重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Constitutional Law Questionnaire Name: Email: School: Self- intro: Expectations: What you already know about the US Constitutional law? Questions about the US Constitutional law: Who is the first individual/person comes to your mind when you hear the word „Constitution”? What is the first image comes to your mind when you hear the word „Constitution”? What are the adjectives you would like to use to describe the US legal system? Where do you obtain information about the United States? Have you encountered any mis-communication or mis-understanding situations with American people? Do you know why that happend?

更多“Constitutional Law Questionnaire Name: Email: Scho...”相关的问题

更多“Constitutional Law Questionnaire Name: Email: Scho...”相关的问题

第1题

Please review your answers to the First Day Questionnaire, in particular: the adjectives you listed to describe the United States and the questions you had about the US and American law. (两道题均为必做,英文或者中文回答) 1. Would you use the same adjectives to describe the US legal system at the end of the class? Or would you use different adjectives to describe the US legal system now? List the original adjectives and the adjectives you would use now. If they are different, explain why you would use different adjectives. (500 words) 2. Please also list the questions you had about the US constitutional law at the beginning of the course, and the questions you have about the US constitutional law at the end of the course. Have your original questions been answered by the lectures, discussions, or your self-study? Do you have new questions about the US legal system and constitutional law? Do you know where to find the answers to your original questions and the answers to your new questions? (500 words)

第2题

A./var/adm/ras/bosinstlog

B./var/adm/ras/devinst.log

C./var/adm/rshlog

D./var/adm/sulog

第3题

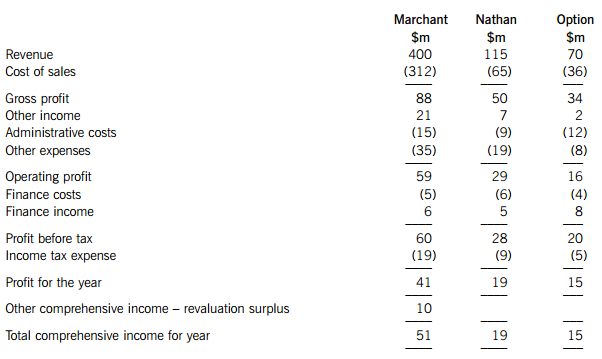

The following draft financial statements relate to Marchant, a public limited company.

Marchant Group: Draft statements of profit or loss and other comprehensive income for the year ended 30 April 2014.

The following information is relevant to the preparation of the group statement of profit or loss and other comprehensive income:

1. On 1 May 2012, Marchant acquired 60% of the equity interests of Nathan, a public limited company. The purchase consideration comprised cash of $80 million and the fair value of the identifiable net assets acquired was $110 million at that date. The fair value of the non-controlling interest (NCI) in Nathan was $45 million on 1 May 2012. Marchant wishes to use the ‘full goodwill’ method for all acquisitions. The share capital and retained earnings of Nathan were $25 million and $65 million respectively and other components of equity were $6 million at the date of acquisition. The excess of the fair value of the identifiable net assets at acquisition is due to non-depreciable land.

Goodwill has been impairment tested annually and as at 30 April 2013 had reduced in value by 20%. However at 30 April 2014, the impairment of goodwill had reversed and goodwill was valued at $2 million above its original value. This upward change in value has already been included in above draft financial statements of Marchant prior to the preparation of the group accounts.

2. Marchant disposed of an 8% equity interest in Nathan on 30 April 2014 for a cash consideration of $18 million and had accounted for the gain or loss in other income. The carrying value of the net assets of Nathan at 30 April 2014 was $120 million before any adjustments on consolidation. Marchant accounts for investments in subsidiaries using IFRS 9 Financial Instruments and has made an election to show gains and losses in other comprehensive income. The carrying value of the investment in Nathan was $90 million at 30 April 2013 and $95 million at 30 April 2014 before the disposal of the equity interest.

3. Marchant acquired 60% of the equity interests of Option, a public limited company, on 30 April 2012. The purchase consideration was cash of $70 million. Option’s identifiable net assets were fair valued at $86 million and the NCI had a fair value of $28 million at that date. On 1 November 2013, Marchant disposed of a 40% equity interest in Option for a consideration of $50 million. Option’s identifiable net assets were $90 million and the value of the NCI was $34 million at the date of disposal. The remaining equity interest was fair valued at $40 million. After the disposal, Marchant exerts significant influence. Any increase in net assets since acquisition has been reported in profit or loss and the carrying value of the investment in Option had not changed since acquisition. Goodwill had been impairment tested and no impairment was required. No entries had been made in the financial statements of Marchant for this transaction other than for cash received.

