重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A、$2,000

B、$1,600

C、$1,000

D、$800

更多“A company’s policy is to charge depreciation on plant and machinery at 20% per year on cos”相关的问题

更多“A company’s policy is to charge depreciation on plant and machinery at 20% per year on cos”相关的问题

第1题

The plant and machinery account (at cost) of a business for the year ended 31 December 20X5 was as follows: Plant and machinery – cost 20X5 $ 20X5 $ 1 Jan Balance b/f 240,000 31 Mar Transfer to disposal account 60,000 30 Jun Cash purchase of plant 160,000 31 Dec Balance c/f 340,000 ––––– ––––– 400,000 400,000 ––––– ––––– The company’s policy is to charge depreciation at 20% per year on the straight line basis, with proportionate depreciation in the years of purchase and disposal. What should be the depreciation charge for the year ended 31 December 20X5?

A、$68,000

B、$64,000

C、$61,000

D、$55,000

第2题

A.is the depreciation on all the equipment.

B.is the cost to maintain the equipment.

C.is the appreciation of the currency.

第3题

Drexler acquired an item of plant on 1 October 20X2 at a cost of $500,000. It has an expected life of five years (straight-line depreciation) and an estimated residual value of 10% of its historical cost or current cost as appropriate. As at 30 September 20X4, the manufacturer of the plant still makes the same item of plant and its current price is $600,000.What is the correct carrying amount to be shown in the statement of financial position of Drexler as at 30 September 20X4 under historical cost and current cost?

A、historical cost and current cost: $320,000 and $600,000

B、historical cost and current cost: $320,000 and $384,000

C、historical cost and current cost: $300,000 and $600,000

D、historical cost and current cost: $320,000 and $384,000

第4题

Drexler acquired an item of plant on 1 October 20X2 at a cost of $500,000. It has an expected life of five years (straight-line depreciation) and an estimated residual value of 10% of its historical cost or current cost as appropriate. As at 30 September 20X4, the manufacturer of the plant still makes the same item of plant and its current price is $600,000.What is the correct carrying amount to be shown in the statement of financial position of Drexler as at 30 September 20X4 under historical cost and current cost?

A、historical cost and current cost: $320,000 and $600,000

B、historical cost and current cost: $320,000 and $384,000

C、historical cost and current cost: $300,000 and $600,000

D、historical cost and current cost: $300,000 and $384,000

第5题

Which of the following statements about the financial statements of limited liability companies are correct according to International Financial Reporting Standards? 1 In preparing a statement of cash flows, either the direct or the indirect method may be used. Both lead to the same figure for net cash from operating activities. 2 Loan notes can be classified as current or non-current liabilities. 3 Financial statements must disclose a company's total expense for depreciation, if material. 4 A company must disclose by note details of all adjusting events allowed for in the financial statements.

A、1, 2 and 3 only

B、2 and 4 only

C、3 and 4 only

D、All four items

第6题

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

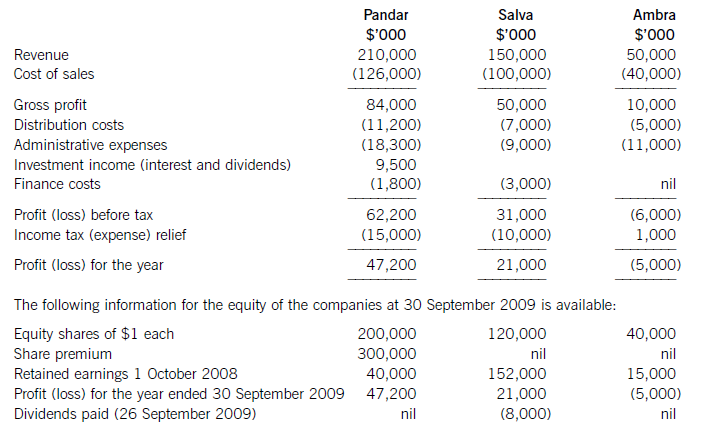

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

第7题

On January 2, a company acquires some state-of-the-art production equipment at a net cost of $14 million. For financial reporting purposes, the firm will depreciate the equipment over a 7-year life using straight-line depreciation and a zero salvage value; for tax reporting purposes, however, the firm will use 3-year accelerated depreciation. Given a tax rate of 35% and a first-year accelerated depreciation factor of 0.333, by how much will the company’s deferred tax liability increase in the first year of the equipment’s life?

A.$931,700.

B.$1,064,800.

C.$1,730,300.

第8题

A. liabilities when calculating the company’s current ratio.

B. equity when calculating the company’s return on equity ratio.

C. liabilities when calculating the company’s debt-to-equity ratio.

第9题

A.include it in equity.

B.include it in liabilities.

C.not include it in either equity or liabilities.

第10题

The fast pace of modem society helps people realize the preciousness of time. So it is very important for them to keep punctual under whatever circumstances.

Write on ANSWER SHEET TWO a composition of about 200 words on the following topic:

The Importance of Being Punctual

You are to write in three parts.

In the first part, state specifically what your view is.

In the second part, support your view with one or two reasons.

In the last part, bring what you have written to a natural conclusion or a summary.

Marks will be awarded for content, organization, grammar and appropriateness. Failure to follow the above instructions may result in a loss of marks.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!