重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

更多“Since the total amount of interest paid when a mortgagee adopts the amortization schedule with equal…”相关的问题

更多“Since the total amount of interest paid when a mortgagee adopts the amortization schedule with equal…”相关的问题

第1题

A、of

B、upon

C、for

D、in

第2题

A.promised yield

B.yield to maturity

C.coupon rate

D.current yield

第3题

A.Issuance of debt has no effect on cash flow from operations.

B.Periodic interest payments decrease cash flow from operations by the amount of interest paid.

C.Payment of debt at maturity decreases cash flow from operations by the face value of the debt.

第4题

The American population was the tallest in the world from about the American Revolution to World WarⅡ—that’s a long time.The U.S.had a very resource rich environment, with game, fish and wildlife. In fact we have data on disadvantaged people in America,such as slaves.They were obviously among the most mistreated populations in the world, but given the resource abundance,and given the fact that the slave owners needed their work,they had to be fed relatively decently. So the slaves were taller than European peasants. It’s no wonder that Europeans were just flooding to America.

Americans today are no longer the tallest people in the world.After World WarⅡ,many Western and Northern European countries began to adopt favorable social policies.There is universal health insurance in most of these societies—that,of course,makes a difference in health care.You can also consider income inequality in the U.S., since people who are at the low end of the totem pole(图腾柱)have considerable adversity making ends meet.I suspect the difference in height between Americans and Europeans is due to both diet and health care.

Americans today suffer from an additional problem:obesity.If children are too well nourished,then they’ re not able to grow optimally.There are certain hormones that control the start of the adolescent growth and the start of adolescence.Nutrition is one of the factors,along with genetic and hormonal ones which are associated with the start of puberty(青春期).And if puberty comes too early,then the youth will peak out sooner,and will not become as tall in adulthood as someone who had better nutrition.Also,the overload of carbohydrates and fats in a fast food diet may hinder the consumption of micro nutrients essential to growth.

1.The word "game" in(line 2,para.1)refers to.

(A). animals hunted for food

(B). rich natural resources

(C). activities played by kids

(D). sports events to be held

2.Slaves in America were taller than European peasants because.

