重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.both bonds will increase in value, but bond F will increase more than bond G

B.both bonds will increase in value, but bond G will increase more than bond F

C.both bonds will decrease in value, but bond F will decrease more than bond G

D.both bonds will decrease in value, but bond G will decrease more than bond F

E.none of the above

更多“Consider two bonds, F and G. Both bonds presently are selling at their par value of $1,000. Each pay…”相关的问题

更多“Consider two bonds, F and G. Both bonds presently are selling at their par value of $1,000. Each pay…”相关的问题

第1题

A.0.07%

B.2.6%

C.93.0%

D.The default correlation cannot be calculated with the information provided.

第2题

A.lower.

B.higher.

C.The same.

第3题

A.higher than that on the noncallable bond

B.lower than that on the noncallable bond

C.the same as that on the noncallable bond

D.that one cannot tell which one of the two bonds should have a higher return

第4题

A.higher than that on the unconvertible bond

B.lower than that on the nonconvertible bond

C.the same as that on the nonconvertible bond

D.that one cannot tell which one of the two bonds should have a higher return

第5题

A. lower.

B. the same.

C. higher.

第6题

A、Highest coupon rate.

B、Coupon rate closest to its market yield.

C、Lowest coupon rate.

第7题

A.Correct Incorrect

B.Correct Correct

C.Incorrect Incorrect

D.Incorrect Correct

第8题

第9题

A. Bond A

B. Bond B

C. Bond C

第10题

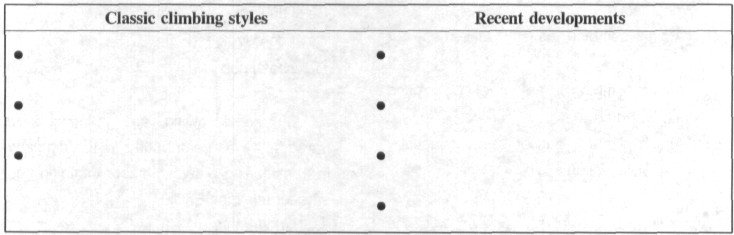

Answer Choices (A)rock climbing (B)indoor climbing (C)environmental bonds (D)a variety of climbing places (E)climbing permits (F)ice climbing (G)professional equipment (H)climbing competitions (I)alpine climbing

Answer Choices (A)rock climbing (B)indoor climbing (C)environmental bonds (D)a variety of climbing places (E)climbing permits (F)ice climbing (G)professional equipment (H)climbing competitions (I)alpine climbing

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!