重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

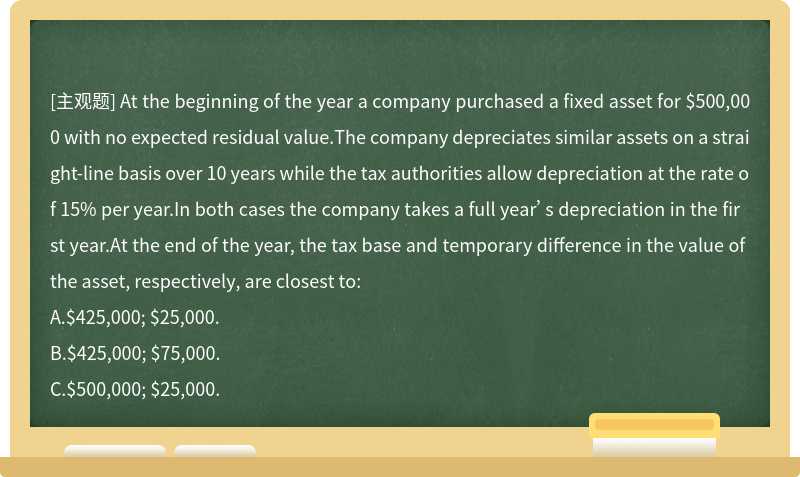

A.$425,000; $25,000.

B.$425,000; $75,000.

C.$500,000; $25,000.

更多“At the beginning of the year a company purchased a fixed asset for $500,000 with no e”相关的问题

更多“At the beginning of the year a company purchased a fixed asset for $500,000 with no e”相关的问题

第1题

Under U.S.GAAP, which of the following factors is an analyst least likely to consider when determining if a company’s deferred tax liabilities should be treated as a liabilities or equity?

A.The growth rate of the firm.

B.The average discount rate of liabilities.

C.the expectation that temporary difference will reverse.

第2题

A financial analyst would classify deferred tax liabilities as equity (versus a liability) when:

A.the deferred tax liabilities are expected to decline over time.

B.the deferred tax liabilities are predominantly comprised of permanent differences.

C.a change in tax law may result in the deferred taxes never being paid by the company.

第3题

Bao Inc.sold a luxury passenger boat from its inventory on December 31 for $2,000,000.It is estimated that Bao will incur $100,000 in warranty expenses during its 5-year warranty period.Bao’s tax rate is 30%.To account for the tax implications of the warranty obligation prior to incurring warranty expenses, Bao should:

A.record a deferred tax asset of $30,000.

B.record a deferred tax asset of $30,000.

C.make no entry until actual warranty expenses are incurred.

第4题

A firm needs to adjust the financial statements for a change in the tax rate.Taxable income if $80,000 and pretax income is $100,000.The current tax rate is 50%, and the new tax rate is 40%.The difference in taxes payable between the two rates is closest to:

A.$8,000.

B.$9,000.

C.$10,000.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!