重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

所有者权益审计,一般采用详查的方式,且一般不需要对其内部控制进行符合性测试。()

A.正确

B.错误

更多“所有者权益审计,一般采用详查的方式,且一般不需要对其内部控制进行符合性测试。()A.正确B.错误”相关的问题

更多“所有者权益审计,一般采用详查的方式,且一般不需要对其内部控制进行符合性测试。()A.正确B.错误”相关的问题

第1题

PERSONAL INCOME TAX RATE (MONTHLY) (_VALID FROM SEPT. 1, 2011_) bracket grading tax rate (%) (TR) simple coefficient (SC) 1 less than 1,500 3 0 2 1,500-4,500 10 105 3 4,500-9,000 20 555 4 9,000-35,000 25 1005 5 35,000-55,000 30 2755 6 55,000-80,000 35 5505 7 Over 80,000 45 13505 NoteTax=(income -3500)*TR-SC The above chart shows individual income tax in China. The tax free threshold is 3,500 RMB per month. The tax rates are divided into 7 brackets. The lowest rate is 3% for income between 3,501 and 5,000, while the highest rate is 45% for income over 80,000. Therefore, the higher our income is, the more tax we should pay. ? Tax, which can be used in public services such as education, road construction, public health and so on, is very important to our country. As we all know, tax makes up a great part of our country’s revenue, and the development of our country depends on it. ? From what has been discussed above, we can see that it is everyone’s legal duty to pay tax because taxes contribute to the country and create benefits for everyone. Those who try to evade taxation are sure to be punished. In short, paying tax is our responsibility to society. DECIDE IF EACH OF THE FOLLOWING STATEMENTS IS TRUE (T) OR FALSE (F).

1. The purpose of the passage is to help people know the tips how to pay less tax.()

2. According to the chart, if a person’s monthly is 3600 yuan, he/she doesn’t need to pay tax.()

3. How much income tax a person pays each month depends on how much his/her income is.()

4. The underlined word “evade” in the last paragraph means increase.()

5. Personal income taxes are included in a government’s revenue.()

第2题

Which chart shows the company's current income by country?

A.

B.

C.

第3题

A、transfers wealth from the government to households.

B、is the increase in real income taxes due to lack of indexation in income tax rules.

C、is a tax on everyone who holds money.

D、All of the above are correct.

第4题

第5题

A、reducing savings.

B、increasing deductions on their income tax

C、reducing cash holdings.

D、None of the above is correct

第6题

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

第7题

A) 0%.

B) 40%.

C) 10%.

第8题

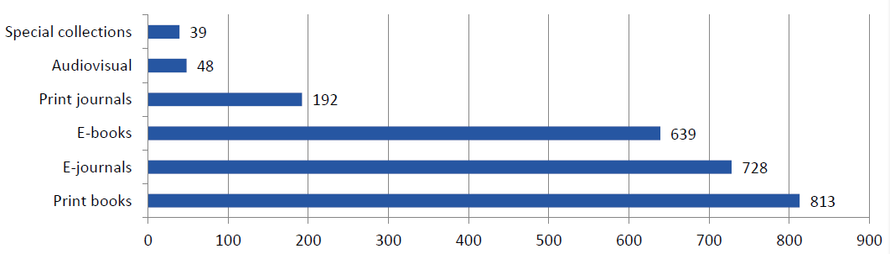

The chart below shows important library resources for individual students. Which of the following statements is not true?

A、E-books and E-jornals are among the third and the second most used library resources.

B、It is still print books that most students use for their studies.

C、The printed journals are more popular than E-journals among students.

D、Special collections and audiovisuals are least popular among students.

第9题

A.The amount of money citizens spend on products subject to the state tax tends to be equal across income levels.

B.The federal income tax favors citizens with high incomes, whereas the state sales tax favors citizens with low incomes.

C.Citizens with low annual incomes can afford to pay a relatively higher percentage of their incomes in state sales tax, since their federal income tax is relatively low.

D.The lower a state"s sales tax, the more it will tend to redistribute income from the more affluent citizens to the rest of society.

E.Citizens who fail to earn federally taxable income are also exempt from the state sales tax.

第10题

A、What is the deadline for tax declaration?

B、What do you mean by taxable services?

C、What do you think of the deadline for tax declaration?

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!