重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.R1

B.R2

C.R3

D.R4

答案

答案

更多“程序段N10R1=30R2=32R3=50R4=20;N20G00X=R2*SIN(R1)+R4Z=R2*COS(R1)+R3;中,只对X坐标值有影响的R参数是(SIEMENS系统)()”相关的问题

更多“程序段N10R1=30R2=32R3=50R4=20;N20G00X=R2*SIN(R1)+R4Z=R2*COS(R1)+R3;中,只对X坐标值有影响的R参数是(SIEMENS系统)()”相关的问题

第1题

%

N10 G90 G54 G00 X70.0 Y1.Z100.0;

N12 S1000 M03; 解释:(______)

N18 Z10.0;

N20 G01 Z0.00 F300.0;

N22 G41 D01 Y30.0 F500.0; 解释:(______)

N24 G03 X40.0 Y0 I0 J-30.0;

N26 G01 Y-35.0 F1000.0;

N28 G02 X35.0 Y-40.0(I______J______);

N30 G01 X-35.0;

N32 G02 X-40.0 Y-35.0 R5.0;

N34 G01 Y35.0;

N36 G02 X-35.0 Y40.0 R5.0;

N38 G01 X35.0;

N40 G02 X40.0 Y35.0 R5.0;

N42 G01 Y0;

N44 G03 X70.0 Y-30.0 130.0 J0 F500.0;

N46 G40 G01 Y0;

N48 Z10.0 F2000.;

N50 G00 Z100.0.M05; 解释:(______)

N52 M30;

%

第2题

问题:

请阅读以下R3和R4的部分配置信息,并补充(6)到(10)空白处的配置命令或参数,按题目要求完成路由器的配置。

R3的POS接口、OSPF和缺省路由的配置信息

Router-R3configure terminal

Router-R3(config)

Router-R3(config)interface pos3/0

Router-R3(config-if)description To Internet

Router-R3(config-if)bandwidth 2500000

Router-R3(config-if)ip address 195.19.78.5 255.255.255.252

Router-R3(config-if) (6) 32

Router-R3(config-if)pos framing sonet

Router-R3(config-if)no ip directed-broadcast

Router-R3(config-if)pos flag (7)

Router-R3(config-if)no shutdown

Router-R3(config-if)exit

Router-R3(config)router ospf 65

Router-R3(config-router)network 222.98.66.128 (8) area 0

Router-R3(config-router)redistribute connected metric-type 1 subnets

Router-R3(config-router)area 0 range 222.98.66.128 (9)

Router-R3(config-router)exit

Router-R3(config)ip route 0.0.0.0.0.0.0.0 195.19.78.6

Router-R3(config)exit

Router-R3

R4的静态路由配置信息

Router-R4configure terminal

Router-R4(config)ip route 222.98.66.128 (10)

第3题

病人LMP2005年7月23日,停经40天出现早孕反应,3个月后消失,妊娠4个多月感胎动,妊娠5个月首次产前检查,测血压90/60mmHg。12天前在当地产前检查发现血压140/90mmHg,胎心、胎位正常,水肿(+++),无头昏、头痛,给予休息、降压处理,11日晚11时30分突感持续性腹痛,进行性加剧,伴有恶心、呕吐。出汗及阴道流血,救护车急送入院。

体格检查:T37℃,R22次/分,P120次/分,BP80/50mmHg,急性重病容,面色苍白,神清合作,心率120次/分,律齐,双下肢、会阴部及腹壁凹陷性水肿。产科情况:腹部膨隆如孕足月大小,子宫底剑下2横指,张力高,板状,子宫左侧壁有明显压痛,胎心音、胎方位不清。肛门检查子宫颈管未消,宫口指尖,先露高浮。

实验室检查:Hb80g/L,WBC12.5×10/L,N0.81,L0.19,PLT86×10/L,尿蛋白(+++)。

第4题

A UK client ordered 10,000 jeans, requiring CIF C 5 London,premiums covering all risks. Purchase cost: 30 RMB per jean,logistics cost:15000 RMB, expected profit rate:10%, foreign exchange rate of BOC:1USD=7.61/7.64RMB,commodity added-value tax rate:17%,rebate tax rate:13%.(P.S:25jeans each carton, carton size:45X36X25,G.W.35KG,N.W.32KG,freight from harber to London:150 USD per ton ,overseas shipping premium is defined as 0.6% by W/M,which covers all insurance).The following conclusions ( ) are correct.

A、FOB net price is 4.07 USD

B、freigt(per set) is 0.24USD

C、CIF C 5 London is 4.34USD

D、CIF C 5% London is 4.57 USD

第5题

A UK client ordered 10,000 jeans, requiring CIF C 5 London,premiums covering all risks. Purchase cost 30 RMB: per jean,logistics cost:15000 RMB, expected profit rate:10%, foreign exchange rate of BOC:1USD=7.61/7.64RMB,commodity added-value tax rate:17%,rebate tax rate:13%.(P.S:25jeans each carton, carton size:45X36X25,G.W.35KG,N.W.32KG,freight from harber to London:150 USD per ton ,overseas shipping premium is defined as 0.6% by W/M,which covers all insurance).The following conclusions ( ) are correct.

