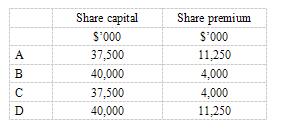

At 30 September 20X2 the trial balance of Cavern i

ncludes the following balances:

Cavern has accounted for a fully-subscribed rights issue of equity shares made on 1 April 20X2 of one new share for every four in issue at 42 cents each. This was the only share issue made during the year.

What were the balances on the share capital and share premium accounts at 30 September 20X1().

第1题

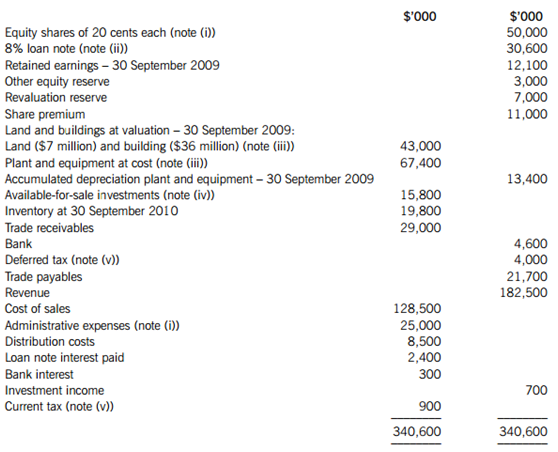

The following notes are relevant:

(i) Cavern has accounted for a fully subscribed rights issue of equity shares made on 1 April 2010 of one new share for every four in issue at 42 cents each. The company paid ordinary dividends of 3 cents per share on 30 November 2009 and 5 cents per share on 31 May 2010. The dividend payments are included in administrative expenses in the trial balance.

(ii) The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective fi nance cost of 10% per annum.

(iii) Non-current assets:

Cavern revalues its land and building at the end of each accounting year. At 30 September 2010 the relevant value to be incorporated into the fi nancial statements is $41·8 million. The building’s remaining life at the beginning of the current year (1 October 2009) was 18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life (using straight-line depreciation with no residual value). Production using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount rate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for this future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010. All depreciation is charged to cost of sales.

(iv) The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the year ended 30 September 2010.

(v) A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2009. At 30 September 2010 the tax base of Cavern’s net assets was $15 million less than their carrying amounts. The movement on deferred tax should be taken to the income statement. The income tax rate of Cavern is 25%.

Required:

(a) Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010.

(b) Prepare the statement of changes in equity for Cavern for the year ended 30 September 2010.

(c) Prepare the statement of fi nancial position of Cavern as at 30 September 2010.

Notes to the fi nancial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 5 marks

(c) 9 marks

第2题

1 Bank charges of $200 have not been entered in the cash book.

2 Lodgements recorded on 30 June 2005 but credited by the bank on 2 July $14,700.

3 Cheque payments entered in cash book but not presented for payment at 30 June 2005 $27,800.

4 A cheque payment to a supplier of $4,200 charged to the account in June 2005 recorded in the cash book as a receipt.

Based on this information, what was the cash book balance BEFORE any adjustments?

A $43,100 overdrawn

B $16,900 overdrawn

C $60,300 overdrawn

D $34,100 overdrawn

第3题

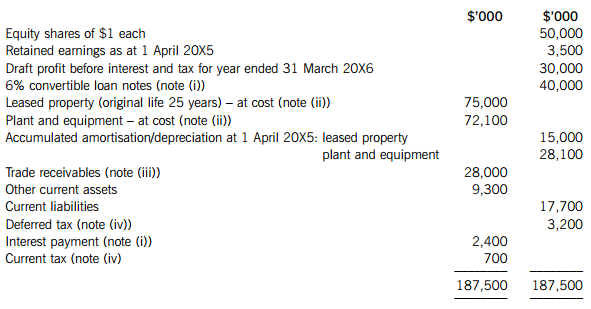

The following notes are relevant:

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

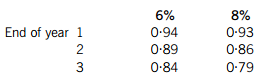

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

第4题

Section B – ALL THREE questions are compulsory and MUST be attempted

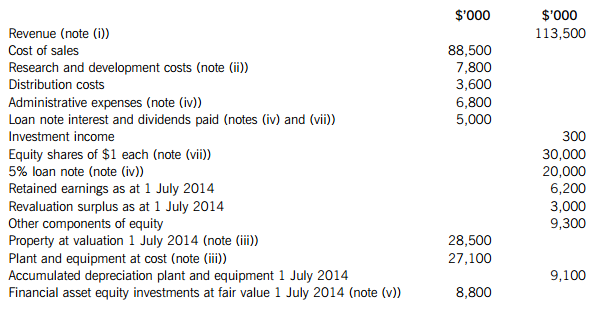

The following trial balance extracts (i.e. it is not a complete trial balance) relate to Moston as at 30 June 2015:

