重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.zero.

B.$14.87.

C.$45.85.

D.$7.44.

E.none of the above.

更多“Consider a $1,000 par value 20-year zero coupon bond issued at a yield tomaturity of 10%. If you buy…”相关的问题

更多“Consider a $1,000 par value 20-year zero coupon bond issued at a yield tomaturity of 10%. If you buy…”相关的问题

第1题

A.8.28%

B.7.28%

C.6.28%

第2题

A.8.37%.

B.8.29%.

C.7.41%.

第3题

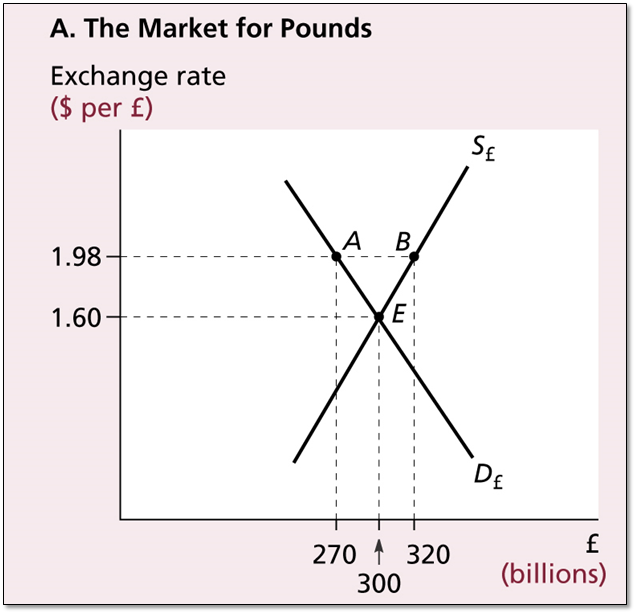

In Figure 3. 2 A, consider an officially declared “par value” is $2.00 per pound, its market-clearing rate is$1.60 per pound. British officials have announced that they will support the pound at 1 percent below par(about $1.98)and the dollar at 1 percent above par(about $2.02. In Figure 3.2A, the official are forced to make good on this pledge by officially intervening in the foreign exchange market: buying £50 billion, and ()。

A、buying $99 billion (equal to £ 50 billion times $1. 98 per pound)

B、selling $99 billion (equal to £ 50 billion times $1. 98 per pound)……

C、buying 50 billion dollars

D、selling 50 billion dollars

第4题

discount rate does not change, one year from now the value of the bond will most likely:

A、increase.

B、decrease.

C、Stay the same.

第5题

A、Decreases then increases

B、Increases then decreases

C、Decreases then remains unchanged

第6题

A、Increases then decreases

B、Decreases then increases

C、Decreases then remains unchanged

第7题

A、Decreases then remains unchanged

B、Decreases then increases

C、Increases then decreases

第8题

A. Decline then remain unchanged.

B. Decline then rise.

C. Rise then decline.

第9题

Consider $1,000,000 par value, 10-year, 6.5% coupon bonds issued on January 1, 2005. The bonds are callable and there is a sinking fund

A、An investor would benefit from having his bonds called under the provision of the sinking fund.

B、An investor will receive a premium if the bond is redeemed prior to maturity under the provision of the sinking fund.

C、The bonds do not have an accelerated sinking fund provision.

第10题

In Figure 3. 2 A (在图表3.2 A中), consider an officially declared “par value” is $2.00 per pound(假设官方宣布的“平价”汇率为每英镑2美元), its market-clearing rate is$1.60 per pound(英镑的市场出清价格1.6美元). British officials have announced that they will support the pound at 1 percent below par(about $1.98)and the dollar at 1 percent above par(about $2.02)(英国官方已宣布其将在平价的1%以下(约为1.98美元)支持英镑,在平价的1%以上(约为2.02美元)支持美元). In Figure 3.2A, the official are forced to make good on this pledge by officially intervening in the foreign exchange market: buying £50 billion, and ()(政府当局被迫通过对外汇市场的干预来履行这一承诺具体做法是在外汇市场中买入500亿英镑, 同时())。

A、buying $99 billion (equal to £ 50 billion times $1. 98 per pound)

B、selling $99 billion (equal to £ 50 billion times $1. 98 per pound)

C、buying 50 billion dollars

D、selling 50 billion dollars

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!