重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.3.5%

B.6.0%

C.7.0%

D.8.0%

更多“Suppose a ten-year bond with semiannual coupons has a price of $1,071.06 and a yield to maturity of …”相关的问题

更多“Suppose a ten-year bond with semiannual coupons has a price of $1,071.06 and a yield to maturity of …”相关的问题

第1题

A、5 percent

B、10 percent

C、15 percent

D、20 percent

第2题

M: Yes. I've set my mind on it. I'd like to find a job with full scope to show my ability.

Q: Why has the man decided to leave the company?

(19)

A.He is not equal to the job.

B.He is not well paid for his work.

C.He doesn't think the job is challenging enough.

D.He cannot keep his mind on his work.

第3题

A.purchase Bond B

B.purchase Bond A

C.be indifferent to which bond to purchase

D.be unable to decide based on the information given

第4题

M: Yes. I've set my mind on it. I'd like to find a job with scope to show my ability.

Why has the man decided to leave the company?

A.He is not equal to the job.

B.He is not well paid for his work.

C.He doesn't think the job is challenging enough.

D.He cannot keep mind on his work.

第5题

a. The current interest rates on two-year and three-year maturity bonds are 8% and 7%. What is the expected one-year interest rate for year 3? 1. 2.10% 2. 5.02% 3. 7.05% 4. 10.04% b. Suppose the prevailing quoted annual market yield is 8%. What will a bond with a coupon rate of 6% sell at? 1. A premium 2. A discount 3. Par 4. €1,000 c. If the short-term treasury bill rate is 6% and expected inflation is 3%, what is the real rate of return? 1. Exactly 3% 2. Exactly 6% 3. Approximately 3% 4. Approximately 6% d. If markets are semi-strong form efficient, which of the following situations would yield abnormal returns? 1. Analyzing a company's earnings report 2. Identifying a pattern in a company's stock price 3. Obtaining insider information 4. Following the advice of your broker's newsletter e. You purchased shares of a company in the automotive industry a year ago. Over the course of the last year, the economy has begun to slow down and the company faced declining sales. As a result, the stock price declined over your holding period. Which of the following is true? 1. This is a violation of strong form market efficiency. 2. This is a violation of semi-strong form market efficiency. 3. This is a violation of weak form market efficiency. 4. This is not a violation of the efficient market hypothesis. f. If market interest rates fall, what happens to bond prices? 1. They fall. 2. They rise. 3. They rise or fall depending on maturity. 4. They rise relative to equity values. g. Suppose a bond with a face value of €1,000, 8 years remaining until maturity, and carrying a 7% coupon with interest paid annually has a current market price of €942.53. What is the bond's yield to maturity? 1. 6% 2. 7% 3. 8% 4. 9% h. Suppose the current spot exchange rate is C$1 = £0.35. If interest rates are expected to be 5% in Canada and 3% in the U.K., what is the one-year forward rate? 1. C$1 = £0.343 2. C$1 = £0.357 3. C$1 = £2.803 4. C$1 = £2.915

