recommended that you work in hours as provided in the table rather than minutes. (6 marks)

(b) The return per factory hour for products A and B has been calculated and is $2,612·53 and $2,654·40 respectively. The throughput accounting ratio for A and B has also been calculated and is 8·96 and 9·11 respectively.

Calculate the optimum product mix and the maximum profit per annum. (7 marks)

(c) Assume that your calculations in part (b) showed that, if the optimum product mix is adhered to, there will be excess demand for procedure C of 696 procedures per annum. In order to satisfy this excess demand, the company is considering equipping and using its own theatre, as well as continuing to rent the existing theatre. The company cannot rent any more theatre time at either the existing theatre or any other theatres in the area, so equipping its own theatre is the only option. An additional surgeon would be employed to work in the newly equipped theatre.

Required:

Discuss whether the overall profit of the company could be improved by equipping and using the extra theatre.

Note: Some basic calculations may help your discussion. (7 marks)

第6题

ment. Historically, the company has used solely financial performance measures to assess the performance of the company as a whole. The company’s Managing Director has recently heard of the ‘balanced scorecard approach’ and is keen to learn more.

Required:

Describe the balanced scorecard approach to performance measurement. (10 marks)

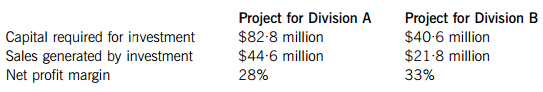

(b) Brace Co is split into two divisions, A and B, each with their own cost and revenue streams. Each of the divisions is managed by a divisional manager who has the power to make all investment decisions within the division. The cost of capital for both divisions is 12%. Historically, investment decisions have been made by calculating the return on investment (ROI) of any opportunities and at present, the return on investment of each division is 16%.

A new manager who has recently been appointed in division A has argued that using residual income (RI) to make investment decisions would result in ‘better goal congruence’ throughout the company.

Each division is currently considering the following separate investments:

The company is seeking to maximise shareholder wealth.

Required:

Calculate both the return on investment and residual income of the new investment for each of the two divisions. Comment on these results, taking into consideration the manager’s views about residual income. (10 marks)

第7题

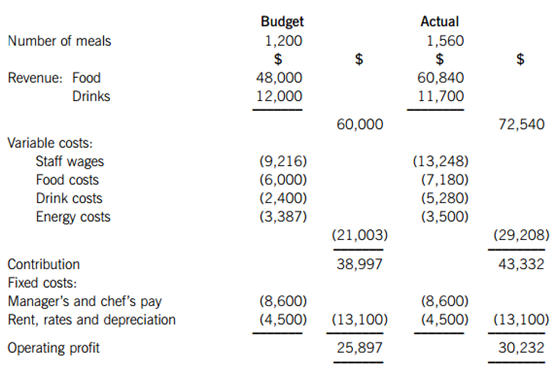

ight restaurant and kitchen staff, each paid a wage of $8 per hour on the basis of hours actually worked. It also has a restaurant manager and a head chef, each of whom is paid a monthly salary of $4,300. Noble’s budget and actual figures for the month of May was as follows:

The budget above is based on the following assumptions:

1 The restaurant is only open six days a week and there are four weeks in a month. The average number of orders each day is 50 and demand is evenly spread across all the days in the month.

2 The restaurant offers two meals: Meal A, which costs $35 per meal and Meal B, which costs $45 per meal. In addition to this, irrespective of which meal the customer orders, the average customer consumes four drinks each at $2·50 per drink. Therefore, the average spend per customer is either $45 or $55 including drinks, depending on the type of meal selected. The May budget is based on 50% of customers ordering Meal A and 50% of customers ordering Meal B.

3 Food costs represent 12·5% of revenue from food sales.

4 Drink costs represent 20% of revenue from drinks sales.

5 When the number of orders per day does not exceed 50, each member of hourly paid staff is required to work exactly six hours per day. For every incremental increase of five in the average number of orders per day, each member of staff has to work 0·5 hours of overtime for which they are paid at the increased rate of $12 per hour. You should assume that all costs for hourly paid staff are treated wholly as variable costs.

6 Energy costs are deemed to be related to the total number of hours worked by each of the hourly paid staff, and are absorbed at the rate of $2·94 per hour worked by each of the eight staff.

Required:

(a) Prepare a flexed budget for the month of May, assuming that the standard mix of customers remains the same as budgeted. (12 marks)

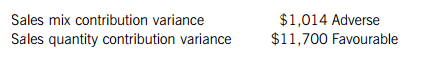

(b) After preparation of the flexed budget, you are informed that the following variances have arisen in relation to total food and drink sales:

(c) Noble’s owner told the restaurant manager to run a half-price drinks promotion at Noble for the month of May on all drinks. Actual results showed that customers ordered an average of six drinks each instead of the usual four but, because of the promotion, they only paid half of the usual cost for each drink. You have calculated the sales margin price variance for drink sales alone and found it to be a worrying $11,700 adverse. The restaurant manager is worried and concerned that this makes his performance for drink sales look very bad.

Required:

Briefly discuss TWO other variances that could be calculated for drinks sales or food sales in order to ensure that the assessment of the restaurant manager’s performance is fair. These should be variances that COULD be calculated from the information provided above although no further calculations are required here. (4 marks)

第8题

rial premises. It is about to launch a new product, the ‘Energy Buster’, a unique air conditioning unit which is capable of providing unprecedented levels of air conditioning using a minimal amount of electricity. The technology used in the Energy Buster is unique so Heat Co has patented it so that no competitors can enter the market for two years. The company’s development costs have been high and it is expected that the product will only have a five-year life cycle.

