重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.2.5%

B.4.2%

C.8.8%

D.11.0%

答案

答案

更多“Consider a portfolio that consists of an equal investment in 20 firms. For each of these firms, ther…”相关的问题

更多“Consider a portfolio that consists of an equal investment in 20 firms. For each of these firms, ther…”相关的问题

第1题

A、1.8

B、2.1

C、2.0

D、2.4

第2题

Consider a U.S. portfolio manager who holds a portfolio of French stocks currently worth €10 million. In order to hedge against a potential depreciation of the euro, the portfolio manager proposes to sell December futures contracts on the euro that currently trade at $1/€ and expire in two months. The spot exchange rate is currently $1.1/€. A month later, the value of the French portfolio is €10,050,000 and the spot exchange rate is $1.05/€, while the futures exchange rate is $0.95/€. a. Evaluate the effectiveness of the hedge by comparing the fully hedged portfolio return with the unhedged portfolio return. b. Calculate the return on the portfolio, assuming a 35 percent hedge ratio.

第3题

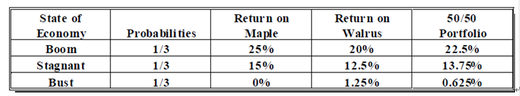

Consider an opportunity to invest in two Canadian stocks on an equally-weighted portfolio with return distributions as follow. (1) Calculate the expected returns and standard deviations of the returns for the two stocks. (2) Calculate the expected return and standard deviation of the return for the equally-weighted portfolio. (3) Calculate the covariance of the returns for Maple and Walrus. (4) Calculate the correlation coefficient for Maple and Walrus, and explain the relationship among the standard deviations for Maple, Walrus, and the portfolio?

(1) Calculate the expected returns and standard deviations of the returns for the two stocks. (2) Calculate the expected return and standard deviation of the return for the equally-weighted portfolio. (3) Calculate the covariance of the returns for Maple and Walrus. (4) Calculate the correlation coefficient for Maple and Walrus, and explain the relationship among the standard deviations for Maple, Walrus, and the portfolio?

第4题

A.$2 million

B.$1.414 million

C.$1.483 million

D.$1.449 million

第5题

A、Consider the suitability of the portfolio relative to the clients needs and situation.

B、Make investment decision that is consistent with the stated objectives and constraints of the fund.

C、Make investment decisions in the context of the clients total portfolio.

第6题

A、$94,117.65

B、$95,117.65

C、$93,117.65

D、$91,117.65

第7题

Consider a risky portfolio, A, with an expected rate of return of 0.15 and a standard deviation of 0.15, that lies on a given indifference curve.Which one of the following portfolios might lie on the same indifference curve?()

A.E(r) = 0.15; Standard deviation = 0.20

B.E(r) = 0.15; Standard deviation = 0.10

C.E(r) = 0.10; Standard deviation = 0.10

D.E(r) = 0.20; Standard deviation = 0.15

第8题

A、If the total price of A and B is cheaper than the price of C, then we could make a profit selling A and B and buying C.

B、Price(C) = Price(A) + Price(B)

C、Because security C is equivalent to the portfolio of A and B, by the law of one price they must have the same price.

D、The relationship known as value additivity says that the value of a portfolio is equal to the sum of the values of its parts.

第9题

You are a U.S. investor and currently have a portfolio worth :100 million in German bonds. The current spot exchange rate is €2/$. The current one-year market interest rates are 6 percent in the euro area and 10 percent in the United States. One-year currency options are quoted with a strike price of $0.50/€; a call on euros is quoted at $0.01 per euro, and a put on euros is quoted at $0.012 per euro. You are worried that inflation in euro area will cause a drop in the euro. You consider using forward contracts or options to hedge the currency risk. a. What is the one-year forward exchange rate $::? b. Calculate the dollar value of your portfolio, assuming that its euro value stays at €100 million; use $:€ spot exchange rates equal in one year to 1.6, 1.8, 2, 2.2, and 2.4. First consider a currency forward hedge, then a currency option insurance. c. What could make your forward hedge imperfect?

第10题

and your own investment constraints and goals. The goals and constraints you should

consider are:

I. the physical property and the legal property rights.

II. the determinants of value: demand, supply, and market valuation.

III. the risk-return relationship of real estate and how much of your portfolio should be in

real estate.

IV. the technical skills needed to maintain the property and the managerial talent

necessary to control the property.

A.I and II only.

B.III and IV only.

C.I and III only.

D.II and IV only.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!