重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A、A 5-year bond with a face value of $1,000 and a coupon rate of 9%, issued that morning and being traded at a price of $1030

B、A 10-year bond with a face value of $1,000 and a coupon rate of 8%, issued on March 22, 2008 and being traded at a price of $980

C、Both of bonds mentioned in A and B

D、None of bonds mentioned in A and B

更多“On March 23, 2013, a 5-year US government bond with a face value of $1,000 that makes annu”相关的问题

更多“On March 23, 2013, a 5-year US government bond with a face value of $1,000 that makes annu”相关的问题

第1题

The club proposes to issue a 7% bond with a face value of $50 million on 1 January 2007 at a discount of 5%

that will be secured on income from future ticket sales and corporate hospitality receipts, which are approximately

$20 million per annum. Under the agreement the club cannot use the first $6 million received from corporate

hospitality sales and reserved tickets (season tickets) as this will be used to repay the bond. The money from the

bond will be used to pay for ground improvements and to pay the wages of players.

The bond will be repayable, both capital and interest, over 15 years with the first payment of $6 million due on

31 December 2007. It has an effective interest rate of 7·7%. There will be no active market for the bond and

the company does not wish to use valuation models to value the bond. (6 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

第2题

A.$9,650,700.

B.$9,683,250.

C.$9,715,850.

第3题

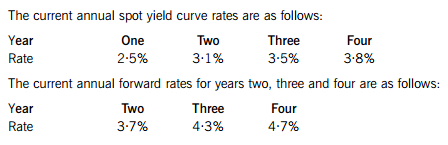

Sembilan Co, a listed company, recently issued debt finance to acquire assets in order to increase its activity levels. This debt finance is in the form. of a floating rate bond, with a face value of $320 million, redeemable in four years. The bond interest, payable annually, is based on the spot yield curve plus 60 basis points. The next annual payment is due at the end of year one.

Sembilan Co is concerned that the expected rise in interest rates over the coming few years would make it increasingly difficult to pay the interest due. It is therefore proposing to either swap the floating rate interest payment to a fixed rate payment, or to raise new equity capital and use that to pay off the floating rate bond. The new equity capital would either be issued as rights to the existing shareholders or as shares to new shareholders.

Ratus Bank has offered Sembilan Co an interest rate swap, whereby Sembilan Co would pay Ratus Bank interest based on an equivalent fixed annual rate of 3·76?% in exchange for receiving a variable amount based on the current yield curve rate. Payments and receipts will be made at the end of each year, for the next four years. Ratus Bank will charge an annual fee of 20 basis points if the swap is agreed.

Required:

(a) Based on the above information, calculate the amounts Sembilan Co expects to pay or receive every year on the swap (excluding the fee of 20 basis points). Explain why the fixed annual rate of interest of 3·76?% is less than the four-year yield curve rate of 3·8%. (6 marks)

(b) Demonstrate that Sembilan Co’s interest payment liability does not change, after it has undertaken the swap, whether the interest rates increase or decrease. (5 marks)

(c) Discuss the factors that Sembilan Co should consider when deciding whether it should raise equity capital to pay off the floating rate debt. (9 marks)

第4题

A、$0

B、$120

C、$200

D、$320

第5题

A. $405.

B. $808.

C. $1,000.

第6题

A.Debt instruments have a face value of the principal amount to be repaid at maturity.

B.Holders of equity usually take precedence over holders of debt instruments in a liquidation.

C.The interest payable on debt instruments is always specified at the outset of the loan.

D.Bonds are negotiable debt instruments.

第7题

A.is expressed as a percentage of the par value of the bond

B.is the same as the current yield

C.changes when current interest rates change

D.changes only when the market price of the bond changes

第8题

A.The bond’s book value is $1000

B.The bond’s book value is $935

C.The bond’s book value is $937

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!