Heat Co is now trying to ascertain the best pricing policy that they should adopt for the Energy Buster’s launch onto the market. Demand is very responsive to price changes and research has established that, for every $15 increase in price, demand would be expected to fall by 1,000 units. If the company set the price at $735, only 1,000 units would be demanded.

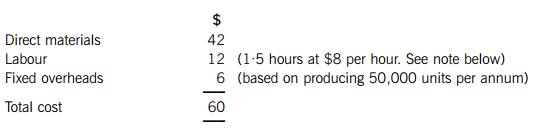

The costs of producing each air conditioning unit are as follows:

Note

The first air conditioning unit took 1·5 hours to make and labour cost $8 per hour. A 95% learning curve exists, in relation to production of the unit, although the learning curve is expected to finish after making 100 units. Heat Co’s management have said that any pricing decisions about the Energy Buster should be based on the time it takes to make the 100th unit of the product. You have been told that the learning co-efficient, b = –0·0740005.

All other costs are expected to remain the same up to the maximum demand levels.

Required:

(a) (i) Establish the demand function (equation) for air conditioning units; (3 marks)

(ii) Calculate the marginal cost for each air conditioning unit after adjusting the labour cost as required by the note above; (6 marks)

(iii) Equate marginal cost and marginal revenue in order to calculate the optimum price and quantity. (3 marks)

(b) Explain what is meant by a ‘penetration pricing’ strategy and a ‘market skimming’ strategy and discuss whether either strategy might be suitable for Heat Co when launching the Energy Buster. (8 marks)

第9题

ilding industry. The company has found that when weather conditions are good, the demand for cement increases since more building work is able to take place. Last year, the weather was so good, and the demand for cement was so great, that Cement Co was unable to meet demand. Cement Co is now trying to work out the level of cement production for the coming year in order to maximise profits. The company doesn’t want to miss out on the opportunity to earn large profits by running out of cement again. However, it doesn’t want to be left with large quantities of the product unsold at the end of the year, since it deteriorates quickly and then has to be disposed of. The company has received the following estimates about the probable weather conditions and corresponding demand levels for the coming year:

Each bag of cement sells for $9 and costs $4 to make. If cement is unsold at the end of the year, it has to be disposed of at a cost of $0·50 per bag.

Cement Co has decided to produce at one of the three levels of production to match forecast demand. It now has to decide which level of cement production to select.

Required:

(a) Construct a pay off table to show all the possible profit outcomes. (8 marks)

(b) Decide the level of cement production the company should choose, based on the following decision rules:

(i) Maximin (1 mark)

(ii) Maximax (1 mark)

(iii) Expected value (4 marks)

You must justify your decision under each rule, showing all necessary calculations.

(c) Describe the ‘maximin’ and ‘expected value’ decision rules, explaining when they might be used and the attitudes of the decision makers who might use them. (6 marks)

第10题

e of high quality electrical appliances such as kettles, toasters and steam irons for domestic use which it sells to electrical stores in Voltland.

The directors consider that the existing product range could be extended to include industrial sized products such as high volume water boilers, high volume toasters and large steam irons for the hotel and catering industry. They recently commissioned a highly reputable market research organisation to undertake a market analysis which identifi ed a number of signifi cant competitors within the hotel and catering industry.

At a recent meeting of the board of directors, the marketing director proposed that BEG should make an application to gain ‘platinum status’ quality certifi cation in respect of their industrial products from the Hotel and Catering Institute of Voltland in order to gain a strong competitive position. He then stressed the need to focus on increasing the effectiveness of all operations from product design to the provision of after sales services.

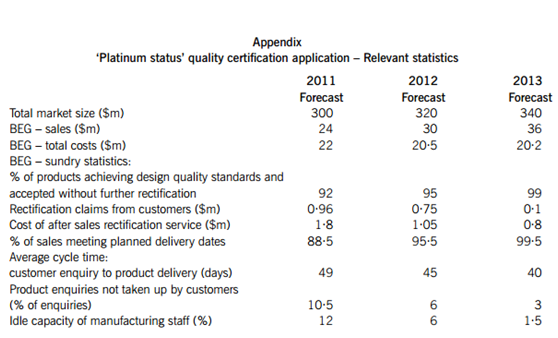

An analysis of fi nancial and non-fi nancial data relating to the application for ‘platinum status’ for each of the years 2011, 2012 and 2013 is contained in the appendix.

The managing director of BEG recently returned from a seminar, the subject of which was ‘The Use of Cost Targets’. She then requested the management accountant of BEG to prepare a statement of total costs for the application for platinum status for each of years 2011, 2012 and 2013. She further asked that the statement detailed manufacturing cost targets and the costs of quality.

The management accountant produced the following statement of manufacturing cost targets and the costs of quality:

Required:

(a) Explain how the use of cost targets could be of assistance to BEG with regard to their application for platinum status. Your answer must include commentary on the items contained in the statement of manufacturing cost targets and the costs of quality prepared by the management accountant. (8 marks)

(b) Assess the forecasted performance of BEG for the period 2011 to 2013 with reference to the application for ‘platinum status’ quality certifi cation under the following headings:

(i) Financial performance and marketing;

(ii) External effectiveness; and

(iii) Internal effi ciency. (12 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!