(A). they were badly treated

(B). they did not do farm work

(C). they had sufficient food to eat

(D). they enjoyed better health care

3. It is implied in the second paragraph that.

(A). Europeans could make more money than Americans

(B). average Americans used to be shorter than Europeans

(C). welfare helps Europeans grow taller than Americans

(D). people on the totem pole are leading a comfortable life

4. According to the third paragraph,overweight children in the U.S..

A. tend to have better nutrition for growth

B. tend to eat more food to grow taller

C. will grow taller than average children

D. will fail to grow into an ideal height

5. Eating too much fast food may affect.

(A). the absorption of micronutrients

(B). the intake of carbohydrates

(C). the consumption of hormones

(D). the digestion of fats

第5题

1. Calculations and workings need only be made to the nearest RMB.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

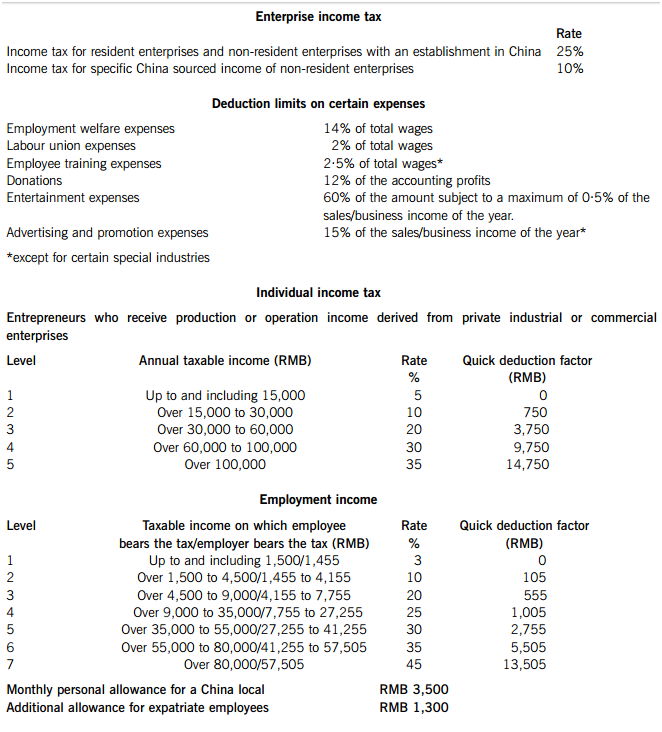

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

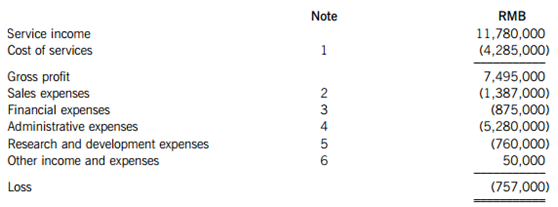

(a) Company B is a limited liability company set up on 1 January 2013. Company B is engaged in the provision of information technology and data processing services. The company’s accountant has prepared the following tax computation for the year ended 31 December 2013:

Notes:

(1) The cost of services includes wages and salaries of RMB 2,900,000, of which RMB 500,000 relates to the accrued portion of a bonus due and payable to a member of senior management on the termination of his contract in 2017.

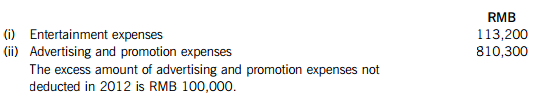

(2) Sales expenses include:

(3) Financial expenses include RMB 40,000 of interest paid on a shareholder’s loan. The interest rate on this loan is 5% p.a. which is the same as the market interest rate on loans on similar terms from banks.

(4) Administrative expenses include:

(5) Research and development (R&D) expenses include RMB 320,000 which has been registered with the tax bureau and agreed as qualifying for the tax incentives on R&D expenses.

(6) Other income and expenses comprise:

Required:

(i) Briefly explain the enterprise income tax (EIT) treatment of each of the 14 items referred to in notes (1) to (6). (17 marks)

(ii) Calculate the correct amount of EIT payable by Company B for the year 2013, starting with the loss of RMB 757,000 and clearly identifying those items which do not require any adjustment. (8 marks)

(b) Company H is a Hong Kong company which has set up a representative office (RO) in China. The RO provides liaison services in China for Company H. The China tax authorities have assessed the tax position of the RO and concluded that the RO should pay tax on a cost-plus basis at a deemed profit rate of 15%. In 2013 the taxable costs of the RO are RMB 160,000.

Required:

Calculate the business tax (BT) and enterprise income tax (EIT) of the representative office (RO) for the year 2013. (3 marks)

(c) Briefly explain the principle of ‘effective management’ used to determine whether an enterprise registered outside China can be considered as a China tax resident. (3 marks)

(d) State any FOUR circumstances in which the tax authorities can assess an enterprise’s liability to enterprise income tax (EIT) using the deemed basis. (4 marks)

2.

Ms Chen, a Chinese national, received the following income in 2013.

Income from her employment as a manager with Company X:

(1) A salary of RMB 10,000 per month for each of the 12 months of 2013. In addition, she was entitled to the following subsidies and allowances in 2013:

(a) A meal allowance of RMB 500 per month.

(b) Overtime income of RMB 1,000 per month.

(c) Reimbursement of business trip expenses in January 2013. The amount incurred was RMB 1,200 and the whole amount was supported with invoices.

(d) Employer’s mandatory contribution to social security of RMB 1,200.

(2) A year-end bonus of RMB 40,000 in December 2013.

Other income:

(3) She had an article published in a magazine in June and republished in July. The authorship fee was RMB 3,000 for each publication.