A、FOB net price is 4.07 USD

B、freigt(per set) is 0.24USD

C、CIF C 5 London is 4.34USD

D、CIF C 5% London is 4.57 USD

第6题

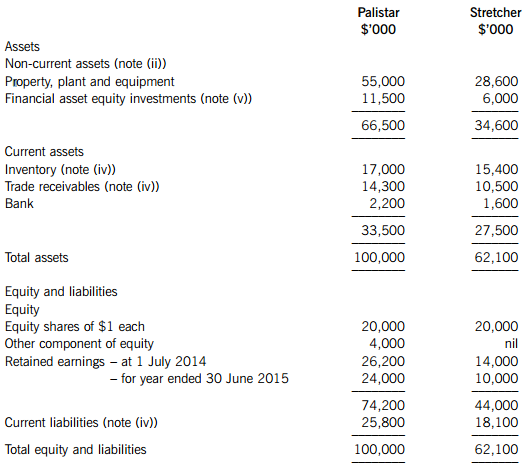

The summarised statements of financial position of the two companies as at 30 June 2015 are:

The following information is relevant:

(i) Stretcher’s business is seasonal and 60% of its annual profit is made in the period 1 January to 30 June each year.

(ii) At the date of acquisition, the fair value of Stretcher’s net assets was equal to their carrying amounts with the following exceptions:

An item of plant had a fair value of $2 million below its carrying value. At the date of acquisition it had a remaining life of two years.

The fair value of Stretcher’s investments was $7 million (see also note (v)).

Stretcher owned the rights to a popular mobile (cell) phone game. At the date of acquisition, a specialist valuer estimated that the rights were worth $12 million and had an estimated remaining life of five years.

(iii) Following an impairment review, consolidated goodwill is to be written down by $3 million as at 30 June 2015.

(iv) Palistar sells goods to Stretcher at cost plus 30%. Stretcher had $1·8 million of goods in its inventory at 30 June 2015 which had been supplied by Palistar. In addition, on 28 June 2015, Palistar processed the sale of $800,000 of goods to Stretcher, which Stretcher did not account for until their receipt on 2 July 2015. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Stretcher before the year end. At 30 June 2015, Palistar had a trade receivable balance of $2·4 million due from Stretcher which differed to the equivalent balance in Stretcher’s books due to the sale made on 28 June 2015.

(v) At 30 June 2015, the fair values of the financial asset equity investments of Palistar and Stretcher were $13·2 million and $7·9 million respectively.

(vi) Palistar’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Stretcher’s share price at that date is representative of the fair value of the shares held by the non-controlling interest.

Required:

Prepare the consolidated statement of financial position for Palistar as at 30 June 2015. (25 marks)

(b) For many years, Dilemma has owned 35% of the voting shares and held a seat on the board of Myno which has given Dilemma significant influence over Myno. The other shares (65%) in Myno were held by many other shareholders who all owned less than 10% of the share capital. On this basis, Dilemma considered Myno to be an associate and has used equity accounting to account for its investment.

In March 2015, Agresso made an offer to buy all of the shares of Myno. The offer was supported by the majority of Myno’s directors. Dilemma did not accept the offer and held on to its shares in Myno.

On 1 April 2015, Agresso announced that it had acquired the other 65% of the share capital of Myno and immediately convened a board meeting at which three of the previous directors of Myno were replaced, including the seat held by Dilemma.

Required:

Explain how the investment in Myno should be treated in the consolidated statement of profit or loss of Dilemma for the year ended 30 June 2015 and the consolidated statement of financial position at 30 June 2015. (5 marks)

第7题

taxpayers. Barry, their son, is aged 32. Graeme, Catherine and Barry are all UK resident, ordinarily resident and

domiciled. Graeme has come to you for some tax advice.

Graeme has invested in shares for some time, in particular shares in Thistle Dubh Limited. He informs you of the

following transactions in Thistle Dubh Limited shares:

(i) In December 1986, on the death of his grandmother, he inherited 10,000 £1 ordinary shares in Thistle Dubh

Limited, an unquoted UK trading company providing food supplies for sporting events. The probate value of the

shares was 360p per share.

(ii) In March 1992, he took up a rights issue, buying one share for every two held. The price paid for the rights

shares was £10 per share.

(iii) In October 1999, the company underwent a reorganisation, and the ordinary shares were split into two new

classes of ordinary share – ‘T’ shares and ‘D’ shares, each with differing rights. Graeme received two ‘T’ and three

‘D’ shares for each original Thistle Dubh Limited share held. The market values for the ‘T’ shares and the ‘D’

shares on the date of reorganisation were 135p and 405p per share respectively.

(iv) On 1 May 2005, Graeme sold 12,000 ‘T’ shares. The market values for the ‘T’ shares and the ‘D’ shares on that

day were 300p and 600p per share respectively.

(v) In October 2005, Graeme sold all of his ‘D’ shares for £85,000.

(vi) The current market value of ‘T’ shares is 384p per share. The shares remain unquoted.

Graeme and Catherine have owned a holiday cottage in a remote part of the UK for many years. In recent years, they

have used the property infrequently, as they have taken their holidays abroad and the cottage has been let out as

furnished holiday accommodation.

Graeme and Catherine are now considering selling the UK country cottage and purchasing a holiday villa abroad.

Initially they plan to let this villa out on a furnished basis, but following their anticipated retirement, would expect to

occupy the property for a significant part of the year themselves, possibly moving to live in the villa permanently.

Required:

(a) Calculate the total chargeable gains arising on Graeme’s disposals of ‘T’ and ‘D’ ordinary shares in May and

October 2005 respectively. (7 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!