重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.10%

B.40%

C.25%

D.17%

更多“A company has the following summarised SOPL for the year. $ Sales revenue 70,000 cost of sales (42,0…”相关的问题

更多“A company has the following summarised SOPL for the year. $ Sales revenue 70,000 cost of sales (42,0…”相关的问题

第1题

A company has the following unadjusted account balances at December 31, of the current year; Accounts Receivable of $185,700 and Allowance for Doubtful Accounts of $1,600 (credit balance). The company uses the aging of accounts receivable to estimate its bad debts. The following aging schedule reflects its accounts receivable at the current year-end: 1. Calculate the amount of the Allowance for Doubtful Accounts that should appear on the December 31, of the current year, balance sheet. 2. Prepare the adjusting journal entry to record bad debts expense for the current year.

第2题

Summarised statements of financial position as at 30 September:

Summarised income statements for the years ended 30 September:

The following additional information is available:

(i) Property, plant and equipment:

The property disposed of was sold for $8·1 million.

(ii) Investments/investment income:

During the year an investment that had a carrying amount of $3 million was sold for $3·4 million. No investments were purchased during the year.

Investment income consists of:

(iii) On 1 April 2011 there was a bonus issue of shares that was funded from the share premium and some of the revaluation reserve. This was followed on 30 April 2011 by an issue of shares for cash at par.

(iv) The movement in the product warranty provision has been included in cost of sales.

Required:

Prepare a statement of cash flows for Mocha for the year ended 30 September 2011, in accordance with IAS 7 Statement of cash flows, using the indirect method. (19 marks)

(b) Shareholders can often be confused when trying to evaluate the information provided to them by a company’s financial statements, particularly when comparing accruals-based information in the income statement and the statement of financial position with that in the statement of cash flows.

Required: In the two areas stated below, illustrate, by reference to the information in the question and your answer to (a), how information in a statement of cash flows may give a different perspective of events than that given by accruals-based financial statements:

(i) operating performance; and

(ii) investment in property, plant and equipment.

The following mark allocation is provided as guidance for this requirement:

(i) 3 marks

(ii) 3 marks

第3题

‘I have just returned from a meeting with the management of Yew Co, and there is a matter I want to bring to your attention. Yew Co’s statement of financial position recognises an intangible asset of $12·5 million in respect of capitalised research and development costs relating to new aircraft engine designs. However, market research conducted by Yew Co in relation to these new designs indicated that there would be little demand in the near future for such designs. Management has provided written representation that they agree with the results of the market research.

Currently, Yew Co has a cash balance of only $125,000 and members of the management team have expressed concerns that the company is finding it difficult to raise additional finance.

The new aircraft designs have been discussed in the chairman’s statement which is to be published with the financial statements. The discussion states that ‘developments of new engine designs are underway, and we believe that these new designs will become a significant source of income for Yew Co in the next 12 months.’

Yew Co’s draft financial statements include profit before tax of $23 million, and total assets of $210 million.

Yew Co is due to publish its annual report next week, so we need to consider the impact of this matter urgently.’

Required:

Discuss the implications of the audit senior’s file note on the completion of the audit and on the auditor’s report, recommending any further actions that should be taken by the auditor. (12 marks)

(b) You are responsible for answering technical queries from other managers and partners of your firm. An audit partner left the following note on your desk this morning:

(i) ‘I am about to draft the audit report for my client, Sycamore Co. I am going on holiday tomorrow and want to have the audit report signed and dated before I leave. The only thing outstanding is the written representation from management – I have verbally confirmed the contents with the finance director who agreed to send the representations to the audit manager within the next few days. I presume this is acceptable?’ (3 marks)

(ii) ‘We are auditing Sycamore Co for the first time. The prior period financial statements were audited by another firm. We are aware that the auditor’s report on the prior period was qualified due to a material misstatement of trade receivables. We have obtained sufficient appropriate evidence that the matter giving rise to the misstatement has been resolved and I am happy to issue an unmodified opinion. But should I refer to the prior year modification in this year’s auditor’s report?’ (3 marks)

Required:

Respond to the audit partner’s comments.