The following notes are relevant:

(i) Revenue includes a $3 million sale made on 1 January 2015 of maturing goods which are not biological assets. The carrying amount of these goods at the date of sale was $2 million. Moston is still in possession of the goods (but they have not been included in the inventory count) and has an unexercised option to repurchase them at any time in the next three years. In three years’ time the goods are expected to be worth $5 million. The repurchase price will be the original selling price plus interest at 10% per annum from the date of sale to the date of repurchase.

(ii) Moston commenced a research and development project on 1 January 2015. It spent $1 million per month on research until 31 March 2015, at which date the project passed into the development stage. From this date it spent $1·6 million per month until the year end (30 June 2015), at which date development was completed. However, it was not until 1 May 2015 that the directors of Moston were confident that the new product would be a commercial success.

Expensed research and development costs should be charged to cost of sales.

(iii) Non-current assets:

Moston’s property is carried at fair value which at 30 June 2015 was $29 million. The remaining life of the property at the beginning of the year (1 July 2014) was 15 years. Moston does not make an annual transfer to retained earnings in respect of the revaluation surplus. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 June 2015. All depreciation is charged to cost of sales.

(iv) The 5% loan note was issued on 1 July 2014 at its nominal value of $20 million incurring direct issue costs of $500,000 which have been charged to administrative expenses. The loan note will be redeemed after three years at a premium which gives the loan note an effective finance cost of 8% per annum. Annual interest was paid on 30 June 2015.

(v) At 30 June 2015, the financial asset equity investments had a fair value of $9·6 million. There were no acquisitions or disposals of these investments during the year.

(vi) A provision for current tax for the year ended 30 June 2015 of $1·2 million is required, together with an increase to the deferred tax provision to be charged to profit or loss of $800,000.

(vii) Moston paid a dividend of 20 cents per share on 30 March 2015, which was followed the day after by an issue of 10 million equity shares at their full market value of $1·70. The share premium on the issue was recorded in other components of equity.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Moston for the year ended 30 June 2015. (11 marks)

(b) Prepare the statement of changes in equity for Moston for the year ended 30 June 2015. (4 marks)

Note: The statement of financial position and notes to the financial statements are NOT required.

第5题

May Ltd. has the following information:

Balance Sheet as at 31 December

Year 1 Year 2 Year 3

($ '000) ($ '000) ($ '000)

Fixed Assets (net) 1,600 2,250 5,750

Stock 1,500 2,000 3,500

Debtors 3,025 5,000 6,250

Bank 2,000 1,250 -

8,125 10,500 15,500

Creditors 2,000 2,500 3,100

Taxation 125 140 150

Overdraft - - 1,750 6,000 7,860 10,500

Financed by

$1 ordinary shares 500 500 500

Reserves 3,250 5,110 7,750

Bank loan(6% above prime rate due 31/12/2009) 2,250 2,250 2,250 6,000 7,860 15,500

Market price per share $25 $20 $16

Profit and Loss Accounts for the year ended 31 December

Year 3 Year 4 Year 5

($ '000) ($ '000) ($ '000)

Sales (all credit sales) 24,000 25,000 26,500

Cost of sales 15,000 17,500 19,000

Gross profit 9,000 7,500 7,500

Salaries 2,500 2,000 1,900

Selling and delivery 4130 360 320

Advertising 1,100 1,200 1,300

Other expense 1,375 490 480

Net profit before taxation 3,625 3,450 3,500

Required:

(a)Calculate the following ratios for Year 3, Year 4 and Year 5 (please show format):

(i)Liquid ratio

(ii)Current ratio

(iii)Debtors collection period (days)

(iv)Stock turnover

(v)Capital turnover

(vi)Return on assets employed

(vii)Gross profit margin

(viii)Earning per share

(ix)Price/Earning ratio

(b)Comment on the performance of the company over the three-year period using the ratios calculated above.

第6题

A.confirms

B.confronts

C.conducts

D.confesses

第7题

The phrase "balance of nature"(Line 1, Para. 1)means______.

A.reducing the population of predators

B.keeping the right number of animals for the right amount of food

C.keeping the ratio of small game to predators

D.driving animals to mass migrations

第8题

A) The incompetence of the Democrats.

B) The existing Family and Medical Leave Act.

C) The lack of a precedent in American history.

D) The opposition from business circles.