(4) In June, a private limited company paid her a dividend from which it withheld individual income tax (IIT). The net-of-tax dividend she received was RMB 40,000.

(5) In April 2013, she invested RMB 20,000 in A-shares and sold them for RMB 35,000 in August 2013.

(6) She has provided consultancy services to a Canadian company and received a gross service fee of USD20,000. Canadian tax of USD2,000 was withheld and deducted at source from this fee.

(7) Her uncle in France died in 2013 and she inherited an estate worth USD1,000,000.

(8) An advertising company used Ms Chen’s photo and image in an advertisement and paid her a fee of RMB 100,000. She decided to donate RMB 15,000 of this fee to an approved charitable organisation specifically for the earthquake in Sichuan. The donation was paid directly to the charity from the advertising company.

(9) She received net-of-tax interest from a private company of RMB 4,800. Individual income tax and business tax were withheld and deducted by the company before paying this interest.

Required:

(a) Calculate the individual income tax (IIT) payable by Ms Chen in respect of each of the items (1) to (9), clearly identifying any item(s) which are tax exempt.

Note: You should ignore the effect of business tax and surtaxes on business tax in respect of items (6) and (8) and surtaxes on business tax in respect of item (9). (16 marks)

(b) (i) State the penalty which will be levied on the publisher for not withholding IIT from the payment made to Ms Chen (item (3)). (1 mark)

(ii) Explain Ms Chen’s responsibilities for filing and paying the IIT on this fee. (3 marks)

3.

(a) Company T, an accountancy firm in Shanghai, is a value added tax (VAT) general taxpayer. Company T’s transactions for the month of November 2013 included the following:

(1) Provided book-keeping services to Client A and billed a fee of RMB 30,000 and outlays of RMB 1,000.

(2) Billed Client B RMB 40,000 inclusive of VAT for audit services provided.

(3) Sent a bill to Client Z on 1 November for RMB 100,000. As Client Z settled the bill before the end of November, Company T granted it an early payment discount of RMB 1,000.

(4) Provided consultancy services to a German client for a fee of RMB 80,000. These services qualified as an export of services.

(5) Engaged a law firm to provide legal advisory services and received a VAT invoice for fees of RMB 15,000.

(6) Paid a trademark fee to a global firm in the USA of RMB 50,000. VAT was withheld and paid by Company T.

(7) Bought computers for RMB 20,000 and obtained a VAT general invoice. (8) Paid RMB 5,000 for the repair of the computers. The repair company was a small-scale taxpayer and issued a general invoice to Company T.

(9) Paid rent to its landlord of RMB 60,000. A business tax invoice was obtained.

(10) Paid a transportation fee of RMB 2,000 for picking up its staff from the metro station and bringing them to its office. A VAT invoice at 11% was obtained.

(11) Provided free-of-charge audit services to a charitable organisation. The market value of these services was RMB 35,000.

(12) Paid leasing charges of RMB 6,000 for a photocopying machine. A VAT invoice was obtained.

Except where stated otherwise, all amounts are exclusive of VAT.

Required:

(i) In respect of Company T’s transactions for November 2013, state, giving reasons, those transactions on which value added tax (VAT) will not be charged or for which a VAT credit will not be allowed. (5 marks)

(ii) Calculate the VAT payable by Company T for the month of November 2013 as a result of transactions (1) to (12). (9 marks)

(b) Company M is a production company manufacturing lighting products for exportation. The company’s transactions for December 2013 are as follows:

(1) Exported goods at a FOB (freight on board) price of RMB 200,000.

(2) Sold goods domestically in China for RMB 180,000.

(3) Imported materials at a CIF (cost including insurance and freight) value of RMB 12,000. The import customs duty rate was 10%.

(4) Purchased raw materials for RMB 160,000. A bulk purchase discount of RMB 10,000 was deducted directly in the VAT invoice obtained.

(5) Paid transportation costs of RMB 10,000. A VAT invoice at 11% was obtained.

