重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A. use LIFO inventory accounting.

B. use proportionate consolidation for a joint venture.

C. recognize unrealized losses from held-for-trading securities in net income.

更多“Firms that prepare their financial statements according to International Financial R”相关的问题

更多“Firms that prepare their financial statements according to International Financial R”相关的问题

第1题

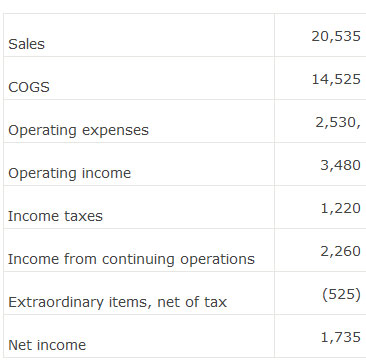

A firm presents the following income statement, which complies with the standards under which it must report:

Based on the differences between U.S.GAAP and International Financial Reporting Standards, this firm:

A. must report any dividends received as operating cash flows.

B. is permitted to recognize upward revaluations of long-lived assets.

C. cannot have used LIFO as its inventory cost assumption.

第2题

likely to be sales driven?

A. Current assets.

B. Interest expense.

C. Administrative expenses.

Ans: B.

Interest expense is considered a fixed burden and a function of a firm’s capital structure, not sales.

A is incorrect. Current assets are normally a sales driven account.

C is incorrect. Administrative expenses, although they may contain fixed costs, are primarily sales driven.

14. Which of the following pairs of general categories are least likely to be considered in the formulas used by credit rating agencies to determine the capacity of a borrower to repay a debt?

A. Operational efficiency; leverage.

B. Margin stability, availability of collateral.

C. Leverage; scale and diversification.

第3题

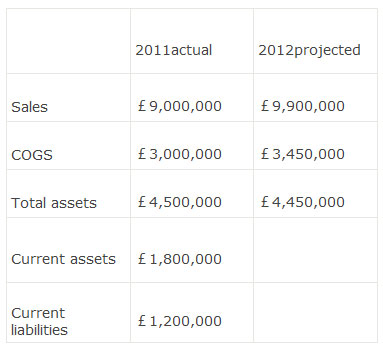

and its projected sales, COGS, and assets for 2012:

Based on the projected sales increase, the best estimate of 2010 projected current assets isclosest to:

A. £1,890,000.

B. £1,980,000.

C. £2,070,000.

第4题

ces, a company’s gross margin ratio increased by 5% (i.e., from 35% to 40%). The most likely effect on the company’s operating margin ratio as a result of the change in strategy would be an increase:

A. equal to 5%.

B. less than 5%.

C. greater than 5%.

第5题

bles to finance a reduction in its long-term debt. The receivables and the risk of default are transferred at 80% of their book value. The debt reduction will reduce interest expense from $50,000 to $25,000 per year. The effective tax rate is 30%. Assuming that the current year’s EBIT is $142,500, at the end of the year, the results of the receivables sale will be an interest coverage ratio closest to:

A. 1.1X.

B. 2.1X.

C. 3.1X.

第6题

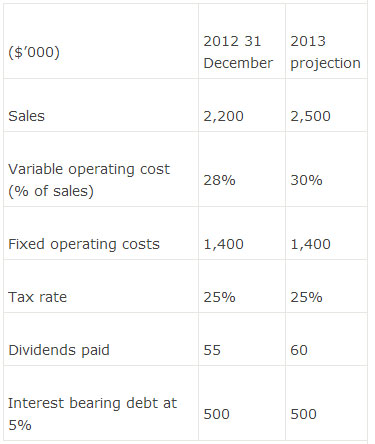

Selected information about a company is as follows:

The forecasted net income (in ‘000) for 2013 is closest to:

A.$169.

B.$202.

C.$244.

第7题

The 2012 income statement for a subject company is as follows:

For 2013, net sales are projected to increase by 12%, gross profit margin is expected to increase by 2% while SG&A expenses as a percent of net sales is expected to remain constant, total debt is not expected to change, and the effective tax rate is expected to remain constant.

Based on the above information, the company’s 2013 projected net income (in millions) is closest to:

A. $33.

B. $44.

C. $55.

第8题

An analyst uses a stock screener and selects the following metrics: a global equity index, P/E ratio lower than the median P/E ratio, and a price-book value ratio lower than the median price-book value ratio. The stocks so selected would be mostappropriate for portfolios of which type of investors?

A. Value investors.

B. Growth investors.

C. Market-oriented investors.

第9题

When analyzing a company that prepares its financial statements according to U.S. GAAP, calculating the price/tangible book value ratio instead of the price/book value ratio is mostappropriate if it:

A. grows primarily through acquisitions.

B. develops its patents and processes internally.

C. invests a substantial amount in new capital assets.

第10题

An equity manager conducted a stock screen on 5,000 U.S. stocks that comprise her investment universe. The results of the screen are presented in the table below.

If all the criteria were completely independent of each other, the number of stocks meeting all four criteria would be closest to:

A.293.

B.371.

C.540.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!