重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

AggroChem is a fully listed company fi nanced wholly by equity. LeverChem is listed on an alternative investment market. Both companies have been trading for over 10 years and have shown strong levels of profi tability recently. However, both companies’ shares are thinly traded. It is thought that the current market value of LeverChem’s shares at higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

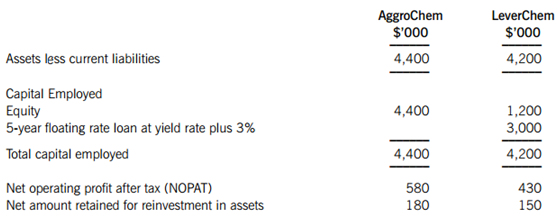

The following information is taken from the fi nancial statements of both companies at the start of the current year:

It can be assumed that the retained earnings for both companies are equal to the net reinvestment in assets.

The assets of both companies are stated at fair value. Discussions with the AtReast Bank have led to an agreement that the fl oating rate loan to LeverChem can be transferred to the combined business on the same terms. The current yield rate is 5% and the current equity risk premium is 6%. It can be assumed that the risk free rate of return is equivalent to the yield rate. AggroChem’s beta has been estimated to be 1·26.

AggroChem Co wants to use the Black-Scholes option pricing (BSOP) model to assess the value of the combined business and the maximum premium payable to LeverChem’s shareholders. AggroChem has conducted a review of the volatility of the NOPAT values of both companies since both were formed and has estimated that the volatility of the combined business assets, if the acquisition were to go ahead, would be 35%. The exercise price should be calculated as the present value of a discount (zero-coupon) bond with an identical yield and term to maturity of the current bond.

Required:

Prepare a report for the management of AggroChem on the valuation of the combined business following acquisition and the maximum premium payable to the shareholders of LeverChem. Your report should:

(i) Using the free cash fl ow model, estimate the market value of equity for AggroChem Co, explaining any assumptions made. (9 marks)

(ii) Explain the circumstances in which the Black-Scholes option pricing (BSOP) model could be used to assess the value of a company, including the data required for the variables used in the model. (5 marks)

(iii) Using the BSOP methodology, estimate the maximum price and premium AggroChem may pay for LeverChem. (9 marks)

(iv) Discuss the appropriateness of the method used in part (iii) above, by considering whether the BSOP model can provide a meaningful value for a company. (5 marks)

Professional marks will be awarded in question 2 for the clarity and presentation of the report. (4 marks)

更多“AggroChem Co is undertaking a due diligence investigation of LeverChem Co and is reviewing”相关的问题

更多“AggroChem Co is undertaking a due diligence investigation of LeverChem Co and is reviewing”相关的问题

第1题

??Section A – BOTH questions are compulsory and MUST be attempted??

The Seal Island Nuclear Power Company has received initial planning consent for an Advanced Boiling Water Reactor. This project is one of a number that has been commissioned by the Government of Roseland to help solve the energy needs of its expanding population of 60 million and meet its treaty obligations by cutting CO2 emissions to 50% of their 2010 levels by 2030.

The project proposal is now moving to the detailed planning stage which will include a full investment appraisal within the financial plan. The financial plan so far developed has been based upon experience of this reactor design in Japan, the US and South Korea.

The core macro economic assumptions are that Roseland GDP will grow at an annual rate of 4% (nominal) and inflation will be maintained at the 2% target set by the Government.

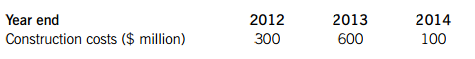

The construction programme is expected to cost $1 billion over three years, with construction commencing in January 2012. These capital expenditures have been projected, including expected future cost increases, as follows:

Generation of electricity will commence in 2015 and the annual operating surplus in cash terms is expected to be $100 million per annum (at 1 January 2015 price and cost levels). This value has been well validated by preliminary studies and includes the cost of fuel reprocessing, ongoing maintenance and systems replacement as well as the continuing operating costs of running the plant. The operating surplus is expected to rise in line with nominal GDP growth. The plant is expected to have an operating life of 30 years.

Decommissioning costs at the end of the project have been estimated at $600 million at current (2012) costs. Decommissioning costs are expected to rise in line with nominal GDP growth.

The company’s nominal cost of capital is 10% per annum. All estimates, unless otherwise stated, are at 1 January 2012 price and cost levels.

Required:

Produce a preliminary briefing note which, on the basis of the above information, includes:

(i) An estimate of the net present value for this project as at the commencement of construction in 2012. (11 marks)

(ii) A discussion of the principal uncertainties associated with this project. (7 marks)

(iii) A sensitivity of the project’s net present value (in percentage and in $), to changes in the construction cost, the annual operating surplus and the decommissioning cost. (Assume that the increase in construction costs would be proportional to the initial investment for each year.) (6 marks)

(iv) An explanation of how simulations, such as the Monte Carlo simulation, could be used to assess the volatility of the net present value of this project. (4 marks)

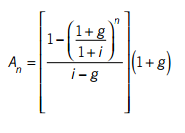

Note: the formula for an annuity discounted at an annual rate (i) and where cash flows are growing at an annual rate (g) is as follows:

第2题

f the portfolio is represented by a holding of 5,550,000 ordinary shares of Mondglobe plc. The managers are concerned about the effect on portfolio value if the price of Mondglobe’s shares should fall, and are considering selling the shares. Daylon’s investment bank has suggested that the risk of Mondglobe’s shares falling by more than 5% from their current value could be protected against by buying an over the counter option. The investment bank is prepared to sell an appropriate six month option to Daylon for £250,000.

Other information:

(i) The current market price of Mondglobe’s ordinary shares is 360 pence.

(ii) The annual volatility (variance) of Mondglobe’s shares for the last year was 169%.

(iii) The risk free rate is 4% per year.

(iv) No dividend is expected to be paid by Mondglobe during the next six months.

Required:

(a) Evaluate whether or not the price at which the investment bank is willing to sell the option is a fair price.(10 marks)

第3题

gy to increase gearing, and explain whether or not the estimates produced in (b) above are likely to be accurate. (10 marks)

第4题

the share repurchase on the company’s cost of capital and value. (5 marks)

第5题

ering a fall in their expected wealth, and discuss whether or not the directors of Paxis should proceed with the bid. (5 marks)

第6题

ted by the shareholders of Wragger plc.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!