Except where stated otherwise, all amounts are exclusive of VAT.

Required:

(i) Calculate the amount of irrecoverable input value added tax (VAT) on the exported goods. Note: The export refund rate is 13%. (1 mark)

(ii) Calculate the VAT payable by Company M for the month of December 2013. (5 marks)

4.

(a) Company S sells cosmetics, its transactions in October 2013 were as follows:

(1) Imported 300 sets of cosmetics packs at a CIF (cost including insurance and freight) value of USD100 per set. The import customs duty rate was 10%.

(2) Purchased 1,000 pieces of lipstick at RMB 10 per piece from a manufacturing company, Company W.

(3) Purchased chemicals for the production of cosmetics packs from Company L for RMB 123,000.

(4) Sold 200 sets of the imported cosmetics packs at RMB 1,500 per set without further processing.

(5) Sold 600 pieces of lipstick at RMB 50 per piece without further processing.

(6) Sold 450 sets of self-produced cosmetics packs at RMB 1,000 per set.

All amounts are stated exclusive of VAT.

Required:

(i) Calculate the consumption tax (CT) paid by Company S on the importation of the cosmetics sets (item (1)). (2 marks)

(ii) State clearly whether the sales of goods in each of items (4), (5) and (6) are or are not subject to CT. (3 marks)

(iii) Calculate the CT payable by Company S on its sales for the month of October 2013. (1 mark)

Note: The consumption tax rate on cosmetics is 30%.

(b) In July 1998, Company P acquired an office for self-use, comprising one floor in a multi-storey building, for RMB 3,000,000. In December 2013, Company P sold the office for RMB 20,000,000. The appraised value of the office was RMB 15,000,000.

The taxes payable on the sale of the property were: business tax (BT); city maintenance and construction tax and education levy of 10% on the BT; and stamp duty of 0·05% on the sales contract.

Required:

Calculate the land appreciation tax (LAT) payable by Company P on the sale of the office. (5 marks)

(c) A retail shop, Shop R, sells air-conditioners to customers for RMB 2,000 each; at the same time Shop R charges a RMB 100 installation fee.

Required:

State, giving reasons, whether Shop R should pay business tax (BT) or value added tax (VAT) on the installation fee. (4 marks)

5.

(a) (i) Define the term ‘tax evasion’ as provided for in the Tax Collection and Administration Law. (3 marks)

(ii) State the statute of limitation on the recovery of taxes in the case of tax evasion. (1 mark)

(b) During a tax audit of Company A, it was discovered that it had committed the following acts:

(1) Deducted expenses of RMB 250,000 which were not related to its business operations.

(2) Sold goods to a related company for RMB 500,000 when the open market selling price of the similar type of goods was RMB 2,000,000.

Required:

Explain whether either or both of the acts committed by Company A constitutes tax evasion, and if not, state how the issue will be classified. (2 marks)

(c) State the actions which the taxpayer can take if there is a dispute on the amount of tax assessed by the tax authorities and by when such action should be taken. (4 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第6题

After the first collision, each station waits either 0 or l (72) times before trying again. If two stations collide and each one picks the same random number, they will collide again. After the second collision, each one picks either 0,1,2,or 3 at random and waits that number of slot times. If a third collision occurs (the probability of this happening is 0.25), then the next time the number of slots to wait is chosen at (73) from the interval 0 to 23-1.

In general, after i collisions,a random number between 0 and 2i-1 is chosen, and that number of slots is skipped. However, after ten collisions have been reached, the randomization (74) is frozen at a maximum of 1023 slots. After 16 collisions, the controller throws in the towel and reports failure back to the computer. Further recoveryis up to (75 )layers.

(71) A.datagram

B.collision

c.connection

D. service

(72) A.slot

B.switch

C.process

D.fire

(73) A.rest

B.random

C.once

D.odds

(74) A.unicast

B.multicast

C.broadcast

D.interval

(75) A.local

B.next

C.higher

D.lower

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!