第6题

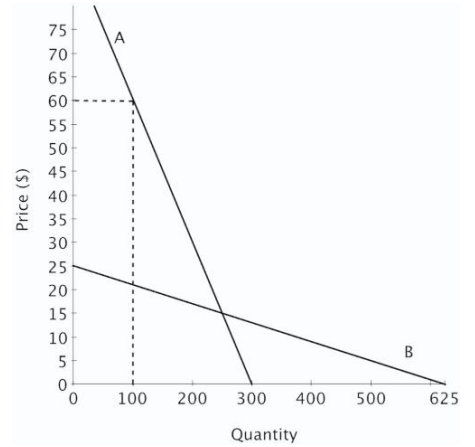

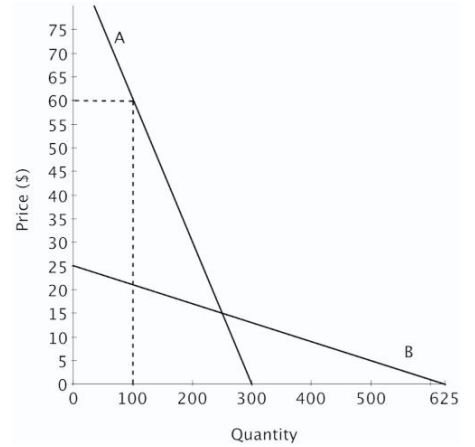

Suppose that a new drug has been approved to treat a lifethreatening disease. The demand for that drug is shown on the graph below. Prior to approval of this drug, the only treatment for this condition was any one of several nonprescription, or overthecounter, pain relievers. The demand for one brand of the several nonprescription pain relievers is also shown on the graph. At a price of $15 (the price at which the two demand curves intersect), the price elasticity of demand for the new drug is ______ the price elasticity of demand for the overthecounter pain reliever.

At a price of $15 (the price at which the two demand curves intersect), the price elasticity of demand for the new drug is ______ the price elasticity of demand for the overthecounter pain reliever.

A、greater than

B、less than

C、the same as

D、the reciprocal of

第7题

Suppose that a new drug has been approved to treat a lifethreatening disease. The demand for that drug is shown on the graph below. Prior to approval of this drug, the only treatment for this condition was any one of several nonprescription, or overthecounter, pain relievers. The demand for one brand of the several nonprescription pain relievers is also shown on the graph. If the manufacturer of the new drug chose to increase its price from $30 to $35, consumers would buy ______ doses, and have _____ total expenditures.

If the manufacturer of the new drug chose to increase its price from $30 to $35, consumers would buy ______ doses, and have _____ total expenditures.

A、more? higher

B、fewer? lower

C、more? lower

D、fewer? higher

第8题

Suppose that a new drug has been approved to treat a lifethreatening disease. The demand for that drug is shown on the graph below. Prior to approval of this drug, the only treatment for this condition was any one of several nonprescription, or overthecounter, pain relievers. The demand for one brand of the several nonprescription pain relievers is also shown on the graph. A likely reason for the difference in the slopes of the demand curves is that:

A likely reason for the difference in the slopes of the demand curves is that:

A、the over the counter pain reliever has many substitutes, but the new drug does not.

B、one drug is new on the market, but the other has been available for a long time.

C、one drug is heavily regulated by the Food and Drug Administration and the other is not.

D、one market is in equilibrium and the other is not.

第9题

Monica Lewis, CFA, has been hired to review data on a series of forward contracts for a major client. The client has asked for an analysis of a contract with each of the following characteristics:

A forward contract on a U.S. Treasury bond

A forward rate agreement (FRA)

A forward contract on a currency

Information related to a forward contract on a U.S. Treasury bond: The Treasury bond carries a 6 percent coupon and has a current spot price of $1,071.77 (including accrued interest). A coupon has just been paid and the next coupon is expected in 183 days. The annual risk-free rate is 5 percent. The forward contract will mature in 195 days.

Information related to a forward rate agreement: The relevant contract is a 3 x 9 FRA. The current annualized 90-day money market rate is 3.5 percent and the 270-day rate is 4.5 percent. Based on the best available forecast, the 180-day rate at the expiration of the contract is expected to be 4.2 percent.

Information related to a forward contract on a currency: The risk-free rate in the U.S. is 5 percent and 4 percent in Switzerland. The current spot exchange rate is $0.8611 per Swiss France (SFr). The forward contract will mature in 200 days.

Part 2)

Suppose that the price of the forward contract for the Treasury bond was negotiated off-market and the initial value of the contract was positive as a result. Which party makes a payment and when is the payment made?

A)The long pays the short at the maturity of the contract.

B)The short pays the long at the initiation of the contract.

C)The short pays the long at the maturity of the contract.

D)The long pays the short at the initiation of the contract.

第10题

M: Yes, I've set my mind on it. I'd like to find a job with full scope to show my ability.

Q: Why has the man decided to leave the company?

(23)

A.With a knife.

B.On the edge of some metal.

C.On some glass.

D.On a piece of paper.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!