Note: the split of the mark allocation is shown within the question. (18 marks)

第4题

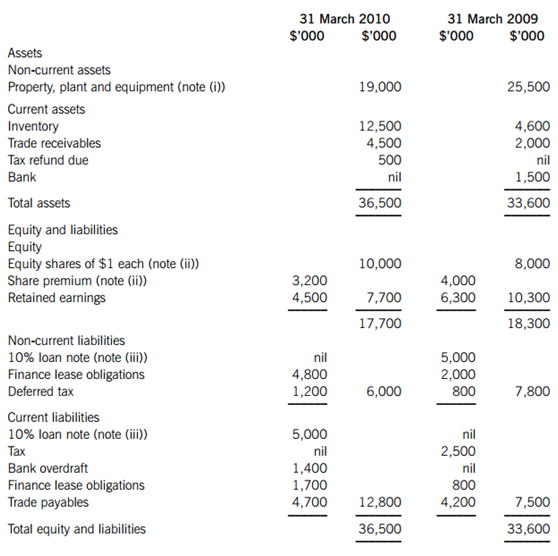

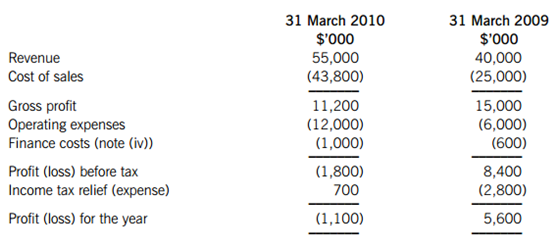

Summarised statements of fi nancial position as at:

Summarised income statements for the years ended:

The following additional information is available:

(i) Property, plant and equipment is made up of:

(ii) On 1 July 2009 there was a bonus issue of shares from share premium of one new share for every 10 held.

On 1 October 2009 there was a fully subscribed cash issue of shares at par.

(iii) The 10% loan note is due for repayment on 30 June 2010. Deltoid is in negotiations with the loan provider to refi nance the same amount for another fi ve years.

(iv) The fi nance costs are made up of:

For year ended:

Required:

(i) Prepare a statement of cash fl ows for Deltoid for the year ended 31 March 2010 in accordance with IAS 7 Statement of cash fl ows, using the indirect method; (12 marks)

(ii) Based on the information available, advise the loan provider on the matters you would take into consideration when deciding whether to grant Deltoid a renewal of its maturing loan note. (8 marks)

(b) On a separate matter, you have been asked to advise on an application for a loan to build an extension to a sports club which is a not-for-profi t organisation. You have been provided with the audited fi nancial statements of the sports club for the last four years.

Required:

Identify and explain the ratios that you would calculate to assist in determining whether you would advise that the loan should be granted. (5 marks)

第5题

Choose the best word to fill each gap from A, B, C or D on the opposite page.

Another successful year

The UK-based agricultural and garden equipment group PLT has had another successful year and is looking forward to the future with. The group, which also has distribution and fuel (19) has enjoyed record profits for the fifth year in a (20) Pre-tax profits for the year (21) March 31 rose by 24 per cent to £4.2 million. Total group sales (22) by five per cent to £155 million, with the agricultural business delivering yet another record (23) despite the somewhat difficult trading (24) in the industry. Sales in the garden equipment (25) were slow in the early months of the year, but increased dramatically in the final quarter.

Chairman Suresh Kumar said, 'It is my (26) that we have continued to grow by (27) our customers well. I am delighted to (28) the continued development of our customer (29) and I would like to thank all our customers for their (30) As well as an increase in customers, our staff numbers also continue to grow. During the year, we have taken (31) 58 new employees, so that our total workforce now numbers in excess of 700. All of the staff deserve my praise for their dedication and continued efforts in (32) these excellent results.' The group has proposed a final (33) of 9.4p per share, bringing the total to 13p for the year.