4. Marchant sold inventory to Nathan for $12 million at fair value. Marchant made a loss on the transaction of $2 million and Nathan still holds $8 million in inventory at the year end.

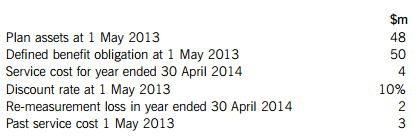

5. The following information relates to Marchant’s pension scheme:

The pension costs have not been accounted for in total comprehensive income.

6. On 1 May 2012, Marchant purchased an item of property, plant and equipment for $12 million and this is being depreciated using the straight line basis over 10 years with a zero residual value. At 30 April 2013, the asset was revalued to $13 million but at 30 April 2014, the value of the asset had fallen to $7 million. Marchant uses the revaluation model to value its non-current assets. The effect of the revaluation at 30 April 2014 had not been taken into account in total comprehensive income but depreciation for the year had been charged.

7. On 1 May 2012, Marchant made an award of 8,000 share options to each of its seven directors. The condition attached to the award is that the directors must remain employed by Marchant for three years. The fair value of each option at the grant date was $100 and the fair value of each option at 30 April 2014 was $110. At 30 April 2013, it was estimated that three directors would leave before the end of three years. Due to an economic downturn, the estimate of directors who were going to leave was revised to one director at 30 April 2014. The expense for the year as regards the share options had not been included in profit or loss for the current year and no directors had left by 30 April 2014.

8. A loss on an effective cash flow hedge of Nathan of $3 million has been included in the subsidiary’s finance costs.

9. Ignore the taxation effects of the above adjustments unless specified. Any expense adjustments should be amended in other expenses.

Required:

(a) (i) Prepare a consolidated statement of profit or loss and other comprehensive income for the year ended 30 April 2014 for the Marchant Group. (30 marks)

(ii) Explain, with suitable calculations, how the sale of the 8% interest in Nathan should be dealt with in the group statement of financial position at 30 April 2014. (5 marks)

(b) The directors of Marchant have strong views on the usefulness of the financial statements after their move to International Financial Reporting Standards (IFRSs). They feel that IFRSs implement a fair value model. Nevertheless, they are of the opinion that IFRSs are failing users of financial statements as they do not reflect the financial value of an entity.

Required:

Discuss the directors’ views above as regards the use of fair value in IFRSs and the fact that IFRSs do not reflect the financial value of an entity. (9 marks)

(c) Marchant plans to update its production process and the directors feel that technology-led production is the only feasible way in which the company can remain competitive. Marchant operates from a leased property and the leasing arrangement was established in order to maximise taxation benefits. However, the financial statements have not shown a lease asset or liability to date.

A new financial controller joined Marchant just after the financial year end of 30 April 2014 and is presently reviewing the financial statements to prepare for the upcoming audit and to begin making a loan application to finance the new technology. The financial controller feels that the lease relating to both the land and buildings should be treated as a finance lease but the finance director disagrees. The finance director does not wish to recognise the lease in the statement of financial position and therefore wishes to continue to treat it as an operating lease. The finance director feels that the lease does not meet the criteria for a finance lease, and it was made clear by the finance director that showing the lease as a finance lease could jeopardise the loan application.

Required:

Discuss the ethical and professional issues which face the financial controller in the above situation. (6 marks)

第4题

A.Adda[GuiUnattend]sectiontounattend.txt.

B.Includea[GuiRunOnce]sectioninunattend.txt.

C.Createanunattend.batfile.Placethefileintherootoftheinstallationsourcefiles.

D.Createaregistryfilenamedsetup.reg.Placethefileintherootoftheinstallationsourcefiles.

第5题

A) Allotropic material N) Interstitialcy

B) Amorphous O) Long-range-order materials

C) Anion P) Monomer

D) Atomic packing factor (APF) Q) Neutrons

E) Cation R) Polymer

F) Coordinationnumber S) Polymorphic material

G) Creep T) Proton

H) Crystalline U) Short-range-ordermaterials

I) Electron affinity V) Smart materials

J) Electronegativity W) Substitutionalsolid solution

K) Engineering materials X) Vacancy

L) Factor ofsafety Y) Van de waals forces

M) Interstitialsolid solution Z) Yield

第6题

A、in another words

B、in the other words

C、with other words

D、in other words

第7题

A. Smart Jack

B. Demarc

C. 110 Block

D. 66 Block

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!