重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

答案

答案

更多“In a closed economy, GDP is $1000, government purchases are $200, and consumption is $700.”相关的问题

更多“In a closed economy, GDP is $1000, government purchases are $200, and consumption is $700.”相关的问题

第1题

A.Suppose that in a closed economy GDP is equal to 10,000, taxes are equal to 2,500 Consumption equals 6,500 and Government expenditures equal 2,000. What are private saving, public saving, and national saving

B.1000, 500, 1500

C.500, 1500, 1000

D.None of the above are correct.

第2题

The Seal Island Nuclear Power Company has received initial planning consent for an Advanced Boiling Water Reactor. This project is one of a number that has been commissioned by the Government of Roseland to help solve the energy needs of its expanding population of 60 million and meet its treaty obligations by cutting CO2 emissions to 50% of their 2010 levels by 2030.

The project proposal is now moving to the detailed planning stage which will include a full investment appraisal within the financial plan. The financial plan so far developed has been based upon experience of this reactor design in Japan, the US and South Korea.

The core macro economic assumptions are that Roseland GDP will grow at an annual rate of 4% (nominal) and inflation will be maintained at the 2% target set by the Government.

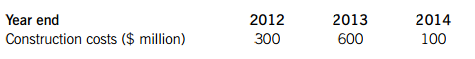

The construction programme is expected to cost $1 billion over three years, with construction commencing in January 2012. These capital expenditures have been projected, including expected future cost increases, as follows:

Generation of electricity will commence in 2015 and the annual operating surplus in cash terms is expected to be $100 million per annum (at 1 January 2015 price and cost levels). This value has been well validated by preliminary studies and includes the cost of fuel reprocessing, ongoing maintenance and systems replacement as well as the continuing operating costs of running the plant. The operating surplus is expected to rise in line with nominal GDP growth. The plant is expected to have an operating life of 30 years.

Decommissioning costs at the end of the project have been estimated at $600 million at current (2012) costs. Decommissioning costs are expected to rise in line with nominal GDP growth.

The company’s nominal cost of capital is 10% per annum. All estimates, unless otherwise stated, are at 1 January 2012 price and cost levels.

Required:

Produce a preliminary briefing note which, on the basis of the above information, includes:

(i) An estimate of the net present value for this project as at the commencement of construction in 2012. (11 marks)

(ii) A discussion of the principal uncertainties associated with this project. (7 marks)

(iii) A sensitivity of the project’s net present value (in percentage and in $), to changes in the construction cost, the annual operating surplus and the decommissioning cost. (Assume that the increase in construction costs would be proportional to the initial investment for each year.) (6 marks)

(iv) An explanation of how simulations, such as the Monte Carlo simulation, could be used to assess the volatility of the net present value of this project. (4 marks)

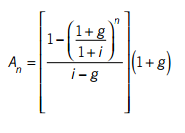

Note: the formula for an annuity discounted at an annual rate (i) and where cash flows are growing at an annual rate (g) is as follows:

第3题

A.real CDP is constant.

B.real GDP is falling but not as rapidly as prices.

C.real GDP is rising.

D.No conclusion can be drawn concerning the real GDP of the economy on the basis of this information.

第4题

American consumers have been the main engine not just of their own economy but of the whole world's. If that engine fails, will the global economy nose-dive? A few years ago, the answer would probably have been yes. But the global economy may now be less vulnerable. At the World Economic Forum in Davos last week, Jim O'Neill, the chief economist at Goldman Sachs, argued convincingly that a slowdown in America need not lead to a significant global loss of power.

Start with Japan, where industrial output jumped by an annual rate of 11% in the fourth quarter. Goldman Sachs has raised its GDP growth forecast for that quarter (the official number is due on February 17th) to an annualised 4.2%. That would push year-on-year growth to 3.9%, well ahead of America's 3.1%. The bank predicts average GDP growth in Japan this year of 2.7%. It thinks strong demand within Asia will partly offset an American slowdown.

Japan's labour market is also strengthening. In December the ratio of vacancies to job applicants rose to its highest since 1992. It is easier to find a job now than at any time since the bubble burst in the early 1990s. Stronger hiring by firms is also pushing up wages after years of decline. Workers are enjoying the biggest rise in bonuses for over a decade.

Higher incomes mean more spending: households spent 3.2% more in December than a year earlier. And according to Richard Jerram, of Macquarie Bank, retail sales rose in 2005 for the first full year since 1996. In other words, Japan's growth is becoming much less dependent on exports. The disappearance of deflation has also reduced real interest rates, giving further support to domestic demand.

Even the euro area is emerging from the doldrums. In Germany in particular, vigorous corporate restructuring has boosted productivity and profits. So far, however, this has been at the expense of jobs and wages, and hence of consumer spending—although with capital expenditure picking up, new hiring is likely to follow. Mr O'Neill suggests that Germany is where Japan was 18 months ago.

The Ifo survey of German business confidence also indicates that the recovery is spreading to consumers. Retailers' confidence in January rose to its highest for five years. The expectations component of the overall survey rose to its highest since November 1994. If the traditional relationship between Ifo's business-confidence index and GDP growth holds, then Germany's economy could grow this year by much more than most economists are forecasting.

For the first time in many years, Germany's domestic demand looks set to contribute more to growth in 2006 than its net exports will. Elsewhere in the euro area, domestic demand has been the main source of growth in any case. According to Morgan Stanley, since 1999 it has supplied 95% of the zone's GDP growth. These economies are therefore more resistant to external shocks than is generally thought.

Although Germany is leading the pack, businesses throughout the euro area are feeling perkier. The European Commission's survey of business sentiment rose healthily in January, to a level that could signal GDP growth of well above the consensus forecast of 2% for this year.

Alongside stronger domestic demand in Europe and Japan, emerging economies are also tipped to remain robust. These economies are popularly perceived as excessively export-dependent, flooding the world with cheap goods, but doing little to boost demand. Yet calculations by Goldman Sachs show that Brazil, Russia, India and China combined

A.Global growth is less lopsided than for many years

B.a comparison of economies of the three engines of the global airplane.

C.America's impact on the world's economy

D.The three economy's contribution to the world economy

第5题

A.income and expenditure both rise.

B.income rises and saving falls.

C.income and saving both rise.

D.income rises and expenditure falls.

第6题

A.GDP is not a reasonable indicator of well-being.

B.GDP is the best available indicator on a timely basis, so there is no need for any reform.

C.When other factors are included, GDP is not very reliable.

D.GDP needs to be complemented by other measures for better economic performance evaluation.

第7题

Read the following table and graph which show the situation of this developing country, telling the sectoral distribution of employment and GDP.

—Use the information in the table to write a short report (about 100-120 words)

—Write on your Answer Sheet.

.jpg)

第8题

Residential construction now makes up more than 6% of GDP. This suggests that a 10% drop would shave some 0.6 percentage points off economic growth. A bigger question, however, is how slower prices might affect consumer spending. Experts expect that America's house prices will have stopped rising by the end of the year. Mainly because a flat market will put a brake on residential building, this is expected to reduce GDP growth by about 1.5 percentage points. "Just Reduced" might soon be a fitting label for the whole economy.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!