(19)

A.commitments

B.interests

C.responsibilities

D.benefits

第6题

A、Net long-term capital loss of $7,000

B、Net short-term capital gain of $2,000

C、Net long-term capital loss of $5,000

D、Net short-term capital gain of $1,000

E、Net long-term capital loss of $3,000

第7题

A.SELECTs.AgentName,SUM(ISNULL(o.OrderTotal,0.00))ASSumOrderTotalFROM SalesAgentsJOINOrderHeaderoONs.AgentID=o.AgentIDWHEREo.OrderDateBETWEEN@FromDateAND@ToDateGROUPBYs.AgentName

B.SELECTs.AgentName,SUM(ISNULL(o.OrderTotal,0.00))ASSumOrderTotalFROMSalesAgentsJOINOrderHeaderoONs.AgentID=o.AgentIDWHEREo.OrderDateBETWEEN@FromDateAND@ToDateANDo.OrderTotal>=2000GROUPBYs.AgentName

C.SELECTs.AgentName,SUM(ISNULL(o.OrderTotal,0.00))ASSumOrderTotalFROMSalesAgentsJOINOrderHeaderoONs.AgentID=o.AgentIDWHEREo.OrderDateBETWEEN@FromDate AND@ToDateGROUPBYs.AgentNameHAVINGSUM(o.OrderTotal)>=2000

D.SELECTs.AgentName,SUM(ISNULL(o.OrderTotal,0.00))ASSumOrderTotalFROMSalesAgentsJOINOrderHeaderoONs.AgentID=o.AgentIDWHEREo.ordertotal=2000ANDo.OrderDateBETWEEN@FromDateAND@ToDateGROUPBYs.AgentNameHAVINGSUM(o.OrderTotal)>=2000

第8题

The following information has been tanken or calculated from Fowler's financial statements for the year ended 30 September 20X5: Cash cycle at 30 September 20X5 70 days Inventory turnover six times Year-end trade payables at 30 September 20X5 $230,000 Credit purchases for the year ended 30 September 20X5 $2 million Cost of sales for the year ended 30 September 20X5 $1.8 million What is Fowler's trade receivables collection period as at 30 September 20X5?The following information has been tanken or calculated from Fowler's financial statements for the year ended 30 September 20X5:

A、106 days

B、89 days

C、56 days

D、51 days

第9题

$

Stock at beginning of period 85,000

Stock at the end of period 90,000

Purchases 300,000

Purchases return 25,000

Cost of goods sold is ______.

A.$295,000

B.$270,000

C.$305,000

D.$280,000

第10题

Income statement information for recent years ending 31 March

Note: the statement of financial position takes no account of any dividend to be paid. The ordinary share capital of YNM Co has not changed during the period under consideration and the 8% bonds were issued in 1998.

Dividend and share price information

Financial objective of

YNM Co YNM Co has a declared objective of maximising shareholder wealth.

(1) To pay the same total cash dividend as in 2010

(2) To pay no dividend at all for the year ending 31 March 2011

Financing decision

YNM Co is also considering raising $50 million of new debt finance to support existing business operations.

Required:

(a) Analyse and discuss the recent financial performance and the current financial position of YNM Co, commenting on:

(i) achievement of the objective of maximising shareholder wealth;

(ii) the two dividend choices;

(iii) the proposal to raise $50 million of new debt finance. (13 marks)

(b) Discuss the following sources of finance that could be suitable for YNM Co, in its current position, to meet its need for $50m to support existing business operations:

(i) equity finance;

(ii) sale and leaseback. (6 marks)

(c) Explain the nature of a scrip (share) dividend and discuss the advantages and disadvantages to a company of using scrip dividends to reward shareholders. (6 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!