重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.$(417,000).

B.$695,000.

C.$278,000.

D.$417,000.

E.$973,000.

更多“A company had sales of $695,000 and cost of goods sold of $278,000. Its gross margin equals:”相关的问题

更多“A company had sales of $695,000 and cost of goods sold of $278,000. Its gross margin equals:”相关的问题

第1题

第2题

A、17.5%.

B、28.0%.

C、62.5%.

D、160.0%.

E、68.2%.

第3题

A、Is another term for merchandise sales.

B、Is the term used for the cost of buying and preparing merchandise for sale.

C、Is another term for revenue.

D、Is also called gross margin.

E、Is a term only used by service firms.

第4题

A.18.5%.

B.22.2%.

C.16.7%.

D.14.2%.

第5题

A.lower EBITDA/Interest ratio.

B.lower dividends-to-total-debt ratio.

C.higher five year average of its coefficient of variation of its operating margin.

第6题

A.low salvage value estimates and long average lives.

B.high salvage value estimates and long average lives.

C.high salvage value estimates and short average lives.

第7题

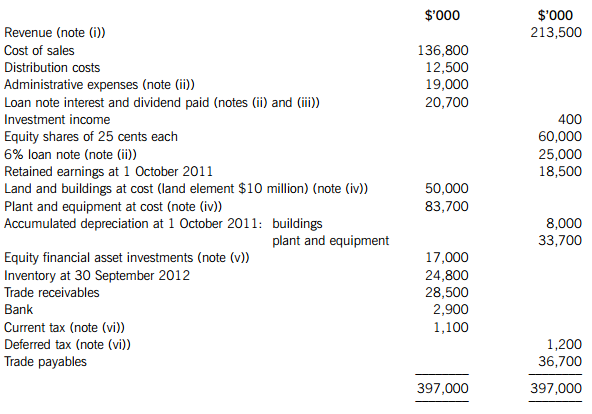

The following notes are relevant:

(i) On 1 October 2011, Quincy sold one of its products for $10 million (included in revenue in the trial balance). As part of the sale agreement, Quincy is committed to the ongoing servicing of this product until 30 September 2014 (i.e. three years from the date of sale). The value of this service has been included in the selling price of $10 million. The estimated cost to Quincy of the servicing is $600,000 per annum and Quincy’s normal gross profit margin on this type of servicing is 25%. Ignore discounting.

(ii) Quincy issued a $25 million 6% loan note on 1 October 2011. Issue costs were $1 million and these have been charged to administrative expenses. The loan will be redeemed on 30 September 2014 at a premium which gives an effective interest rate on the loan of 8%.

(iii) Quincy paid an equity dividend of 8 cents per share during the year ended 30 September 2012.

(iv) Non-current assets:

Quincy had been carrying land and buildings at depreciated cost, but due to a recent rise in property prices, it decided to revalue its property on 1 October 2011 to market value. An independent valuer confirmed the value of the property at $60 million (land element $12 million) as at that date and the directors accepted this valuation. The property had a remaining life of 16 years at the date of its revaluation. Quincy will make a transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation reserve. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2012. All depreciation is charged to cost of sales.

(v) The investments had a fair value of $15·7 million as at 30 September 2012. There were no acquisitions or disposals of these investments during the year ended 30 September 2012.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2011. A provision for income tax for the year ended 30 September 2012 of $7·4 million is required. At 30 September 2012, Quincy had taxable temporary differences of $5 million, requiring a provision for deferred tax. Any deferred tax adjustment should be reported in the income statement. The income tax rate of Quincy is 20%.

Required:

(a) Prepare the statement of comprehensive income for Quincy for the year ended 30 September 2012.

(b) Prepare the statement of changes in equity for Quincy for the year ended 30 September 2012.

(c) Prepare the statement of financial position for Quincy as at 30 September 2012. Notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 4 marks

(c) 10 marks

第9题

A、Taxable income (应纳税所得额)

B、Change in retained earnings (留存收益变动)

C、Operating income (营业收入)

D、Gross margin (毛利率)

第10题

Per unit($)

Total($)

Direct material costs

l 50

30 000

Direct labor costs

80

1 6 000

Variable production overheads

50

1 0 000

Variable selling and administration overheads

30

6 000

Fixed production overheads

6 000

Fixed selling and administration overheads

3 000

Requirement:

A.Calculate the total contribution margin.

B.Calculate the amounts of profit at the budgeted level of production.

C.Calculate the break-even point in units and the margin of safety.

D.If M company desires a profit of$4 800,calculate the number of units that it must produce and sell.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!